Thread for Semis. Not my area of expertise, but trying to learn. Feedback appreciated.

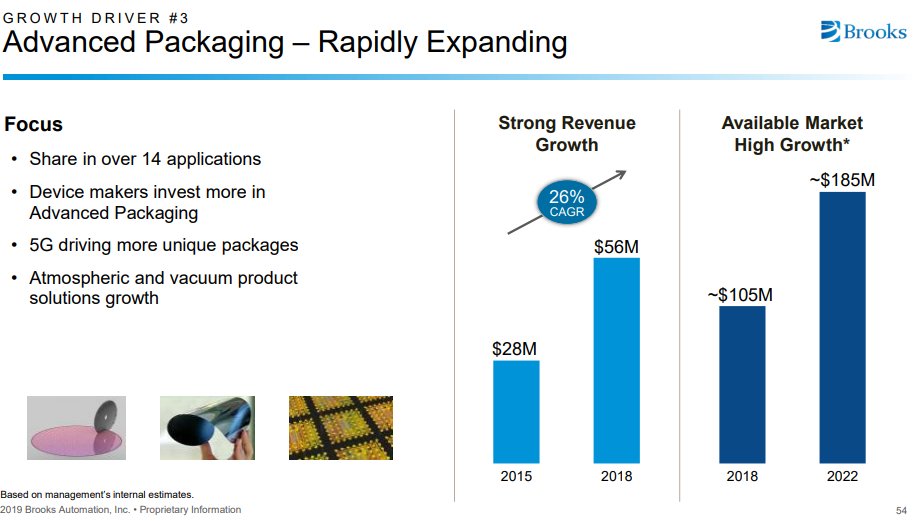

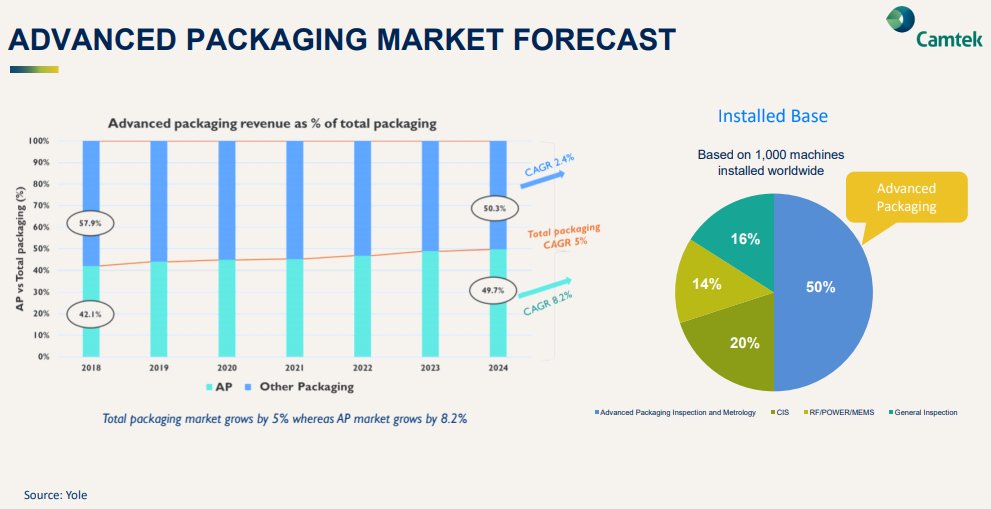

Advanced Level Packaging - Brooks Automation ($BRKS) and CamTek ($CAMT).

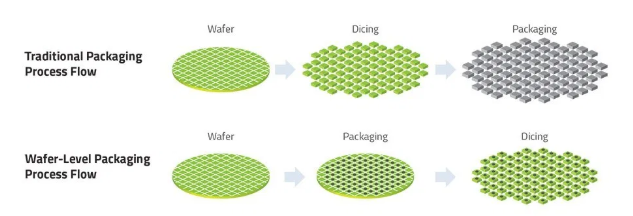

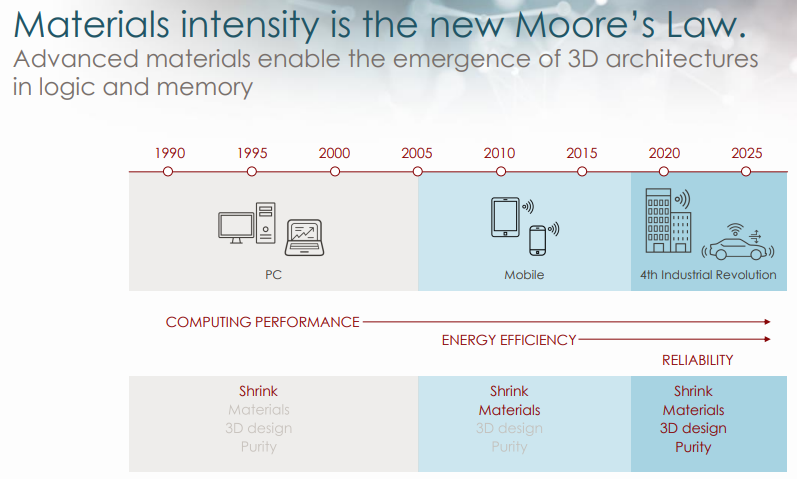

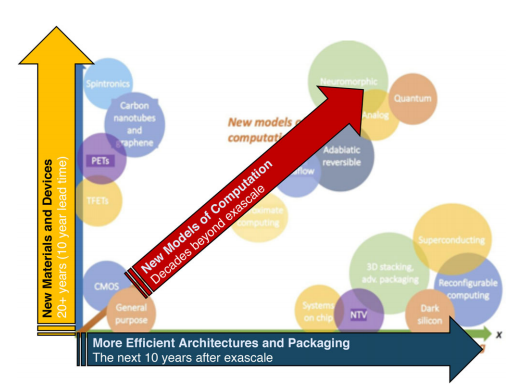

Decline of Moore& #39;s Law means Semis looking for other opportunities to improve chip efficiency? Packaging is an opportunity to continue efficiency arc?

