It& #39;s Brexit day so we should do the definitive assessment of the 2016 referendum vote on economic performance

Note: Definititve DOES NOT EQUAL certain

Definitive DOES NOT EQUAL permanent 1/

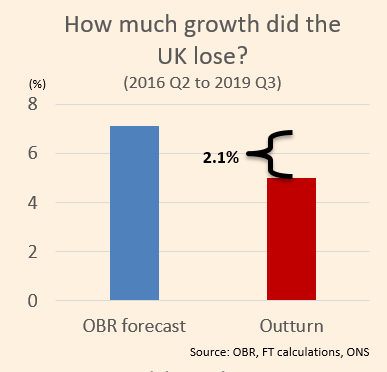

If you look at a standard pre-referendum forecast (eg OBR March 2016),

It expected 7.1% growth to Q3 2019

Reality was 5%

So there was a disappointment compared with pre-referendum forecasts of a little over 2% of national income 2/

It expected 7.1% growth to Q3 2019

Reality was 5%

So there was a disappointment compared with pre-referendum forecasts of a little over 2% of national income 2/

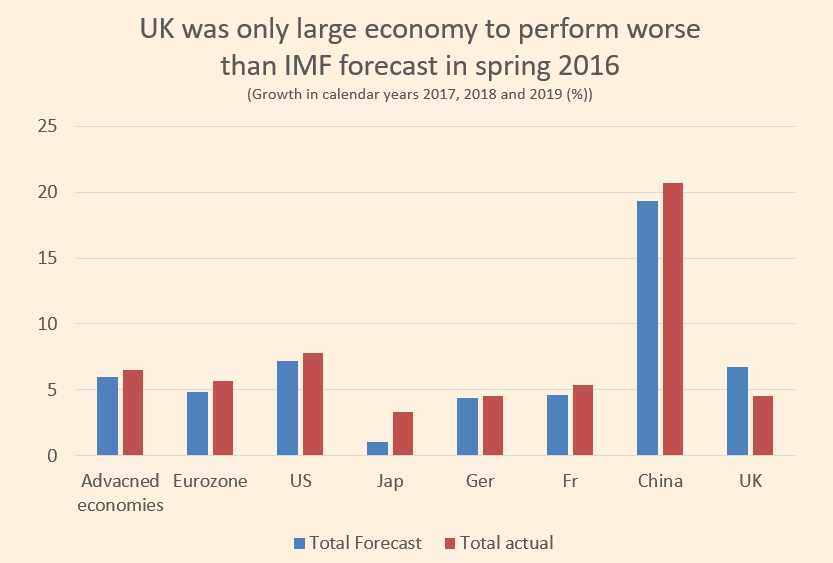

There are many possible reasons for forecasts to be over-optimistic. This happens all the time.

So did we see similar over-optimism for other large economies ???

No.

The opposite.

(These from IMF data) 3/

So did we see similar over-optimism for other large economies ???

No.

The opposite.

