“Jamaica’s Golden Window”.

What is it and how can it help you live a better life?

This idea has been germinating in my mind for months and I have been meaning to share here recently, but life has been hectic...apologies.

//A thread

#FinanceTwitterJa

What is it and how can it help you live a better life?

This idea has been germinating in my mind for months and I have been meaning to share here recently, but life has been hectic...apologies.

//A thread

#FinanceTwitterJa

Note: this is a hypothesis that I have developed, so forgive me if it is a bit rough around the edges, or if others have said it more eloquently than I.

There very well may be economic theories to explain this more succinctly, but I don’t know of any so I came up with the name.

There very well may be economic theories to explain this more succinctly, but I don’t know of any so I came up with the name.

What is the ‘Golden Window’?

The period of time, typically within in 1 generation, when a country develops fast enough to create significant wealth for many of its citizens — Me https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">

Examples:

- USA (post WW2 - Baby Boomers)

- Germany (post WW2)

- Asian Tigers (1960 - now)

The period of time, typically within in 1 generation, when a country develops fast enough to create significant wealth for many of its citizens — Me

Examples:

- USA (post WW2 - Baby Boomers)

- Germany (post WW2)

- Asian Tigers (1960 - now)

- China (1990s - early 2000s)

- Jamaica (2017/18 - ???)

After WW2, the US had the GI Bill - https://en.m.wikipedia.org/wiki/G.I._Bill

That">https://en.m.wikipedia.org/wiki/G.I.... provided cheap loans (for mortgages, businesses), cheap land & free college tuition among many other benefits. An entire generation of wealth was created.

- Jamaica (2017/18 - ???)

After WW2, the US had the GI Bill - https://en.m.wikipedia.org/wiki/G.I._Bill

That">https://en.m.wikipedia.org/wiki/G.I.... provided cheap loans (for mortgages, businesses), cheap land & free college tuition among many other benefits. An entire generation of wealth was created.

Now in the US, the source of much of the political struggle is between the generations. 1 - 2 generations after the Boomers don’t have the same opportunities that the Boomers had, so there is a tension between the generations.

From 1990s to 2000s China had GDP growth of ~10%/yr. That led to hundreds of millions of people being lifted out of absolute poverty.

It is the largest poverty reduction the world has seen in modern times. Now China has more billionaires than the US - https://www.cnbc.com/2016/02/24/china-has-more-billionaires-than-us-report.html">https://www.cnbc.com/2016/02/2...

It is the largest poverty reduction the world has seen in modern times. Now China has more billionaires than the US - https://www.cnbc.com/2016/02/24/china-has-more-billionaires-than-us-report.html">https://www.cnbc.com/2016/02/2...

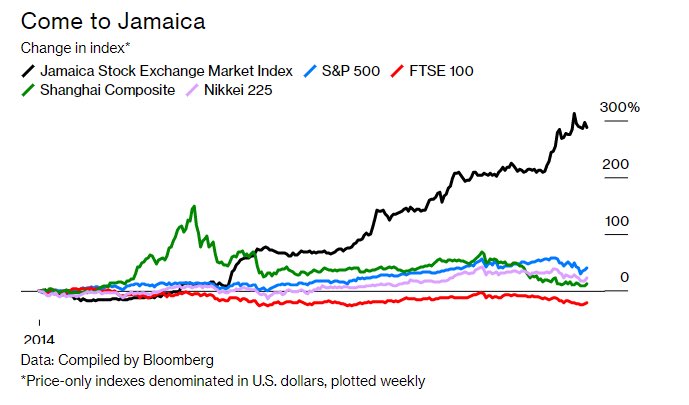

How do we know Jamaica is entering her ‘golden window’?

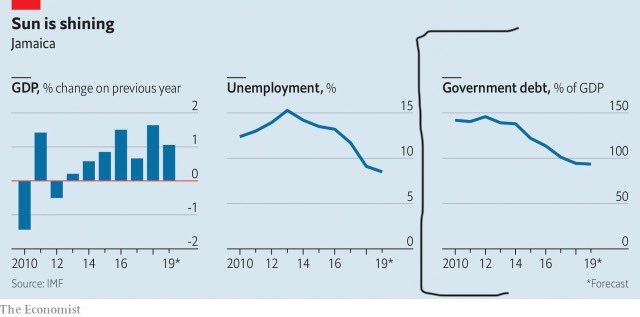

Take a look at the graphs below, specifically the one highlighted on the right. Our debt-to-GDP ratio.

This reduction in our debt is as big as (if not bigger than) any Olympic records set by our phenomenal athletes.