Decline of Moore& #39;s Law means Semis looking for other opportunities to improve chip efficiency? Packaging is an opportunity to continue efficiency arc?

https://en.wikipedia.org/wiki/Wafer-level_packaging

Size">https://en.wikipedia.org/wiki/Wafe... constraints for smartphones driving demand.

Size">https://en.wikipedia.org/wiki/Wafe... constraints for smartphones driving demand.

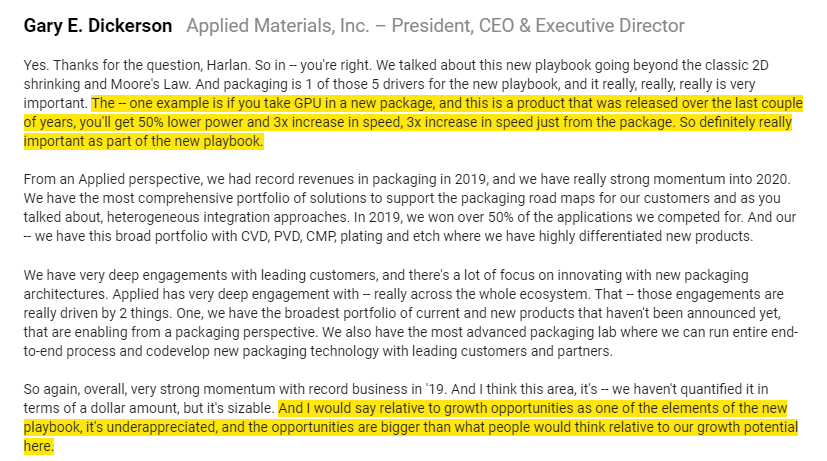

$AMAT CEO on why Semi industry is evolving and packaging becoming more important. Highlights Equipment % of Revenue has been rising over the last 5 years.

Does that mean supply chain gaining value within ecosystem?

Does that mean supply chain gaining value within ecosystem?

$AMAT CEO 1Q20 -

Our packaging business delivered record revenues in 2019 while winning well over 50% of our available market.

Our packaging business delivered record revenues in 2019 while winning well over 50% of our available market.

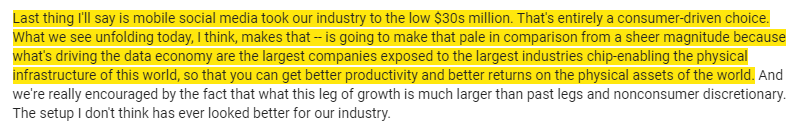

Semi Industry Size and Drivers

PCs $25b --->

Mobile grew Semi to ~$30b --->

Data grew Semi to ~$50b --->

Data/cloud still in its infancy.

PCs $25b --->

Mobile grew Semi to ~$30b --->

Data grew Semi to ~$50b --->

Data/cloud still in its infancy.

Why the next move could be larger and faster than anyone is anticipating. Mobile/Social growth was driven by consumers. Data/Cloud driven by Corporations that can demonstate ROI on these products.

Industry Trends and Outlook -

https://semiengineering.com/big-design-ip-and-end-market-shifts-in-2020/">https://semiengineering.com/big-desig...

https://semiengineering.com/big-design-ip-and-end-market-shifts-in-2020/">https://semiengineering.com/big-desig...

$BRKS re-aligning Life Science unit. Genewiz + Storage new Service unit (Good biz) Freezers + Other Product (Volatile biz) https://brooks.investorroom.com/2020-03-10-Brooks-Automation-Announces-Realignment-of-its-Life-Sciences-Segment">https://brooks.investorroom.com/2020-03-1...

To provide a baking analogy, traditional packaging is similar to frosting individual cupcakes, while WLP is like frosting a whole cake and then slicing it into pieces.

https://semiengineering.com/whats-what-in-advanced-packaging/">https://semiengineering.com/whats-wha...

https://semiengineering.com/whats-what-in-advanced-packaging/">https://semiengineering.com/whats-wha...

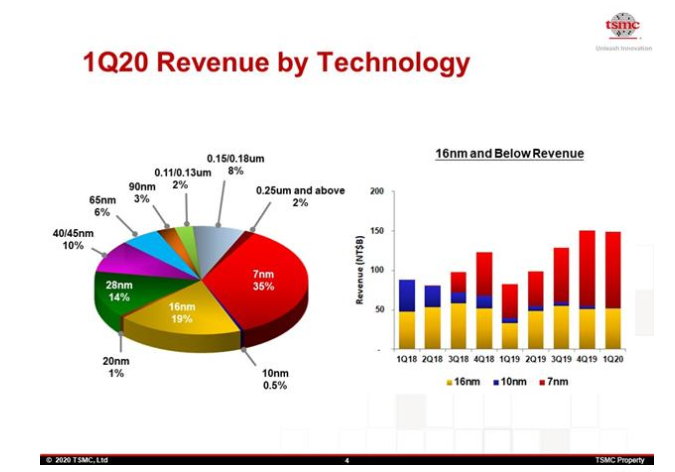

$TSM Revenue breakdown.

