Thread on $DIS

DIS has gone down from $150 to $90 in no time. Is it a buy? After spending decent time on DIS, it& #39;s on my "too hard" pile. Here& #39;s why.

DIS has gone down from $150 to $90 in no time. Is it a buy? After spending decent time on DIS, it& #39;s on my "too hard" pile. Here& #39;s why.

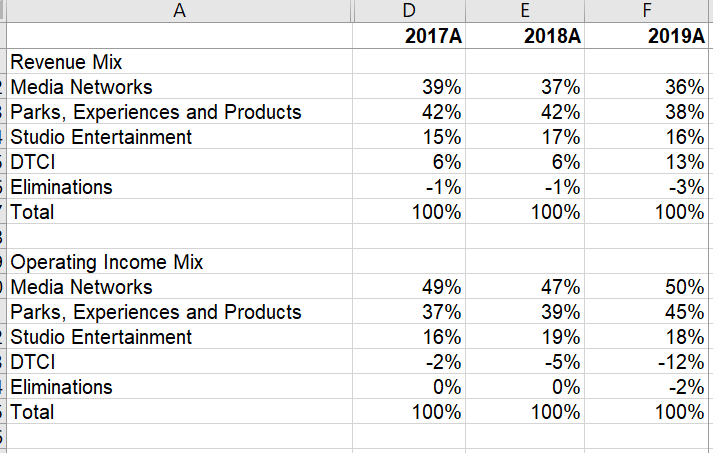

1/ Currently, ~50% earnings come from Media Networks, a segment that has real terminal value risk. Theme parks are going to be closed for an indefinite period, perhaps followed by recession. People are not going to movie theaters as well. That leaves us with DTCI...

2/ Before I talk about DTCI, let me talk a little more about other three segments one by one.

3/ Media Networks is in secular decline in the long term. In the near term, the business will suffer because who really wants to pay for >$100 cable TV. Cord cutting will probably intensify. Also don& #39;t forget the FOX integration. These are never fun and easy things to pull off.

3/ Assuming theme parks remain closed for two full quarters, $DIS will lose a truck load of revenue and profits. There are a lot of fixed costs in this segment. Hotel and cruise are within this segment all of which will take the hit. I estimate DIS can still just break-even...

4/ in this segment. For context, in 2019, they made $6.7 Bn operating profit from just this segment. So merely breaking even is still going to hurt a lot.

If there is a recession afterwards, Parks business may not just go back to the level where it was quickly.

If there is a recession afterwards, Parks business may not just go back to the level where it was quickly.

5/ Studio segment generated $11 Bn revenue and $2.7 Bn operating profit. ~43% of studio revenue was from theatrical distribution which will obviously take a hit this year. The rest is home entertainment and TV/SVOD distribution rights. Home entertainment is in secular decline...

6/ and $DIS is pulling content from $NFLX. So they& #39;ll lose some good chunk of licensing revenues they enjoyed last year. This business should do better even in recession, but will take a hit in the near term because of the nature of the current crisis.

7/ Now let& #39;s get to the meat of the discussion. $DIS DTCI i.e. Direct-to-Consumer and International segment.

Basically, you cannot own DIS unless you are fairly bullish on DTCI, at least not in this price.

Basically, you cannot own DIS unless you are fairly bullish on DTCI, at least not in this price.

8/ DIS just launched DIS+ in November, and they are launching it in many European countries and in India in next few weeks. It& #39;s a no-brainer product for consumers. The price point is just too good to ignore.

9/ But where I really struggle with is we do not have any idea about profitability. In fact, management and sell-side think it will be profitable in 2024. I believe that& #39;s way too conservative, but it& #39;s just my "belief", if you push me, I don& #39;t have concrete data to back my point

10/ To be fair, nobody knows just how profitable DTCI will be in the long term, not even management. I don& #39;t blame them. They are just launching their product, and they don& #39;t have any crystal ball either. They probably have estimates, but whether they will be able to transform...

11/ ...the business successfully is an open question. I would not bet against $DIS. Their track record is phenomenal.

12/ ...but it would be much easier name to own if DTCI had robust support from Parks, and studio segment which will probably not be there in next two years.

Will market be patient enough to look through short term pain in studio, and Park and tolerate huge losses in DTCI?

Will market be patient enough to look through short term pain in studio, and Park and tolerate huge losses in DTCI?

13/ I do not know the answer. It does not feel like a screaming buy, at least not before you have a good handle at the economics of DTCI which I admittedly do not have!

14/ Overall, great brand, and product, but can potentially be an uncomfortable name to own if this crisis lingers and a recession follows! Also, don& #39;t forget the debt which doesn& #39;t look ominous. Just 2.3x net debt/EBITDA. But if EBITDA falls precipitously, can become ~4x.

15/ All on a sudden, market seems to hate uncertainty the most! And when I looked closer, I think $DIS has lot more uncertainty than it seemed even a few months ago. I could not solve DTCI puzzle. So I will pass for now.

Read on Twitter

Read on Twitter