Take a look at the graphs below, specifically the one highlighted on the right. Our debt-to-GDP ratio.

This reduction in our debt is as big as (if not bigger than) any Olympic records set by our phenomenal athletes.

GDP is all of the income that every person & company in Jamaica earns in 1 year (well, in the measurable formal economy — excluding scamming, drugs, etc.).

10 years ago, GOJ owed about $1.47 for every $1 that we all earned. Within 10 years that has fallen to $0.96 to $1.

10 years ago, GOJ owed about $1.47 for every $1 that we all earned. Within 10 years that has fallen to $0.96 to $1.

The reason this is significant is because there has been no other country in modern history that has ever reduced debt so fast in such a short period of time without debt forgiveness or debt relief.

Through 3 administrations (Golding, PSM & Holness), GOJ took hard decisions.

Through 3 administrations (Golding, PSM & Holness), GOJ took hard decisions.

These hard decisions were tough politically.

Before we could even qualify for the privilege of getting an IMF deal, we had to hit some pre-requisites. We had to sell Air Jamaica, Sugar Company & do JDX.

Air JA (2009) posted a $9B loss. Ie GOJ had to find $9B for Air JA.

Before we could even qualify for the privilege of getting an IMF deal, we had to hit some pre-requisites. We had to sell Air Jamaica, Sugar Company & do JDX.

Air JA (2009) posted a $9B loss. Ie GOJ had to find $9B for Air JA.

To put that in context, in the 2009/10 budget, GOJ allocated $2.2B for Early Childhood Development. $2.2B!!

Student Nutrition got $1.9B.

So when GOJ paid $9B to cover Air JA’s losses, they were literally taking food out of the mouths of students.

https://mof.gov.jm/documents/documents-publications/document-centre/file/1081-estimates-of-expenditure-2009-2010.html">https://mof.gov.jm/documents...

Student Nutrition got $1.9B.

So when GOJ paid $9B to cover Air JA’s losses, they were literally taking food out of the mouths of students.

https://mof.gov.jm/documents/documents-publications/document-centre/file/1081-estimates-of-expenditure-2009-2010.html">https://mof.gov.jm/documents...

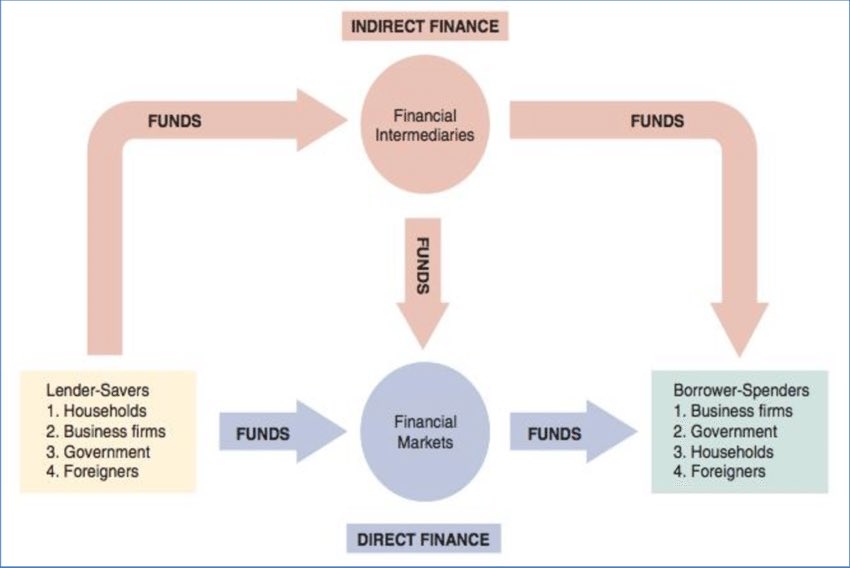

To understand the impact of GOJ accumulating a lot of debt, you have to understand the financial system.

It is comprised of 3 components:

- Sources of Funds (Savers)

- Conduit of Funds (banks, markets, etc.)

- Users of Funds (Borrowers)

It is comprised of 3 components:

- Sources of Funds (Savers)

- Conduit of Funds (banks, markets, etc.)

- Users of Funds (Borrowers)

All savers (households, biz, govt, foreigners) invest their savings in banks and markets that then on lend/invest into projects that borrowers (households, biz, govt & foreigners) have. It’s that simple.

