1/n I hope this thread DOES NOT age well.

I hope we discover most Indians are immune to Covid19. Our healthcare/testing infrastructure does not collapse and this crisis blows over in weeks.

Life goes back to normal - kids go to school and spouses to work.

However..

I hope we discover most Indians are immune to Covid19. Our healthcare/testing infrastructure does not collapse and this crisis blows over in weeks.

Life goes back to normal - kids go to school and spouses to work.

However..

2/n However, if the above doesn’t happen - here are some things to think about:

We are possibly facing the biggest ECONOMIC DISLOCATON of Independent India.

There is no playbook, no living memory of such an event.

We are possibly facing the biggest ECONOMIC DISLOCATON of Independent India.

There is no playbook, no living memory of such an event.

3/n Repeat: we have NO bureaucratic, political or institutional experience of dealing with such a Black Swan.

This is World War II. Or worse.

A massive consumption shock is underway, and it can PERMANENTLY damage the underpinnings of our economy& #39;s superstructure.

This is World War II. Or worse.

A massive consumption shock is underway, and it can PERMANENTLY damage the underpinnings of our economy& #39;s superstructure.

4/n This superstructure stands on the back of the service sector jobs created by small and medium businesses,

And the about 50M *consuming* households who trickle spends directly or indirectly into the rest of the pyramid.

(More on this later in the thread)

And the about 50M *consuming* households who trickle spends directly or indirectly into the rest of the pyramid.

(More on this later in the thread)

5/n Over the last DECADE, almost our entire growth has been driven by a rapid rise in consumption, which were funded by two factors:

A) confidence to save less and spend more, and

B) easy credit - buy now, pay later.

A) confidence to save less and spend more, and

B) easy credit - buy now, pay later.

6/n I discussed this savings vs spending phenomena in an earlier thread: https://twitter.com/hchawlah/status/1167485898721640448">https://twitter.com/hchawlah/...

7/n Thus, Growth hasn’t been “fundamental” or “secular" - ie we’ve not created productive capital assets, or created massive infrastructure or expanded exports by an order of magnitude by being globally competitive.

This is akin to flying a Boeing 747 Jumbo on ONE engine.

This is akin to flying a Boeing 747 Jumbo on ONE engine.

8/n The other engines of growth - Investment demand, Exports and Manufacturing are sputtering to put it as mildly as one can.

This has been the case with successive governments - so no potshot at anyone here. :)

This has been the case with successive governments - so no potshot at anyone here. :)

9/n The “excessive and aspirational" consumption of the 50M households has acted like a large lever within our population pyramid.

They spend, and India earns, and then they earn and spend even more.

They are the India 1 households - the top 15%

http://www.foundingfuel.com/article/how-indias-digital-economy-can-rediscover-its-mojo/">https://www.foundingfuel.com/article/h...

They spend, and India earns, and then they earn and spend even more.

They are the India 1 households - the top 15%

http://www.foundingfuel.com/article/how-indias-digital-economy-can-rediscover-its-mojo/">https://www.foundingfuel.com/article/h...

10/n The trickle down effect of this top 15% of Indians keeps the fires in the rest of the economy burning.

They are served by countless small entrepreneurs, who employ millions of Indians and conjure up services and experiences for the rest of the nation.

They are served by countless small entrepreneurs, who employ millions of Indians and conjure up services and experiences for the rest of the nation.

11/n These small entrepreneurs are the backbone.

They are invisible to us.

They take risks because they have nothing to lose - there are no jobs for them anyway.

So they step out in the big bag world with a handful of notes and start small businesses.

They are invisible to us.

They take risks because they have nothing to lose - there are no jobs for them anyway.

So they step out in the big bag world with a handful of notes and start small businesses.

12/n Small firms have been reeling with multiple shocks over the years.

