AMC industry in India is heating up. HDFC AMC trades at pretty high valuations from global standards, and more AMCs lining up for IPO. A thread on some key numbers in the AMC industry - taken from the UTI AMC IPO Prospectus. (1/n)

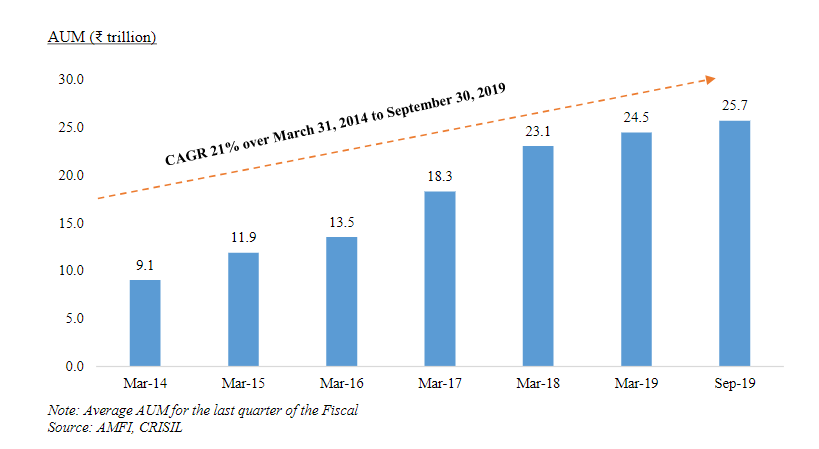

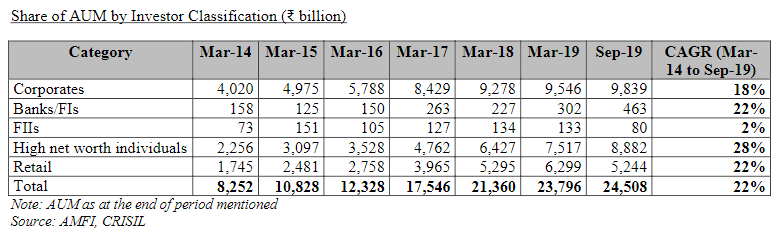

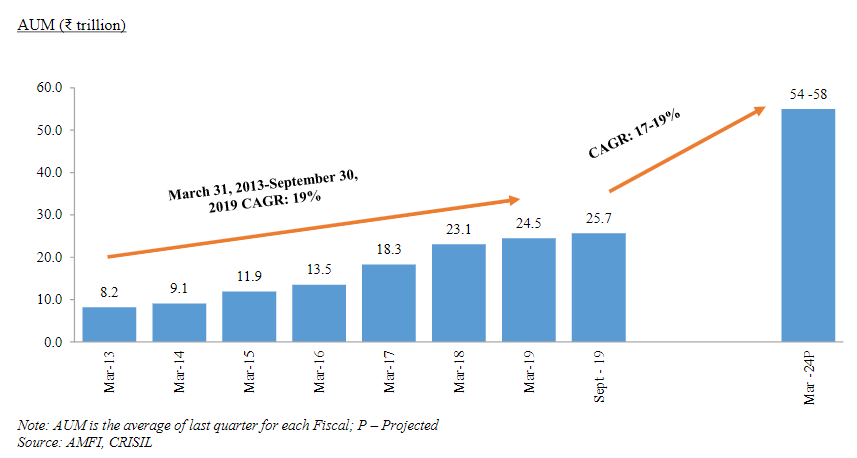

Total AUM has grown at a CAGR of 21% between March 2014 and Sep 2019. We have almost doubled our AUM between March 2016 and March 2019, indicating massive shift in investment patterns (2/n)

