1/ #Corona, Recession, Depression, biggest #Crash of all time...

While everybody is occupied with speculating about the consequences of the Virus, I believe there is something much bigger going on here:

The Death of the Fiat System - the biggest Wealth Transfer of all time

While everybody is occupied with speculating about the consequences of the Virus, I believe there is something much bigger going on here:

The Death of the Fiat System - the biggest Wealth Transfer of all time

2/ If you don& #39;t get it yet, this is the biggest economic event of our lifetimes.

I have the feeling when everything is said and done, paper money might be worthless.

We might be witnessing the biggest paradigm shift ever! A few thoughts:

I have the feeling when everything is said and done, paper money might be worthless.

We might be witnessing the biggest paradigm shift ever! A few thoughts:

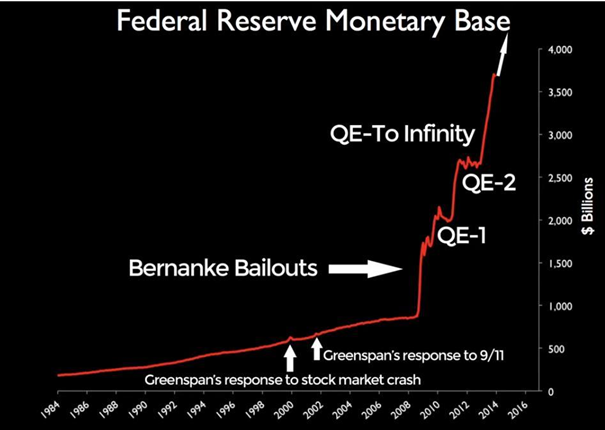

3/ This is my favorite chart of all time:

Over the past decade the Fed balance sheet grew exponentially.

What do you think will happen this time considering the whole world is going into lockdown right now?

Over the past decade the Fed balance sheet grew exponentially.

What do you think will happen this time considering the whole world is going into lockdown right now?

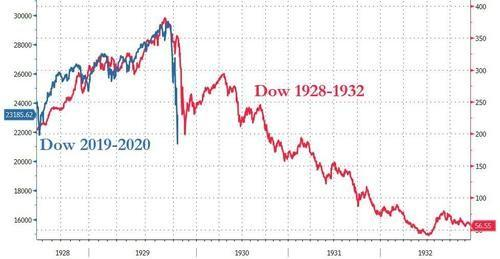

4/ We are witnessing the pop of the biggest bubble of all time. Make no mistake, Corona is not the reason it is only the pin that popped the bubble.

5/ To be in the proper mood for what& #39;s coming, I highly recommend listening to this brilliant song produced by @mike_maloney team

Ben, Ben....helicopter Ben

https://www.youtube.com/watch?v=UKU1RVwzqkA">https://www.youtube.com/watch...

Ben, Ben....helicopter Ben

https://www.youtube.com/watch?v=UKU1RVwzqkA">https://www.youtube.com/watch...

6/ Central Banks and politicians around the world are already telling you what& #39;s coming! Act now and act fast.

It doesn& #39;t matter if Corona gets better or worse, this is inevitable and it might end badly for paper money.

It doesn& #39;t matter if Corona gets better or worse, this is inevitable and it might end badly for paper money.

7/ The German finance minister even calls it a "bazooka".

This is Europe’s "Whatever it takes" moment 2.0, but this time it will only be bigger and more massive. https://www.ft.com/content/1b0f0324-6530-11ea-b3f3-fe4680ea68b5">https://www.ft.com/content/1...

This is Europe’s "Whatever it takes" moment 2.0, but this time it will only be bigger and more massive. https://www.ft.com/content/1b0f0324-6530-11ea-b3f3-fe4680ea68b5">https://www.ft.com/content/1...

8/ USA:

The #Fed will open all flood gates, this is just the beginning.

With rates at zero we might be witnessing the end of the fiat dollar experiment.

