$DS Checking on how things are going with their new venues. Wait times are good indicator of popularity since TopGolf locations have 1 hour wait times typically

"There is definitely a really long (1 1/2-2h) wait for a lane"

"an hour wait for the 2nd deck."

/1

"There is definitely a really long (1 1/2-2h) wait for a lane"

"an hour wait for the 2nd deck."

/1

" 90min wait-time for the first floor bay and a 2-2.5h wait-time for second level."

"guy at the front desk informed us that there would be 2 1/2 hour wait. So we decided how we we& #39;re gonna wait it out. Thankfully, there was a bar on the 2nd floor... "

/2

"guy at the front desk informed us that there would be 2 1/2 hour wait. So we decided how we we& #39;re gonna wait it out. Thankfully, there was a bar on the 2nd floor... "

/2

"I& #39;m glad we have something similar to Top Golf in Raleigh"

"The wait can be long if you go after 5pm. Ours was a three hour wait. There are a lot of people. It was hard to find somewhere to sit and eat. People were waiting to sit at the bar."

/3

"The wait can be long if you go after 5pm. Ours was a three hour wait. There are a lot of people. It was hard to find somewhere to sit and eat. People were waiting to sit at the bar."

/3

Most of the bad reviews are focused on long wait times, sometimes more than 3 hours!

/4

/4

$DS and TopGolf locations by state ( 11 TopGolf locations in Texas)

Source: Imperial Capital report

/5

Source: Imperial Capital report

/5

Sometimes Drive Shack and Top Golf compete for locations : example is the now cancelled TopGolf plan to build 3 miles away from Drive Shack location in New Orleans

https://www.nola.com/news/business/article_2ee48804-c562-5747-ad29-9ffe0761425a.html

/6">https://www.nola.com/news/busi...

https://www.nola.com/news/business/article_2ee48804-c562-5747-ad29-9ffe0761425a.html

/6">https://www.nola.com/news/busi...

For SoCal, Top Golf is opening location in El Segundo, while Drive Shack will open location in Newport Beach.

So Top Golf will get more of LA area people, while Drive Shack will get more of Orange County folks.

/7

So Top Golf will get more of LA area people, while Drive Shack will get more of Orange County folks.

/7

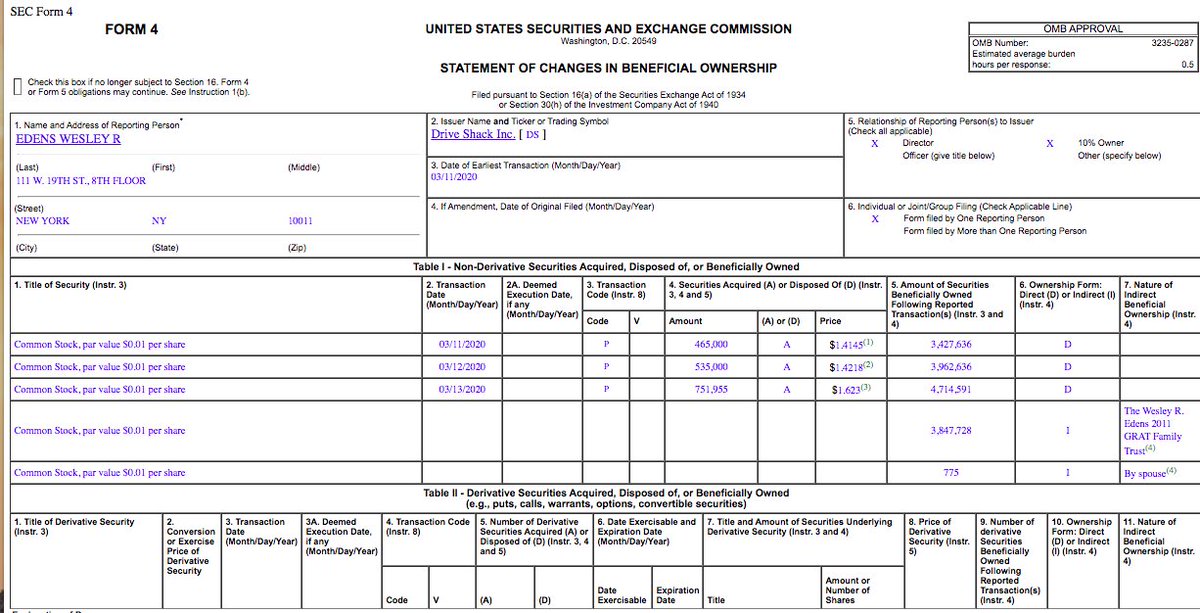

Wes Edens made a big buy in $1.4 - $1.6 range the last three days. Like a boss!

$DS is a restaurant / bar with a golf entertainment venue connected to it. So COVID-19 is a big risk. BUT

a. They have only 4 open venues

b. traditional golf courses are mostly leased or managed

/8

$DS is a restaurant / bar with a golf entertainment venue connected to it. So COVID-19 is a big risk. BUT

a. They have only 4 open venues

b. traditional golf courses are mostly leased or managed

/8

Replying to

@walnutavevalue

Let& #39;s stress test $DS (all annual costs):

Cash = $28M

Finances lease liability = $7M

Preferred Dividends = $5.6M

G&A = $12M

Op Lease liability = $33.15M

Interest expense = $3.8M

/9

@walnutavevalue

Let& #39;s stress test $DS (all annual costs):

Cash = $28M

Finances lease liability = $7M

Preferred Dividends = $5.6M

G&A = $12M

Op Lease liability = $33.15M

Interest expense = $3.8M

/9

They have only 4 Drive Shack sites open. So it& #39;s all abut managed and leased American Golf Corp courses

Let& #39;s say those are closed for 6 months

Cash = $28M

Liability = $32M.