(These from IMF data) 3/

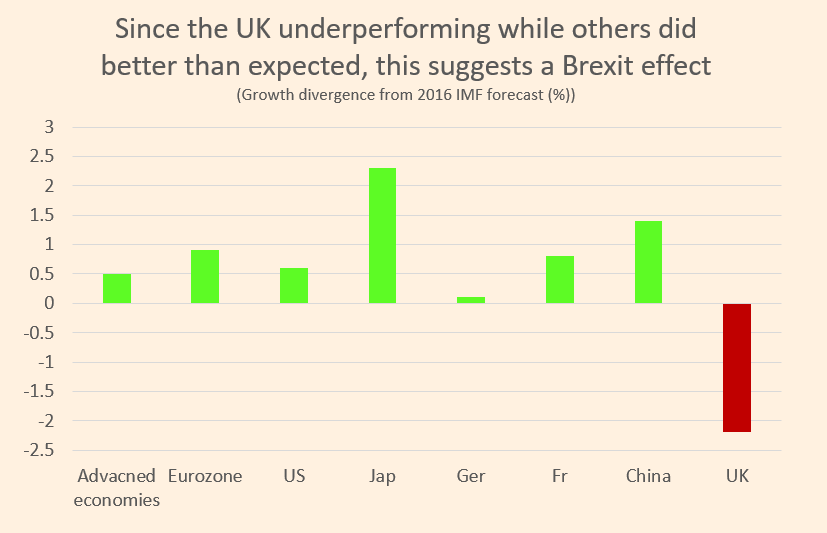

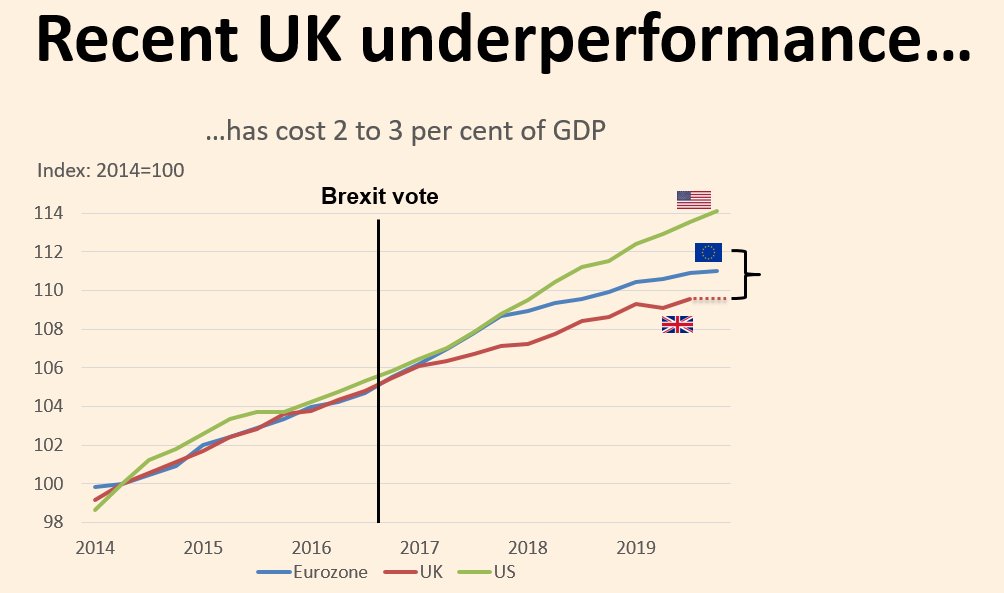

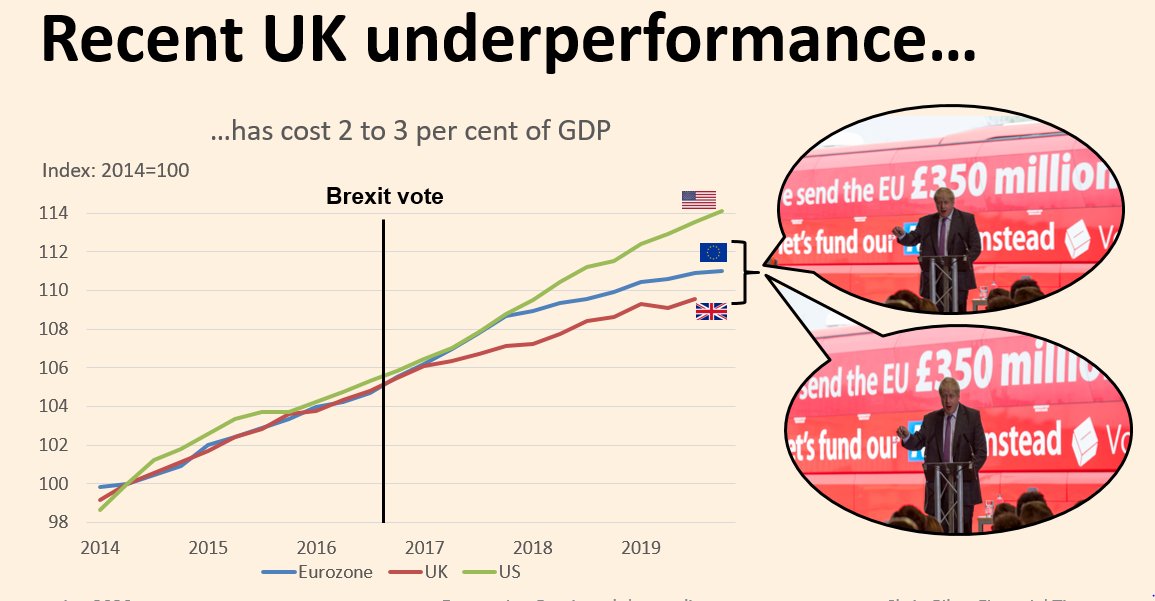

Or just look at the differences

This does suggest something different and bad was happening to the UK economy that didn& #39;t occur elsewhere

4/

This does suggest something different and bad was happening to the UK economy that didn& #39;t occur elsewhere

