How VCs Make Money by @vcstarterkit https://vcstarterkit.substack.com/p/how-vcs-make-money">https://vcstarterkit.substack.com/p/how-vcs...

Can you write a similar long form for private equity covering PE partners, portfolio companies, the junk bond offering in a deal and the buyout fund investors? Thanks

"don& #39;t worry about the title on your business card. You& #39;re a venture capitalist now. Do as venture capitalists do. Find, Decide, Win, Help, Exit - those are the 5 parts of the job. Work on them all"

by @nbt https://nbt.substack.com/p/the-venture-capital-flowchart">https://nbt.substack.com/p/the-ven...

by @nbt https://nbt.substack.com/p/the-venture-capital-flowchart">https://nbt.substack.com/p/the-ven...

slightly different frameworks and nomenclature;

- "sourcing, selection, and stewardship,"

- "see, pick, win, steer" and

- "access, judgment, winning, helping," for instance.

- "sourcing, selection, and stewardship,"

- "see, pick, win, steer" and

- "access, judgment, winning, helping," for instance.

what are the details a VC will have to layout for an LP?

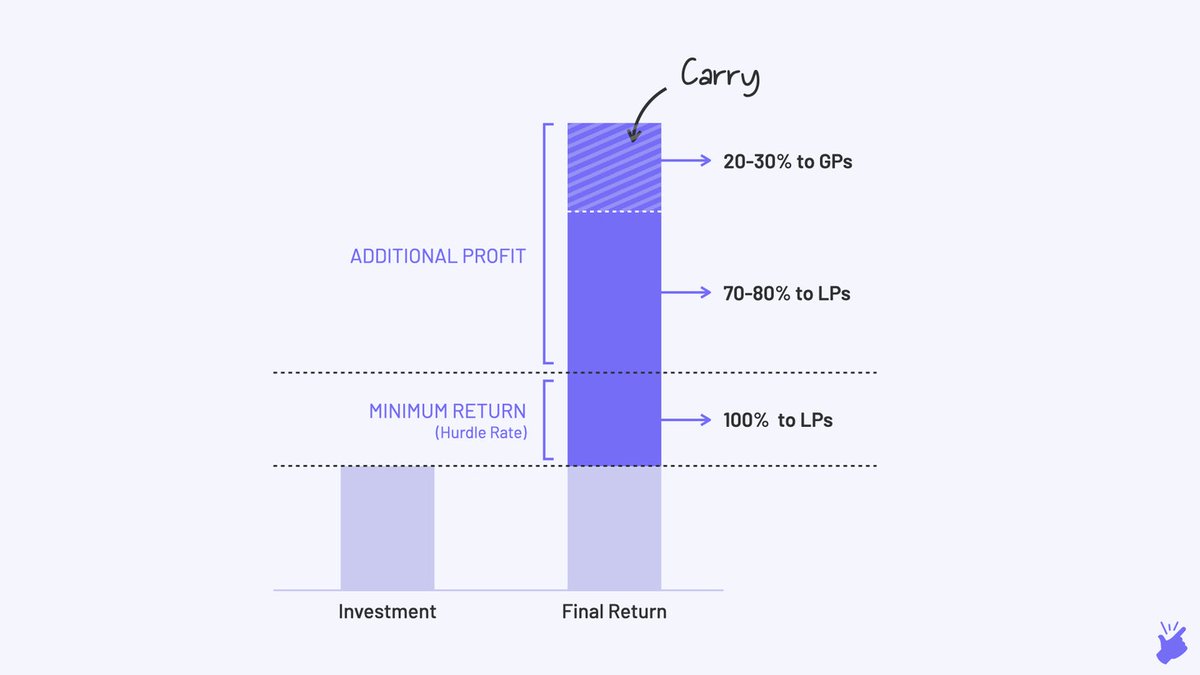

- fund size, fund theme, hurdle rate, fund life, deal structure (protecting risk), management fees, carry

- VC returns work on Power Law - 10x in 10 years, 25-35% annualized

by @simplanations https://simplanations.substack.com/p/2-how-vc-works-a-beginners-guide">https://simplanations.substack.com/p/2-how-v...

- fund size, fund theme, hurdle rate, fund life, deal structure (protecting risk), management fees, carry

- VC returns work on Power Law - 10x in 10 years, 25-35% annualized

by @simplanations https://simplanations.substack.com/p/2-how-vc-works-a-beginners-guide">https://simplanations.substack.com/p/2-how-v...

is venture capital easier than product management? an attempt at mapping respective tasks https://twitter.com/dotglum/status/1231329718957264896">https://twitter.com/dotglum/s...

silicon (whale)y; the arc of venture capital is a story of determined individuals betting on the long tail (/me thinks, is it actually & #39;fat tail& #39;) & more importantly, of spending a lifetime discovering the niche exceptions that prove a new rule

by @ani_pai https://electricsheep.substack.com/p/the-first-venture-capitalists">https://electricsheep.substack.com/p/the-fir...

by @ani_pai https://electricsheep.substack.com/p/the-first-venture-capitalists">https://electricsheep.substack.com/p/the-fir...

- hunting whales is only the first part of this > whaling created the organizational model that VCs use today

- crew owned ‘lay’ or equity ownership on the voyage

- gold exploration & oil wildcatting, have been characterized by long-tail outcomes https://twitter.com/ani_pai/status/1206638350494392321">https://twitter.com/ani_pai/s...

- crew owned ‘lay’ or equity ownership on the voyage

- gold exploration & oil wildcatting, have been characterized by long-tail outcomes https://twitter.com/ani_pai/status/1206638350494392321">https://twitter.com/ani_pai/s...

- unlimited vs limited liability (debt vs equity) > NY state brought in a general limited-liability in 1811

- carry; captain of the ship would keep an interest of 20 percent for whatever they carried. Hence - carried interest

by @Nicolas_Colin https://salon.thefamily.co/a-brief-history-of-the-world-of-venture-capital-65a8610e7dc2?source=social.tw">https://salon.thefamily.co/a-brief-h...

- carry; captain of the ship would keep an interest of 20 percent for whatever they carried. Hence - carried interest

by @Nicolas_Colin https://salon.thefamily.co/a-brief-history-of-the-world-of-venture-capital-65a8610e7dc2?source=social.tw">https://salon.thefamily.co/a-brief-h...

- Henry Goldman& #39;s underwriting concept based on their earning power

- Georges Doriot, the father of vc (ARD)

- vc is still a relatively marginal asset class

- Georges Doriot, the father of vc (ARD)

- vc is still a relatively marginal asset class

Read on Twitter

Read on Twitter