$TSM Outlook -

While we have not seen significant order reduction from our customers, so far, we do observe supply chain dislocation and weaker end market demand from COVID-19 in the first half of this year.

While we have not seen significant order reduction from our customers, so far, we do observe supply chain dislocation and weaker end market demand from COVID-19 in the first half of this year.

With the recent disruption from COVID-19, we now expect global smartphone units to decline high single digit year-over-year in 2020. However, 5G network deployment continues and OEMs continue to prepare to launch 5G phones.

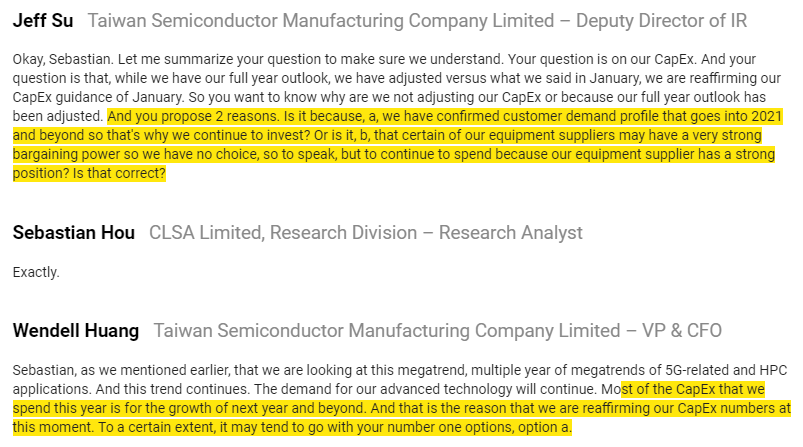

CapEx is spent in anticipation of the growth that will follow ... the impact of COVID-19 virus brings near-term uncertainties, we expect the multiyear megatrends of 5G and HPC to continue to drive strong demand for our technologies ... reaffirm our 20 CapEx of $15-16b.

Risk -

Huawei, has posted inventories up 75% in 2019.

Fabless customers are not building inventory per se, but it& #39;s clear that the end customer, the OEMs, significantly stockpiling and not cutting orders ... Lead to a more material decline in your 2H outlook

Huawei, has posted inventories up 75% in 2019.

Fabless customers are not building inventory per se, but it& #39;s clear that the end customer, the OEMs, significantly stockpiling and not cutting orders ... Lead to a more material decline in your 2H outlook

$LRCX Call -

It is likely we won& #39;t buy any stock back in the June quarter.

Drag on GMs from Social Distancing -

We will trend towards the lower end of where you& #39;ve seen our gross margin over that time frame. I don& #39;t think we& #39;ll go below the range we& #39;ve been in, but I think we will be towards the lower end, given the dynamic I described.

We will trend towards the lower end of where you& #39;ve seen our gross margin over that time frame. I don& #39;t think we& #39;ll go below the range we& #39;ve been in, but I think we will be towards the lower end, given the dynamic I described.

$INTC -

We expect the strength in cloud and comms infrastructure to continue in Q2, while IOTG and Mobileye will see lower demand ... Total revenue of $18.5 billion with PC-centric approximately flat to slightly up year-over-year and data-centric up approximately 25% YoY.

We expect the strength in cloud and comms infrastructure to continue in Q2, while IOTG and Mobileye will see lower demand ... Total revenue of $18.5 billion with PC-centric approximately flat to slightly up year-over-year and data-centric up approximately 25% YoY.

