The US, above all, depends on its ports to keep the retail supply chains moving - we are a net importer, with a trade deficit of $600B for 2019.

What happens if the ports - our lifeblood - are bottlenecked?

Thread.

Prerequisite 1:

Understanding how US supply chains are tightly interconnected with China...

2/ https://twitter.com/theammind/status/1238614832317739008">https://twitter.com/theammind...

Understanding how US supply chains are tightly interconnected with China...

2/ https://twitter.com/theammind/status/1238614832317739008">https://twitter.com/theammind...

Prerequisite 2:

Understanding how the US consumer market is an import-focused model that has shaped the framework of US logistics and supply chain management...

3/ https://twitter.com/man_integrated/status/1232332493552070659">https://twitter.com/man_integ...

Understanding how the US consumer market is an import-focused model that has shaped the framework of US logistics and supply chain management...

3/ https://twitter.com/man_integrated/status/1232332493552070659">https://twitter.com/man_integ...

With those out of the way, let& #39;s dive in to the current state of affairs at US ocean ports and what the coming days will likely bring.

Now, any port of entry (ocean or air) is going to have a vast ecosystem of stakeholders, processes, and equipment to account for.

4/

Now, any port of entry (ocean or air) is going to have a vast ecosystem of stakeholders, processes, and equipment to account for.

4/

A single shipment importing to/exporting from the US is going to have some/all of the following entities involved:

Shipper

Consignee

Third parties (forwarder/customs broker)

US Customs

Ocean carrier

Port

Terminal at port

Drayman (trucker)

Railroad

Chassis provider

5/

Shipper

Consignee

Third parties (forwarder/customs broker)

US Customs

Ocean carrier

Port

Terminal at port

Drayman (trucker)

Railroad

Chassis provider

5/

Every single one of these entities must do their job timely and effectively to prevent planned shipment costs from spiraling out of control.

Importantly, all are accruing costs to perform their task, and will pass along any additional costs resulting from breakdowns.

6/

Importantly, all are accruing costs to perform their task, and will pass along any additional costs resulting from breakdowns.

6/

𝙄𝙢𝙥𝙤𝙧𝙩 𝙋𝙧𝙤𝙘𝙚𝙨𝙨

Before sailing from overseas, ISF (10+2) is filed to US Customs to notify of incoming shipment details

10 days prior to arrival, customs broker files entry to Customs and duties are calculated

Vessel arrives and destows

https://youtu.be/lEqjhSG-uJU

7/">https://youtu.be/lEqjhSG-u...

Before sailing from overseas, ISF (10+2) is filed to US Customs to notify of incoming shipment details

10 days prior to arrival, customs broker files entry to Customs and duties are calculated

Vessel arrives and destows

https://youtu.be/lEqjhSG-uJU

7/">https://youtu.be/lEqjhSG-u...

If container delivers locally, a drayman will pick up the container. 99% of draymen use a rented chassis (bare frame with wheels that mates with the container to make a complete trailer).

Chassis rental costs anywhere from $20-75/day, depending on type.

8/

Chassis rental costs anywhere from $20-75/day, depending on type.

8/

Chassis pools at ports/container yards are managed by a few large groups.

The chassis are often owned by leasing companies who pay for the asset itself plus maintenance.

Note that chassis are one of the biggest chokepoints in the whole process.

https://www.joc.com/rail-intermodal/intermodal-shipping/no-easy-fix-chassis-conundrum-speakers_20190918.html

9/">https://www.joc.com/rail-inte...

The chassis are often owned by leasing companies who pay for the asset itself plus maintenance.

Note that chassis are one of the biggest chokepoints in the whole process.

https://www.joc.com/rail-intermodal/intermodal-shipping/no-easy-fix-chassis-conundrum-speakers_20190918.html

9/">https://www.joc.com/rail-inte...

If the container is not delivering locally, and is being railed somewhere, a different process is initiated.

Most major ports are serviced "on dock" by 1 or 2 major railroads, where containers load directly to the train inside the terminal and are taken inland.

10/

Most major ports are serviced "on dock" by 1 or 2 major railroads, where containers load directly to the train inside the terminal and are taken inland.

10/

Railroads are fairly efficient operations, but increasingly limited.

A single unit train of containers can stretch for 3 miles, with as many as 200 wells (slots to double stack containers).

