Oil prices heading downwards. No surprises there. But @Reuters piece seems to suggest that some sort of "Asia oil premium" is still alive and well. Thought it had been killed off. With worsening market conditions, Indian buyers should be particularly ruthless. @dpradhanbjp https://twitter.com/Reuters/status/1236468087035224064">https://twitter.com/Reuters/s...

The coming months are going to test Saudi Arabia& #39;s economy. The collapse of OPEC+ is going to be good for oil buyers. https://twitter.com/business/status/1236560671879372800?s=20">https://twitter.com/business/...

"Goldman Sachs Group Inc. became the first major Wall Street bank to anticipate that global oil demand will contract in 2020 for only the fourth time in nearly 40 years." https://twitter.com/WorldOil/status/1235555680955895810?s=20">https://twitter.com/WorldOil/...

Monday sees latest @IEA oil demand forecast which should see further downward revisions. https://twitter.com/IEA/status/1236203897464803328?s=20">https://twitter.com/IEA/statu...

"Saudi Arabia kicks off an all-out price war with aggressive plans to increase oil output next month." India needs to ruthlessly squeeze every last naya paisa out of our oil suppliers until the "pips squeak". @dpradhanbjp @PetroleumMin https://twitter.com/business/status/1236527333831573504?s=20">https://twitter.com/business/...

As in PM @narendramodi& #39;s 1st term, we need to use the opportunity of reduced oil prices to create fiscal headroom i.e. reduce retail petrol & diesel prices at a much slower rate & use the additional tax revenue to fund infrastructure. @nsitharaman

HT article echoes my views that this is going to be a big windfall for India. We& #39;re very oil dependent, so should use our leverage as a large buyer to squeeze every last discount on the market price that we can. @dpradhanbjp @PiyushGoyal https://www.hindustantimes.com/editorials/what-the-dip-in-oil-prices-means/story-lD0DL3lD5CANK7JzljWGoK.html">https://www.hindustantimes.com/editorial...

Excellent piece from @FT on some of the dynamics behind the oil price war between Saudi Arabia and Russia. https://www.ft.com/content/59dcba56-61a2-11ea-b3f3-fe4680ea68b5">https://www.ft.com/content/5...

I would be very wary of ever betting against President Putin. https://twitter.com/FT/status/1237064972326354944?s=20">https://twitter.com/FT/status...

Saudi-Russia oil price war could push Brent crude to close to $20 per barrel, according to Goldman Sachs. If prices do get there, it& #39;ll be even better news for the Indian economy. https://markets.businessinsider.com/commodities/news/oil-price-crash-20-dollars-goldman-sachs-forecast-opec-coronavirus-2020-3-1028976234">https://markets.businessinsider.com/commoditi...

@IEA& #39;s just updated forecast for 2020 revises global oil demand downwards by about 1 million barrels a day due to the impact of the coronavirus. It& #39;s expected to be the 1st full-year decline in oil demand in over a decade.

IEA& #39;s Fatih Birol says that for some major oil producers "..sustained low prices could make it almost impossible to fund essential areas such as education, health care & public sector employment." His very readable thread is here. https://twitter.com/IEABirol/status/1236949531117465600?s=20">https://twitter.com/IEABirol/...

The Saudis are in trouble. They need about $80 a barrel to balance their budget, and their staying power against Russia and US shale producers is doubtful, particularly in the latter case if Pres. Trump bails out these producers. https://www.independent.co.uk/voices/saudi-arabia-mbs-oil-prices-stock-market-dictator-america-plotting-downfall-a9391031.html">https://www.independent.co.uk/voices/sa...

Approaches already being made to US administration. https://twitter.com/SissiBellomo/status/1237479660281307143?s=20">https://twitter.com/SissiBell...

Looks like most of the major producers are going to cut loose, and flood the market with supply. Time for Indian oil buyers to fill their boots with cheap crude. @dpradhanbjp, this might be a good time to expand India& #39;s strategic oil reserves? https://twitter.com/ja_herron/status/1237384813033615360?s=20">https://twitter.com/ja_herron...

Saudi Arabia is looking for more tankers to carry its extra production. https://twitter.com/JavierBlas/status/1237458363279163393?s=20">https://twitter.com/JavierBla...