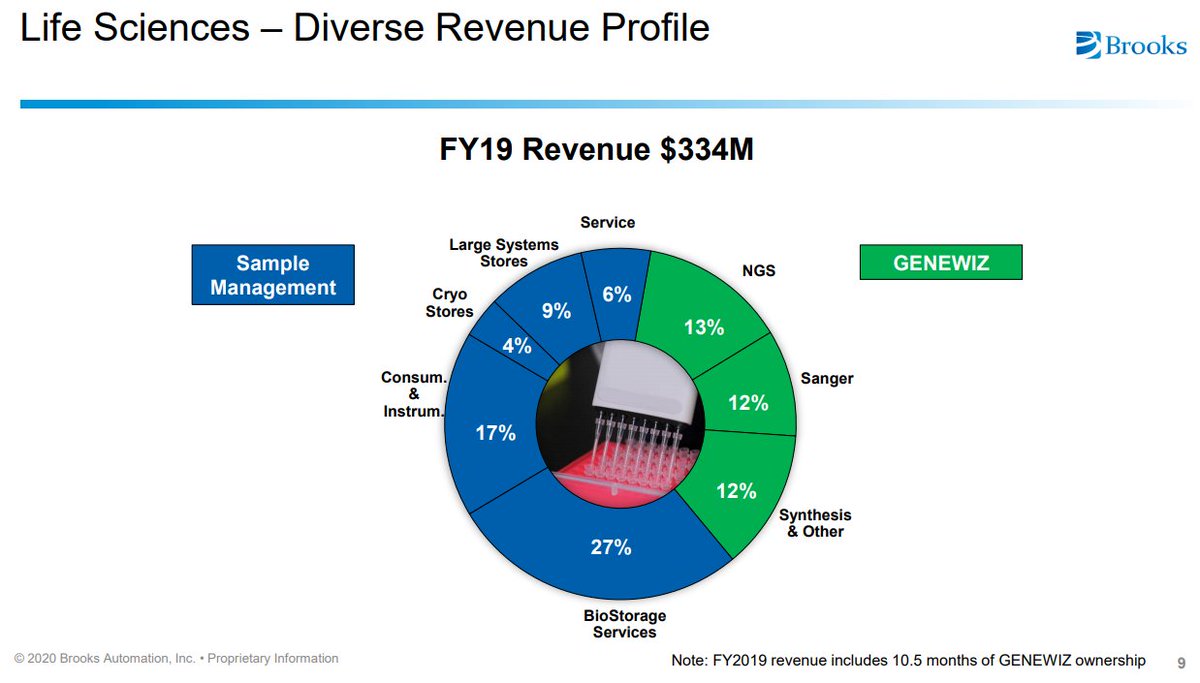

$BRKS Life Science Unit

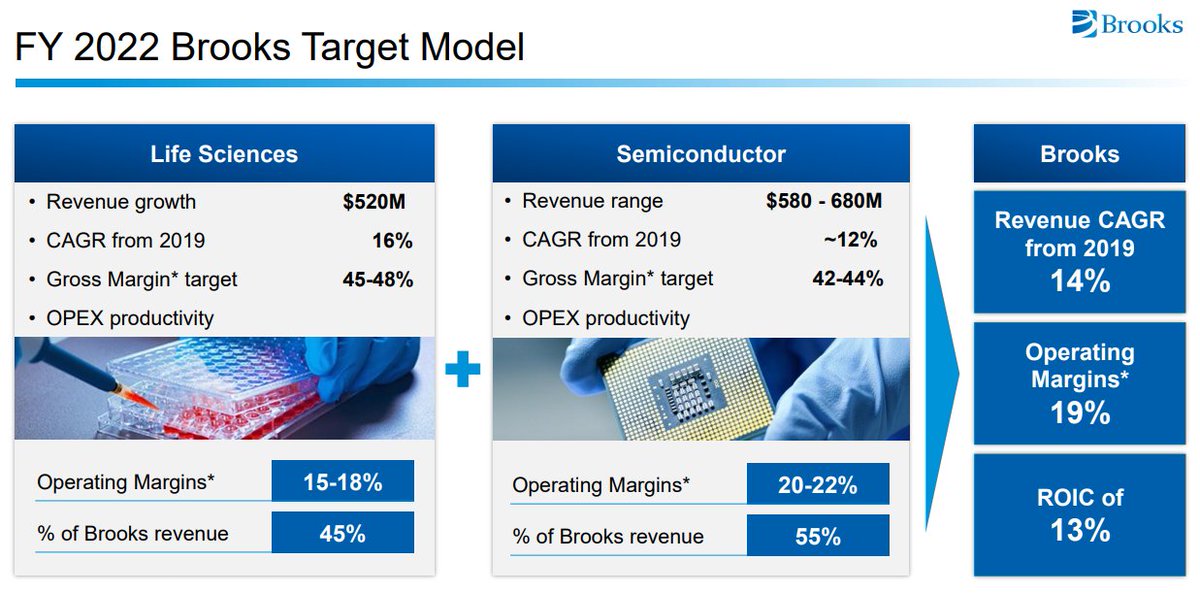

$BRKS laying out past M+A and where they see business over the next few years.

Divestitures of $840m.

Acquisitions of $945m.

ROIC doubling in next 3 years to 13%. Driven by major divestiture (Semi Cryo) + acquisition (GeneWiz) in last 18 months.

Divestitures of $840m.

Acquisitions of $945m.

ROIC doubling in next 3 years to 13%. Driven by major divestiture (Semi Cryo) + acquisition (GeneWiz) in last 18 months.

Gotta love a S/Mid Cap company willing to divest non-core assets and take proceeds to expand leadership position in core areas.

Sounds like $GOOGL is maintaining data center spend.

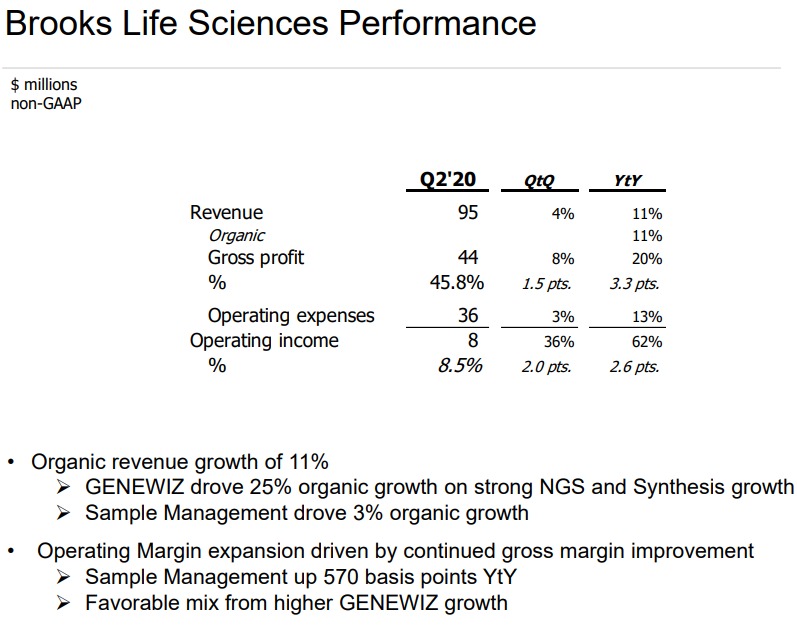

$BRKS Life Science posting solid Organic and >20% Incremental OpM.

