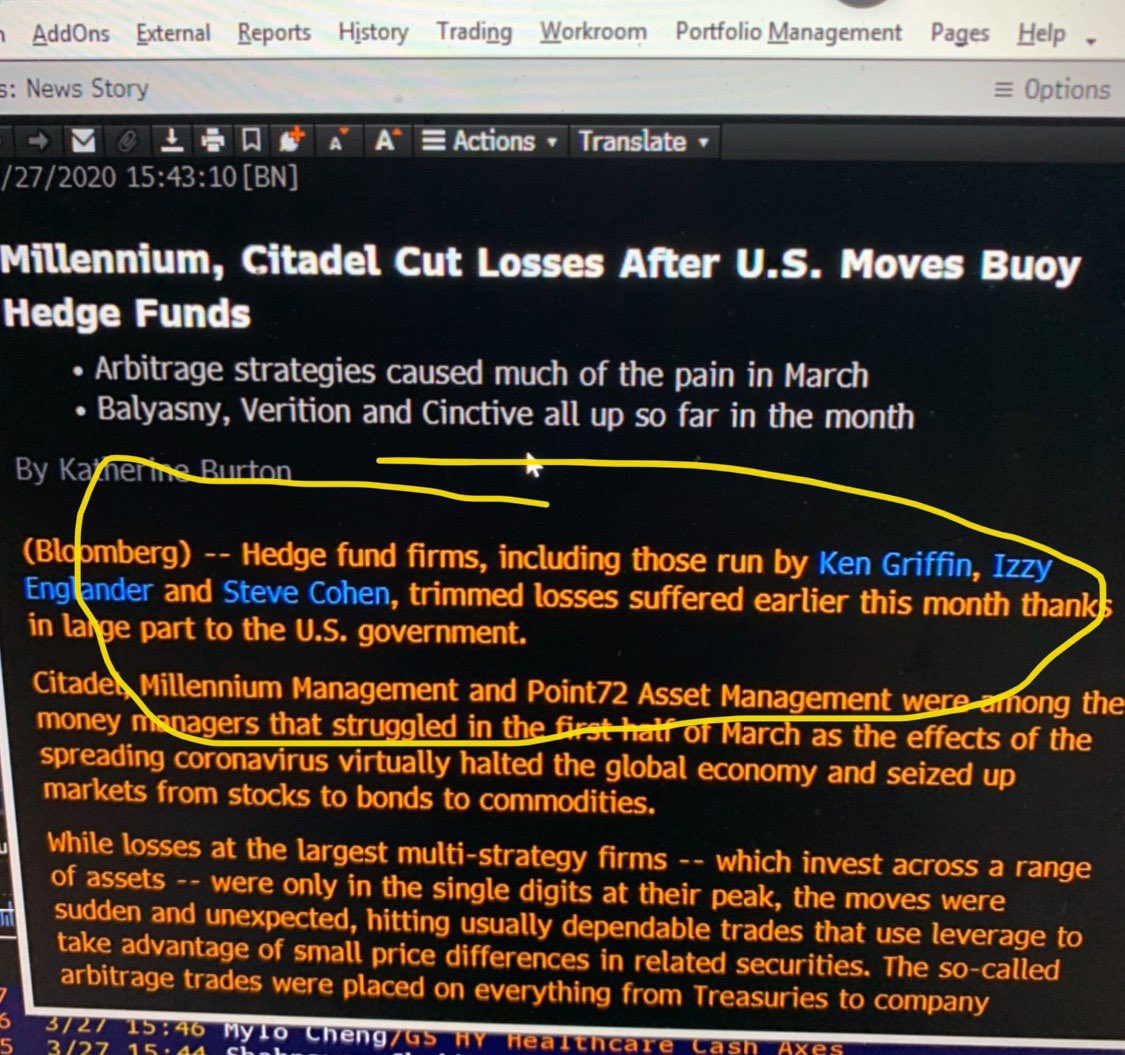

No one wants to admit it but there was a bailout to some of the nation& #39;s biggest hedge funds this week.

Credit books and risk parity shops would have nuked the markets further unless Mnuchin stepped in with the Fed.

Credit books and risk parity shops would have nuked the markets further unless Mnuchin stepped in with the Fed.