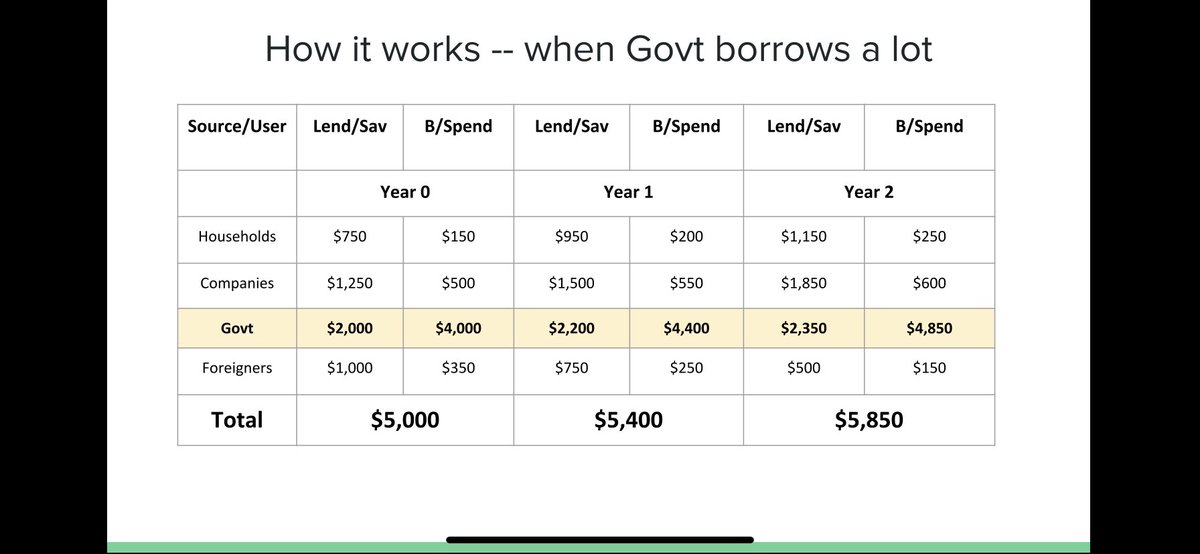

So imagine a scenario where Gov’t borrows a lot, see table below.

So imagine a scenario where Gov’t borrows a lot, see table below.

Assume in Year 0, there is only $5,000 in the entire financial system. When govt borrows $4,000, then all other users of funds have to fight over the $1,000. All mortgages, credit cards, biz loans, etc, come out of that measly $1,000. When these conditions exist, only...

the biggest and best companies get loans and only the rich get credit.

Notice that when that happens, the overall financial system expands slower. There is less money going back to households in the form of wages which prevents them from saving as much which further...

Notice that when that happens, the overall financial system expands slower. There is less money going back to households in the form of wages which prevents them from saving as much which further...

starves the system from much needed savings to fund expansion and it limps along slowly.

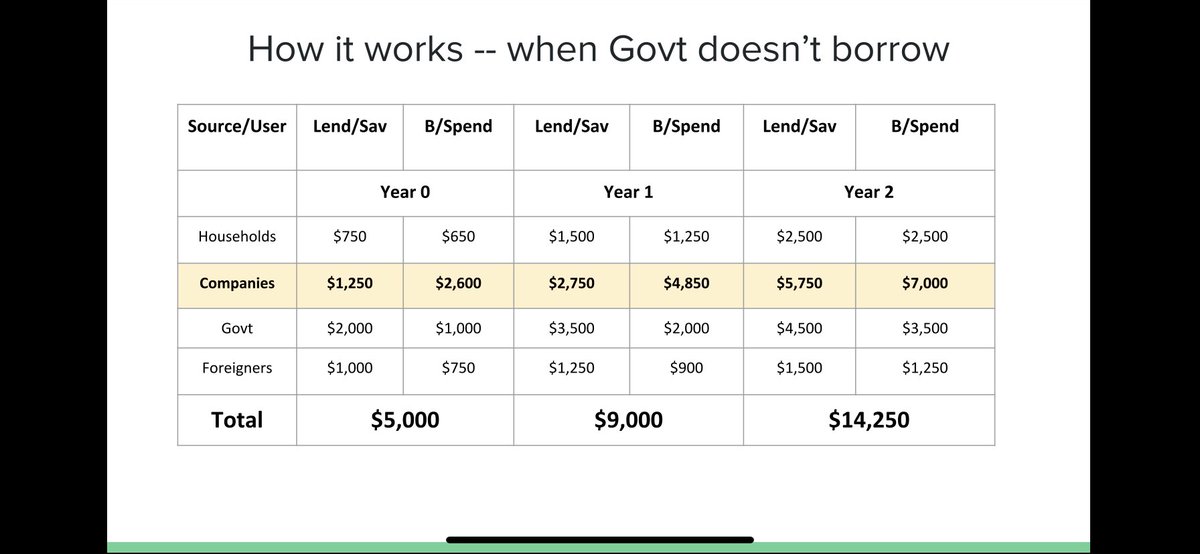

Consider the other scenario when the government doesn’t consume most of the saving. In this scenario, companies borrow more. This is what a healthy financial system looks like.