$BRKS discussing patience with integrating largest acquisition to-date. The re-org they announced on 4/1 signifies it is time to step on the gas.

$AAPL on commodity pricing. NAND and DRAM to remain at historical lows.

Sobering outlook.

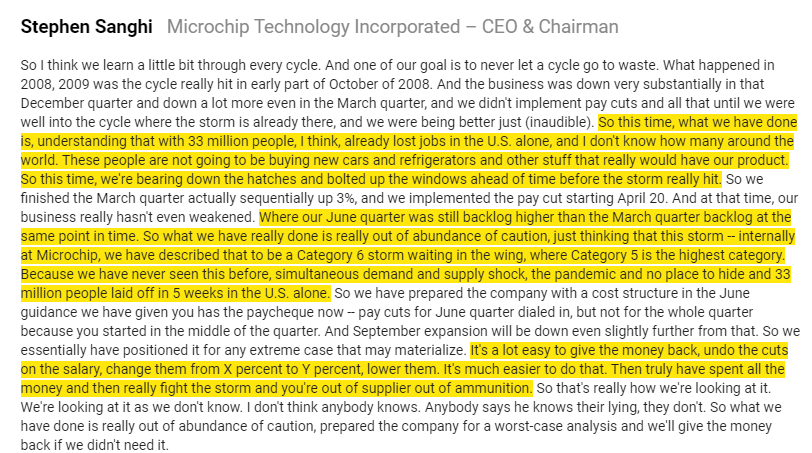

Point about better and easier to reverse cuts than end up without ammunition in the middle of the fight makes a lot of sense.

Point about better and easier to reverse cuts than end up without ammunition in the middle of the fight makes a lot of sense.

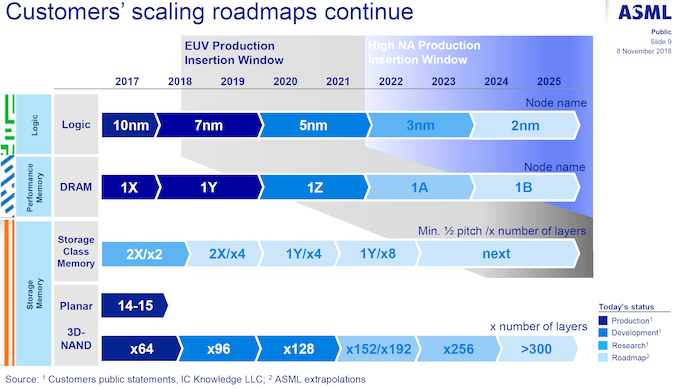

Industry evolution according to $ENTG

h/t @OswaldValue https://www.wsj.com/articles/taiwan-company-to-build-advanced-semiconductor-factory-in-arizona-11589481659">https://www.wsj.com/articles/...

Huawei timeline - https://www.cnet.com/news/huawei-ban-full-timeline-us-restrictions-china-trump-executive-order-commerce-department-security-threat-5g/">https://www.cnet.com/news/huaw...

