Ready? Thread on the corona virus & what trade and investment has got to do with it. This is similar to trade-war but going to be WORSE b/c we& #39;re adding a component LABOR, by that LACK of labor supply as well as the demand hit too.

Here we go. All about economic impact of virus!

Here we go. All about economic impact of virus!

Part 1. China

Before we talk about the impact of China, we must discuss the role of China in global TRADE & INVESTMENT:

*1/5 manufactured items are exported out of China - that share higher for some electronics, textile and household goods. So China is the manufacturing center.

Before we talk about the impact of China, we must discuss the role of China in global TRADE & INVESTMENT:

*1/5 manufactured items are exported out of China - that share higher for some electronics, textile and household goods. So China is the manufacturing center.

*As a manu center for the world & the center of the Asian supply chain, esp for electronics, textile, footwear & household goods, what China does or doesn& #39;t produce matter as few subsitutes

*But not just massive in gross exports, China has exported more & more intermediates

*But not just massive in gross exports, China has exported more & more intermediates

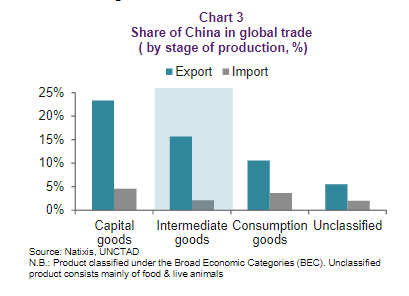

Let& #39;s look at this through China trade - exports & imports by global market share by STAGE OF PRODUCTION.

What do u see? a) China global market share of exports are massive for capital goods & intermediate goods & increasingly consumption goods. Share of its imports is much less

What do u see? a) China global market share of exports are massive for capital goods & intermediate goods & increasingly consumption goods. Share of its imports is much less

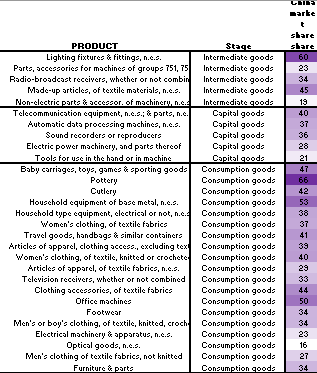

If u must see this by items, let me show u some Chinese manufactured goods by global market share & USDbn in value. What do you see? Well, high concentration risks for:

ELECTRONICS, MACHINERY, TEXTILE & HOUSEHOLD GOODS.

ELECTRONICS, MACHINERY, TEXTILE & HOUSEHOLD GOODS.

Read on Twitter

Read on Twitter