First was a demand shock with Demonetisation. Next, compliance shock with GST. A credit/working capital shock with the NBFC crisis and finally the GDP sluggishness with slowing demand over last 6 quarters

First was a demand shock with Demonetisation. Next, compliance shock with GST. A credit/working capital shock with the NBFC crisis and finally the GDP sluggishness with slowing demand over last 6 quarters

13/n And now we are possibly face to face with SEVEREST demand shock that the economy has ever experienced.

14/n A new demand compression will wreak havoc and drive FAILURE of small and medium firms. And it will be devastating.

Irrespective of the virus, they were under hardship and water was up to their chins.

Now the proverbial tide can rise over their ears.

Irrespective of the virus, they were under hardship and water was up to their chins.

Now the proverbial tide can rise over their ears.

15/n We have to act decisively to minimise damage.

Every day of inaction can lead to thousands of firms vanishing.

Unlike individuals who save for a rainy day, and have family to fall back. Firms have nothing.

Cashflow is like oxygen. Cut it off and the firm falls apart.

Every day of inaction can lead to thousands of firms vanishing.

Unlike individuals who save for a rainy day, and have family to fall back. Firms have nothing.

Cashflow is like oxygen. Cut it off and the firm falls apart.

16/n This sudden shock to consumption can become a long-winded one. Why do I say that?

Remember this is the same India 1 that has lived with less, consumed carefully and saved penny by penny over the last three decades (since 1991)

Remember this is the same India 1 that has lived with less, consumed carefully and saved penny by penny over the last three decades (since 1991)

17/n Living within means is a memory that is alive and kicking in every household.

They can shift gear to living with less.

They will simply travel /dine less, shop less and generally access fewer services.

This will be devastating for small firms.

They can shift gear to living with less.

They will simply travel /dine less, shop less and generally access fewer services.

This will be devastating for small firms.

18/n Economists will know better, but reducing interest rates may NOT kick start demand.

If your business/job is under threat, you will STOP consumption and defer it entirely.

(Of course, we have to prevent credit markets from freezing though)

If your business/job is under threat, you will STOP consumption and defer it entirely.

(Of course, we have to prevent credit markets from freezing though)

19/n If you are uncertain about the future, then you don’t want to replace your car, just because interest rates are now at 5% instead of 10% or the dealer is offering Rs. 2L discount.

Right?

Right?

20/n These ATOMIC consumption deferment decisions, when multiplied across households can reverberate into a tsunami.

"We don’t need another pairs of sneakers, or sandals anymore. Why drink coffee at Starbucks four times a week, why not make it just a Saturday treat"

"We don’t need another pairs of sneakers, or sandals anymore. Why drink coffee at Starbucks four times a week, why not make it just a Saturday treat"

21/n Our biggest challenge today is how do we stop the failure of these small firms.

How do we maintain their risk appetite in face of this great uncertainty. And how to restore consumer confidence and inclination to spend.

How do we maintain their risk appetite in face of this great uncertainty. And how to restore consumer confidence and inclination to spend.

22/n The silver lining in this cloud is that it’s still not late.