4/

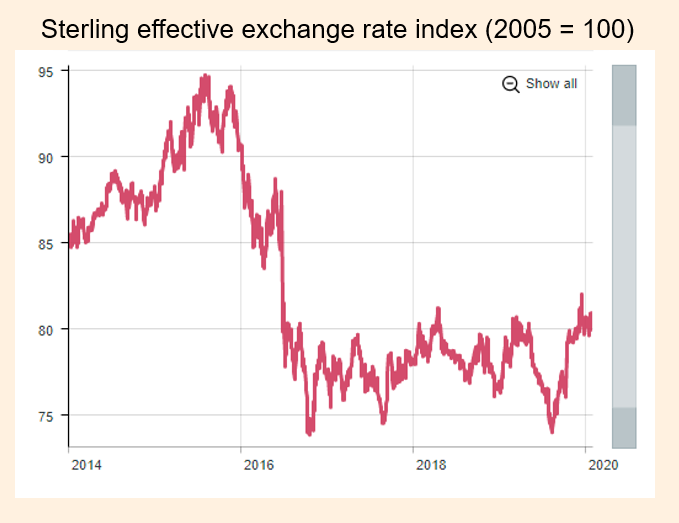

We can pinpoint one thing easily. A big fall in sterling which squeezed household and corporate incomes (higher import prices) but did next to nothing for exports

5/

5/

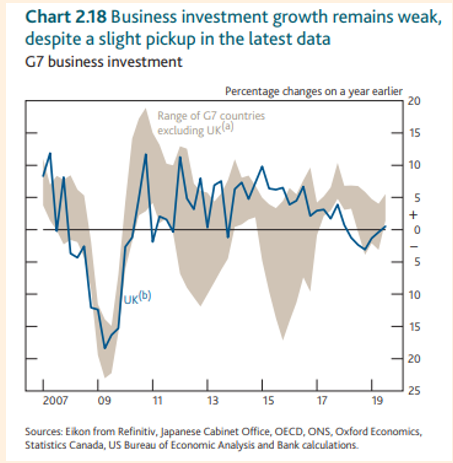

And the uncertainty of the economic environment, damped business investment relative to other countries until very recently