$16M of that liability is Op Lease liaibility, i.e. rent for running city golf courses

/10

Let& #39;s say those are closed for 6 months

Cash = $28M

Liability = $32M.

$16M of that liability is Op Lease liaibility, i.e. rent for running city golf courses

/10

My guess here is that cities will waive minimum rents if

a. city mandates closure

b. big drop in users on city run golf courses leased by $DS

Eg: In Long Beach CA, $D pays min $4M annual rent to city for 5 leased courses. City likely to waive rent if $DS can& #39;t pay

/11

a. city mandates closure

b. big drop in users on city run golf courses leased by $DS

Eg: In Long Beach CA, $D pays min $4M annual rent to city for 5 leased courses. City likely to waive rent if $DS can& #39;t pay

/11

Current status at Long beach: All city operations closed, except parks and golf course. This could change, but till then it& #39;s the only means of entertainment there

http://longbeach.gov/press-releases/long-beach-announces-temporary-modifications-to-city-operations/

/12">https://longbeach.gov/press-rel...

http://longbeach.gov/press-releases/long-beach-announces-temporary-modifications-to-city-operations/

/12">https://longbeach.gov/press-rel...

Overall: $DS will pass 6 month stress test with help from cities. In any case, cities will waive penalties for late payment of rent on leased courses.

If $DS survives, can it thrive? Will other competition for Drive Shack locations survive (local bars / restaurants)?

/13

If $DS survives, can it thrive? Will other competition for Drive Shack locations survive (local bars / restaurants)?

/13

How does TopGolf survive long shut down period? How will it fair against stress tests since they are more indebted and based by PE? How will they IPO?

Ironically, traditional golf courses might save $DS and help it rebound after #COVID19 passes.

/14 https://www.bloomberg.com/news/articles/2020-01-06/topgolf-is-said-to-work-with-morgan-stanley-on-u-s-ipo">https://www.bloomberg.com/news/arti...

Ironically, traditional golf courses might save $DS and help it rebound after #COVID19 passes.

/14 https://www.bloomberg.com/news/articles/2020-01-06/topgolf-is-said-to-work-with-morgan-stanley-on-u-s-ipo">https://www.bloomberg.com/news/arti...

As for valuation, $170M for $DS is ridiculously cheap given that TopGolf wanted to IPO for $4B.

Entertainment will be back again, and $DS will be there

/15

Entertainment will be back again, and $DS will be there

/15

$DS can also suspend quarterly preferred dividends for up to 6 periods before those preferred holders meet and decide to elect 2 board members. So another $5.6M cash potential saved.

/16

/16

Thinking a bit more, $DS sub American Golf has managed Long Beach golf courses since 1984. City of Long Beach is NOT letting American Golf Corp. fail for not paying one year of rent. They will cut minimum rent just to ensure no impact on long term employment

/17

/17

Cash + Real Estate held for sale:

Q219 end: $73M

Q319 end: $52M

Q419 end: $45M ($28M is cash)

$DS spent $20M in Q3 for new venues. Spending slowed in Q4 to $7M. Hoping that they slowed more in Q1 with impending COVID-19

/18

Q219 end: $73M

Q319 end: $52M

Q419 end: $45M ($28M is cash)

$DS spent $20M in Q3 for new venues. Spending slowed in Q4 to $7M. Hoping that they slowed more in Q1 with impending COVID-19

/18

They planned to start construction on urban Box concept in summer 2020 (so no to small spend in Jan / Feb)

Finalized designs for New Orleans - need to check if they spent much in Jan / FEb 2020 there

So they likely still have $28M cash -- which is the main thing right now!

/19

Finalized designs for New Orleans - need to check if they spent much in Jan / FEb 2020 there

So they likely still have $28M cash -- which is the main thing right now!

/19

$DS has enough liquidity. It& #39;s really undervalued.

This does not consider Opex which is huge because it& #39;s mainly labor cost, mainly hourly workers. More on that in next tweet

/20

This does not consider Opex which is huge because it& #39;s mainly labor cost, mainly hourly workers. More on that in next tweet

/20

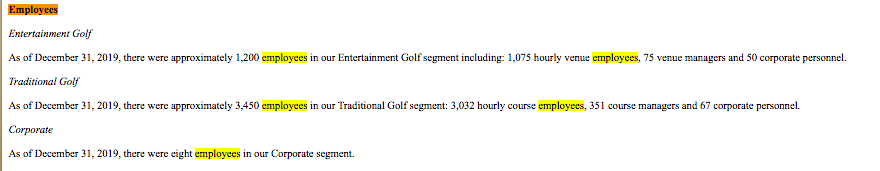

Opex: assume they have already cut hourly staff costs. That leaves 426 venue + course managers who are not hourly, maybe $30M per year (or $2.5M per month).

125 corp personnel (G&A cost = $47M/yr, or $4M/month).

Cash burn of $6M per month, will be $3M / month with cuts

/21

125 corp personnel (G&A cost = $47M/yr, or $4M/month).

Cash burn of $6M per month, will be $3M / month with cuts

/21

So $DS can take 2-3 month shut down. But beyond that they will need financing. They can get that by taking mortgage against their Drive Shack locations (currently unencumbered)

/22

/22

Read on Twitter

Read on Twitter