This is history in the making. https://www.bloomberg.com/news/articles/2020-03-15/fed-cuts-main-rate-to-near-zero-to-boost-assets-by-700-billion?srnd=premium-europe">https://www.bloomberg.com/news/arti...

The #Fed will open all flood gates, this is just the beginning.

With rates at zero we might be witnessing the end of the fiat dollar experiment.

This is history in the making. https://www.bloomberg.com/news/articles/2020-03-15/fed-cuts-main-rate-to-near-zero-to-boost-assets-by-700-billion?srnd=premium-europe">https://www.bloomberg.com/news/arti...

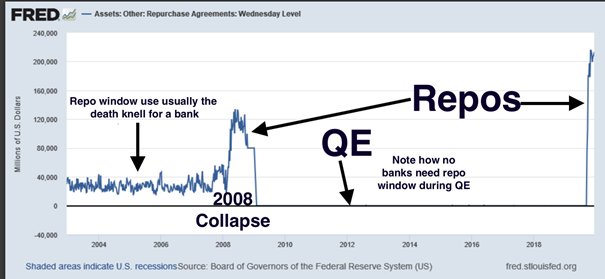

9/

0% Interest Rate

0% Reserve Requirement

1.5T USD in extended repo operations

700B USD printed out of thin air QE4 launched

0% Interest Rate

0% Reserve Requirement

1.5T USD in extended repo operations

700B USD printed out of thin air QE4 launched

10/ I expect CBs to buy everything they can get their hands ons. Bonds, corporate bonds, stocks...

They will try to bail outs banks, hedgefonds, insurance companies.

But I am afraid that this time whatever they will try, won& #39;t be enough.

The system is broken and cannot be fixed

They will try to bail outs banks, hedgefonds, insurance companies.

But I am afraid that this time whatever they will try, won& #39;t be enough.

The system is broken and cannot be fixed

11/ Helicopter money will come for sure in every way possible. Taxes down to zero, subsidies for consumer goods....they will subsidize literally everything, especially if it is supposedly good for the climate.

The US already waiving interests on student loans...

The US already waiving interests on student loans...

12/ Governments will try to bail out companies all over the place. A lot of them will be nationalized in a desperate attempt to stop the melt down. I expect the first ones in the upcoming week.

To sum it up, they will print like never before.

To sum it up, they will print like never before.

14/ At this point this will happen no matter how the virus will spread.

I still believe there is a fair chance the corona situation will ease from April/May on and the panic will magically disappear over the summer.

In the short term it will get worse though.

I still believe there is a fair chance the corona situation will ease from April/May on and the panic will magically disappear over the summer.

In the short term it will get worse though.

15/ While CBs balance sheets will explode and they literally buy everything they get their hands on, Inflation will kick in big time and possibly get out of control.

Actually the #Fed might have lost control already.

Actually the #Fed might have lost control already.

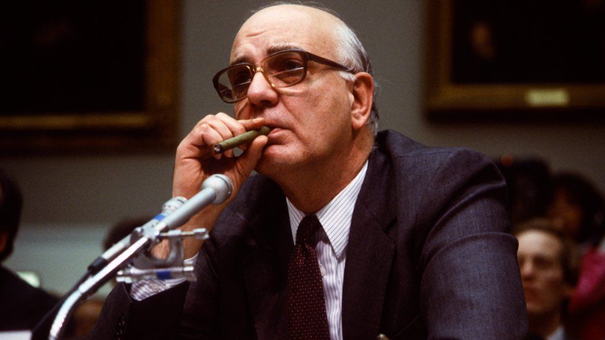

16/ Remember this guy?

Paul Volcker raised interest rates to 16% in the 70ies to save the $.

Will CBs be able to do the same this time around?

Paul Volcker raised interest rates to 16% in the 70ies to save the $.

Will CBs be able to do the same this time around?

17/ What did we learn from 2008? Nothing.

We just added more debt, brought about even more cheap money and jammed valuation and market disconnects to even higher levels.

We intentionally created the biggest debt bubble of all time.

