The City of Vancouver’s Budget deliberations are underway. Here’s some background info for those interested.

THREAD: https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)"> #vanpoli

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)"> #vanpoli

THREAD:

Budgets are a statement of our values and priorities as a society. We pay for what we care about.

In this budget we are investing in the things you elected us to address: the #ClimateEmergency, protection of renters, #housing, the #opioidcrisis, and basic city infrastructure.

In this budget we are investing in the things you elected us to address: the #ClimateEmergency, protection of renters, #housing, the #opioidcrisis, and basic city infrastructure.

There are countless things we are better off paying for together, through taxes, than trying to pay for individually.

Taxes are the original crowd-funding! Let’s get together and pay for fire safety, libraries, caring for those struggling. All things we can’t afford alone.

Taxes are the original crowd-funding! Let’s get together and pay for fire safety, libraries, caring for those struggling. All things we can’t afford alone.

Contrary to how it may feel, #Vancouver’s property taxes are low relative to other large Canadian cities: https://www.policynote.ca/housing-crisis-fuel/.">https://www.policynote.ca/housing-c...

And low property taxes encourage speculative investment in housing (which increases housing prices): https://business.financialpost.com/real-estate/vancouvers-homes-may-be-costly-to-buy-but-theyre-cheap-to-own">https://business.financialpost.com/real-esta...

And low property taxes encourage speculative investment in housing (which increases housing prices): https://business.financialpost.com/real-estate/vancouvers-homes-may-be-costly-to-buy-but-theyre-cheap-to-own">https://business.financialpost.com/real-esta...

You may see conflicting graphs showing the tax rate is going  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> or

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend"> or  https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Chart with downwards trend" aria-label="Emoji: Chart with downwards trend">. That’s because Vancouver has a “mill rate” that takes the total city budget, and then divides it up based on assessed property values.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Chart with downwards trend" aria-label="Emoji: Chart with downwards trend">. That’s because Vancouver has a “mill rate” that takes the total city budget, and then divides it up based on assessed property values.

So while the total proposed budget increase is 8.2%, and the dollar amount of property taxes will increase, the actual tax rate relative to assessed value has been declining for years, as @1alexhemingway explains below. https://twitter.com/1alexhemingway/status/1199107519924162560">https://twitter.com/1alexhemi...