Demand for oil in free-fall. Crude prices heading much, much lower. And unlikely to ever recover to levels needed to balance budgets of many ME states. Saudis must be desperate to call time on their ill-fated war in Yemen. @DrSJaishankar @dpradhanbjp https://twitter.com/business/status/1239280476730339328?s=20">https://twitter.com/business/...

Saudis & Russians gambled that their oil price war would push US shale producers to the wall. Hard to see @realDonaldTrump sacrificing what has now become an important part of the US economy. https://twitter.com/FT/status/1238837342212849664?s=20">https://twitter.com/FT/status...

Forecasts of how low oil prices can go are being re-written. Geopolitical impacts of very low prices for the Middle East will be profound. Meanwhile, India should significantly expand its strategic oil reserves storage. @dpradhanbjp @narendramodi https://finance.yahoo.com/news/oil-prices-could-fall-below-152446634.html?guccounter=1&guce_referrer=aHR0cHM6Ly90LmNvLw&guce_referrer_sig=AQAAAJfDSGJ20DCdxyJiSRga8TMndD2SMb1i6H2RYk1CPp9wLV329lWcGePluJwaFQBscKmbfElR__bAfjP1Ks3cuxH2pxBoB_3l_WYLMSCRhdR3hhKnX6v92CkTkBehsBA9zgJL_D0RqmBZLdGKaY4seoj6qyC77ZM2RmHwH0E46u33">https://finance.yahoo.com/news/oil-...

With many major oil consumers in lockdowns, the oil glut will only grow. Prices may crash to record lows. So big oil producers may have to fight two battles at the same time: the #ChineseCoronaVirus and empty cash tills. Who& #39;ll bail them out? https://twitter.com/business/status/1242920729382969345?s=20">https://twitter.com/business/...

With many in some form of lockdown & OPEC+ continuing to pump, global oil storage (tank farms, pipelines, tankers) running out of space. Wait until the oil price goes negative, then fill up the Indian strategic oil reserves. @dpradhanbjp @DrSJaishankar https://twitter.com/Jkylebass/status/1245791953003974656?s=20">https://twitter.com/Jkylebass...

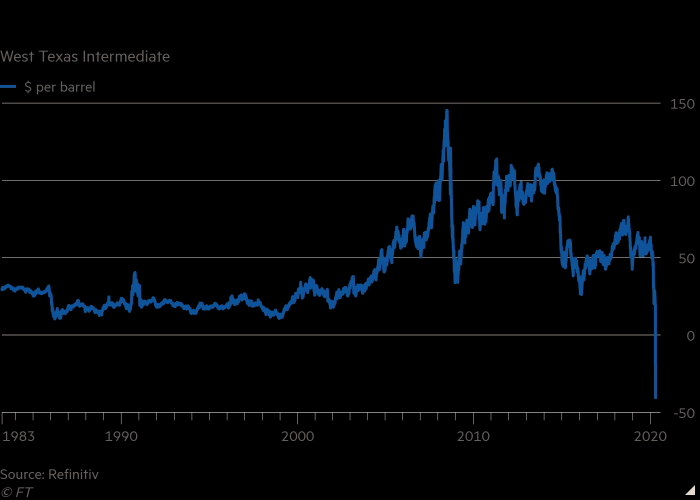

US oil benchmark, West Texas Intermediate (WTI), for May delivery is negative. https://www.ft.com/content/a5292644-958d-4065-92e8-ace55d766654">https://www.ft.com/content/a...

Now that& #39;s a chart.

Settlement price on Monday was -$37.63, compared to +$18.27 on Friday. https://twitter.com/business/status/1252306679154323457?s=20">https://twitter.com/business/...

Great thread on the technical reasons for the negative pricing. https://twitter.com/Chris_arnade/status/1252300148023197701?s=20">https://twitter.com/Chris_arn...

Another great tweet. https://twitter.com/TheStalwart/status/1252318539677085697?s=20">https://twitter.com/TheStalwa...

"The Oil Price Crash in One Word: Inelasticity". No one wants oil. Producers keep pumping oil. https://twitter.com/BW/status/1252339068739833859?s=20">https://twitter.com/BW/status...

Read on Twitter

Read on Twitter