We just added more debt, brought about even more cheap money and jammed valuation and market disconnects to even higher levels.

We intentionally created the biggest debt bubble of all time.

19/ The master of the universe are in a trap with no way out.

If they raise rates as Volcker did, it& #39;s game over immediately.

But the point where printing money is not the solution anymore might be right now.

This will be the end of the era of Central Banking.

If they raise rates as Volcker did, it& #39;s game over immediately.

But the point where printing money is not the solution anymore might be right now.

This will be the end of the era of Central Banking.

20/ In 2018, 16% of US companies were found to be zombies, surviving paycheck-to-paycheck & just covering their debt. (1990 it was 2%)

Just let that sink in: this is the status quo while the world goes into lockdown.

What will happen to all those zombies?

Just let that sink in: this is the status quo while the world goes into lockdown.

What will happen to all those zombies?

21/ Who is next in line if companies default on their debts?

Banks: Watch closely for early signs of stress. If one domino falls, they could all go this time. Protect yourself! https://twitter.com/RaoulGMI/status/1147878009870983169">https://twitter.com/RaoulGMI/...

Banks: Watch closely for early signs of stress. If one domino falls, they could all go this time. Protect yourself! https://twitter.com/RaoulGMI/status/1147878009870983169">https://twitter.com/RaoulGMI/...

22/ What about nation states? Italy is in full lockdown. Currency reset or debt jubilee in Italy might be the end of the Euro. https://www.bloomberg.com/news/articles/2020-03-16/coronavirus-latest-italy-s-finances-have-a-2-4-trillion-problem">https://www.bloomberg.com/news/arti...

23/ But what comes after all of this?

Just getting back to normal after a few months?

Unfortunately, I do not see this happening. Paper currencies will get printed into oblivion.

Doing business as usual will not work this time.

Just getting back to normal after a few months?

Unfortunately, I do not see this happening. Paper currencies will get printed into oblivion.

Doing business as usual will not work this time.

24/ Solution?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Elektrische Glühbirne" aria-label="Emoji: Elektrische Glühbirne">

There is only one logical step left once fiat currencies blow up:

Central Banks will create a digital currency and issue fiat money on a blockchain!

There is only one logical step left once fiat currencies blow up:

Central Banks will create a digital currency and issue fiat money on a blockchain!

25/ Not.