Each loaded well holds > 100,000 lbs. in weight, so load management is critical.

11/

A single unit train of containers can stretch for 3 miles, with as many as 200 wells (slots to double stack containers).

Each loaded well holds > 100,000 lbs. in weight, so load management is critical.

11/

That single unit train will have cargo for tens or hundreds of receivers on it, all having planned their supply chains around timely arrival of the train.

At the rail ramp (a rail/truck-served inland port), the draymen and chassis chokepoint awaits.

12/

At the rail ramp (a rail/truck-served inland port), the draymen and chassis chokepoint awaits.

12/

Draymen, as truckers, are subject to a version of the same hours of service (HOS) regulations that have gotten so much play during the supply chain crunch post-COVID.

Depending on the city/route, a driver will only get 1-2 loads delivered per day.

13/

Depending on the city/route, a driver will only get 1-2 loads delivered per day.

13/

Additionally, receivers have different rules on how they will accept delivery.

Some live-unload, meaning the driver waits for an hour or two while the container is unloaded.

Many require delivery appointments.

Some require "drops" - the container stays for a day or two.

14/

Some live-unload, meaning the driver waits for an hour or two while the container is unloaded.

Many require delivery appointments.

Some require "drops" - the container stays for a day or two.

14/

Further, some receivers need their draymen to "prepull", meaning pick up a container early and hold it at the drayman& #39;s lot until delivery day(s) later.

Since it& #39;s operationally more inefficient, the draymen charge for the service.

And the chassis per-diem racks up too.

15/

Since it& #39;s operationally more inefficient, the draymen charge for the service.

And the chassis per-diem racks up too.

15/

Once delivery is made, the same dray company picks up the empty container and returns it and the chassis to their respective depots (container storage facilities) or the rail ramp.

Here again, cost. The ocean carriers pay the railroad or depots to hold the containers.

16/

Here again, cost. The ocean carriers pay the railroad or depots to hold the containers.

16/

Governing this ballet of diesel and steel are demurrage and detention.

Demurrage is a penalty charged by the port or railroad for use of their facilities past a grace period (usually 2 days).

Detention is charged by the ocean carrier for excessive time on the container.

17/

Demurrage is a penalty charged by the port or railroad for use of their facilities past a grace period (usually 2 days).

Detention is charged by the ocean carrier for excessive time on the container.

17/

Shippers and receivers closely monitor demurrage and detention risk.

Ports and railroads charge $100-300/day for demurrage, and detention can be $50-150+/day.

A single "stuck" container can accrue enormous debt for the bill payor.

18/

Ports and railroads charge $100-300/day for demurrage, and detention can be $50-150+/day.

A single "stuck" container can accrue enormous debt for the bill payor.

18/

Logistics managers have to balance all of this, every shipment, every day.

A single stoppage has an accordion effect on the rest of the delivery cycle.

At scale, it can crush a supply chain and take months to unwind.

19/

A single stoppage has an accordion effect on the rest of the delivery cycle.

At scale, it can crush a supply chain and take months to unwind.

19/

Downstream of all this are the US exporters. When imports are rolling in hot and heavy, empty containers and vessel space are plentiful.

But with COVID-19, imports (and thus empty containers) have slowed way down, along with the vessel space.

20/

But with COVID-19, imports (and thus empty containers) have slowed way down, along with the vessel space.

