1) So here& #39;s how I now think stocks & bonds will unravel. (NOTE: THIS FORECAST IS WORTH WHAT TWITTER IS CHARGING YOU FOR IT!)

Core CPI now = 2.3% and I think (in the face of trillion-dollar deficits) it will remain steady or keep climbing.

$SPY $IWM

Core CPI now = 2.3% and I think (in the face of trillion-dollar deficits) it will remain steady or keep climbing.

$SPY $IWM

2) Long-term bonds will begin pricing in this inflation and demand a premium to it (vs the current discount), especially as the Fed will continue to pretend it& #39;s not happening.

As LT rates increase PE multiple compression will outstrip the ability of companies to raise prices...

As LT rates increase PE multiple compression will outstrip the ability of companies to raise prices...

3) ...thereby creating "a window" (3 mos?) for a significant decline in stock prices (30%?) before the Fed (in a desperate attempt to support both stocks & bonds) says "Damn the torpedoes, we& #39;re printing MORE!" and starts buying long-term bonds. Stocks will bounce a bit BUT...

4) ...long-term rates in the REAL world will begin escalating meaningfully as lenders realize the Fed no longer cares about fighting inflation, and the economy will begin seriously choking on those higher rates. THIS ACTUALLY HAPPENED IN THE LATE 1940s: https://www.jstor.org/stable/2122888?seq=1">https://www.jstor.org/stable/21...

5) As politicians (in BOTH parties) no longer have the stomach to make tough decisions, I suspect we then spend a long time in a 1970s-style stagflationary morass, with stocks caught between higher NOMINAL (inflationary) earnings and PE multiple compression, while bond yields...

6) ...climb faster than the Fed can buy them. In other words, the Fed finally loses control of the bond market.

How are we positioned for it? Short $TLT & individual stocks, and if yields climb I& #39;ll short the stock indexes.

THIS FORECAST IS WORTH WHAT TWITTER IS CHARGING FOR IT

How are we positioned for it? Short $TLT & individual stocks, and if yields climb I& #39;ll short the stock indexes.

THIS FORECAST IS WORTH WHAT TWITTER IS CHARGING FOR IT

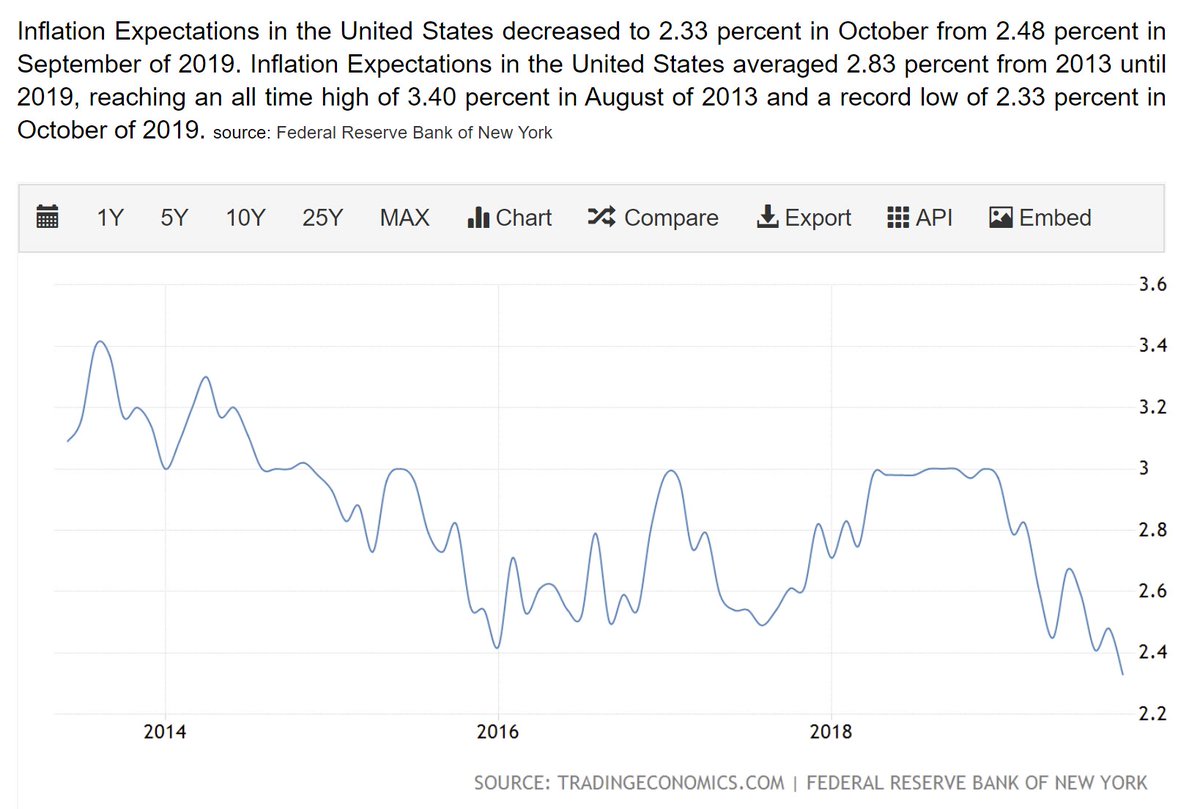

7) I should add that however YOU might feel about this forecast (and many of you may agree with it as on Twitter we tend to interact with like-minded people), it& #39;s EXTREMELY non-consensus as inflation expectations are at (or near) all-time lows:

https://tradingeconomics.com/united-states/inflation-expectations">https://tradingeconomics.com/united-st...

https://tradingeconomics.com/united-states/inflation-expectations">https://tradingeconomics.com/united-st...

Read on Twitter

Read on Twitter