Recent news has #TaxTwitter buzzing regarding partnerships. The 2019 Form 1065 is being delayed because of new proposed disclosures on the K-1. Well look at what the IRS released yesterday, stats on Form 1065 for 2017. Let’s dive in to the numbers... https://www.irs.gov/pub/irs-pdf/p5035.pdf">https://www.irs.gov/pub/irs-p... 1/X

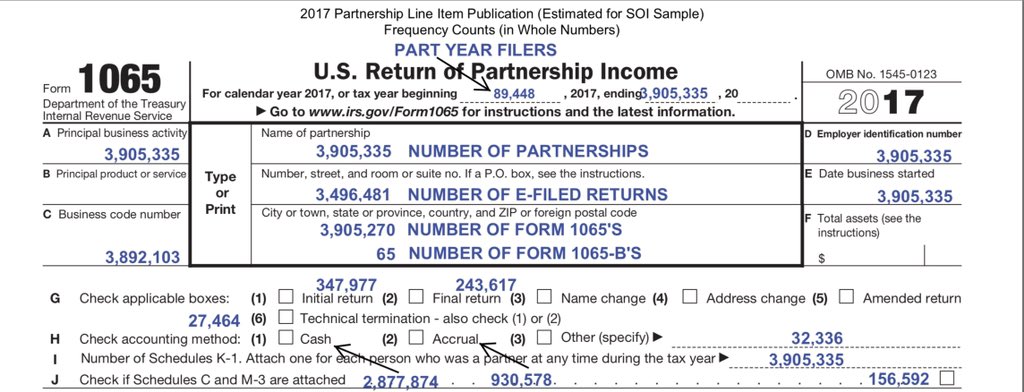

There were just over 3.9 million pships returns filed for 2017. Of those, 2.875 million were filed on the cash basis. About 950k filed on the accrual basis. 2/X

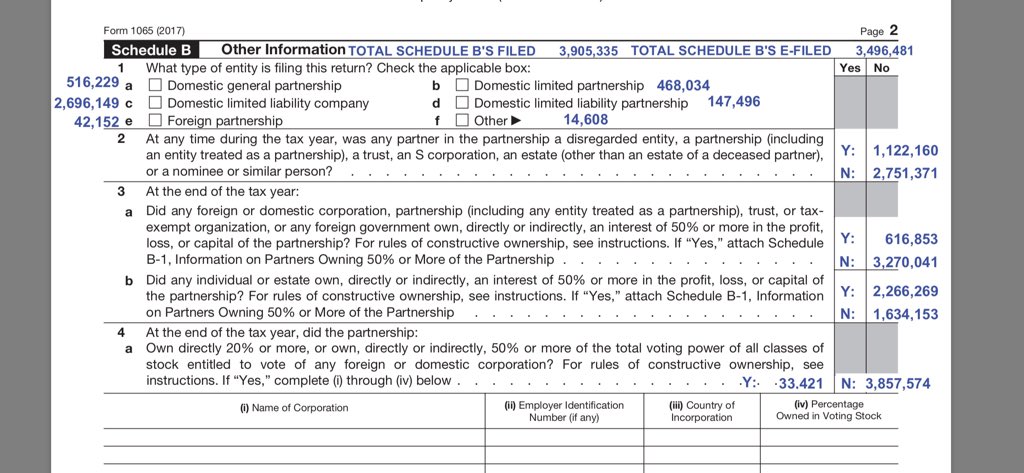

We can see the vast majority of pship returns, nearly 2.7 million, were LLC’s filing as a pship. Followed by good old fashioned general pships at 516k. 3/X

Based on line 6, almost 50% of the pships were not large enough to be required to file a Sch L balance sheet, 1.9 million returns. Those small returns then may not be reporting capital at all on the K-1. More on this later. 4/X