But note - these effects might be temporary, as @julianHjessop reasonably claims

6/

But note - these effects might be temporary, as @julianHjessop reasonably claims

6/

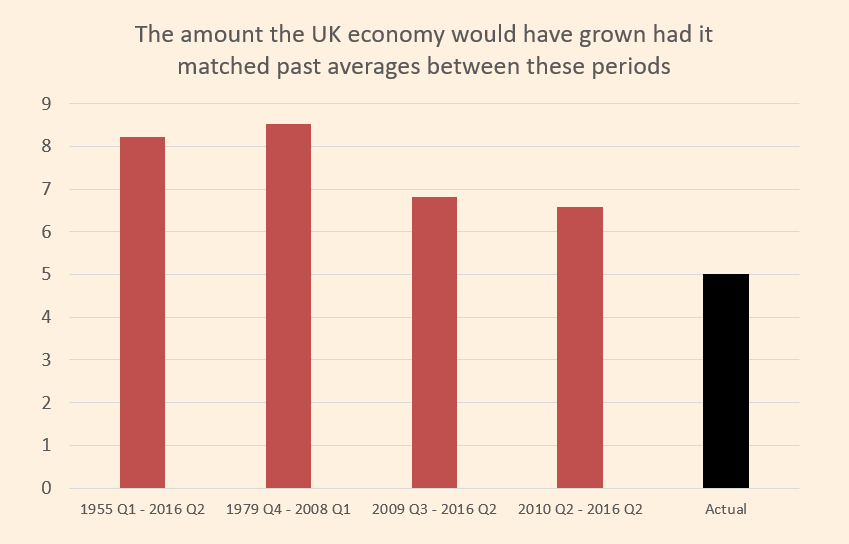

Compared with sensible historical comparisons, UK economic performance has also been weak since Q2 2016.

Again, these episodes have been seen before and do not prove anything alone...

7/

Again, these episodes have been seen before and do not prove anything alone...

7/

But the combined picture of weakness compared with forecasts, weakness compared with other countries and weakness compared with history all suggests the Brexit vote has left the UK worse off than it would have been...

I think a sensible estimate is about 2 per cent of GDP

8/

I think a sensible estimate is about 2 per cent of GDP

8/

We can put that in context - that the equivalent of the UK economy missing out on activity worth roughly £44bn a year (the economy is roughly £2,200 bn in 2019-20)

That is quite big money - and in the referendum context, it& #39;s more than 2 Boris buses 9/

That is quite big money - and in the referendum context, it& #39;s more than 2 Boris buses 9/

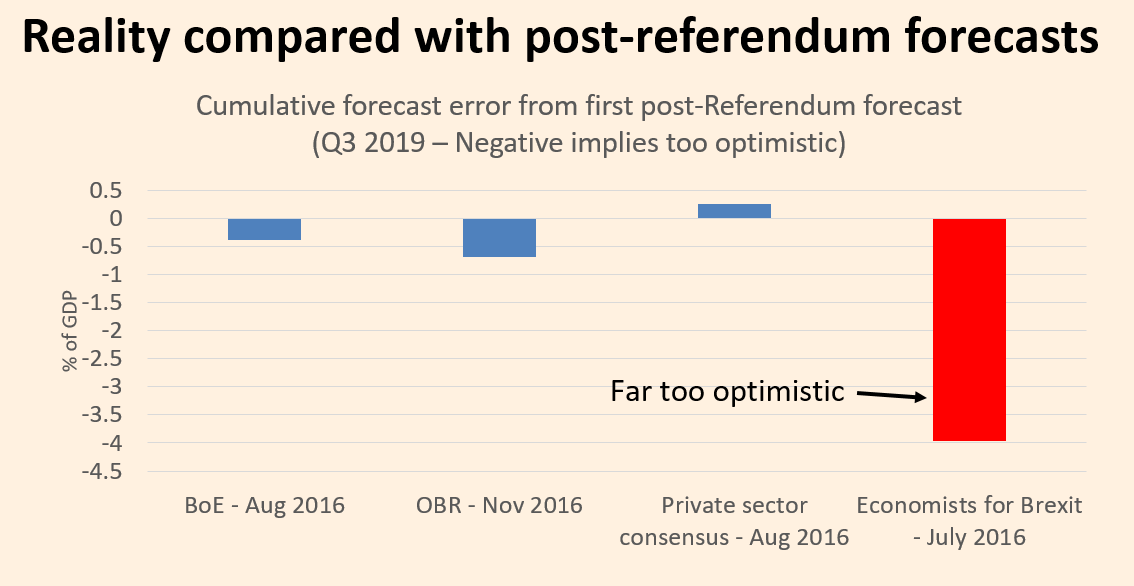

There& #39;s been much talk of how economists got it wrong and the predictions of some economic pain were misplaced.

