SCOOP: Walmart dodged tax on nearly $2 billion, according to a whistleblower filing sent to the IRS and leaked to me.

Happy #BlackFriday!

/1 https://qz.com/1756717/whistleblower-alleges-walmart-engineered-2-billion-tax-dodge/">https://qz.com/1756717/w...

Happy #BlackFriday!

/1 https://qz.com/1756717/whistleblower-alleges-walmart-engineered-2-billion-tax-dodge/">https://qz.com/1756717/w...

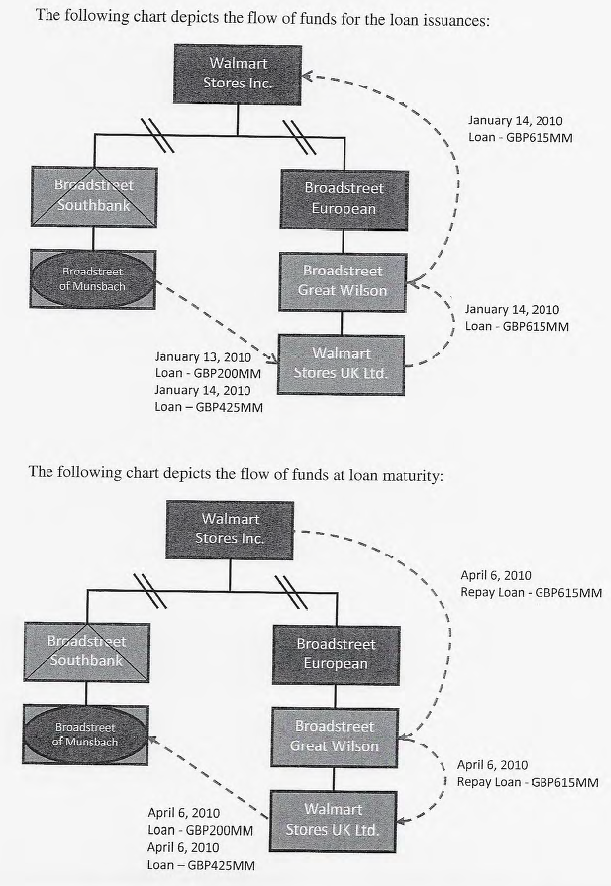

The world& #39;s biggest company had a ton of money sitting in Luxembourg—a tax haven—which it wanted to send home. But bringing it straight back would incur a large tax bill. /2

So, in an elaborate maneuver, @Walmart Walmart sent the money to the UK, and then onwards to the US. Once it got there, it pretended the money had never come from Luxembourg, the whistleblower alleged. /3

This allowed Walmart to claim $400 million in unearned foreign tax credits and to underpay US tax by $200 million. /4

(As I& #39;ve previously reported, Walmart, whose owners are the world& #39;s richest family with a reported $191bn fortune, has something of a history of alleged tax dodging) https://twitter.com/MddeH/status/1169630604436090886">https://twitter.com/MddeH/sta...

Internally Walmart& #39;s tax team would refer to the scheme by referencing the part of the tax code it was allegedly trying to manipulate. In front of the IRS, they just called the myriad payments "year-end cash planning," the whistleblower said.

Its auditor @EYnews actively shirked its oversight role on this scheme, the whistleblower said.

When an EY tax partner was told there may be problems with the payments, he allegedly said: "You know, I don& #39;t want to know." https://qz.com/1756717/whistleblower-alleges-walmart-engineered-2-billion-tax-dodge/">https://qz.com/1756717/w...

When an EY tax partner was told there may be problems with the payments, he allegedly said: "You know, I don& #39;t want to know." https://qz.com/1756717/whistleblower-alleges-walmart-engineered-2-billion-tax-dodge/">https://qz.com/1756717/w...

The money Walmart has dodged paying solely in documents seen by me could be as high as $3.2 billion. https://qz.com/1756717/whistleblower-alleges-walmart-engineered-2-billion-tax-dodge/">https://qz.com/1756717/w...

If you know of eyebrow-raising dealings at Walmart or other companies, here& #39;s how to contact me:

1. Email (insecure): mdh@qz.com

2. Signal (secure): +1 929 202 9229

3. Mail or Secure Drop (secure & anonymous): http://qz.com/tips ">https://qz.com/tips"...

1. Email (insecure): mdh@qz.com

2. Signal (secure): +1 929 202 9229

3. Mail or Secure Drop (secure & anonymous): http://qz.com/tips ">https://qz.com/tips"...

Read on Twitter

Read on Twitter