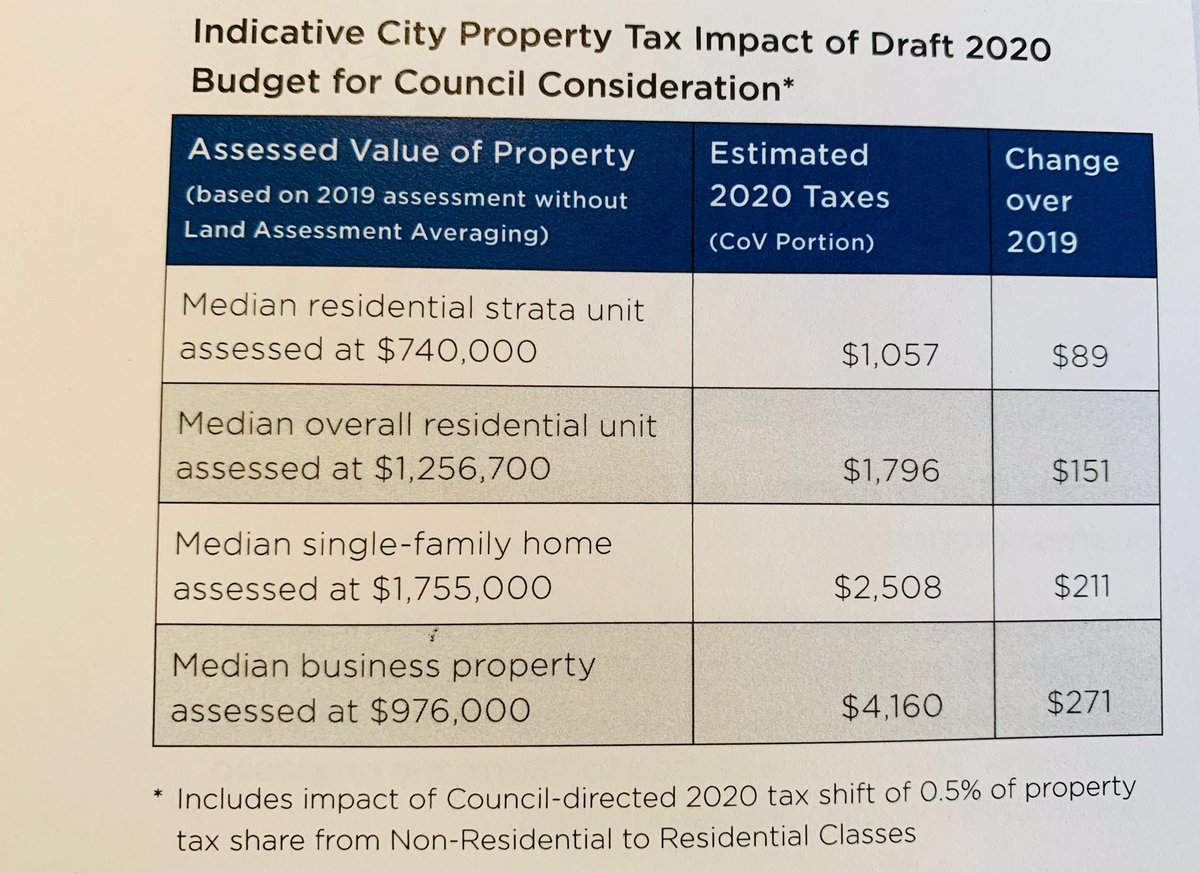

Putting aside the sticker shock of hearing an “8.2% increase”, the dollar amounts are far less alarming:

If you own a $1.7M home, the proposed tax increase translates to $211 more this year ($354 including metro utility fees).

If you own a $740K condo, it would be $89.

If you own a $1.7M home, the proposed tax increase translates to $211 more this year ($354 including metro utility fees).

If you own a $740K condo, it would be $89.

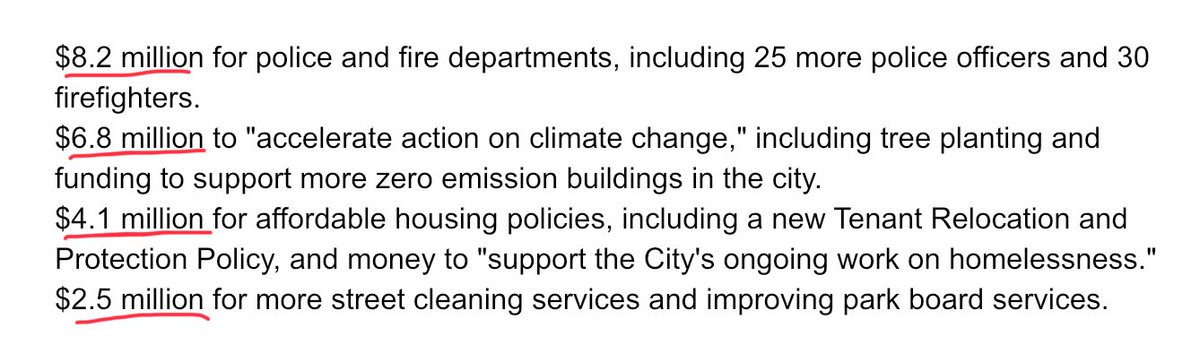

Here’s just some of what Vancouver’s proposed tax increase would cover. I think it’s good value for money (particularly the #climate and #housing portions). That’s why we pay for things together.

