#Covid_19 on UG Economy.

Low tourism no = businesses suffer + reduced forex (UGX depreciation?)

Supply chain from China = low imports + reduced supply + increased demand, prices raise + reduced excise duty.

Low taxes + increased borrowing + budget constraints

1/1

Low tourism no = businesses suffer + reduced forex (UGX depreciation?)

Supply chain from China = low imports + reduced supply + increased demand, prices raise + reduced excise duty.

Low taxes + increased borrowing + budget constraints

1/1

Portfolio investors retreat to "safe" markets as $ strengthens

Then come the 2021 elections https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Face with rolling eyes" aria-label="Emoji: Face with rolling eyes"> = inflationary pressures + reduced FDI

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙄" title="Face with rolling eyes" aria-label="Emoji: Face with rolling eyes"> = inflationary pressures + reduced FDI

Further delay in getting to First Oil.

The positive, exports rise + alternative markets for imports.

2/2

Then come the 2021 elections

Further delay in getting to First Oil.

The positive, exports rise + alternative markets for imports.

2/2

All this is based on an assumption that we are able keep #Covid_19 from Uganda. In case it does make a landing, the hit for the economy will be worse.

Update:

In the February 2020 Monetary Policy Statement, @BOU_Official warned of the effects of #Covid_19 to economic growth.

Thread

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://twitter.com/mumakeith/status/1228196571302387715?s=19">https://twitter.com/mumakeith...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://twitter.com/mumakeith/status/1228196571302387715?s=19">https://twitter.com/mumakeith...

In the February 2020 Monetary Policy Statement, @BOU_Official warned of the effects of #Covid_19 to economic growth.

Thread

So, imagine businesses that have borrowed money & then it all slows. If we get to a point of "staying at home", the businesses will still have to meet obligations. They will default. Then NPLs will rise. Banks will slow on lending no matter how low @BOU_Official will be..

It is at this point that the government through fiscal policy (Ministry of Finance) will be required to come in with a rescue. Already facing low revenues, how will the govt intervene, if required?

We are in this for a Long haul

We are in this for a Long haul

Stage 1: Supply Chains

Stage 2: Tourism.

Stage 3: Businesses. Job losses. No income. Money lender calls. Kids are home. They need to eat.

Stage 4: Coming soon

The domino effect.

#COVID19UG

Stage 2: Tourism.

Stage 3: Businesses. Job losses. No income. Money lender calls. Kids are home. They need to eat.

Stage 4: Coming soon

The domino effect.

#COVID19UG

The effects of #Covid_19 on the tourism sector in Uganda. Fleet of Great Lakes Safaris grounded. Drivers affected. Tour guides affected. Hotels/lodges affected.

This is just the tip of the iceberg. It will get worse unless we don& #39;t confirm a #COVID19UG case in 60 days.

This is just the tip of the iceberg. It will get worse unless we don& #39;t confirm a #COVID19UG case in 60 days.

A conversation with someone yesterday

"My friend opened a bar & restaurant 3 months ago. It may have cost him btn UGX30m & UGX70m to set up. Now, he has to close the bar. Layoff workers. The restaurant is not enough to cover the costs + meet his loan obligations." https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face"> #covid19UG

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face"> #covid19UG

"My friend opened a bar & restaurant 3 months ago. It may have cost him btn UGX30m & UGX70m to set up. Now, he has to close the bar. Layoff workers. The restaurant is not enough to cover the costs + meet his loan obligations."

