Is Warren Buffett / Berkshire Hathaway *too* long coal?

In 2019:

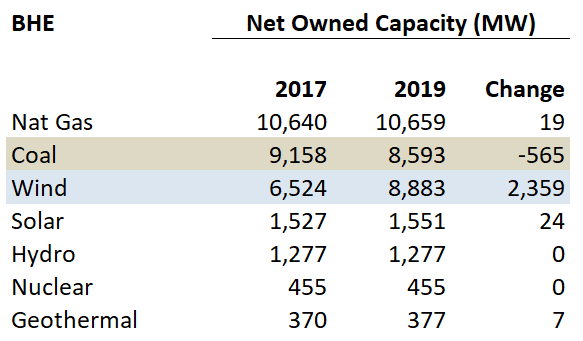

- 27% of Berkshire Hathaway Energy& #39;s "net owned capacity" is coal-fired plants

- 17% of BNSF& #39;s rail revenues were from coal

- Precision Castparts makes parts for coal plants (how material is this? I don& #39;t know)

In 2019:

- 27% of Berkshire Hathaway Energy& #39;s "net owned capacity" is coal-fired plants

- 17% of BNSF& #39;s rail revenues were from coal

- Precision Castparts makes parts for coal plants (how material is this? I don& #39;t know)

Has Buffett been investing in melting ice cubes? This is from the 2015 letter to investors. These warnings seem ever-closer today. Dealerships *will* hurt from autonomy, but electrification is a much nearer threat. Interestingly, he seems to be short electric battery tech:

If you lean against the future, the future will always win. Storage costs for electricity have come down a lot, and Buffett says it& #39;ll hurt Berkshire, while the CEO of Nextera (a competing utility) sees it as an opportunity: https://twitter.com/MarceloPLima/status/1224765393279102976?s=20">https://twitter.com/MarceloPL...

Berkshire Hathaway Energy has been slowly shedding coal plants and leaning into wind, but curious to understand why battery storage is a negative for the company...

Read on Twitter

Read on Twitter