US GDP per capita growth averaged 2.25%/yr in the back half of the 20th century, but only 1% so far in the the 21st century. Is this evidence of recent stagnation in innovation? Let& #39;s look at what @DietzVollrath says in his new book. #ThursdayThreads https://www.goodreads.com/book/show/44179328-fully-grown">https://www.goodreads.com/book/show...

The innovation stagnation idea is that the digital revolution is real, but not important enough to offset declines in innovation in physical "stuff." "We wanted flying cars and got 140 characters", etc.

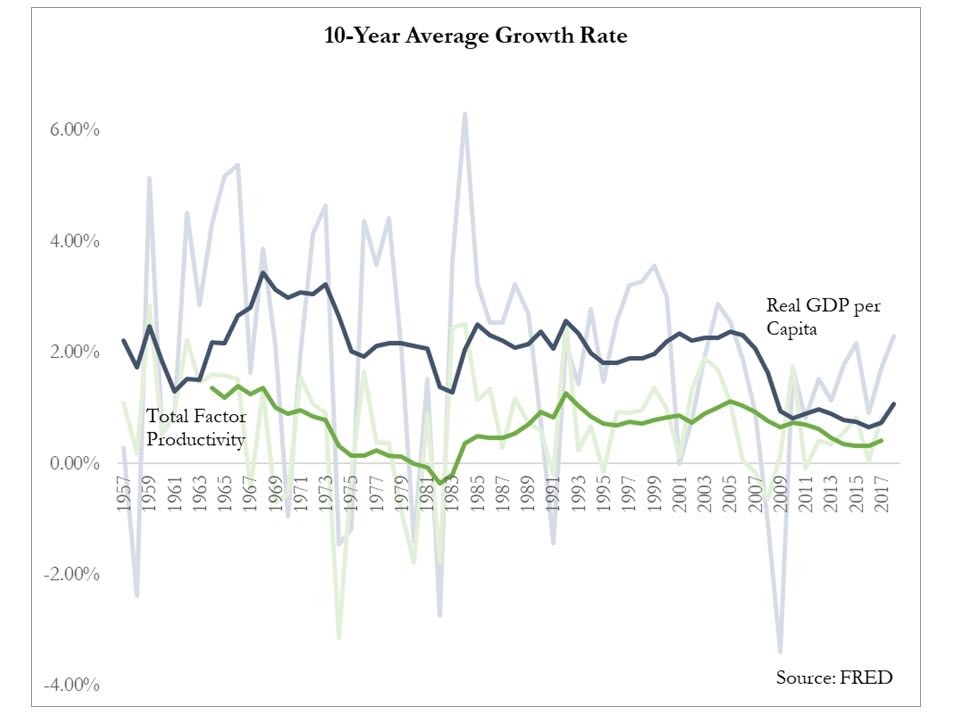

As evidence for this view, some point to the slowdown in real GDP growth, since technology is the fundamental driver of economic prosperity. GDP per capita growth slowed significantly in the 21st century, even excluding the great recession years.

But GDP per capita is also driven by changes in labor and capital inputs. Better yet to use total factor productivity (TFP) growth, since TFP is an estimate of how much extra GDP you can get after controlling for inputs. It& #39;s also slowed.

Everyone knows these measures are not perfect, and stagnationists usually say as much. But then, most they go on to use them because… what else are you gonna do?

One of Vollrath’s contributions is to underscore just imperfect these measures are as proxies for technological change. It can easily be the case that technological progress did not slow at all, and the slowdown in growth is entirely driven by non-technological factors.

Vollrath& #39;s preferred decomposition of the GDP per capita slowdown is:

0.8pp declining growth in human capital

+0.2pp the shift of spending from goods to services

+0.15pp declining reallocation of firms and workers

+0.1pp declining geographic mobility

=1.25pp slower growth

0.8pp declining growth in human capital

+0.2pp the shift of spending from goods to services

+0.15pp declining reallocation of firms and workers

+0.1pp declining geographic mobility

=1.25pp slower growth

Note changes in human capital alone accounts for two-thirds of the slowdown. The decline in the growth of human capital stems from four main factors: older workers, fewer workers, fewer hours worked, and stabilizing educational attainment.

Of these the biggest shift is the decline in the number of workers per capita. It seems all rich societies decide to have fewer kids.

This leaves about 0.45pp left over for explanations related to the capital stock and TFP. Thus, right off the bat, Vollrath argues a slowdown in technological progress explains at most part of one-third of the growth slowdown.

He& #39;ll argue it actually explains far less though.

He& #39;ll argue it actually explains far less though.

TFP growth for the entire economy is the spending-share weighted average of TFP growth across the different sectors that make up our economy.

A slowdown in aggregate TFP growth can occur either because TFP growth slows in each sector OR because the economy starts spending a greater share of income in sectors with slower (but not slowING) TFP growth.

Vollrath argues the latter effect has been more important.

Vollrath argues the latter effect has been more important.

There has been a big shift in spending away from goods and towards services.

TFP growth in goods is typically faster than for services, and so putting more weight on the TFP growth of services has lowered economy-wide TFP growth.

TFP growth in goods is typically faster than for services, and so putting more weight on the TFP growth of services has lowered economy-wide TFP growth.

Why is TFP growth in services slower? Recall that TFP is a measure of how much extra output you can squeeze out of your inputs. For many services, you& #39;re paying for attention (from daycare workers, doctors, servers, etc).

TFP growth would mean getting more attention from the same number of labor inputs. But everyone has the same 24 hours of attention to give, so it& #39;s not easy to see how to achieve that.

There& #39;s no analogous problem for goods. I don& #39;t care how much time it took to make my iPhone.

There& #39;s no analogous problem for goods. I don& #39;t care how much time it took to make my iPhone.

Human capital and the shift to services accounts for about 80% of the slowdown. The remaining 20% is driven by reduced entry and exit of firms and reduced job changes (driven partially by reduced geographic mobility).

Since more productive firms tend to supplant lower productivity ones, and since workers tend to move to higher wages (and therefore, higher productivity, if standard economics is mostly right), when firm and job turnover slows, this can reduce TFP growth.

Why has there been a slowdown in the reallocation of resources across firms and people across jobs? There are lots of candidates besides a slowdown in innovation.

The slowdown in firm turnover could be due to increased market power, stemming from lax antitrust enforcement. Or it could be another consequence of slowing population growth. https://www.nber.org/papers/w25382 ">https://www.nber.org/papers/w2...

The slowdown in geographic mobility could be due to zoning rules that raise the cost of housing and make moving prohibitively costly. Or it might be that people just don& #39;t like to move, and that the earlier rates of high mobility were an aberration. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3497290">https://papers.ssrn.com/sol3/pape...

So most of the reason for the slowdown in growth has to do with choices people made. Between preferences for smaller families, fewer work hours, and services over stuff, Vollrath argues you can account for 80% of the growth slowdown.

And it’s not at all clear the remainder can be easily blamed on a technological slowdown.

If you liked this thread, I write about research related to innovation on Thursdays (search my feed for #ThursdayThreads). Or you can subscribe to a newsletter version ( https://mattsclancy.substack.com"> https://mattsclancy.substack.com ) or an RSS feed version ( https://mattsclancy.substack.com/feed ).">https://mattsclancy.substack.com/feed"... Thanks!

Read on Twitter

Read on Twitter