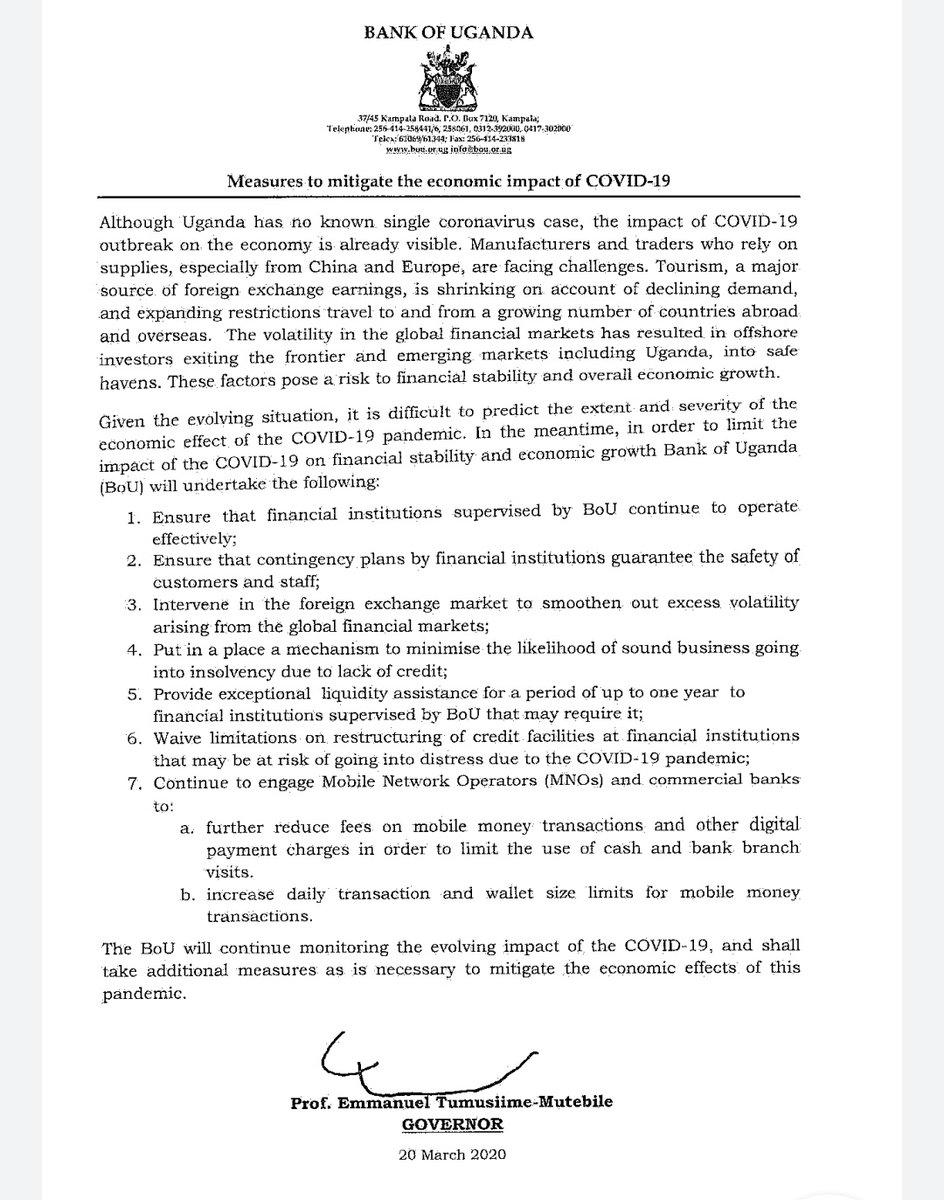

Prof. Emmanuel Tumusiime Mutebile Governor @BOU_Official has just issued a statement on #COVID19UG mitigation...

He said;

BOU to continue monitoring the impact of #Covid_19 and intervene to mitigate the effects of, if necessary.

He said;

BOU to continue monitoring the impact of #Covid_19 and intervene to mitigate the effects of, if necessary.

Mutebile said:

- BOU to ensure Commercial Bank Contingency Plans on #Covid_19 guarantee safety of customers and staff

- Intervene in the forex market to stem volatility

- BOU to minimize the risk (rescue) of legit businesses going under due to lack of credit. #COVID19UG

- BOU to ensure Commercial Bank Contingency Plans on #Covid_19 guarantee safety of customers and staff

- Intervene in the forex market to stem volatility

- BOU to minimize the risk (rescue) of legit businesses going under due to lack of credit. #COVID19UG

- To provide one year liquidity support, if necessary (my understanding)

- Engage MNO& #39;s and Commercial Banks to reduce charges on MM and Digital charges in order to limit the use of cash. #covid19UG

- Engage MNO& #39;s and Commercial Banks to reduce charges on MM and Digital charges in order to limit the use of cash. #covid19UG

My take:

For now, we are still clutching the straws, the @BOU_Official is to provide reassurance that govt will help/intervene where necessary. This is unprecedented & the @BOU_Official will require the fiscal side to also "put in" a shift.

For now, we are still clutching the straws, the @BOU_Official is to provide reassurance that govt will help/intervene where necessary. This is unprecedented & the @BOU_Official will require the fiscal side to also "put in" a shift.