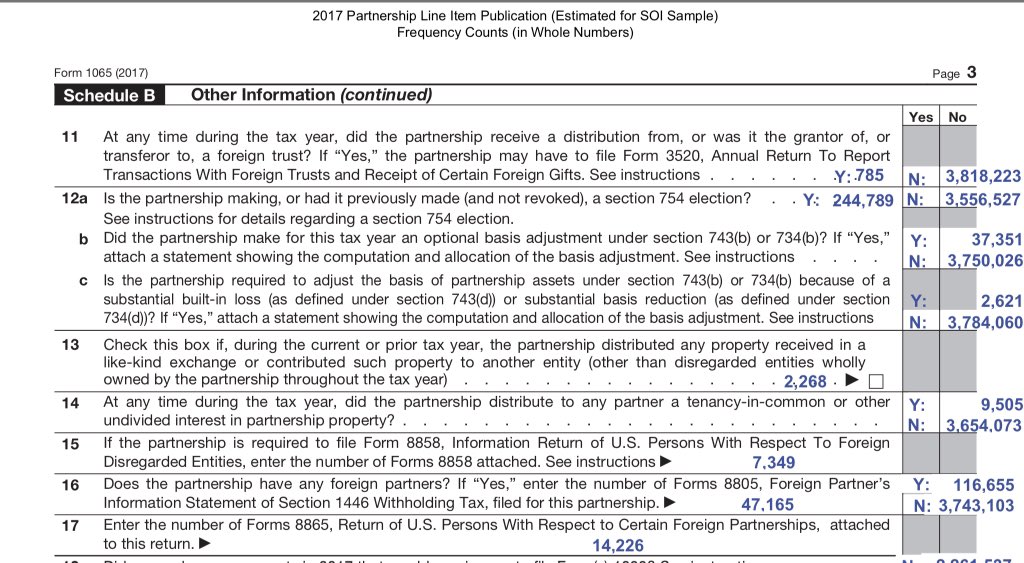

Regarding §754 elections, we can see (cumulative) elections have been made on only 235k of the 3.9 million returns. About 6%. For the year, there were 37k elections made, less than 1% of the total. However, this means an 18% increase (37k / 198k) over last year. 5/X

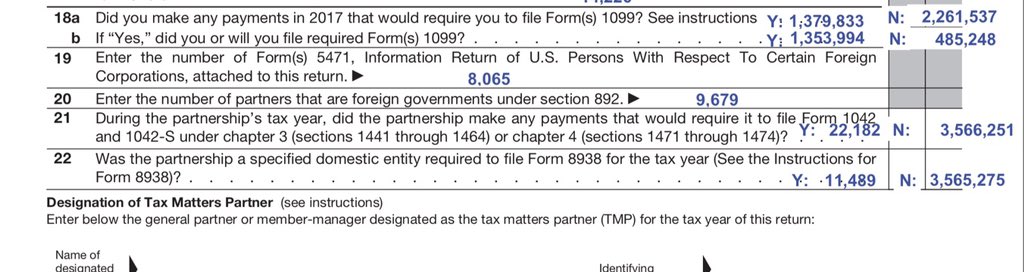

How many pships are required to file 1099s? 1.38 million. Interesting that only 1.35 million filed 1099s though. That’s about 26,000 pships telling the IRS they’re required to file a 1099 but don’t plan to file! #Bold This will get more attention under #199A (TorB) now. 6/X

Publicly traded partnerships number 1,837 returns. We understand there to be issues with the new 2019 draft K-1 reporting requirements for these pships in particular. A small but mighty group with many partners. 7/X

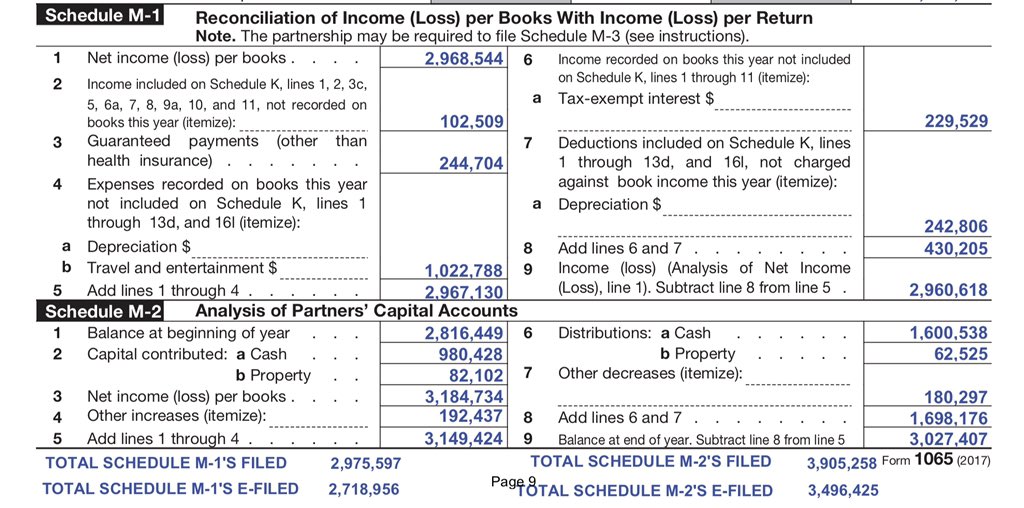

Nearly 3 million of the pship returns prepared schedule M-1, which reconciles book to taxable income. That means about 1 million returns filed schedule M-1 even though not required by the IRS. 8/X