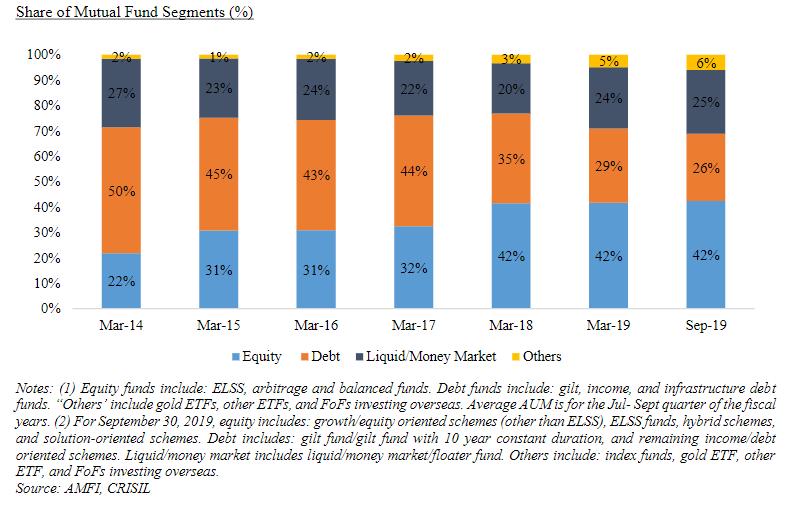

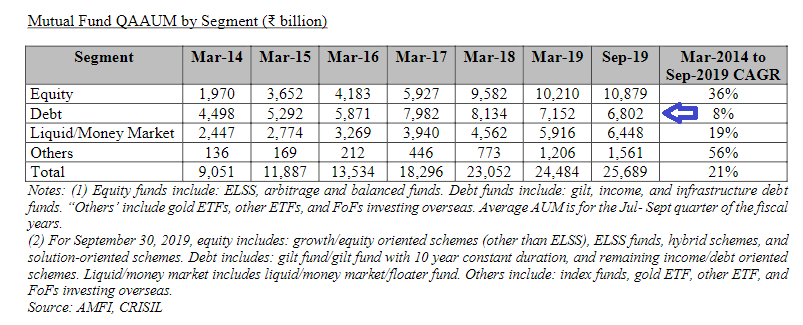

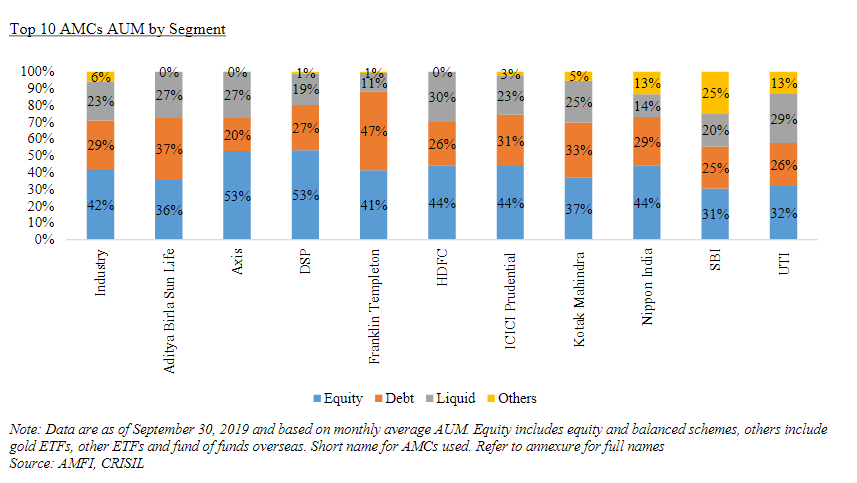

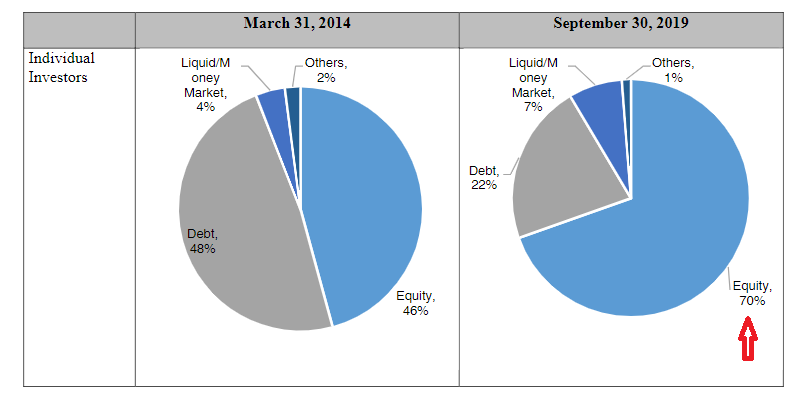

(3/n) While the debt segment has suffered post the ILFS fiasco, Equity continues to gain. The thing to note however is equity includes balanced funds, so the number may not exactly be representative. Yet, growth in Equity has been solid