Unpaid leave/redundancy in an already informal economy with a large %age of underemployment. #COVID19UG

The impact is like the domino effect.

The impact is like the domino effect.

I am not optimistic. The consequences to the economy are huge. Massive. Devastating. They& #39;re depressing. The economy will recover at some point but how will it look like before that happens? #COVID19UG

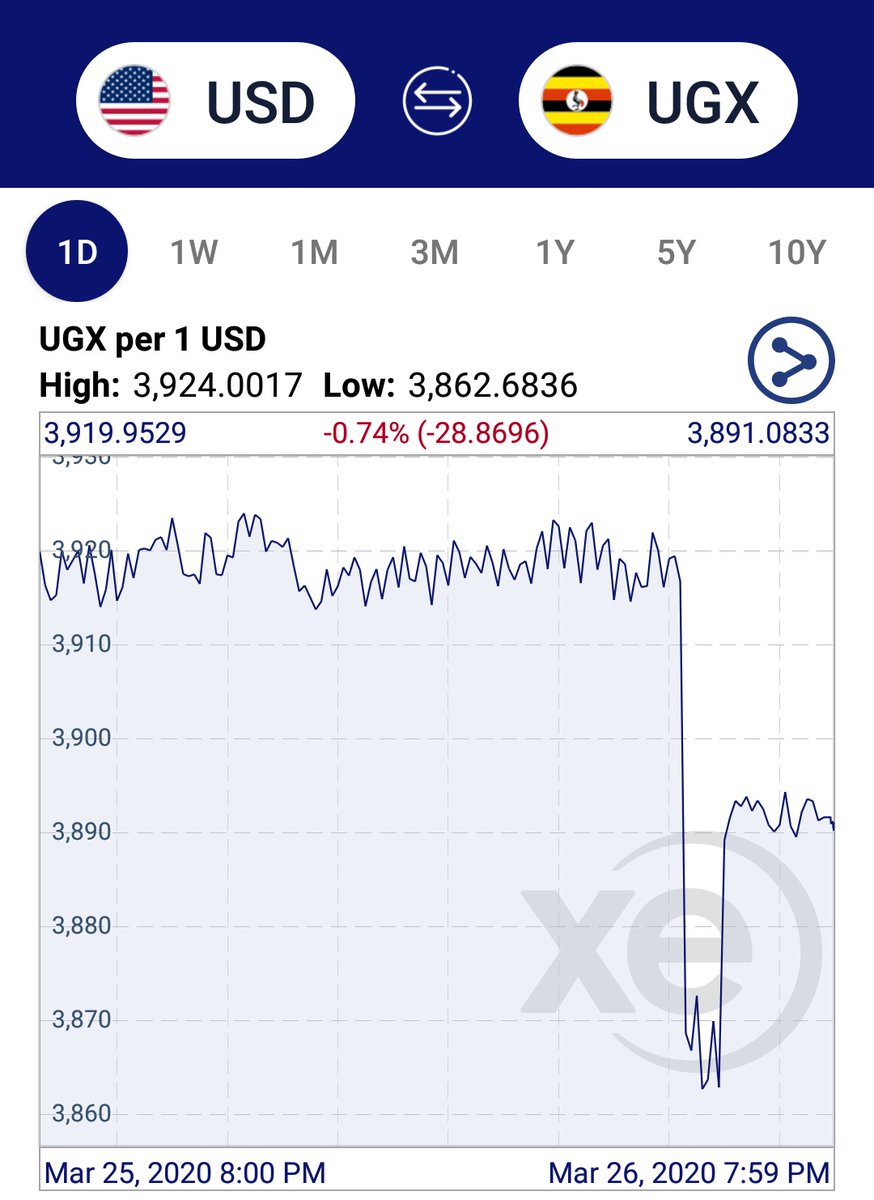

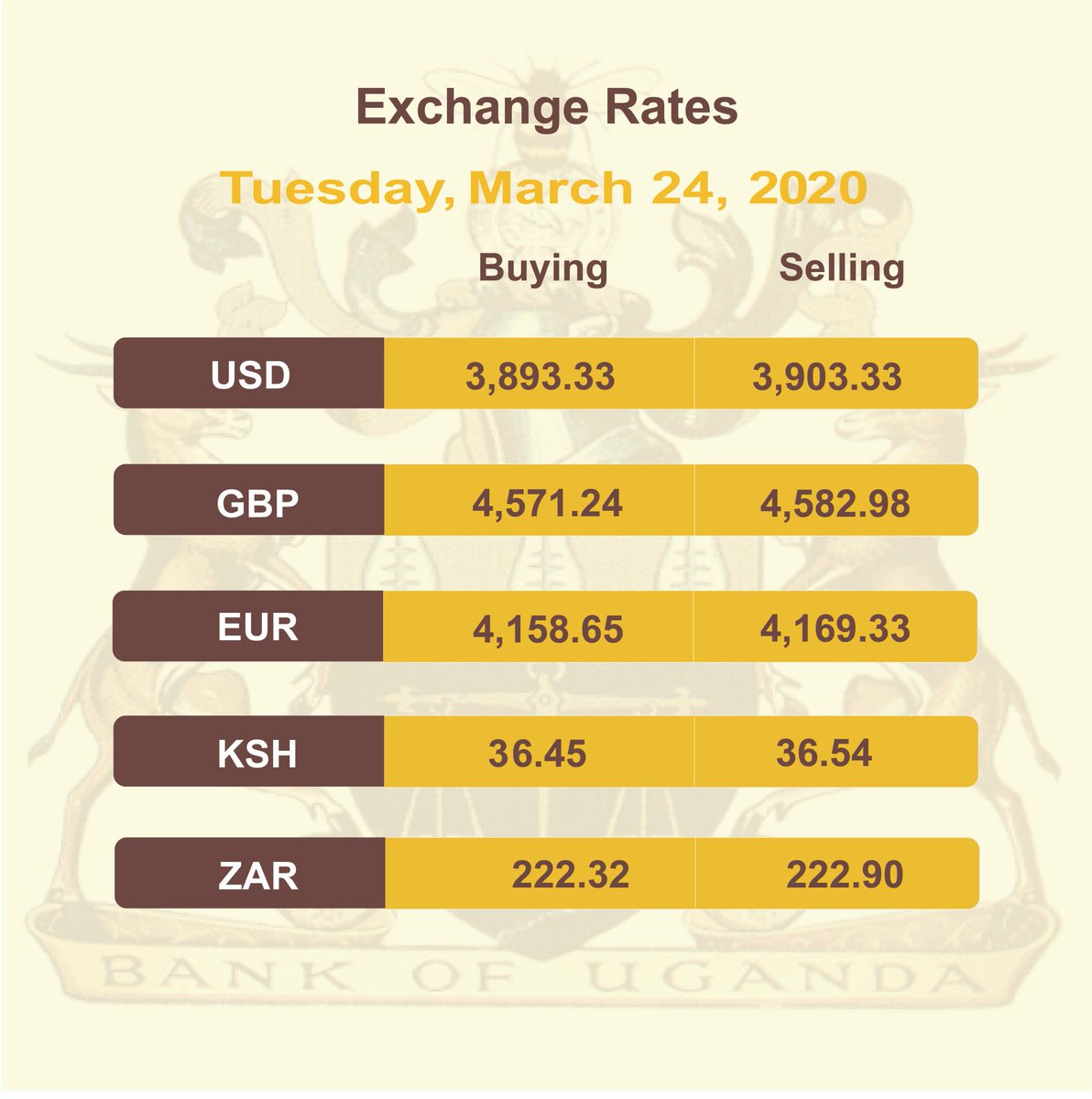

The Uganda Shilling depreciation continues over #COVID19UG fears. Getting to UGX3900 for each dollar sooner than expected.

We are almost at a 10 year low for the Uganda Shilling. Depreciation pressures = hike in prices of (imported) goods. #COVID19UG

The @nssfug statement on early access of savings due #COVID19UG.

- The fund has no legal basis to do that.

@rpbyaru would @nssfug

consider buying more govt securities if that money will be used to mitigate the effects of #COVIDー19? https://twitter.com/nssfug/status/1242431043694714883?s=19">https://twitter.com/nssfug/st...

- The fund has no legal basis to do that.

@rpbyaru would @nssfug

consider buying more govt securities if that money will be used to mitigate the effects of #COVIDー19? https://twitter.com/nssfug/status/1242431043694714883?s=19">https://twitter.com/nssfug/st...

