MOBLE HOME PARKS

(MHP = mobile home park ; MH = mobile home)

Born in the Great Depression; absorbing war-workers in the 40’s; increasingly solidifying in the following decades: MHP are a niche sector serving a small (yet persistent) section of lower-class America.

(MHP = mobile home park ; MH = mobile home)

Born in the Great Depression; absorbing war-workers in the 40’s; increasingly solidifying in the following decades: MHP are a niche sector serving a small (yet persistent) section of lower-class America.

A section of the populace – those who cannot afford a traditional mortgage (yet do not qualify for publicly subsidized housing) – fall through the cracks and a stable population – there are approximately 50k MHP housing 6.5% of the US pop – has emerged.

A stigmatized and fragmented industry (though institutional interest is certainly growing quickly) largely in the South & Midwest, residents often never move because of weak credit or low-savings, the structures cannot withstand the move, and finding a new spot is untenable.

MHP operates on two different models: park-owned homes (POH) and tenant-owned homes (TOH). With POH, the owner owns the home and rents it out. A TOH is when the tenant owns their home and rents the land. Often, parks are a mix of the two.

MH is a misnomer; once a home is set it rarely moves from the location. Certainly an off-the-beaten-path investment, the fundamentals of the asset class are extremely strong.

Unlike other RE asset classes, supply is largely static; less than 200 MHP have been built in the last 10 years. The chief pillar supporting barriers to supply is stigmatized NIMBY (essentially NIMBY-on-steroids), with opposition virtually ubiquitous nationwide.

Fierce and relentless local opposition on local legislative bodies tends to be highly effective! Likewise, more traditional developments – apartments etc. – are usually far more profitable (and far, far easier) for developers to get done.

The average MH price is 1/4th the average price an existing single-family (including land cost). Often, Credit scores need be no higher than 550 to buy MH (even if their credit records include a bankruptcy or home foreclosure).

Rents are almost always cheaper than other forms of housing. With the ranks of poor growing and Baby Boomers retiring in droves, demand is extremely high. Likewise, in a recession, demand would increase further.

Over the past few decades – and intensifying in 2016 – MHP have increasingly gone from “mom and pop” to large, multi-state players. Big-time names like Brookfield, Carlyle, Apollo (as well as pension & sovereign funds) have invested. PE firms now own more than 100k MH sites.

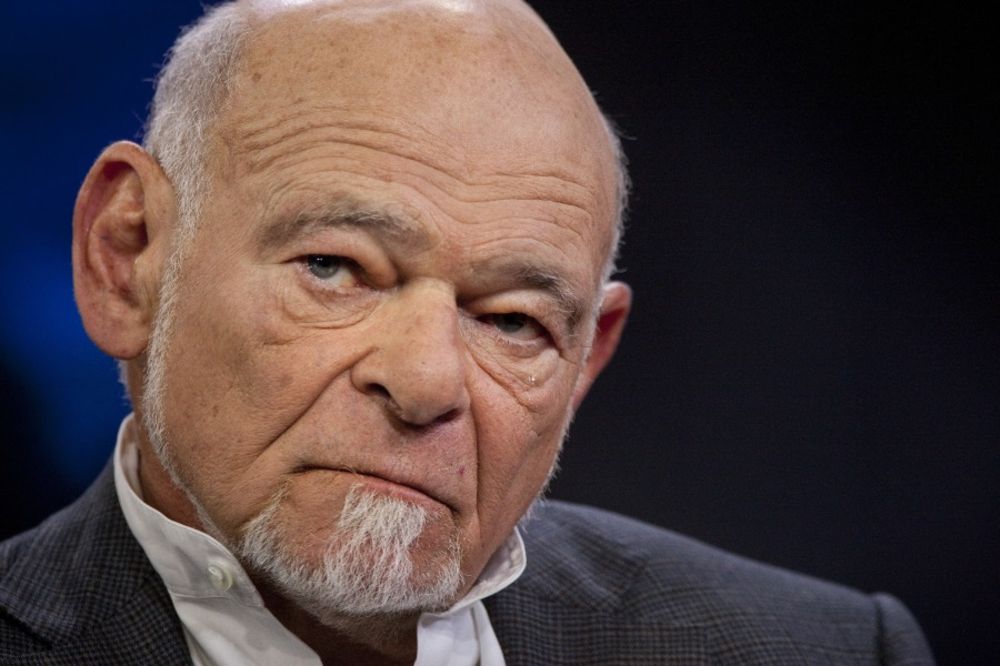

Equity Lifestyle Properties is the largest owner in N. America; helmed by Sam Zell (one of my fav investor who also happens to double as an even-split between a Hobbit & Orc from Lord of the Rings).

While many big fish are starting to catch on, most MHP are still “mom and pop” operations. And there is still significant opportunity. Positive characteristics of the asset class are notable: stable income, lower operating costs (especially for TOH), recession resistant.

While luxury condos for sale in Manhattan sit untouched (with tepid demand at best), the consumer-demand for MHP sites is through-the-roof. This niche RE sector, embedded in lower-class America, is virtually unaffected by macroeconomic storms of the financial world.

Read on Twitter

Read on Twitter