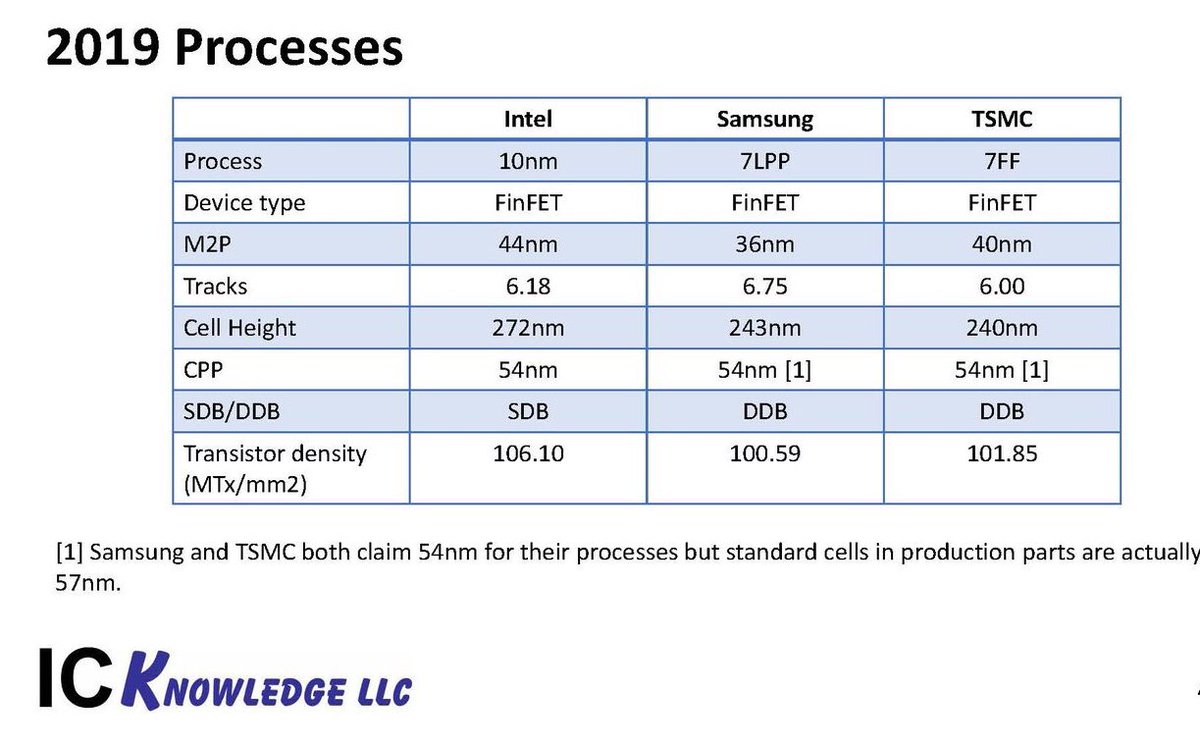

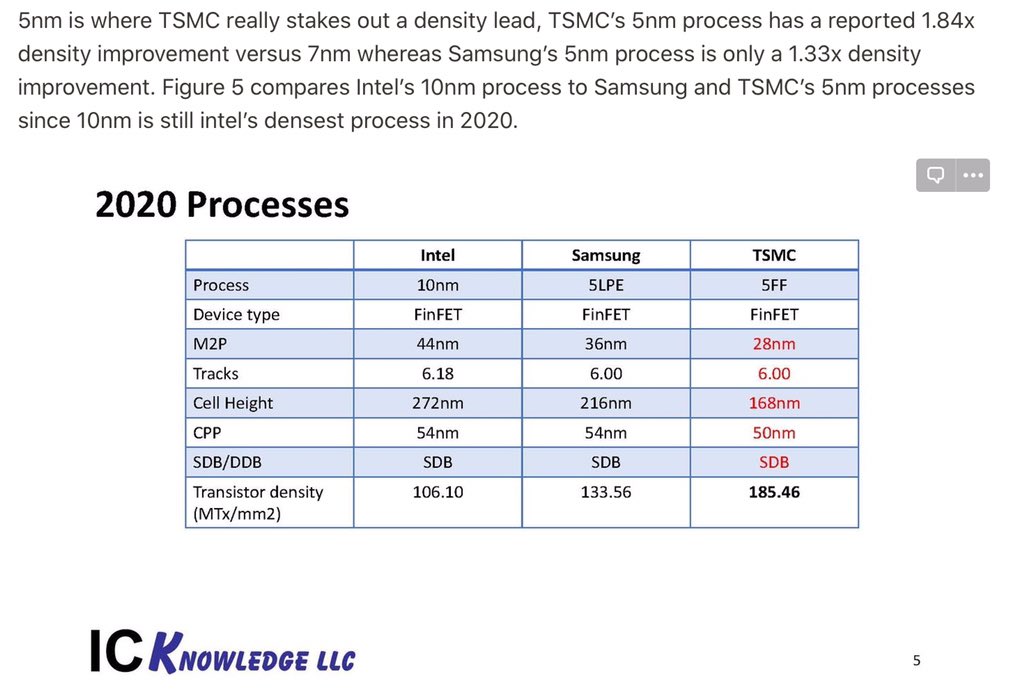

People look at an INTC Microprocessor designed for maximum performance and compare the transistor density to something like an AAPL Cell Phone Process with a completely different design goal and that simply doesn’t provide a process to process comparison under the same conditions

$TSM taking lead in 2020 -

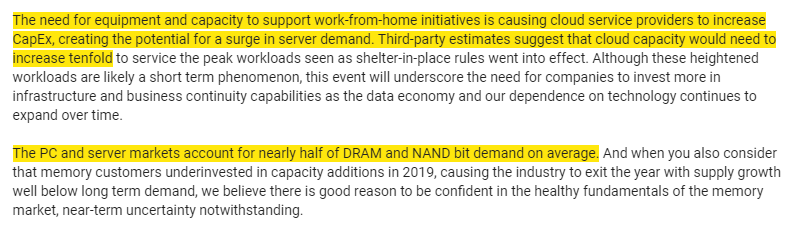

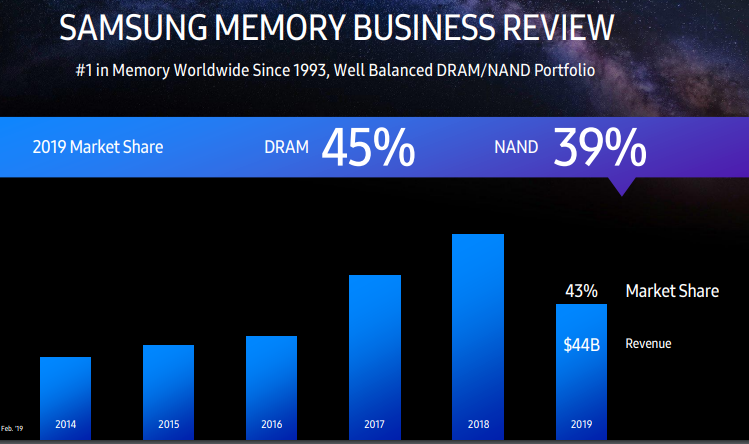

$MU DRAM & NAND market

Anyone have source/data on the ROIs at the Foundries? Are leading-edge investments ROI +/-/=?

@FoolAllTheTime

$NVDA already positioning themselves in genomics market -

https://news.developer.nvidia.com/advancing-dna-sequencing/">https://news.developer.nvidia.com/advancing...

$NVDA already positioning themselves in genomics market -

https://news.developer.nvidia.com/advancing-dna-sequencing/">https://news.developer.nvidia.com/advancing...

Per the Release -

At the world’s rate of sequencing, we’ll generate 20 ExaBytes of data by 2025 – more than Twitter, Youtube and astronomy combined. In fact, it would take all the CPUs in every cloud and more than 200 days to run genome analysis.

At the world’s rate of sequencing, we’ll generate 20 ExaBytes of data by 2025 – more than Twitter, Youtube and astronomy combined. In fact, it would take all the CPUs in every cloud and more than 200 days to run genome analysis.