In 2008, it was Bear Stearns and Lehman.

In 2020, it& #39;s monster hedge funds you won& #39;t see on TV but believe me, they got smoked this week and if it wasn& #39;t for another round of socialism for the rich, the markets would be much lower.

In 2020, it& #39;s monster hedge funds you won& #39;t see on TV but believe me, they got smoked this week and if it wasn& #39;t for another round of socialism for the rich, the markets would be much lower.

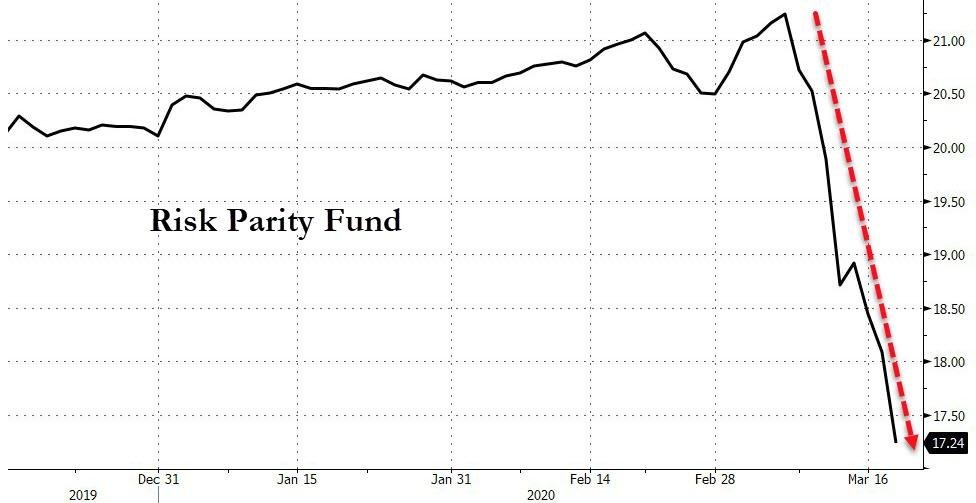

Risk parity is a type of asset-allocation strategy that aims to hold an equal amount of risk among investment classes, which react differently to market changes.

The trader diversifies among assets like fixed income, equities, and inflation-risk assets based not on price but on *volatility* or some other measure of risk. The less volatile an asset, the bigger the weighting it gets in the portfolio.

Simple right?

Simple right?

The key to the strategy is assessing the volatility of each asset class. If stocks are determined to be 4x as volatile as Treasury bonds, an investor would put 4x as much in bonds as in stocks.

As stock volatility increases, (see the VIX, currently near its ATH), a risk-parity portfolio manager would sell some stocks—something that you may have noticed over the past few weeks  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Eyes" aria-label="Emoji: Eyes">—which adds pressure to the stock market overall.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Eyes" aria-label="Emoji: Eyes">—which adds pressure to the stock market overall.

But what if the "low volatility" aka "safe" investments start to become volatile as well?

Well, portfolio managers have to sell them as well or get liquidated/called.

Well, portfolio managers have to sell them as well or get liquidated/called.

Ruh-roh. Your value-at-risk model is now hosed because everything is volatile, everything is dumping and you need to raise cash quickly so you can live to fight another day.

To be clear, the risk parity group only makes up a fraction of dollars vs. the trillions Index funds have but they are sophisticated shops that trade and deleverage at the speed of light.

However, if the world& #39;s top hedge funds all blow up in one week, what& #39;s that say for the rest of the market? What& #39;s that mean for the banks? The retail investor?

Mnuchin& #39;s phone was likely on fire from these billionaire fund managers pleading the case to backstop them for a more favorable unwinding or deleveraging of their investments.

That& #39;s a bailout folks and it happened this week.

That& #39;s a bailout folks and it happened this week.

More confirmation of the Fed bailout for hedge funds: the Bank of International Settlement

https://www.bis.org/publ/bisbull02.pdf">https://www.bis.org/publ/bisb...

https://www.bis.org/publ/bisbull02.pdf">https://www.bis.org/publ/bisb...

And here& #39;s @chamath obliterating the Wall Street media narrative around bailouts https://twitter.com/CNBC/status/1248323677898366978">https://twitter.com/CNBC/stat...

Read on Twitter

Read on Twitter