1/Livongo ($LVGO) Reports strong results (I’m long)

It is a small position in my portfolio and that feels like an appropriate size. This was a very strong earnings report so I’m considering adding to my position. https://austin.substack.com/p/7investingcom-is-officially-live?r=8q6q&utm_campaign=post&utm_medium=web&utm_source=twitter">https://austin.substack.com/p/7invest...

It is a small position in my portfolio and that feels like an appropriate size. This was a very strong earnings report so I’m considering adding to my position. https://austin.substack.com/p/7investingcom-is-officially-live?r=8q6q&utm_campaign=post&utm_medium=web&utm_source=twitter">https://austin.substack.com/p/7invest...

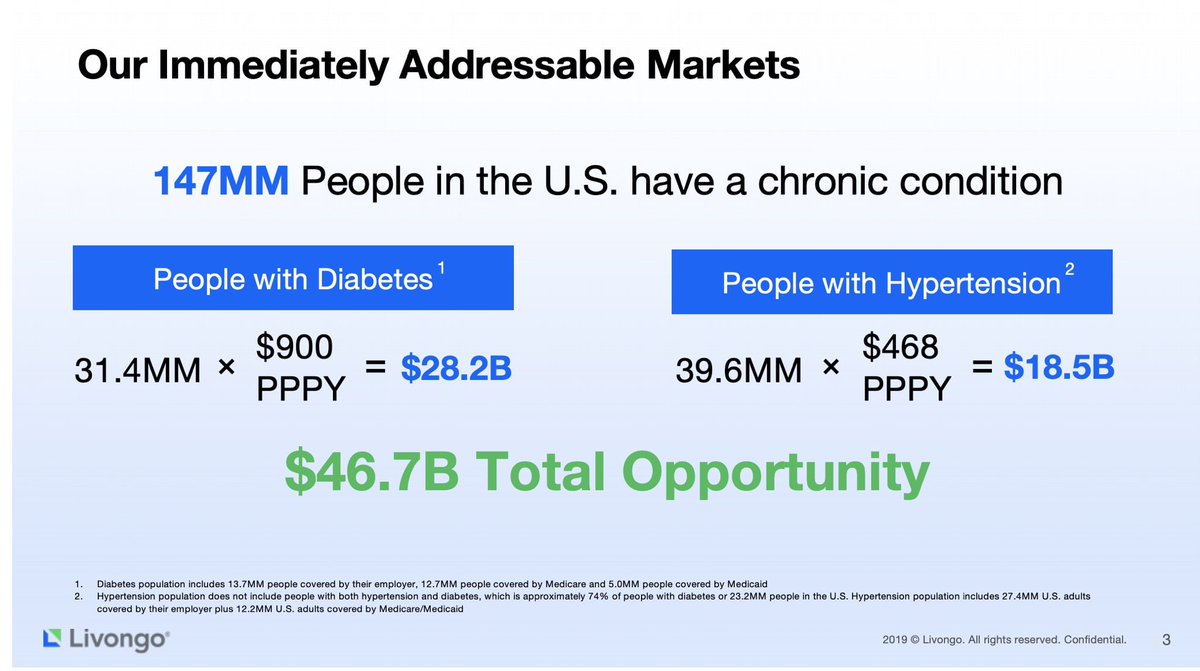

2/My basic thesis is that I think LVGO, TDOC, and even ZM are helping to revolutionize how people access healthcare. Appears to be a huge market opportunity

4/ Highlights from the Year:

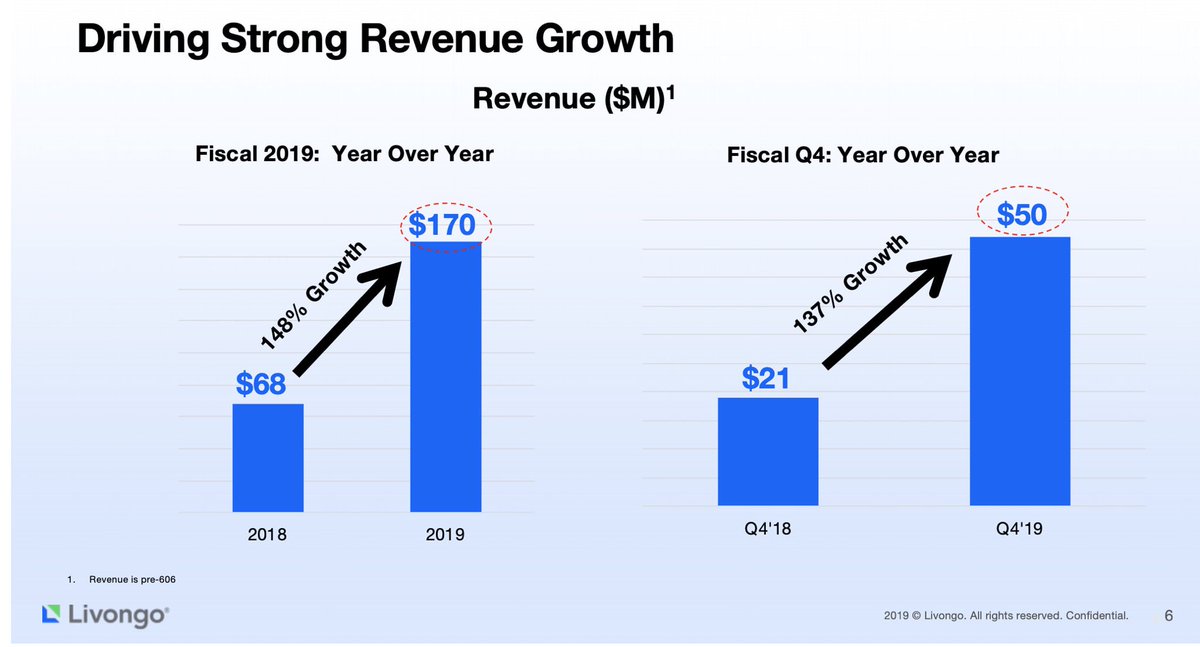

Strong Full-Year Revenue of $170.2 million, up 149% from 2018

As a reminder, after Q2 2019, guidance for Full-year 2019 was $159 million - $162 million. This means over Q3 and Q4, they outpaced the high-end of their guidance by 5% or $8.2 million

Strong Full-Year Revenue of $170.2 million, up 149% from 2018

As a reminder, after Q2 2019, guidance for Full-year 2019 was $159 million - $162 million. This means over Q3 and Q4, they outpaced the high-end of their guidance by 5% or $8.2 million

5/ see the post for the rest of my $lvgo review which includes notes from their conference call and links to the report.

Do you own or plan to buy shares? Leave your thoughts in comments!

https://austin.substack.com/p/7investingcom-is-officially-live?r=8q6q&utm_campaign=post&utm_medium=web&utm_source=copy">https://austin.substack.com/p/7invest...

Do you own or plan to buy shares? Leave your thoughts in comments!

https://austin.substack.com/p/7investingcom-is-officially-live?r=8q6q&utm_campaign=post&utm_medium=web&utm_source=copy">https://austin.substack.com/p/7invest...

Read on Twitter

Read on Twitter