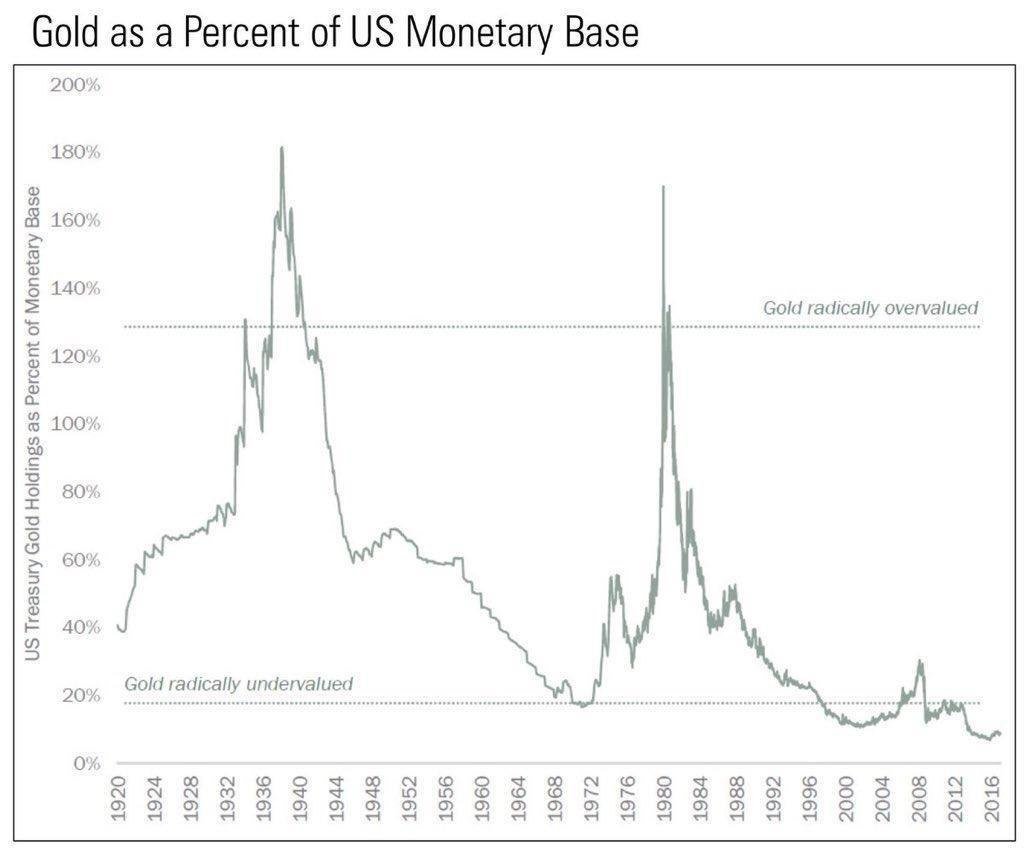

People will demand something differently.

The only solution will be a Gold Standard. Am I crazy?

Well let& #39;s think about how it might go down.

People will demand something differently.

The only solution will be a Gold Standard. Am I crazy?

Well let& #39;s think about how it might go down.

26/ Step 1: Once the situation keeps getting worse, Trump will call an emergency meeting.

Step 2: Audit of US gold supply

Step 3: The Fed will be dissolved

Step 2: Audit of US gold supply

Step 3: The Fed will be dissolved

27/ Step 4: The Treasury Department will issue a new gold/silver backed currency.

Step 5: Old fed dollars will be exchangeable through a certain rate.

Step 5: Old fed dollars will be exchangeable through a certain rate.

28/ As a side benefit, the US debt nominated in Fed dollars will be gone overnight.

On the contrary all fiat currencies will become worthless overnight.

Maybe we could see a coordinated effort between several countries (US, China, Europe, Russia)

On the contrary all fiat currencies will become worthless overnight.

Maybe we could see a coordinated effort between several countries (US, China, Europe, Russia)

29/ You might still think, this sounds crazy and out of this world.

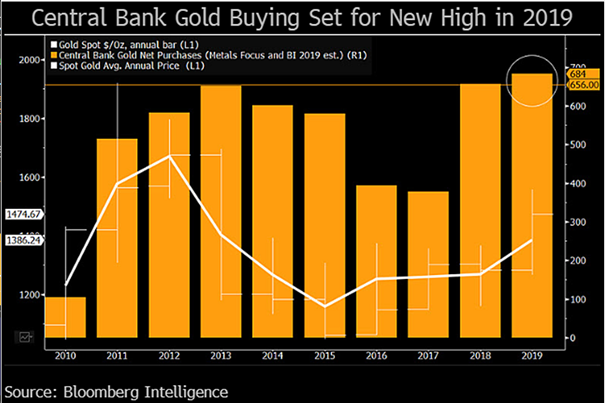

But you might also wonder why CBs around the world buy Gold on record levels?

What do they know, you don’t?

But you might also wonder why CBs around the world buy Gold on record levels?

What do they know, you don’t?

30/ What about Trump? Isn& #39;t he a fiat guy? Maybe even a socialist, using cheap money to get reelected?

But what if there are many signs that the Trump administration is in favor of a Gold Standard?

But what if there are many signs that the Trump administration is in favor of a Gold Standard?

31/ What about @judyshel , Trumps Fed nominee advocating for a Gold Standard? https://www.wsj.com/articles/SB123440593696275773?mod=article_inline&adobe_mc=MCMID%3D32098337397292610722936892250983881882%7CMCORGID%3DCB68E4BA55144CAA0A4C98A5%2540AdobeOrg%7CTS%3D1584308070">https://www.wsj.com/articles/...