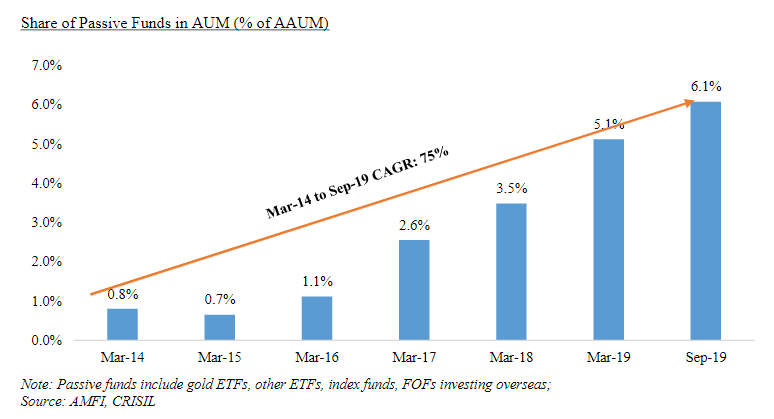

(5/n) Passive Funds, including ETFs and Index Funds, have grown at a CAGR of 75%. As a share of total AUM, they now account for about 6%, from less than 1% in March 2015.

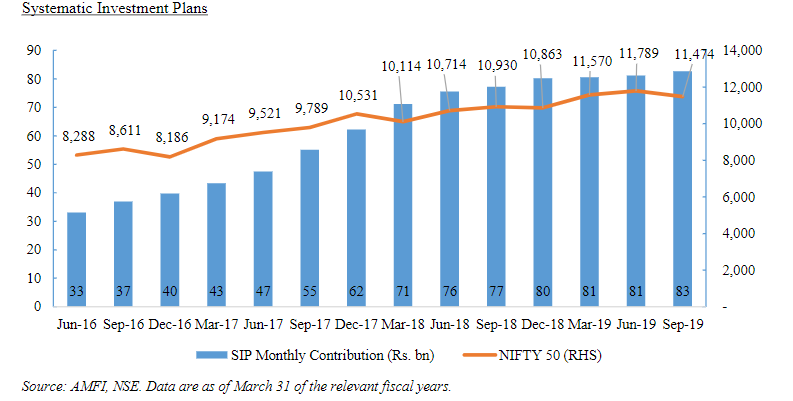

(6/n) SIPs have taken up significantly. Now monthly SIP inflow is at Rs 8300 crore as of Sep 2019. SIPs remember is sticky money, and does not go out quickly.

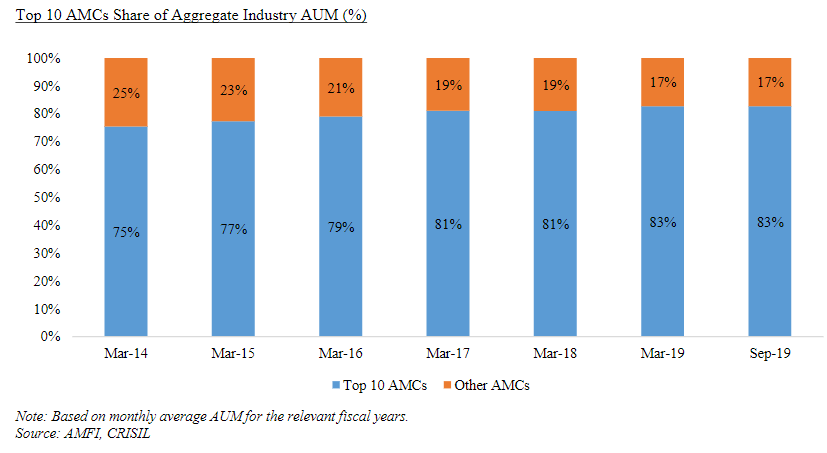

(8/n) This is an industry where the big gets bigger and stronger, especially in times of crisis. Top 10 AMC AUM has become 83% of total AUM, as compared to 75% in 2014. This is probably the reason that larger AMCs get higher valuation.

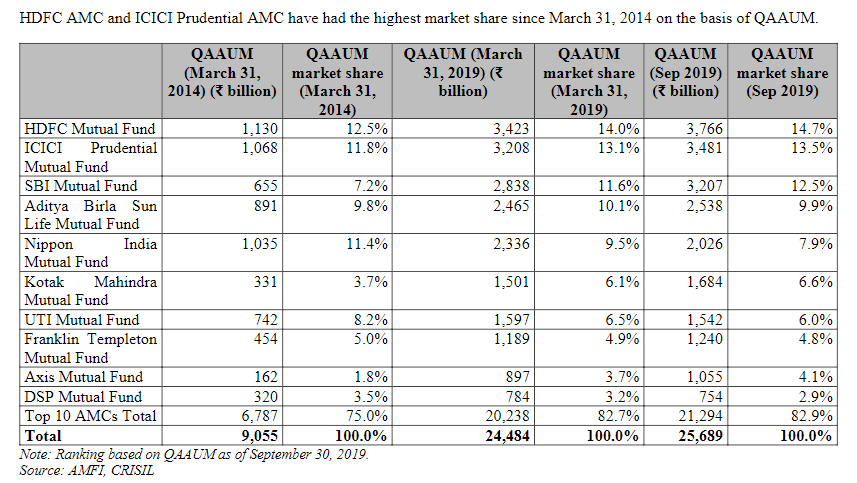

(9/n) The top 3 AMCs account for 40% of the market share. The top 2 have continued to remain the same companies since 2014.