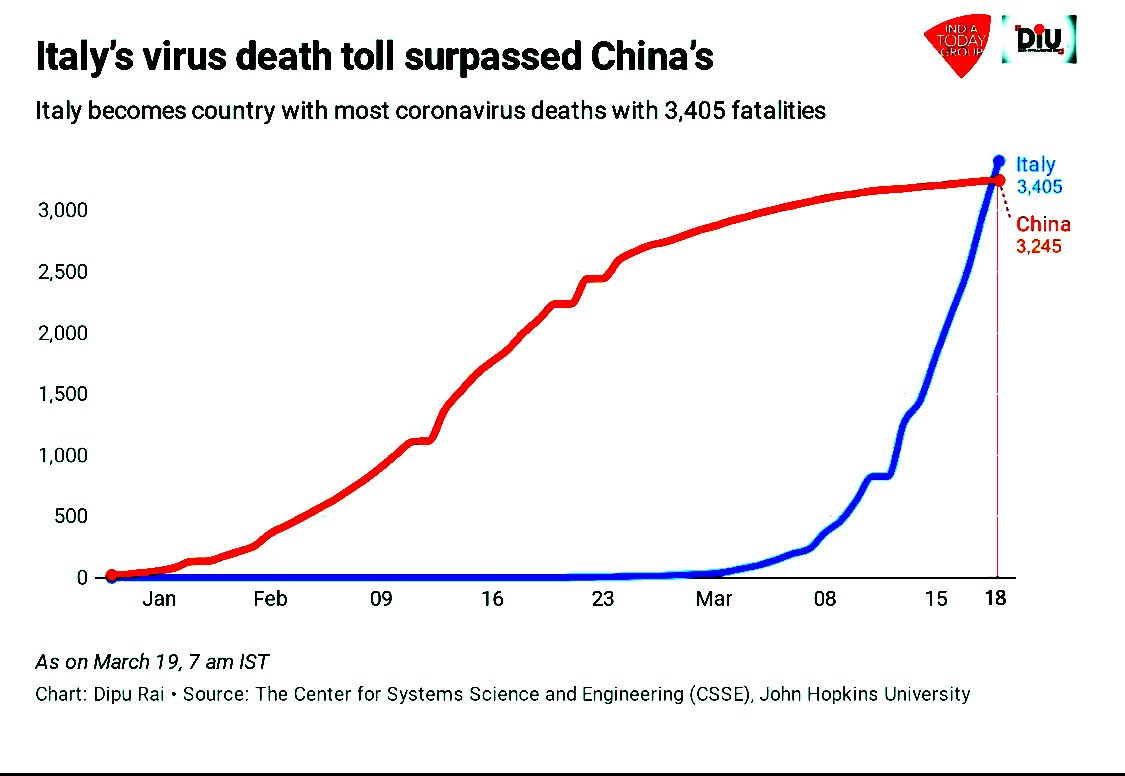

Covid is still in stages it was in Italy and France 2-3 weeks ago.

Crude is down from average of $45 to nearly $25 - and with a 110B$ oil import bill we can save nearly 40B$ (that’s 3,00,000 Crores). Annually.

Covid is still in stages it was in Italy and France 2-3 weeks ago.

Crude is down from average of $45 to nearly $25 - and with a 110B$ oil import bill we can save nearly 40B$ (that’s 3,00,000 Crores). Annually.

23/n Imagine if we redirect 2 years of crude savings (that’s 7,00,000 crores) into two initiatives:

a) a total emergency lock down to stop Covid in its tracks, and improve healthcare

b) a massive demand stimulus cum schemes to save firms and jobs

a) a total emergency lock down to stop Covid in its tracks, and improve healthcare

b) a massive demand stimulus cum schemes to save firms and jobs

24/n This can ensure that firms survive, jobs are saved and demand can creep back to normal.

(Caveat : This is a simplistic assumption, I know - there are many second order effects to take into account.)

(Caveat : This is a simplistic assumption, I know - there are many second order effects to take into account.)

25/n We need deep, calculated response to ensure they are able to survive the coming few months.

Any firm with leverage is under danger of going under - and so are individuals.

Moratoriums on principal and interest are the minimum actions we will end up taking, we need more

Any firm with leverage is under danger of going under - and so are individuals.

Moratoriums on principal and interest are the minimum actions we will end up taking, we need more

26/n Also, it is an assumption that large firms or banks will be immune.

The moment the demand compression trickles down to India 2 and 3 - EMIs for two-wheelers, 4 wheelers and homes will stop.

The moment the demand compression trickles down to India 2 and 3 - EMIs for two-wheelers, 4 wheelers and homes will stop.

27/n Personal loan repayments will stall and our hetherto invincible private retail banks and NBFCs will suffer a contraction and NPA that will be unprecedented in scale.

(NIFTY Bankex is down by 30% over this month)

(NIFTY Bankex is down by 30% over this month)

28/n We need direct, sector by sector interventions - we need direct distribution of cash to the folks who will be unemployed.

We have reasonably effective mechanisms to transfer aid to people and firms in the agricultural sector and formal manufacturing sector.