20/

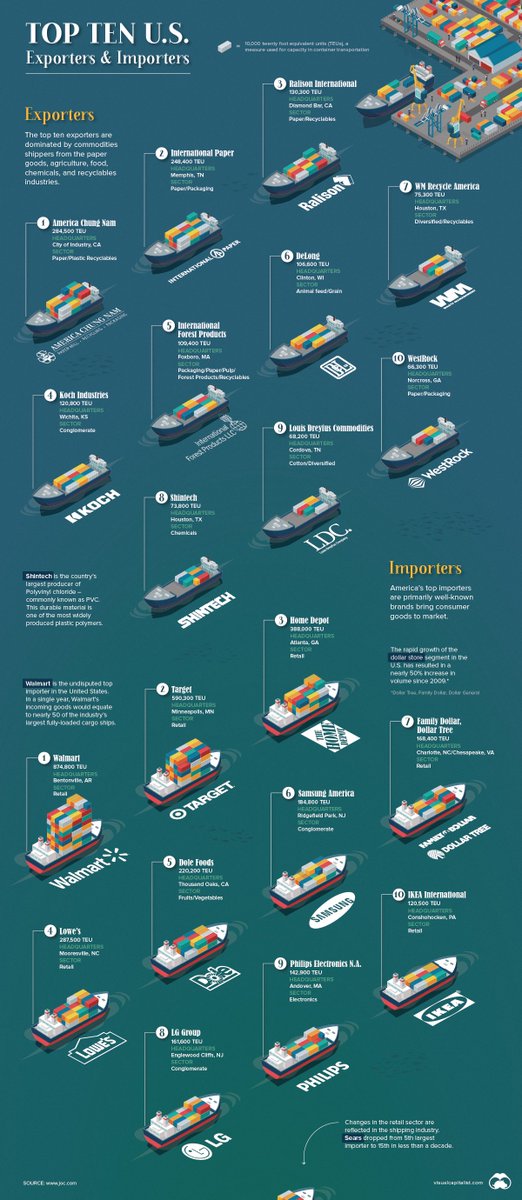

Containerized US exports are on average much heavier than imports.

In general, the US imports consumer goods and exports materials (lumber, grain, chemicals, etc).

And weight/container governs everything, since a train or ship can only hold so much tonnage.

21/

In general, the US imports consumer goods and exports materials (lumber, grain, chemicals, etc).

And weight/container governs everything, since a train or ship can only hold so much tonnage.

21/

Thus, US exports are limited by the fact that for every 4 or 5 "slots" on a container ship of imports, only 3-4 full exports can go back out. The rest is dead space or empty containers.

This puts US exporters further behind the 8-ball in a capacity crunch.

22/

This puts US exporters further behind the 8-ball in a capacity crunch.

22/

This absurdly long-winded (but still really basic) primer was important to explaining the current state of affairs.

Simply put, the average person has no idea how complex and precarious an international supply chain is, or how easy it is for costs to spin out of control.

23/

Simply put, the average person has no idea how complex and precarious an international supply chain is, or how easy it is for costs to spin out of control.

23/

Like a pebble thrown into a pond that causes big ripples, a disruption at any point triggers a widespread shock to the system.

The second half of this thread will deal with specific effects and recommendations to prevent supply chain bottlenecks.

Here& #39;s a baby fennec fox.

24/

The second half of this thread will deal with specific effects and recommendations to prevent supply chain bottlenecks.

Here& #39;s a baby fennec fox.

24/

PART TWO: https://twitter.com/man_integrated/status/1241085445737517056">https://twitter.com/man_integ...

Read on Twitter

Read on Twitter 𝐏𝐞𝐛𝐛𝐥𝐞 𝐈𝐧 𝐓𝐡𝐞 𝐏𝐨𝐧𝐝The US, above all, depends on its ports to keep the retail supply chains moving - we are a net importer, with a trade deficit of $600B for 2019.What happens if the ports - our lifeblood - are bottlenecked?Thread." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚢" title="Schiff" aria-label="Emoji: Schiff">𝐏𝐞𝐛𝐛𝐥𝐞 𝐈𝐧 𝐓𝐡𝐞 𝐏𝐨𝐧𝐝The US, above all, depends on its ports to keep the retail supply chains moving - we are a net importer, with a trade deficit of $600B for 2019.What happens if the ports - our lifeblood - are bottlenecked?Thread." class="img-responsive" style="max-width:100%;"/>

𝐏𝐞𝐛𝐛𝐥𝐞 𝐈𝐧 𝐓𝐡𝐞 𝐏𝐨𝐧𝐝The US, above all, depends on its ports to keep the retail supply chains moving - we are a net importer, with a trade deficit of $600B for 2019.What happens if the ports - our lifeblood - are bottlenecked?Thread." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚢" title="Schiff" aria-label="Emoji: Schiff">𝐏𝐞𝐛𝐛𝐥𝐞 𝐈𝐧 𝐓𝐡𝐞 𝐏𝐨𝐧𝐝The US, above all, depends on its ports to keep the retail supply chains moving - we are a net importer, with a trade deficit of $600B for 2019.What happens if the ports - our lifeblood - are bottlenecked?Thread." class="img-responsive" style="max-width:100%;"/>