(10/n) DSP and Axis have the highest proportion of Equity AUM. SBI has the lowest. SBI has the highest proportion of Passive funds

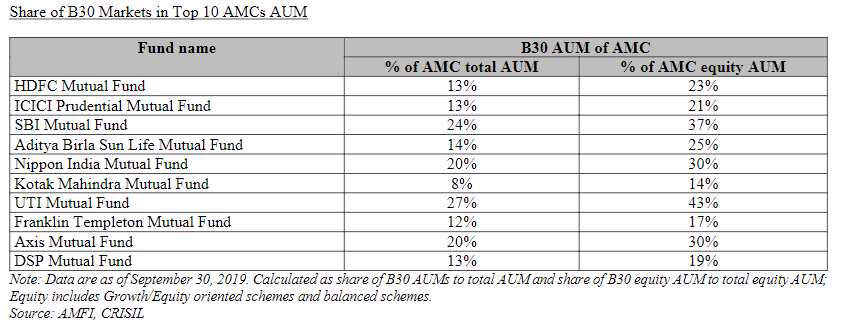

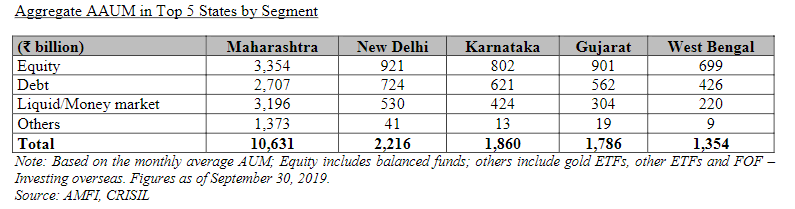

(11/n) Bulk of the investments come from the top 30 cities. B30, which is below the top 30 cities, contributes lesser to most mutual funds. UTI has the highest share of B30 in the top 10, showing their reach in the smaller cities. Ditto for SBI.

(13/n) Individual Investors are heavily skewed towards equity. 70% of their AUM is in Equities, making this segment prone to market volatility. We need to see a bigger correction in markets to see how this money reacts.

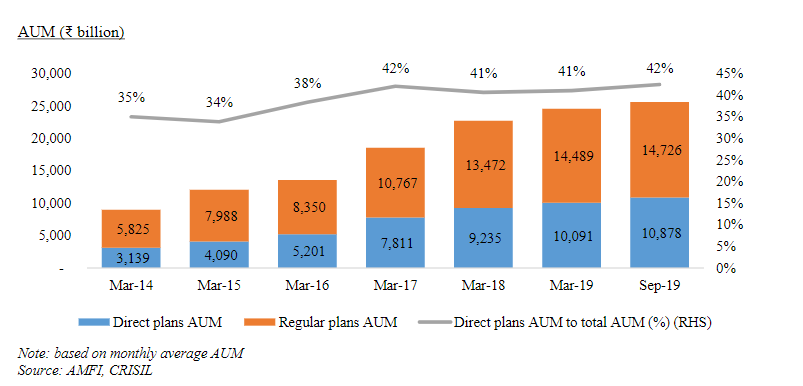

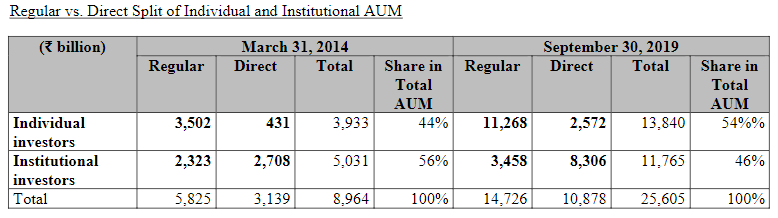

(14/n) Direct Plans now account for 42% of total AUM, but most of this is from institutional investors

(15/n) Amongst Individual investors, only around 19% comes from Direct Plans. Distribution is important in this segment.