On the current "fuel shortage"

Finance minister @MatiaK5 says it is because:

- We are getting in low fuel from Kenya due to reduced production as a result of #COVIDー19

- Reserves in Jinja running low

#COVID19UG

Finance minister @MatiaK5 says it is because:

- We are getting in low fuel from Kenya due to reduced production as a result of #COVIDー19

- Reserves in Jinja running low

#COVID19UG

The Uganda Shilling was in a stable position all day until mid-afternoon. There was that huge spike that sent it to record depreciation levels -

$1 = UGX3917

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">

In one month alone, the UGX has depreciated by 6.6% against the USD.

How will this end? #COVID19UG

$1 = UGX3917

In one month alone, the UGX has depreciated by 6.6% against the USD.

How will this end? #COVID19UG

Even before #COVID19UG, the Ugandan govt faced revenue shortfalls & increased expenditure demands. Breakdown below of the issues.

- Dec 2019, @mofpedU submits request to @Parliament_Ug to borrow €600m from Standard Bank & TDA.

But why?

- Dec 2019, @mofpedU submits request to @Parliament_Ug to borrow €600m from Standard Bank & TDA.

But why?

Here is why?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Revenue collection projected shortfall from @URAuganda UGX1.8trillion

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Revenue collection projected shortfall from @URAuganda UGX1.8trillion

- Non-receipt of:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">World Bank grant - UGX375bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">World Bank grant - UGX375bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Capital Gain Tax from Tullow - UGX225bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Capital Gain Tax from Tullow - UGX225bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">License fee renewal from MTN - $100m.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">License fee renewal from MTN - $100m.

Total shortfall = UGX2.5trillion

#COVID19UG

- Non-receipt of:

Total shortfall = UGX2.5trillion

#COVID19UG

That& #39;s not all

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Additional expenditure pressures UGX1.4trillion.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Additional expenditure pressures UGX1.4trillion.

Supplementary budget requests:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Classified for defense UGX400bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Classified for defense UGX400bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">State House (classified) UGX35bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">State House (classified) UGX35bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Others UGX228bn

https://abs.twimg.com/emoji/v2/... draggable="false" alt="➡️" title="Rightwards arrow" aria-label="Emoji: Rightwards arrow">Others UGX228bn

The €600m loan would cover the deficit + plus new expenditure before #COVID19UG

Supplementary budget requests:

The €600m loan would cover the deficit + plus new expenditure before #COVID19UG

Parliament approved the loan eventually but we& #39;ve a new challenge >> #COVID19UG in the same financial year 2019/20.

- Slowdown in growth to 5% (non-conservative est.)

- Additional revenue shortfall

- Another supplementary request

- Stimulus to support the economy?

- Slowdown in growth to 5% (non-conservative est.)

- Additional revenue shortfall

- Another supplementary request

- Stimulus to support the economy?

The @mofpedU projection is that we& #39;ll have revenue shortfalls of:

2019/20 - UGX87bn & worst case UGX288bn

2020/21 - UGX185bn & worst case UGX350bn

Remember we& #39;re budgeting for the 2021 elections & the Electoral Commission needs UGX700bn from 2020/21 budget.

And #COVID19UG?

2019/20 - UGX87bn & worst case UGX288bn

2020/21 - UGX185bn & worst case UGX350bn

Remember we& #39;re budgeting for the 2021 elections & the Electoral Commission needs UGX700bn from 2020/21 budget.

And #COVID19UG?

- Well, Finance Minister @MatiaK5 told MPs that the plan is to borrow $100m from the World Bank but that& #39;s just to plug the budget financing gap.

- They& #39;d seek support from the IMF to ensure Bank of Uganda reserve buffers remain strong.

Still, no specific #covid19UG econ action

- They& #39;d seek support from the IMF to ensure Bank of Uganda reserve buffers remain strong.

Still, no specific #covid19UG econ action

Global oil prices reach "record lows"

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤪" title="Zany face" aria-label="Emoji: Zany face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤪" title="Zany face" aria-label="Emoji: Zany face">

We& #39;re gonna have low fuel prices

Hold on

Due to the effects of #COVIDー19, supply has gone done

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face">

To make matters worse, we don& #39;t have enough in our reserves

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face">

Oh, have you also seen the Uganda Shilling depreciation?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😢" title="Crying face" aria-label="Emoji: Crying face">

#Covid19UG

We& #39;re gonna have low fuel prices

Hold on

Due to the effects of #COVIDー19, supply has gone done

To make matters worse, we don& #39;t have enough in our reserves

Oh, have you also seen the Uganda Shilling depreciation?

