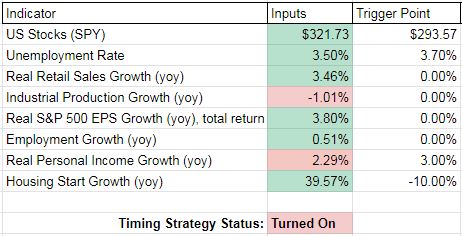

Been watching a version of @Jesse_Livermore& #39;s GTT strategy for 1-2 years.

Mine looks at full set of indicators from http://philosophicaleconomics.com/2016/01/gtt/ ,">https://philosophicaleconomics.com/2016/01/g... adds UE trend ( http://philosophicaleconomics.com/2016/02/uetrend/)">https://philosophicaleconomics.com/2016/02/u... & needs 2 (vs 1) signals to turn on timing.

For 1st time, timing is ON with >recession prob.

Mine looks at full set of indicators from http://philosophicaleconomics.com/2016/01/gtt/ ,">https://philosophicaleconomics.com/2016/01/g... adds UE trend ( http://philosophicaleconomics.com/2016/02/uetrend/)">https://philosophicaleconomics.com/2016/02/u... & needs 2 (vs 1) signals to turn on timing.

For 1st time, timing is ON with >recession prob.

Meaning if the S&P 500 drops below the moving avg, the strategy would suggest selling US equities.

Currently we& #39;d need to see another ~7% drop depending on what SMA you use.

So no need to sell yet, but https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Eyes" aria-label="Emoji: Eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Eyes" aria-label="Emoji: Eyes">

Currently we& #39;d need to see another ~7% drop depending on what SMA you use.

So no need to sell yet, but

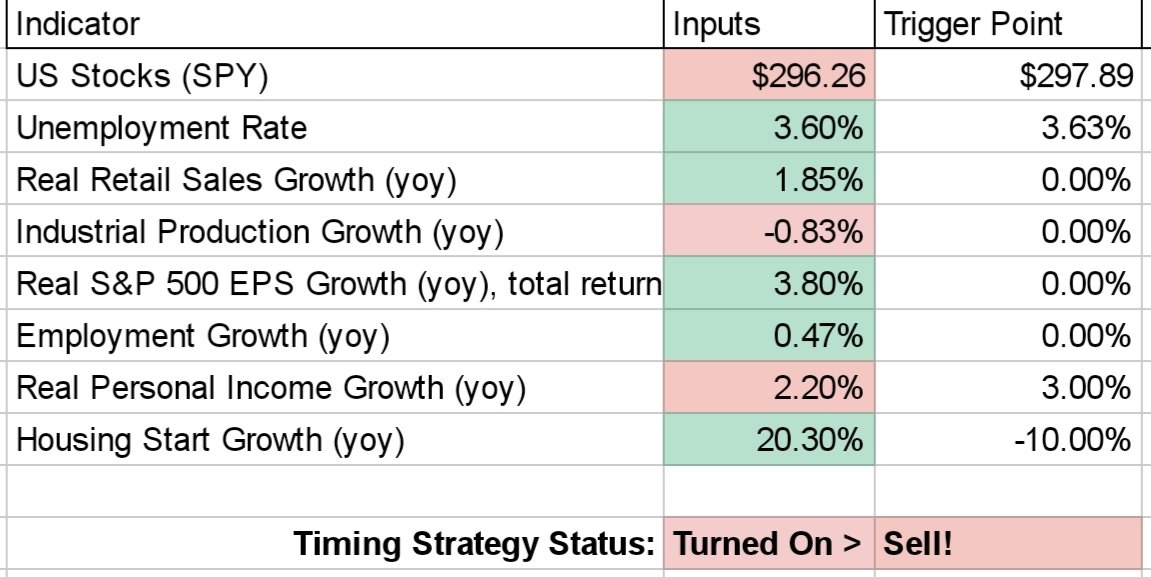

With friday& #39;s closing price + latest industrial production & personal income readings, the model now says sell your stocks!

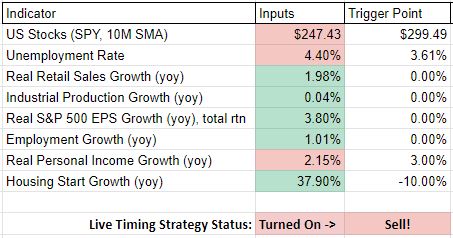

Almost forgot about this thread I started what seems like 10 years ago.

Industrial production actually turned back slightly positive in March. But after employment figures released today, we again have two recession indicators triggered & are below trend.

So it& #39;s saying SELL!

Industrial production actually turned back slightly positive in March. But after employment figures released today, we again have two recession indicators triggered & are below trend.

So it& #39;s saying SELL!

Read on Twitter

Read on Twitter