Progress -

In 1954, five years before the

IC [integrated circuit] was invented, the average selling price of a transistor was US$5.52. Fifty

years later, in 2004, this had dropped to 191 nanodollars (a billionth of a dollar)

In 1954, five years before the

IC [integrated circuit] was invented, the average selling price of a transistor was US$5.52. Fifty

years later, in 2004, this had dropped to 191 nanodollars (a billionth of a dollar)

$BRKS leadership in each vertical

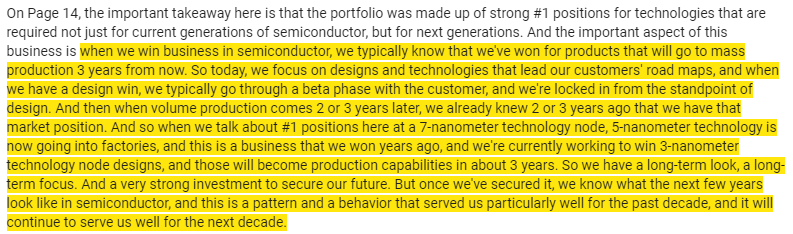

Gotta love this quote from $BRKS about Semi industry. Design wins today securing Revenue in 2-3 years.

$KLAC explaining the + associated with onshoring Semi. Less efficient manufacturing means more equipment.

Feel like I am missing something?

KLAC writes off 15% of purchase price from Orbotech. Acquired 12 months ago. See no change in LT growth outlook for business.

Is there some accounting treatment forcing it?

KLAC writes off 15% of purchase price from Orbotech. Acquired 12 months ago. See no change in LT growth outlook for business.

Is there some accounting treatment forcing it?

Cost estimates for $TSM factory in AZ. Equipment alone will cost $5.4b for 20,000wpm. https://semiwiki.com/semiconductor-manufacturers/tsmc/285846-cost-analysis-of-the-proposed-tsmc-us-fab/">https://semiwiki.com/semicondu...

Good article from @stratechery on $INTC $AAPL and Arm - https://stratechery.com/2020/apple-arm-and-intel/?utm_source=Memberful&utm_campaign=28520df81a-weekly_article_2020_06_16&utm_medium=email&utm_term=0_d4c7fece27-28520df81a-111166937">https://stratechery.com/2020/appl...

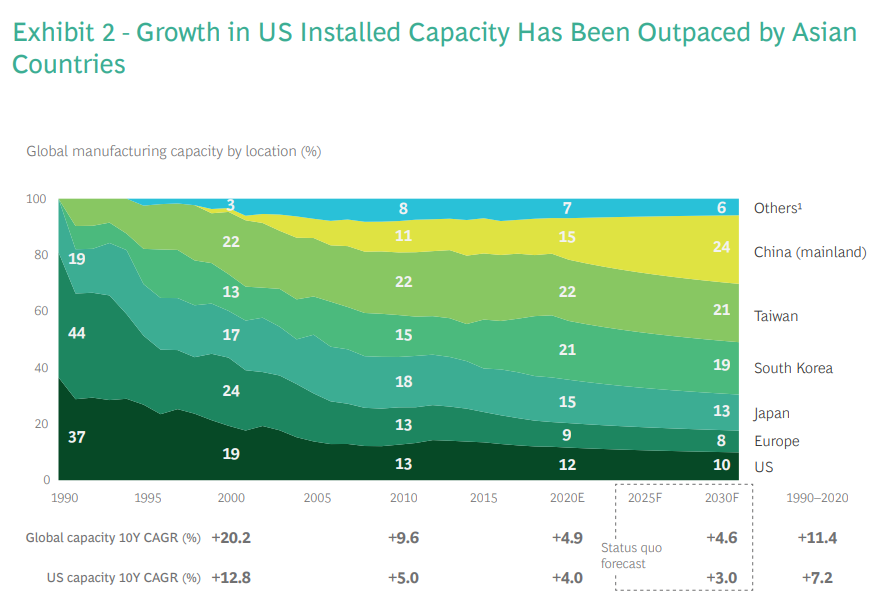

FRED Capacity data

https://fred.stlouisfed.org/series/CAPUTLHITEK2S">https://fred.stlouisfed.org/series/CA...

https://fred.stlouisfed.org/series/CAPUTLHITEK2S">https://fred.stlouisfed.org/series/CA...

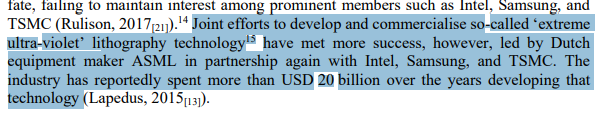

Cost to develop EUV for $ASML

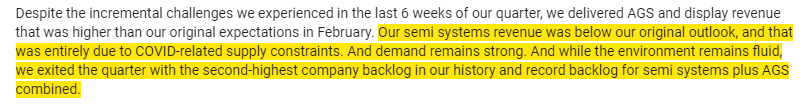

$ENTG 2020 Outlook -

The semi market appears to be holding up better than originally feared, driven by the well-documented strength in areas like data centers, 5G, laptops and gaming.

The semi market appears to be holding up better than originally feared, driven by the well-documented strength in areas like data centers, 5G, laptops and gaming.

We have seen no real indication of a downturn in the semiconductor market or, for that matter, in our business for the upcoming few months. Furthermore, our advanced memory and logic customers continue to be very committed to their node transitions for the back half of the year,

$AMAT

We expect momentum to continue throughout the calendar year. Specifically, we believe our revenue in both foundry/logic and memory will be second half weighted, leading to another year of growth and outperformance for Applied.