To date: this is definitively untrue.

10/

To date: this is definitively untrue.

10/

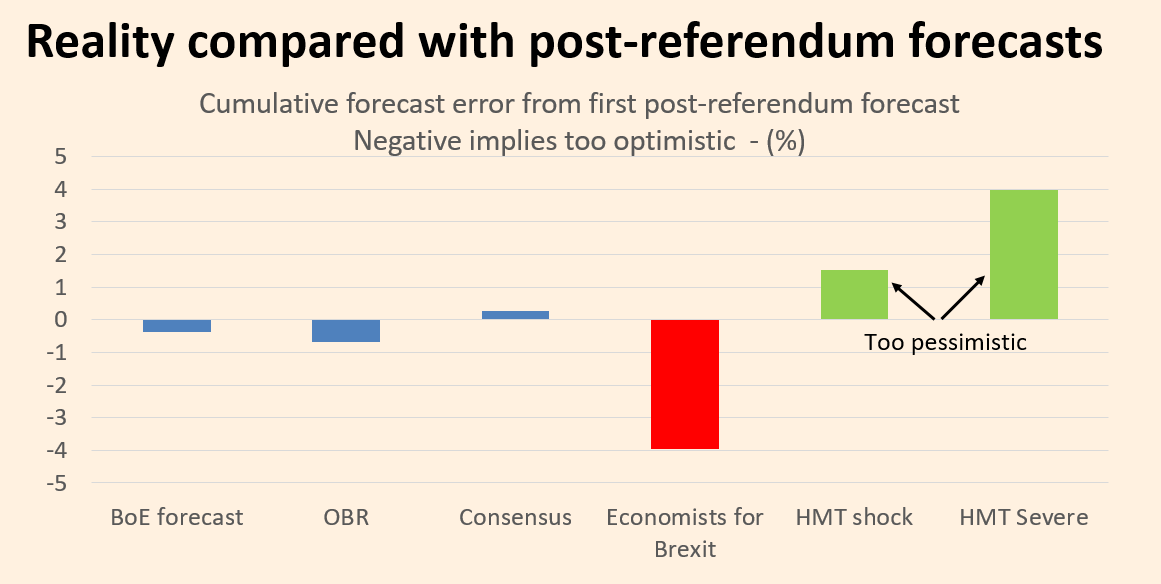

The forecasts made by BoE, OBR, IMF, Consensus of private forecasters after the referendum have been remarkably good.

One private sector group did very badly, however. Economists for Brexit - which now goes under the name @Econs4FreeTrade

11/

One private sector group did very badly, however. Economists for Brexit - which now goes under the name @Econs4FreeTrade

11/

But the @hmtreasury also made definitively bad forecasts, just before the referendum when it predicted a shallow recession -

It was too pessimistic, although it& #39;s main scenario (shock) is no longer looking so shabby

12/

It was too pessimistic, although it& #39;s main scenario (shock) is no longer looking so shabby

