Ok, I& #39;m probably going to get lynched for this but here goes.

There& #39;s a bunch of enlightened, all seeing, & all wise folk and Twitter & elsewhere constantly tweeting about how easy it is to pick a good stock. You& #39;ll see tweets like:

"Buy a good stock and hold it forever" 1/n

There& #39;s a bunch of enlightened, all seeing, & all wise folk and Twitter & elsewhere constantly tweeting about how easy it is to pick a good stock. You& #39;ll see tweets like:

"Buy a good stock and hold it forever" 1/n

Pick quality businesses & forget.

Investing is 10% stock picking, 90% patience.

And a deluge of Warren Buffet, Charlie Munger quotes. Long term this, psychology that & such simplistic bullshit. But one thing these wise men don& #39;t talk about is just how tough stock picking is2/n

Investing is 10% stock picking, 90% patience.

And a deluge of Warren Buffet, Charlie Munger quotes. Long term this, psychology that & such simplistic bullshit. But one thing these wise men don& #39;t talk about is just how tough stock picking is2/n

is. Describing stock picking as hard would be the understatement of the century. Bungee Jumping is hard, figuring out how Tinder works is hard, watching Ram Gopal Varma Ki Aag without committing suicide is hard. Picking a good stock is borderline impossible. "Borderline" 3/n

being the operative word. But very few of these enlightened men talk about this. Why? Most often than not, they have something to sell - tips, seminars etc. Let& #39;s set some context here, how hard is stock picking? I don& #39;t claim to know all of them, but their shtick is BS 4/n

Since the US markets have the longest data, let& #39;s look at some research. Professor Hendrik Bessembinder found:

"The best-performing 4% of listed companies explain the net gain for the entire US stock market since 1926, as other stocks collectively matched Treasury bills. 5/n

"The best-performing 4% of listed companies explain the net gain for the entire US stock market since 1926, as other stocks collectively matched Treasury bills. 5/n

T-bills = cash. Still feeling all romantic about picking stocks & building mansions, yachts, travelling the world, and buying fast cars? Remember the all it takes to get rich is "Buy good stocks, and hold until your 2nd GF dies?" tweet?

From the paper:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2900447">https://papers.ssrn.com/sol3/pape... 6/n

From the paper:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2900447">https://papers.ssrn.com/sol3/pape... 6/n

"Just 42.6% of common stocks, slightly less than three out of seven, have a buy-and-hold return (inclusive of reinvested dividends) that exceeds the return to holding one-month Treasury bills over the matched horizon."

We don& #39;t have too many studies for the Indian market, but 7/n

We don& #39;t have too many studies for the Indian market, but 7/n

the good Professor looked at the Indian markets too. Couldn& #39;t find the full research but here& #39;s a slide from his presentation at a conference.

"Just 1% of Indian stocks account for 83% (90-2018) of net wealth creation!" How do you like the odds. https://twitter.com/svkunte/status/1204974549474988033?s=20">https://twitter.com/svkunte/s... 8/n

"Just 1% of Indian stocks account for 83% (90-2018) of net wealth creation!" How do you like the odds. https://twitter.com/svkunte/status/1204974549474988033?s=20">https://twitter.com/svkunte/s... 8/n

Tweeting simplified bullshit about a complicated activity has become the norm on Fintwit & investing blogs. Most likely, like I said, these guys have something to sell. Would you go to an adviser or a "so called advisor" if he told you picking stocks is hard and that he may 9/n

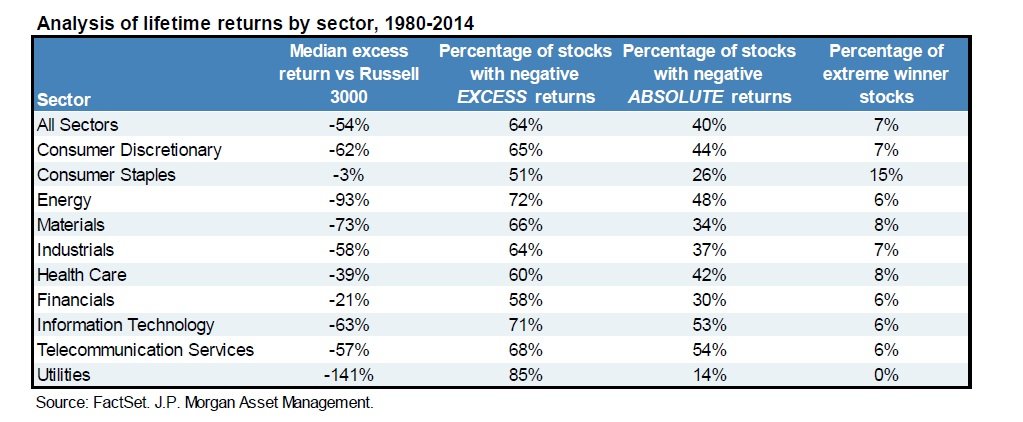

in all likelihood fail? Hell no! Before you bite my head off that just one study doesn& #39;t prove anything, here& #39;s another screamer. This study is for the period of 1980-2104, but things have become even harder for stock pickers since 14 and if anything, the numbers would 10/n

look even more tragic. At any given point of time over 50% of the stocks give you negative excess returns. And since for most people, investing is a dream of picking that HDFC Bank, Bajaj Finance or MRF, those extreme wealth creators are in single digits. With me still? 11/n