We expect momentum to continue throughout the calendar year. Specifically, we believe our revenue in both foundry/logic and memory will be second half weighted, leading to another year of growth and outperformance for Applied.

This strength in our systems business is fuel for growth in our installed base business, which is also on track to be up in the second half and into the future.

More than 55% of the spend is in foundry/logic. We think that strength continues into next year, both the overall market as well as our position against that opportunity. We see strength into 2021. And we feel like the proportion of spend in 2021 is going to be very similar.

$BRKS discussing Tec-Sem acquisition from 2018 -

"we paid round numbers, $15 million for a company. And we have already significantly exceeded the the output of that bet just in gross profit dollars came back in almost 1 year time frame from that investment."

"we paid round numbers, $15 million for a company. And we have already significantly exceeded the the output of that bet just in gross profit dollars came back in almost 1 year time frame from that investment."

Advanced Packaging Opportunity -

So think of it in that $60 million a year going to $80 million to $100 million, we expect. Does this ever become a $0.5 billion number for us, we don& #39;t expect that. We expect that this could go to $100 million on its way to $200 million perhaps

So think of it in that $60 million a year going to $80 million to $100 million, we expect. Does this ever become a $0.5 billion number for us, we don& #39;t expect that. We expect that this could go to $100 million on its way to $200 million perhaps

Good write-up on strategic rational for $NVDA ARM deal - https://semianalysis.com/jensen-huangs-vision-for-data-center-dominance-will-destroy-the-arm-ecosystem/">https://semianalysis.com/jensen-hu...

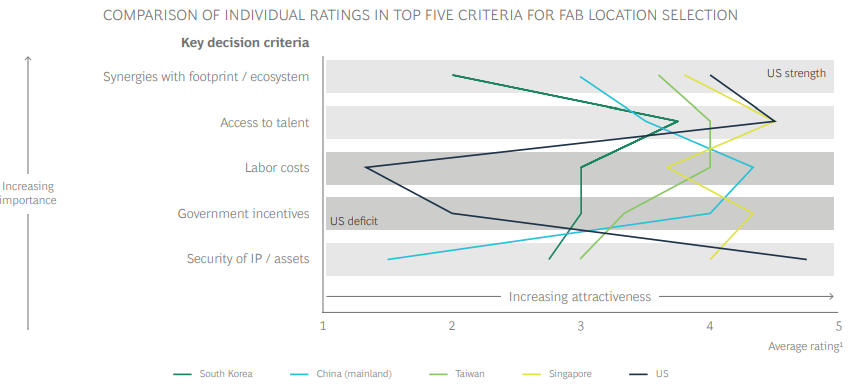

Criteria for selecting Manufacturing location. USA is high for synergy, talent, IP protection. Low for labor costs and incentives.

Fabs are not cheap to build. Semi is one of the most CapEx intensive industry in the world. Industry spends 20% of Revenues on CapEx.

https://www.semiconductors.org/wp-content/uploads/2020/09/Government-Incentives-and-US-Competitiveness-in-Semiconductor-Manufacturing-Sep-2020.pdf">https://www.semiconductors.org/wp-conten...

Using the history of the silicon fin

field-effect transistor (FinFET), it takes about 10 years for an advance in basic device physics to reach mainstream use. Therefore, any new technology will require a long lead-time and sustained

R&D of one to two decades

field-effect transistor (FinFET), it takes about 10 years for an advance in basic device physics to reach mainstream use. Therefore, any new technology will require a long lead-time and sustained

R&D of one to two decades

History of $AMD - https://www.techspot.com/article/2043-amd-rise-fall-revival-history/">https://www.techspot.com/article/2...

At each node, chipmakers scaled the transistor specs by 0.7X, enabling the industry to deliver a 40% performance boost for the same amount of power and a 50% reduction in area. https://semiengineering.com/5nm-vs-3nm/ ">https://semiengineering.com/5nm-vs-3n...

The adoption rate for TSMC’s 5nm is slower than 7nm. For one thing, 5nm is a completely new process with updated EDA tools and IP. In addition, it costs more. Generally, the cost to design a 5nm device ranges from $210 million to $680 million, according to Gartner.

$ASML on potential import ban and importance of Litho-

"When we talk to our Chinese customers, and you have to understand that when they look at some of the other process tools, there are some alternatives here in there.

"When we talk to our Chinese customers, and you have to understand that when they look at some of the other process tools, there are some alternatives here in there.

There& #39;s alters in Japan, when you talk about ALD or you talk about depth position tools. There& #39;s a European company, which is in Singapore, that can be an alternative. So on metrology, there are alternatives, both in the Netherlands and outside the U.S., in Japan

But currently, the customer that we& #39;ve been talking about, our logic customer and 1 of the major logic customers in China, actually allows -- order rules allow us to ship with litho tools.

And it& #39;s for those Chinese customers, very important to actually get their litho tools and then find a solution for the other process tools. But litho is critical. It& #39;s most critical tool in your fab.

So that& #39;s why it& #39;s not changed -- that& #39;s why it& #39;s not strange that they still talk to us and said, hey, just make sure that you ship us the tools that we need because it all starts with -- in terms of CapEx, it all starts with the most expensive tool in the fab and that litho."

Good thread from @FoolAllTheTime on Semi manufacturing and first mover advantages - https://twitter.com/FoolAllTheTime/status/1316749653057171458">https://twitter.com/FoolAllTh...

Read on Twitter

Read on Twitter