12/

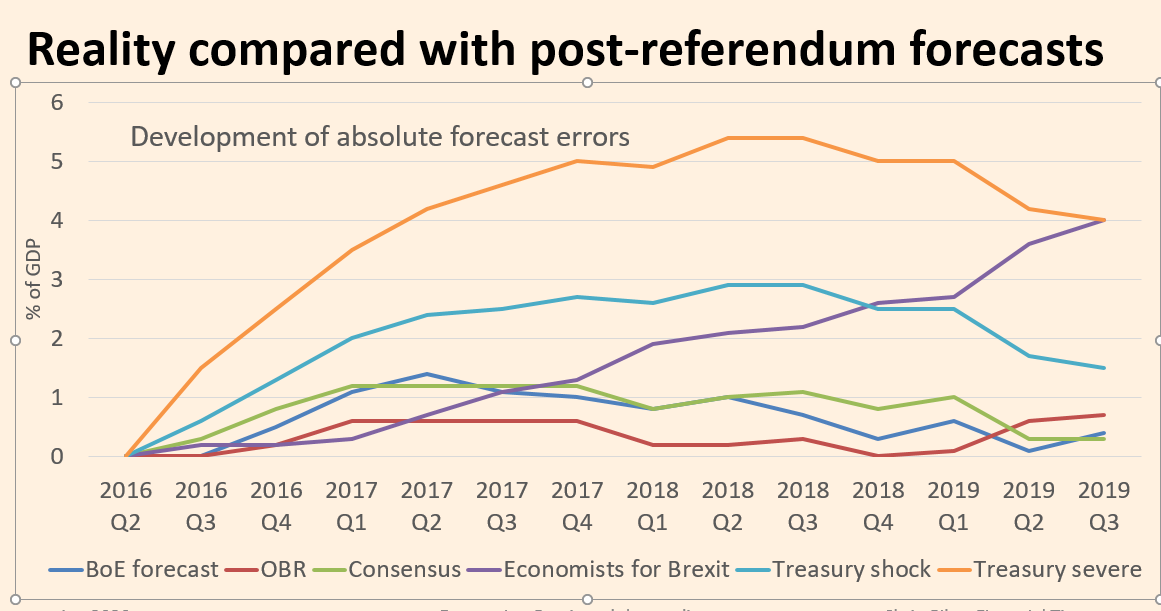

Over time the absolute errors have evolved.

At first - in 2016, it seemed economic damage was much smaller than expected.

But it was delayed not averted.

We must hope that after Brexit, things get better. They might

13/

At first - in 2016, it seemed economic damage was much smaller than expected.

But it was delayed not averted.

We must hope that after Brexit, things get better. They might

13/

Equally, we might live in the world the @bankofengland sketched out yesterday with 1% sustainable growth a year.

That will not be enough to fund the public services we expect.

14/

That will not be enough to fund the public services we expect.

14/

Conclusions:

1) Brexit has left Britain missing out on about 2% of growth so far

2) Economists expect the difficulties to mount, but it& #39;s not certain

3) Forecasts were good, unless they were made by people with axes to grind

4) These conclusions are not set in stone

ENDS https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">

1) Brexit has left Britain missing out on about 2% of growth so far

2) Economists expect the difficulties to mount, but it& #39;s not certain

3) Forecasts were good, unless they were made by people with axes to grind

4) These conclusions are not set in stone

ENDS

Read on Twitter

Read on Twitter PUBLIC SERVICE KLAXON https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">It& #39;s Brexit day so we should do the definitive assessment of the 2016 referendum vote on economic performanceNote: Definititve DOES NOT EQUAL certainDefinitive DOES NOT EQUAL permanent 1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light"> PUBLIC SERVICE KLAXON https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">It& #39;s Brexit day so we should do the definitive assessment of the 2016 referendum vote on economic performanceNote: Definititve DOES NOT EQUAL certainDefinitive DOES NOT EQUAL permanent 1/" class="img-responsive" style="max-width:100%;"/>

PUBLIC SERVICE KLAXON https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">It& #39;s Brexit day so we should do the definitive assessment of the 2016 referendum vote on economic performanceNote: Definititve DOES NOT EQUAL certainDefinitive DOES NOT EQUAL permanent 1/" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light"> PUBLIC SERVICE KLAXON https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light">It& #39;s Brexit day so we should do the definitive assessment of the 2016 referendum vote on economic performanceNote: Definititve DOES NOT EQUAL certainDefinitive DOES NOT EQUAL permanent 1/" class="img-responsive" style="max-width:100%;"/>