32/ What about the VICE PRESIDENT OF THE USA being in favor of the Gold Standard?

"I think the time has come to have a debate over gold, and the proper role it should play in our nations monetary affairs." https://thinkprogress.org/rep-mike-pence-suggests-that-the-u-s-return-to-the-gold-standard-4f207559c1f7/">https://thinkprogress.org/rep-mike-...

"I think the time has come to have a debate over gold, and the proper role it should play in our nations monetary affairs." https://thinkprogress.org/rep-mike-pence-suggests-that-the-u-s-return-to-the-gold-standard-4f207559c1f7/">https://thinkprogress.org/rep-mike-...

33/ Issuing gold backed money through the treasury department sounds crazy?

Executive Order 11110

The order allowed the Secretary to issue silver certificates, during the transition period under President Kennedy& #39;s plan to eliminate Silver Certificates and use Fed Notes.

Executive Order 11110

The order allowed the Secretary to issue silver certificates, during the transition period under President Kennedy& #39;s plan to eliminate Silver Certificates and use Fed Notes.

34/ FOURTH TURNING

There are also other trends that indicate huge shifts.

@HoweGeneration describes in his book that historically every four generations major events take place that have a huge impact on society.

@RaoulGMI , @ttmygh , @ErikSTownsend are big fans of his work.

There are also other trends that indicate huge shifts.

@HoweGeneration describes in his book that historically every four generations major events take place that have a huge impact on society.

@RaoulGMI , @ttmygh , @ErikSTownsend are big fans of his work.

35/ During last fourth turning (WW2) a new monetary system (Bretton Woods) was established including several institutions like the IMF or the World Bank.

Guess what, we are right in the middle of another Fourth Turning that will once again change everything.

Guess what, we are right in the middle of another Fourth Turning that will once again change everything.

36/ Long story short, do not believe me, do your own research but now is the time to start thinking about major changes within the monetary system!

37/ Make no mistake, in order to establish a new monetary standard the old one has to be destroyed first.

The transition to a Gold Standard will lead to a lot of turmoil in the world and won& #39;t be a smooth transition!

But it will also be the start of a golden economic age.

The transition to a Gold Standard will lead to a lot of turmoil in the world and won& #39;t be a smooth transition!

But it will also be the start of a golden economic age.

38/ All debt will turn worthless. We will free the whole system including all individuals from this crazy debt madness.

It will start a period of economic prosperity like never before.

If Trumps frees the American people from their debt, guess who they gonna vote for?

It will start a period of economic prosperity like never before.

If Trumps frees the American people from their debt, guess who they gonna vote for?

39/ Let’s take a quick look how to take advantage of what to come.

Give the current events everything might happen way faster than expected

(No Financial advice, just a few guesses for fun on my end)

Give the current events everything might happen way faster than expected

(No Financial advice, just a few guesses for fun on my end)

40/Stocks

Will go up in an inflationary environment but not the asset to hold during a currency reset. You want to buy it afterwards.

Also be aware of markets being closed during such a time as happening right now. Markets might close for several days.

Will go up in an inflationary environment but not the asset to hold during a currency reset. You want to buy it afterwards.

Also be aware of markets being closed during such a time as happening right now. Markets might close for several days.

41/ Bonds might be an interesting play short-term as rates will go lower and lower but during the reset they will turn worthless.

42/ Cash

Cash is King? Well during a deflation this might be true (right now) during a reset or strong inflation it will be worthless.

Don’t forget, money on your bank account does not belong to you but your bank! If your bank goes bust, the money is gone!

Cash is King? Well during a deflation this might be true (right now) during a reset or strong inflation it will be worthless.

Don’t forget, money on your bank account does not belong to you but your bank! If your bank goes bust, the money is gone!

43/ Ironically retail bank deposits are on an all-time high.

Unfortunately, currency resets happen suddenly and unexpected and will punish most people who are not aware of whats going on:

Unfortunately, currency resets happen suddenly and unexpected and will punish most people who are not aware of whats going on:

44/ Real Estate

Overvalued right now, no need to own it during a Fourth Turning.

