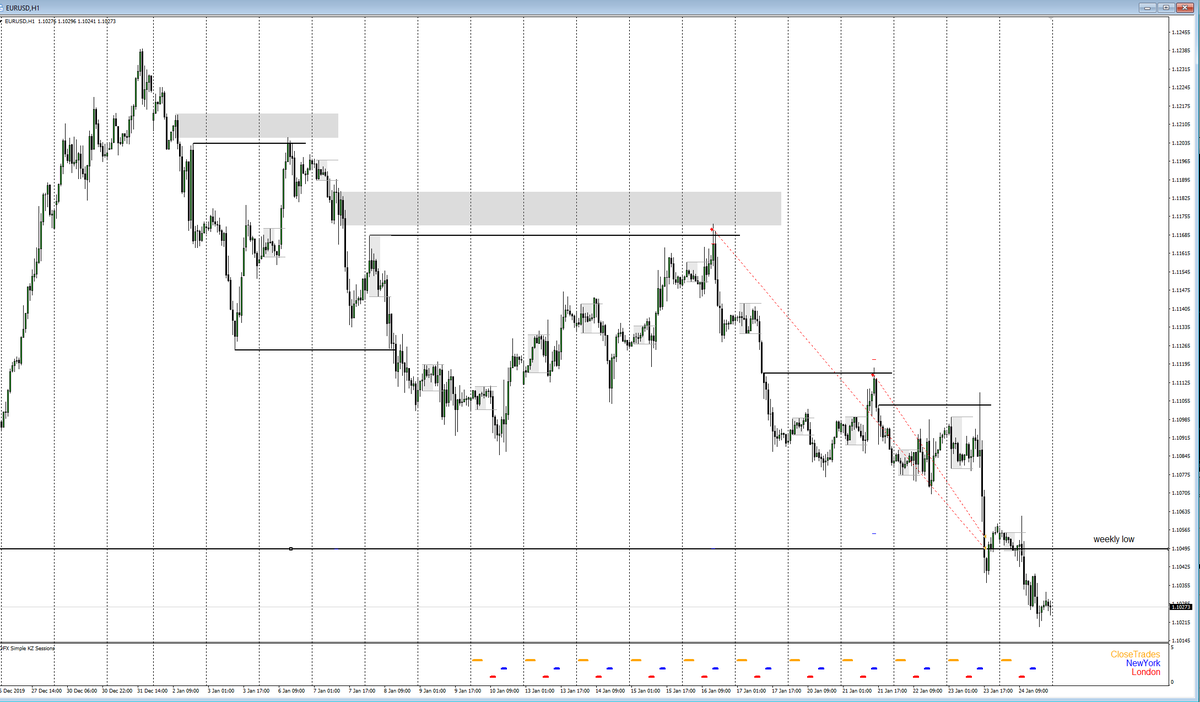

filtering m/s breaks, when to anticipate lower highs or higher lows.. only valid with confluence on support / resistance blocks.

what I like to do is draw optimal setups in hindsight to spot them better the next time.. when to compound, when invalidation levels form etc and to see what I& #39;ve missed with the rules I should follow.

note to only target levels corresponding with the timeframe the breaks occur.

note to only target levels corresponding with the timeframe the breaks occur.

doing this stuff should be possible at some point I guess, combined with the usual liquidity / reversal points etc etc.

my main thing about these moves is if it doesn& #39;t react as you& #39;d expect just stay out or get out, it probably isn& #39;t ready yet.

my main thing about these moves is if it doesn& #39;t react as you& #39;d expect just stay out or get out, it probably isn& #39;t ready yet.

some more reviewing when m/s doesn& #39;t break yet.. I& #39;ve burned myself too often holding positions wanting it to break a certain m/s or the block that breaks m/s, while that is the true invalidation level and thus it should be my target.

this is not as a prediction, just to give some insight how to make a plan for setting targets etc and what to wait for.. if it does break you can use the above things in this thread for getting onboard.

as long as it doesn& #39;t break it& #39;s ranging, no trend before that imo.

as long as it doesn& #39;t break it& #39;s ranging, no trend before that imo.

this is one of the things i& #39;ve seen repeat in a reliable way, and while nothing is perfect or 100% I would& #39;ve made more by just closing at these levels instead of hoping it will break compared to the wins I& #39;ve (feared) of missing out on by holding positions.

in the end it& #39;s just defining the last stoprun that broke a m/s as an invalidation level and a strong zone to base a certain play on.. let someone else figure out how it& #39;ll react after that and go from there.

comparison to the other $BTC chart in this thread.

in reverse, but filtering out which high defines to me where the flow is heading, only after that your entry makes & #39;sense& #39; and you can use an entry method that works for you.

filter what& #39;s relevanttt, only then do blocks work.

in reverse, but filtering out which high defines to me where the flow is heading, only after that your entry makes & #39;sense& #39; and you can use an entry method that works for you.

filter what& #39;s relevanttt, only then do blocks work.

interesting stuff.. pick your poison.

rules followed from this thread with dxy and other xxxusd pairs as confluence.. how lower highs form and what to target next, liquidity runs in some form are seen in all cases here before moving down so that& #39;s something to wait for first.

rules followed from this thread with dxy and other xxxusd pairs as confluence.. how lower highs form and what to target next, liquidity runs in some form are seen in all cases here before moving down so that& #39;s something to wait for first.

conclusion for the setup based on observations:

1) a defined trend direction

2) break of m/s confirming trend continuation

3) anticipate bearish retracement

4) wait for a liquidity run ( preferably into a block that broke m/s)

5) invalidation above liq run (new m/s high)

1) a defined trend direction

2) break of m/s confirming trend continuation

3) anticipate bearish retracement

4) wait for a liquidity run ( preferably into a block that broke m/s)

5) invalidation above liq run (new m/s high)

from a long time ago, same idea but more refined nowadays :) https://twitter.com/koningkarell/status/1074699595270316033?s=20">https://twitter.com/koningkar...

so what does it take?

patience, which I try to build by backtesting like in the thread: seeing that the swing setups take place after a ~70% retrace making a liq run into the last place where you& #39;re wrong, which is where your ideal entry is.

then not trying to fight it lol

patience, which I try to build by backtesting like in the thread: seeing that the swing setups take place after a ~70% retrace making a liq run into the last place where you& #39;re wrong, which is where your ideal entry is.

then not trying to fight it lol

today& #39;s review relevant to this thread.

Read on Twitter

Read on Twitter