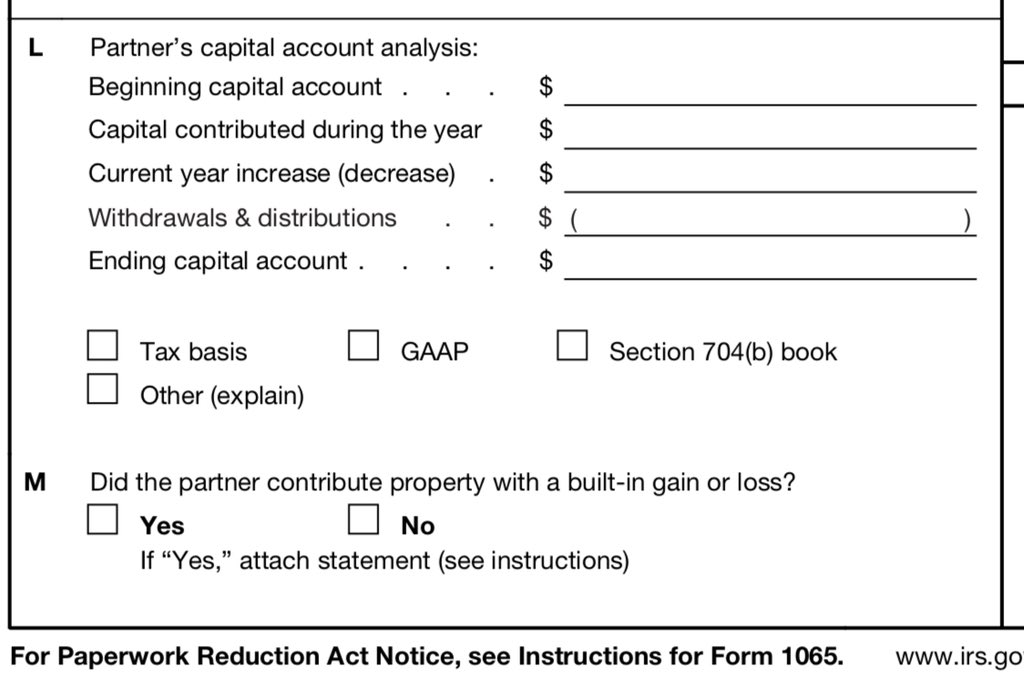

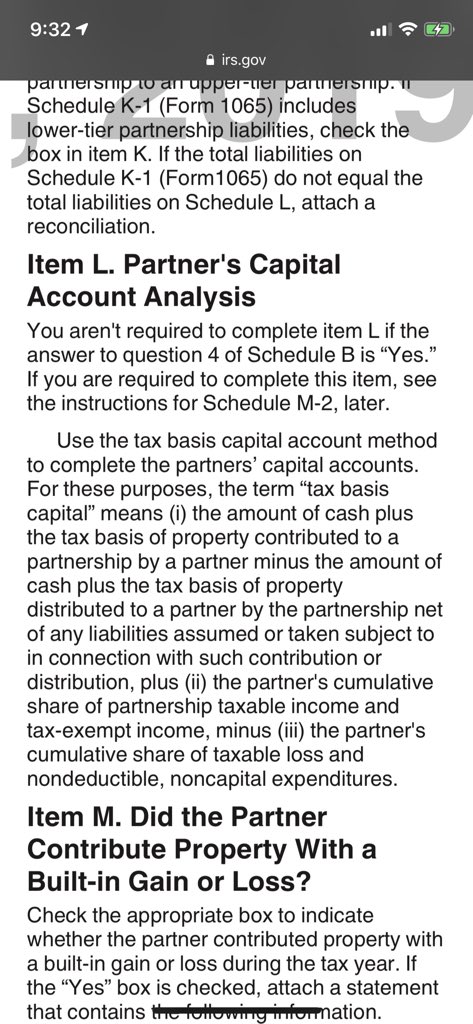

Back to partner capital, about 2.95 million returns reported something on the Sch L partner capital line. This should mean about 1 million returns would have reported no info in the K-1 capital section. In other words, Section L on the K-1 would be blank for 1 million pships. 9/X

Read on Twitter

Read on Twitter