1/7 Is $SPX the new inflation? Thoughts on central banking & equity valuation…

2/7 Inflation is a policy, not a price. Dominant CB models (NAIRU, output gap, etc.) limit the scope of inflation to CPI. But asset inflation is also plausible. The object of a monetary inflation in not determined by CB models. Old saying: Central banks propose, markets dispose.

3/7 If the Fed is captive to a wealth-effect strategy, is $SPX is the new inflation?

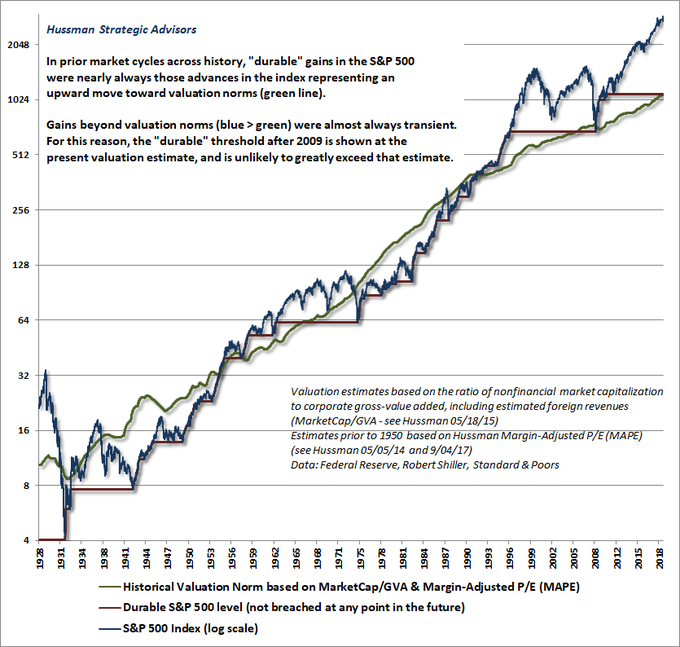

4/7 Difficult to prove, except by inference. Under-asked question: If a market escapes valuation orbit for nearly 30 years, and the outlying period includes a secular bear market, has the underlying process changed?

5/7 Get my drift? Don’t expect traditional valuation to cap a bull-market process if the bull-market process is not driven by traditional valuation.

6/7 Scenario: The Fed’s 1970’s-style models are suspect. CPI has been contained by technological innovation & globalization, not restrictive monetary policy. Policy is lax, and J-Po knows it. But he can’t allow a prolonged bear market, as wealth effect works both ways.

7/7 Is $SPX the new inflation? Perhaps a stretch. But few will dispute my lesser points: 1) inflationary processes aren’t limited to consumer prices; 2) CB models are suspect; and 3) valuation parameters seem unhinged.

No easy exit from wealth-effect strategy, once adopted.

No easy exit from wealth-effect strategy, once adopted.

Read on Twitter

Read on Twitter