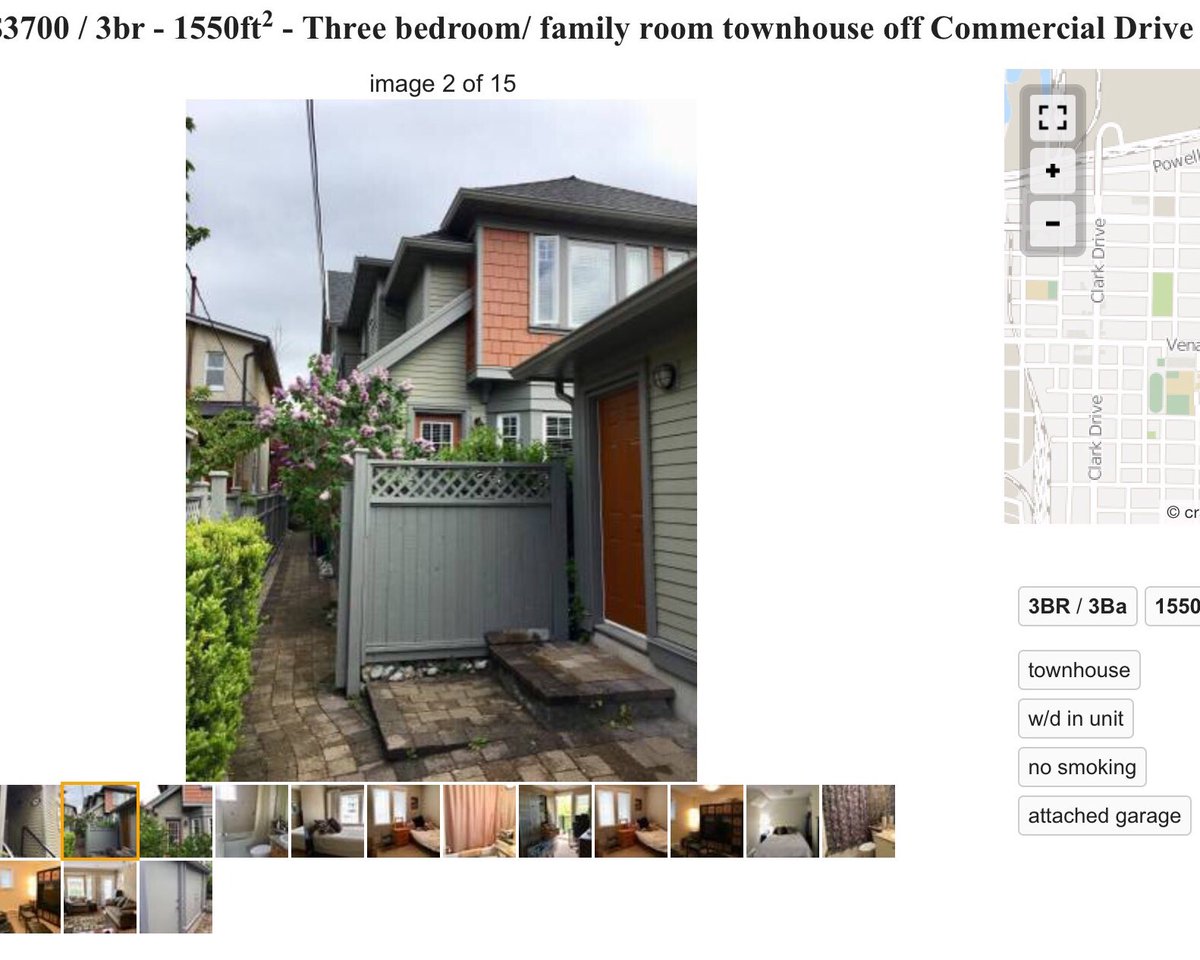

Some argue it’s unfair that property taxes could go up by 8.2%, when landlords can only increase rents by ~2%. But that’s comparing apples and oranges, because the property tax is a much smaller base. To explain, here’s a real-life example from a current rental listing  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">

This 3bd townhome is listed for rent @ $3700/month. The 2019 assessed property value is $1.17M.

8.2% property tax increase for the landlord = https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)">about $150/year.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)">about $150/year.

(Including Metro’s utility fees, about $290/year.)

2% rent increase for the tenants = https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)"> $74/month, or $888/year.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)"> $74/month, or $888/year.

8.2% property tax increase for the landlord =

(Including Metro’s utility fees, about $290/year.)

2% rent increase for the tenants =

In the real life example above, the increase in rental income is 3x the increase in property tax. So, no need to pity your landlord. They are going to be fine. And, remember, the base value of their property has been skyrocketing. Here’s more: https://twitter.com/lausterna/status/1199841524533596167?s=21">https://twitter.com/lausterna...

Vancouver’s property taxes are low, & annual increases have been held to a minimum for years. That may sound great, but there’s a cost to us all over time: less investment in basic infrastructure, eroded services, & a reduced capacity to fund the things this moment demands of us.

Tackling #homelessness & the #climateemergency will require big investments AND political will. (Even tho acting on them will save money down the road.)

We can’t solve these large challenges alone, or through charity. But when we all contribute, we can accomplish great things.

We can’t solve these large challenges alone, or through charity. But when we all contribute, we can accomplish great things.

Read on Twitter

Read on Twitter #vanpoli" title="The City of Vancouver’s Budget deliberations are underway. Here’s some background info for those interested. THREAD:https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)"> #vanpoli" class="img-responsive" style="max-width:100%;"/>

#vanpoli" title="The City of Vancouver’s Budget deliberations are underway. Here’s some background info for those interested. THREAD:https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)"> #vanpoli" class="img-responsive" style="max-width:100%;"/>

about $150/year. (Including Metro’s utility fees, about $290/year.)2% rent increase for the tenants = https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)"> $74/month, or $888/year." title="This 3bd townhome is listed for rent @ $3700/month. The 2019 assessed property value is $1.17M. 8.2% property tax increase for the landlord = https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)">about $150/year. (Including Metro’s utility fees, about $290/year.)2% rent increase for the tenants = https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)"> $74/month, or $888/year." class="img-responsive" style="max-width:100%;"/>

about $150/year. (Including Metro’s utility fees, about $290/year.)2% rent increase for the tenants = https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)"> $74/month, or $888/year." title="This 3bd townhome is listed for rent @ $3700/month. The 2019 assessed property value is $1.17M. 8.2% property tax increase for the landlord = https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)">about $150/year. (Including Metro’s utility fees, about $290/year.)2% rent increase for the tenants = https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆🏽" title="Up pointing backhand index (medium skin tone)" aria-label="Emoji: Up pointing backhand index (medium skin tone)"> $74/month, or $888/year." class="img-responsive" style="max-width:100%;"/>