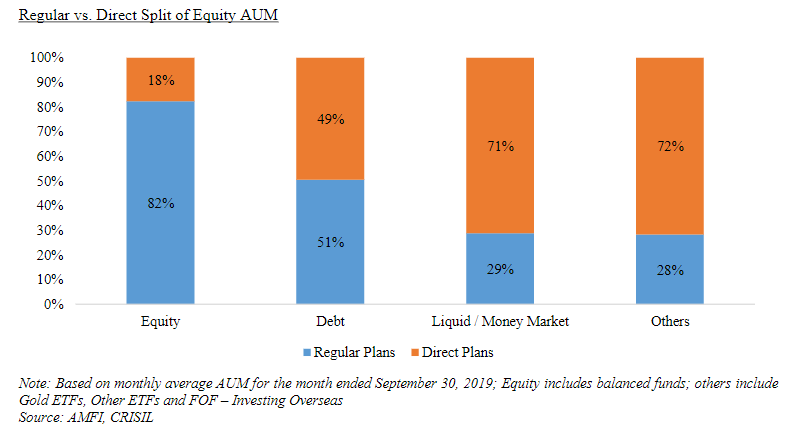

(16/n) Direct plans have a bigger proportion in liquid funds and money market funds. Equities continue to have 82% under regular plans, outlining the fact that they continue to be sold by distributors.

(18/n) Total AUM is expected to grow by 17-19% over the next 5 years, to reach about 54 lakhs crores in 2024. This would be about 15-18% of the GDP, depending on how fast nominal GDP grows in India

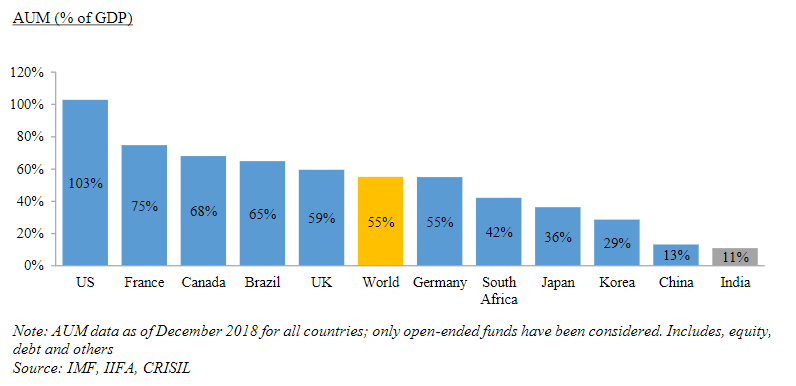

(19/n) As per global comparisons, we are nowhere close in AUM to GDP ratio – a long way to go. However, the results are skewed by US which accounts for 100% of GDP as its AUM. India should still target reaching around 25% of GDP as AUM over the next decade

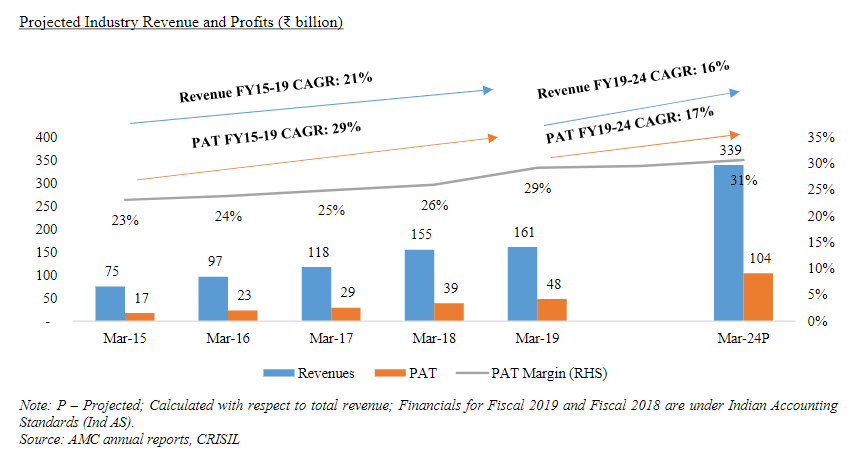

(20/n) Industry profitability is expected to grow well. March 2019 industry PAT was around Rs 4800 crore, which is expected to reach Rs 10,400 crore by 2024.

(21/n) HDFC AMC had nearly 20% of the industry profits in 2019, as compared to 14% AUM Market Share. Assuming 20% to stay constant in the industry profit pool, HDFC AMC should make about Rs 2100 crore of profit in 2024.

(22/22) It trades at a market cap of Rs 67000 crore, nearly 32 times FY24 earnings! It deserves a premium being the strongest player, as this industry works on trust. But how much premium is for you to decide.

P.S - Not a recommendation. Please do your own research.

P.S - Not a recommendation. Please do your own research.

Read on Twitter

Read on Twitter