#Covid19UG

Sanity prevailed today. The Uganda Shilling gained 0.74% against the US Dollar.

@BOU_Official kudos for this today. At least we can slow the inevitable.

#COVID19UG

@BOU_Official kudos for this today. At least we can slow the inevitable.

#COVID19UG

More insanity averted in the forex market today. Uganda Shilling gained 1.87% on the US Dollar today. We live to "due" another day.

But at what price? $200m plus from our Foreign reserves. #COVID19UG

But at what price? $200m plus from our Foreign reserves. #COVID19UG

Bank of Uganda directs banks to differ dividends & bonus payments (in order to maintain good reserves + reduce pressure on the Uganda Shilling) #COVID19UG https://edition.pagesuite.com/popovers/dynamic_article_popover.aspx?artguid=ae88060c-70a8-4dfe-813b-6098a6e33c27">https://edition.pagesuite.com/popovers/...

The longest Monetary Policy Statement issued by @BOU_Official in light of #COVID19UG

- Economic growth to "slow drastically" in second half of 2019/20.

- Overall growth in 2019/20 is projected at between 3-4%. Initial projection before Covid was 6.2% https://twitter.com/BOU_Official/status/1247131455312068608?s=20">https://twitter.com/BOU_Offic...

- Economic growth to "slow drastically" in second half of 2019/20.

- Overall growth in 2019/20 is projected at between 3-4%. Initial projection before Covid was 6.2% https://twitter.com/BOU_Official/status/1247131455312068608?s=20">https://twitter.com/BOU_Offic...

The @BOU_Official reduces Central Bank Rate to 8% by 1%age point in order to ease access to credit as #COVID19UG bites.

Lowest CBR rate....

The bank also announced some additional measures.

Lowest CBR rate....

The bank also announced some additional measures.

1. Liquidity assistance to commercial banks that are in liquidity distress for one year.

2. Liquidity to commercial banks for a longer period through reverse Repos + roll over opportunity

....3

#COVID19UG

2. Liquidity to commercial banks for a longer period through reverse Repos + roll over opportunity

....3

#COVID19UG

3. Buy back treasury bonds from Microfinance Institutions (MDIs) & Credit Institutions (CIs) to provide them with liquidity.

4. BOU will provide liquidity to MDIs & CIs that do not hold any Treasury Bills or Bonds with Fixed Deposits being the collateral.

...5

#COVID19UG

4. BOU will provide liquidity to MDIs & CIs that do not hold any Treasury Bills or Bonds with Fixed Deposits being the collateral.

...5

#COVID19UG

5. Banks given permission to restructure loans both corporate & personal on a "case by case basis" for 12 months effective 1st April 2020.

#COVID19UG

#COVID19UG

The @BOU_Official also said that it would continue to monitor the financial markets and macroeconomic conditions and "callibrate its operations in order to meet the needs for additional liquidity support".

#COVID19UG

#COVID19UG

Read on Twitter

Read on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">In one month alone, the UGX has depreciated by 6.6% against the USD. How will this end? #COVID19UG" title="The Uganda Shilling was in a stable position all day until mid-afternoon. There was that huge spike that sent it to record depreciation levels - $1 = UGX3917 https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">In one month alone, the UGX has depreciated by 6.6% against the USD. How will this end? #COVID19UG">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">In one month alone, the UGX has depreciated by 6.6% against the USD. How will this end? #COVID19UG" title="The Uganda Shilling was in a stable position all day until mid-afternoon. There was that huge spike that sent it to record depreciation levels - $1 = UGX3917 https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">In one month alone, the UGX has depreciated by 6.6% against the USD. How will this end? #COVID19UG">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">In one month alone, the UGX has depreciated by 6.6% against the USD. How will this end? #COVID19UG" title="The Uganda Shilling was in a stable position all day until mid-afternoon. There was that huge spike that sent it to record depreciation levels - $1 = UGX3917 https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">In one month alone, the UGX has depreciated by 6.6% against the USD. How will this end? #COVID19UG">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">In one month alone, the UGX has depreciated by 6.6% against the USD. How will this end? #COVID19UG" title="The Uganda Shilling was in a stable position all day until mid-afternoon. There was that huge spike that sent it to record depreciation levels - $1 = UGX3917 https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Pensive face" aria-label="Emoji: Pensive face">In one month alone, the UGX has depreciated by 6.6% against the USD. How will this end? #COVID19UG">