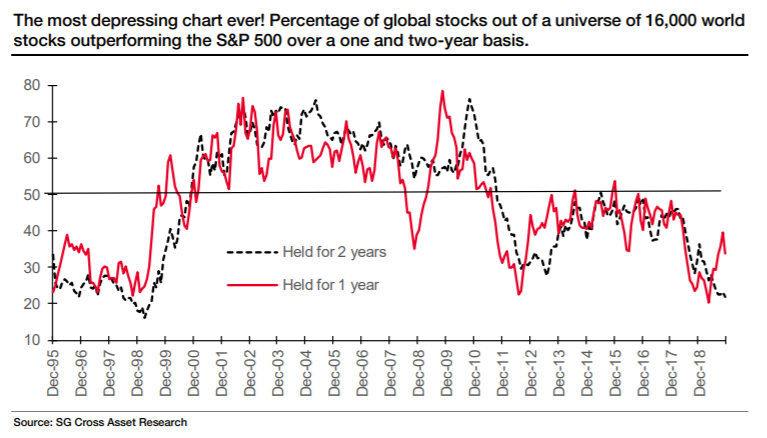

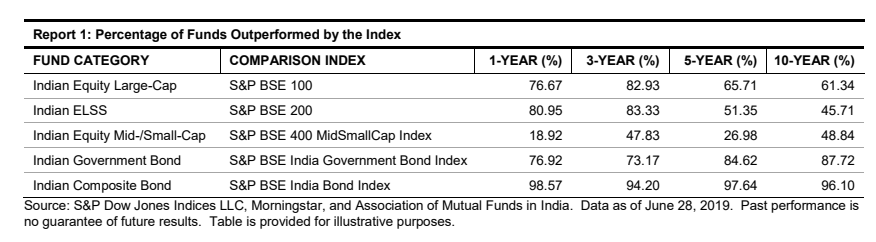

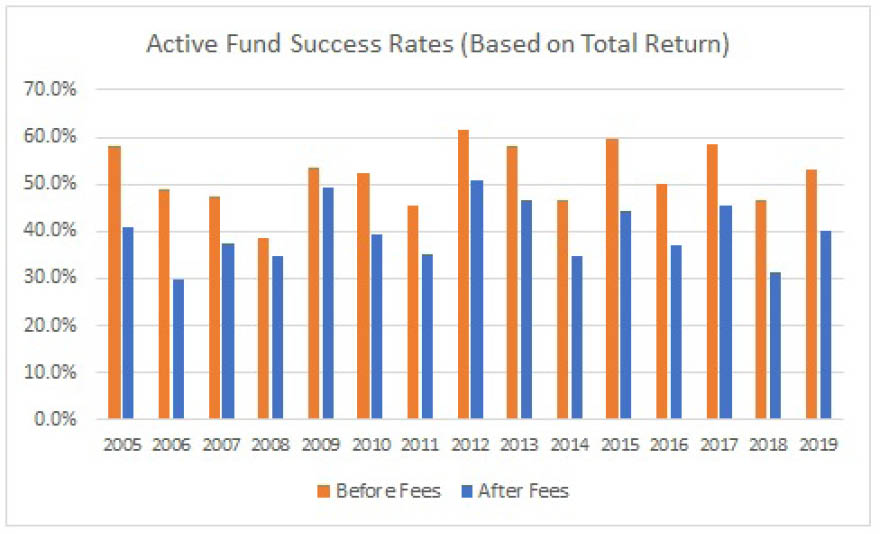

Let& #39;s look at more cheerful, sunny data. 12/n

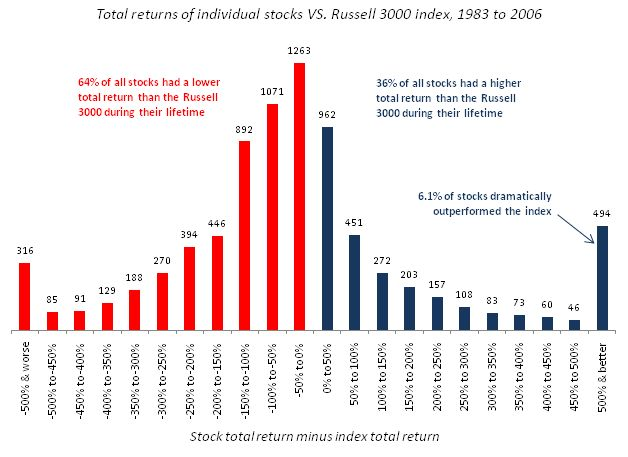

Still don& #39;t believe me? Ok, here& #39;s more. And don& #39;t gimme the "Oh, the Indian markets are different from the US markets" bullshit. It& #39;s just something we tell ourselves to justify our ineptitude. 13/n

https://mebfaber.com/2008/12/02/the-capitalism-distribution-fat-tails-in-action/">https://mebfaber.com/2008/12/0...

https://mebfaber.com/2008/12/02/the-capitalism-distribution-fat-tails-in-action/">https://mebfaber.com/2008/12/0...

