One thing that is very interesting to notice is the role of digital payment systems playing during the coronavirus outbreak, and it very likely to accelerate the development and the adoption of DC/EP.

After Feb 8 a lot of people start to returning back to work when the large scale of the population moving to cross the cities, it also adds more pressure on epidemic prevention and control. According to the statistic, 75% of china’s population is concentrated in 19 cities

at the same, with the development of fast and affordable transportation infrastructure, such as high-speed trains or bullet trains. so the population mobility has increased massively, about 6 times higher compared to the SARS epidemic in 2003.

After over a decade of development, widely adopted digital payments plays a critical role during the coronavirus outbreak. Here are some direct and indirect effects on how digital payment helps to prevent and controlling the virus spreading.

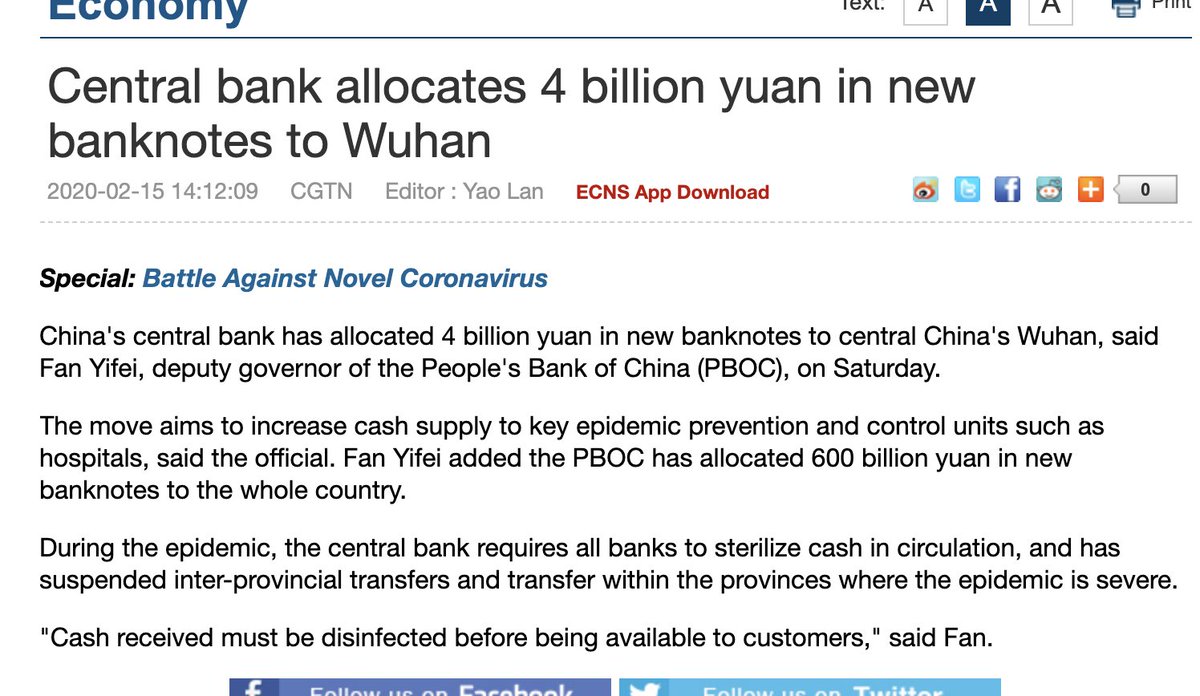

a) cashless payment, avoid cash become another transmission vectors, Coronavirus is confirmed can survive on a smooth surface after it comes out from its human host, cash can easily become a transmission vector.

In fact, during the SARS epidemic, the concerns of cash might become a vector to spread the SARS, the public start to resist to use cash, even the old people. meanwhile, the central bank increase publicity on the bank cards simplifies the procedures of getting and use bank cards.

Both laid the solid foundation for the rise of digital payments in China. In now day it is pretty normal that people don’t have cash for days or even months. and coronavirus will accelerate the speed of china getting into a cashless society.

b)on Feb 6, the ministry of commerce of china post an announcement, it specifically "suggests" that retailer and catering businesses using digital payments to replace cash. And multiple cities also request people to use digital payments only when they take public transportation.

it can avoid viruses spread through cash for sure, but there& #39;s also another reason, it can help local authorities to track close contacts very quickly through transaction histories.

c)Feb 1, centra bank and several other departments released an announcement to increase financial support for epidemic control, article 13 has specific requests about digital payment, it encourages Banking financial institutions and non-bank payment institutions offers...

discount on transaction fees to the merchants/businesses in certain regions. On Feb 3, China UnionPay and several major commercial banks quickly responded to that, offer a discount even wave the transaction fee for the merchants and small businesses in the Hubei region.

Article 13: Banking financial institutions and non-bank payment institutions are encouraged to use online tools to conduct merchant access audits and daily inspections and strengthen risk control through transaction monitoring, And clearing institutions...

bank, non-bank payment institutions are encouraged to offers transaction fee discounts to businesses, To ensure the digital payment platforms run smoothly, it could offer more flexibility to its users. Guide their clients to use online electronic commercial draft system..

personal/corporate online banking, payment apps.

d)In order to support oversea donations, RMB Cross-border Interbank Payment System(CIPS) starts to operate from Feb 3, provides emergency services for businesses related to the epidemic. To ensure timely allocations of the donations.

and here& #39;s the reasons why after digital payments play a critical role during the coronavirus outbreak, it will accelerate the development and adoption of DC/EP.

a)DC/EP is fiat, it has "无限法偿性", means you can& #39;t refuse to accept DC/EP, now its quite normal that some merchants/platforms refuse to accept WeChat pay if they got Alipay or the opposite. And DC/EP transactions can be done when both sender and receiver are offline

b) Current digital payment system are heavily rely on commercial banks(means there& #39;s a chance they will bankrupt)

c) Regulatory reasons, make easier on Anti-money laundering, anti-tax evasion ect.. using DC/EP can cover the supervision on the payment clearing network which currently digital payment systems are not able to. Much more intense supervision

Read on Twitter

Read on Twitter