Consider the other scenario when the government doesn’t consume most of the saving. In this scenario, companies borrow more. This is what a healthy financial system looks like.

Companies are both borrowing more and raising equity capital. That leads to more money going to households in the form of more jobs, higher wages, or cap gains which leads to more savings leading to more cash for companies.

This is what has been happening in JA recently.

This is what has been happening in JA recently.

Those conditions have led to the outstanding performance of our stock market.

Guess what? These conditions are not getting any worse. In fact, they are getting better.

Next year, GOJ is expected to retire more debt which will push more cash into the hands of companies...

Guess what? These conditions are not getting any worse. In fact, they are getting better.

Next year, GOJ is expected to retire more debt which will push more cash into the hands of companies...

and households. The effect of that is we can expect to see more housing solutions coming on stream, with more competitive mortgages and other credit products. We will also see more credit facilities for companies, especially SMEs (we have begun seeing it already).

We will see more companies listing on both the JSE & JJSE.

So back to the original question in the first tweet — how can you benefit?

- Invest in your financial literacy. Understand and learn about finance.

- Keep an eye out for opportunities to start a company.

So back to the original question in the first tweet — how can you benefit?

- Invest in your financial literacy. Understand and learn about finance.

- Keep an eye out for opportunities to start a company.

The economy is about to open up in front of our very eyes and opportunities will be there for the picking.

Make sure you understand our local stock market and invest. Even if you are starting with just a small amount. Even $100.

I wrote an entire thread on this https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Rückhand Zeigefinger nach unten (mittlerer Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittlerer Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Rückhand Zeigefinger nach unten (mittlerer Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittlerer Hautton)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Rückhand Zeigefinger nach unten (mittlerer Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittlerer Hautton)"> https://twitter.com/marcgayle/status/1186461065267306498">https://twitter.com/marcgayle...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Rückhand Zeigefinger nach unten (mittlerer Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (mittlerer Hautton)"> https://twitter.com/marcgayle/status/1186461065267306498">https://twitter.com/marcgayle...

Make sure you understand our local stock market and invest. Even if you are starting with just a small amount. Even $100.

I wrote an entire thread on this

Get involved on #FinanceTwitterJa. There are so many wonderful threads and discussions from many of us. Too many to list here given that I am running out of characters  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Nachdenkliches Gesicht" aria-label="Emoji: Nachdenkliches Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😔" title="Nachdenkliches Gesicht" aria-label="Emoji: Nachdenkliches Gesicht">

Keep in mind that with all opportunities for reward there is risk. Risk/Reward are tightly linked.

Keep in mind that with all opportunities for reward there is risk. Risk/Reward are tightly linked.

That’s why I keep stressing about investing in your education. Once you learn more, you can learn how to manage risk so you can be more prudent with both the opportunities you pursue and how you pursue them.

We are entering a new Jamaica where our generation can create a lot...

We are entering a new Jamaica where our generation can create a lot...

of wealth. But it isn’t guaranteed.

It can be squandered away with political expediency. This is why I am so strident in my defense of our progress.

We have an opportunity that few get. We need to safeguard it and protect it vigorously. One way is to spread knowledge.

It can be squandered away with political expediency. This is why I am so strident in my defense of our progress.

We have an opportunity that few get. We need to safeguard it and protect it vigorously. One way is to spread knowledge.

I believe we have an obligation to protect our gains from all attacks from any policymaker or special interest from any side of the aisle.

These windows don’t come along very often. If we take advantage of this, we could change JA forever...finally.

Jamaica https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇯🇲" title="Flagge von Jamaika" aria-label="Emoji: Flagge von Jamaika"> Land We Love.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇯🇲" title="Flagge von Jamaika" aria-label="Emoji: Flagge von Jamaika"> Land We Love.

These windows don’t come along very often. If we take advantage of this, we could change JA forever...finally.

Jamaica

If you liked this thread and are interested in learning more about finance in general, I offer a series of courses. From very beginners to more experienced.

I cover a wide variety of topics.

Check out this thread below for more info. https://twitter.com/marcgayle/status/1307810287739904008">https://twitter.com/marcgayle...

I cover a wide variety of topics.

Check out this thread below for more info. https://twitter.com/marcgayle/status/1307810287739904008">https://twitter.com/marcgayle...

Read on Twitter

Read on Twitter