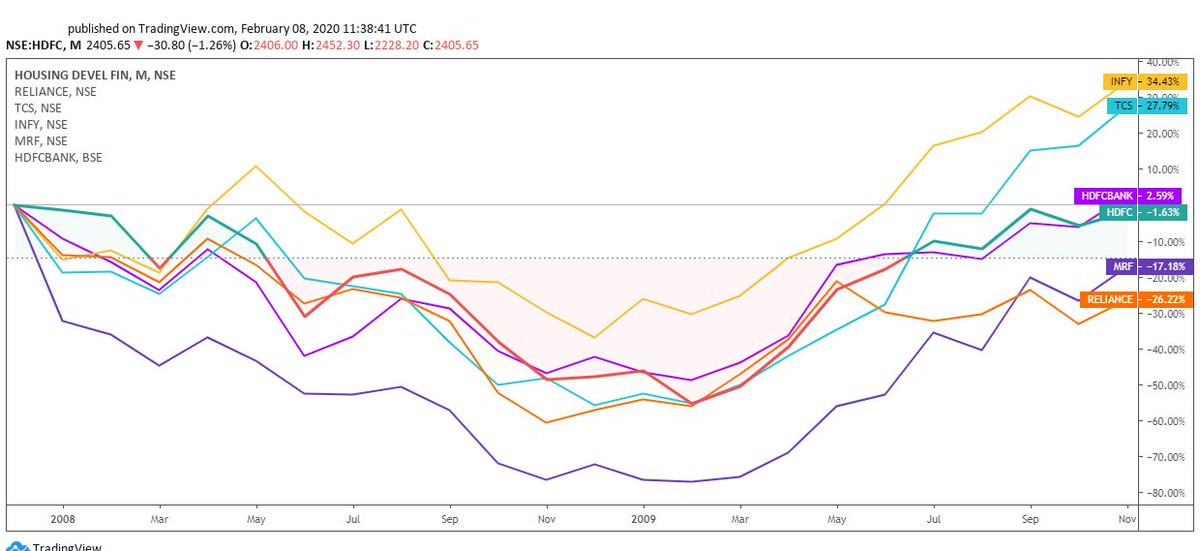

It& #39;s always a fat head and a long skinny tail everywhere. Right from the moment you decide to pick a stock, the odds are heavily stacked against you. You have to identify a good business, the odds of you doing which are slim at best. Then you& #39;ll have to hold through the 14/n

excruciatingly painful drawdowns. While it& #39;s all sunshine and roses today, some of the biggest wealth creators were down by 50%+ at various point in their journeys. When a stock is down 50%, all the Warren Buffet and other simplified bullshit gyan goes out of the window. 15/n

Doubt and fear take over. You& #39;ll have to think about your life goals, wife, kids etc and continue holding the stock with no certainty that you may end up on the right side.

And then you& #39;ll have to deal with the self doubt, noise on TV, papers, newsletters twitter, friends, 16/n

And then you& #39;ll have to deal with the self doubt, noise on TV, papers, newsletters twitter, friends, 16/n

WhatsApp and Telegram groups etc. And the most beautiful thing about the markets is that efforts and outcomes are almost always inversely correlated. Just because, you read through Warren Buffet& #39;s letters, read a million books on psychology, 17/n

listened to Charlie Munger, read annual reports, did calculations on Excel, doesn& #39;t mean you are guaranteed success. Let& #39;s face it, we humans are cocky little shits, we vastly overestimate our strengths and grossly underestimate our weaknesses. We all think we& #39;ll be the 18/n

next star stock picker, even when we deep down know just how hard it is & that odds of success are Infinitesimally small & the odds of failure are infinitely high. Like this slightly modified Mike Tyson quote goes:

"Everybody& #39;s got a plan until they get hit in the face" 19/n

"Everybody& #39;s got a plan until they get hit in the face" 19/n

Having said, that, no amount negative things you read will probably stop you, as it should be. The only way you can find out, if you really have the smarts to pick good stocks, is if you actually put some real money on the line. And until Mr. Market kicks you in the groin, 20/n

You& #39;ll think you& #39;re the shiz. Now, if you are wondering, who died & made me judge, I& #39;ve tried this, not that I& #39;m smart. In fact my psychologist told me that I have the IQ of an unwashed coffee mug. But hey, I gave it a shot & realized I& #39;m a stupid, pretentious little shit. 21/n

And when Mr. Market kicked me in my nether regions, it REALLY hurt. But don& #39;t take my word, feel free to mute, block me & do what you gotta do. Now, just to ensure, I fully drive the point home, let& #39;s look at mutual fund managers. Now remember, these are some of the smartest 22/n

guys around with PHDs, Bloomberg Terminals, Quantum underwear, AI+ML and an assortment of other resources. You& #39;d think that these guys would actually be successful, and you& #39;d be excused for thinking so. 23/n

Read on Twitter

Read on Twitter