We have reasonably effective mechanisms to transfer aid to people and firms in the agricultural sector and formal manufacturing sector.

29/n But no trail/mechanism of how to do it in the services sector, and informal sector.

We’ll have to be creative on how help these firms.

Maybe we use GST as a trail and offer credit linked to that.

We’ll have to be creative on how help these firms.

Maybe we use GST as a trail and offer credit linked to that.

30/n Still we will miss out on possibly thousands of entrepreneurs and informal firms who work invisibly below our GST and Tax nets.

Yes there will be leakages in governance and other moral hazards. But do we have a choice?

Yes there will be leakages in governance and other moral hazards. But do we have a choice?

31/n Time, unfortunately, is running out.

For both - health of our citizens and health of our firms.

For both - health of our citizens and health of our firms.

32/n An aside: Assuming Indians have seasoned immune systems and many are likely to develop immunity.

Thus, it is imperative to get Antibody screening tests that can mark an individual as safe. That person can get back to working productively.

This has to be done at scale.

Thus, it is imperative to get Antibody screening tests that can mark an individual as safe. That person can get back to working productively.

This has to be done at scale.

33/n We need immediate, drastic and creative action.

Actual interventions and not accouncements. We need the Government to rope in private and public agencies and a centrally co-ordinated and orchestrated move to save firms.

Actual interventions and not accouncements. We need the Government to rope in private and public agencies and a centrally co-ordinated and orchestrated move to save firms.

34/n Unfortunately jobs will be lost and we need to take care of those people, but if the firms themselves go - how will jobs come back?

35/n We need to observe what other countries are doing and adapt lessons to our context. UK just announced a stimulus of 16% of GDP. USA is considering UBI + a trillion dollar infusion.

Fin.

Fin.

Other threads relevant to this subject: https://twitter.com/hchawlah/status/1236325239132286977?s=20">https://twitter.com/hchawlah/...

https://twitter.com/hchawlah/status/1231401046058184704?s=20">https://twitter.com/hchawlah/...

Canada& #39;s message - focus on your health, we& #39;ll figure how to get you money to buy supplies.

https://twitter.com/jchatterleycnn/status/1240641783329107968?s=21">https://twitter.com/jchatterl... https://twitter.com/jchatterleyCNN/status/1240641783329107968">https://twitter.com/jchatterl...

Convex versus Concave:

The difference between a total clampdown on activity versus graded/slow action.

The difference between a total clampdown on activity versus graded/slow action.

"...An economic crisis which will be more severe than ... anything we have ever seen in modern history,”

-Singapore’s minister for national development https://www.cnbc.com/2020/03/18/coronavirus-singapore-minister-on-outbreak-and-its-economic-impact.html">https://www.cnbc.com/2020/03/1...

-Singapore’s minister for national development https://www.cnbc.com/2020/03/18/coronavirus-singapore-minister-on-outbreak-and-its-economic-impact.html">https://www.cnbc.com/2020/03/1...

Global stimulus needed! https://twitter.com/business/status/1240474353042685958?s=20">https://twitter.com/business/...

“No one alive has experienced an economic plunge this sudden.”

This Is Not a Recession. It’s an Ice Age. https://www.theatlantic.com/ideas/archive/2020/03/quantifying-coming-recession/608443/">https://www.theatlantic.com/ideas/arc...

This Is Not a Recession. It’s an Ice Age. https://www.theatlantic.com/ideas/archive/2020/03/quantifying-coming-recession/608443/">https://www.theatlantic.com/ideas/arc...

This thread on the pain that our *invisible* informal workers go through.

https://twitter.com/indianexpress/status/1244916880814432256?s=21">https://twitter.com/indianexp... https://twitter.com/IndianExpress/status/1244916880814432256">https://twitter.com/IndianExp...

https://twitter.com/indianexpress/status/1244916880814432256?s=21">https://twitter.com/indianexp... https://twitter.com/IndianExpress/status/1244916880814432256">https://twitter.com/IndianExp...

Read on Twitter

Read on Twitter