Farmland different story, cant go wrong with that

Overvalued right now, no need to own it during a Fourth Turning.

Farmland different story, cant go wrong with that

45/ Gold/Silver (1/4)

If you are reading this and don& #39;t own any Gold/Silver -> Run and get some as fast as possible https://abs.twimg.com/emoji/v2/... draggable="false" alt="👻" title="Geist" aria-label="Emoji: Geist">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👻" title="Geist" aria-label="Emoji: Geist">

During a currency reset we will see absurd price levels

If you are reading this and don& #39;t own any Gold/Silver -> Run and get some as fast as possible

During a currency reset we will see absurd price levels

47/ Gold – Silver (3/4) Ratio is at absurd levels right now.

Over 115

Silver might the best bet ever.

Over 115

Silver might the best bet ever.

48/ Gold/Silver (4/4)

You might run into trouble getting physical gold/silver right now. Reports keep popping up that everything is sold out.

“By now it is abundantly clear that the physical gold market and paper gold market will disconnect.” https://www.zerohedge.com/commodities/price-physical-gold-decouples-paper-gold">https://www.zerohedge.com/commoditi...

You might run into trouble getting physical gold/silver right now. Reports keep popping up that everything is sold out.

“By now it is abundantly clear that the physical gold market and paper gold market will disconnect.” https://www.zerohedge.com/commodities/price-physical-gold-decouples-paper-gold">https://www.zerohedge.com/commoditi...

49/ Mining Stocks

More volatile than Bitcoin but as Gold itself historically cheap! Buy a few and hold on to them for a while and do not look at price levels

More volatile than Bitcoin but as Gold itself historically cheap! Buy a few and hold on to them for a while and do not look at price levels

50/ Bitcoin (1/2)

Tricky one short-term! Mid-long term super bullish.

As @saifedean has put it many times. A Gold Standard might be the biggest "risk" to Bitcoin short-term.

It is also still unclear how Bitcoin will perform during economic turmoil.

Tricky one short-term! Mid-long term super bullish.

As @saifedean has put it many times. A Gold Standard might be the biggest "risk" to Bitcoin short-term.

It is also still unclear how Bitcoin will perform during economic turmoil.

51/ Bitcoin (2/2)

That being said, Bitcoin should have a place in everybody’s portfolio.

Whereas fiat currencies are on the verge of the biggest coordinated QE program the word has ever seen, Bitcoin will be the scarcest asset ever known at the end of the decade.

That being said, Bitcoin should have a place in everybody’s portfolio.

Whereas fiat currencies are on the verge of the biggest coordinated QE program the word has ever seen, Bitcoin will be the scarcest asset ever known at the end of the decade.

52/ Bitcoin vs Gold Standard

This will be the biggest finance story in the 2020ies!

Less incentive to buy bitcoin as an inflation hedge, but Bitcoin still offers attributes regarding financial privacy and sovereignty a Gold Standard can never offer.

This will be the biggest finance story in the 2020ies!

Less incentive to buy bitcoin as an inflation hedge, but Bitcoin still offers attributes regarding financial privacy and sovereignty a Gold Standard can never offer.

53/ Additionally I might be completely wrong about my gold standard theory, which would make bitcoin our only get out of jail card during hyperinflation.

The separation of state and money is still a vision I strongly believe in.

The separation of state and money is still a vision I strongly believe in.

54/ However things play out, the 2020ies will be the wildest decade of our lives.

Stay safe out there, enjoy the show and get some hard money just in case the biggest wealth transfer from paper assets to sound money will take place.

Stay safe out there, enjoy the show and get some hard money just in case the biggest wealth transfer from paper assets to sound money will take place.

55/ With things escalating by the hour, I would rather act fast.

Better to be safe than sorry.

Good Luck

Over and out.

Better to be safe than sorry.

Good Luck

Over and out.

Read on Twitter

Read on Twitter