THREAD

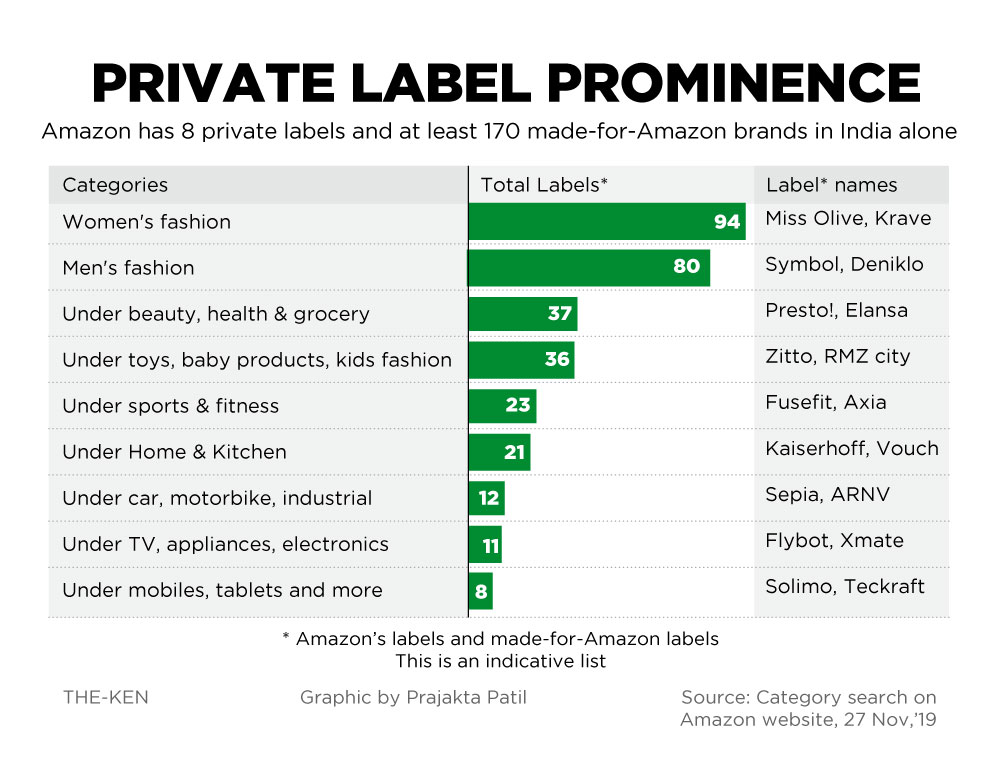

When I started looking into Amazon’s private labels in India, little did I realise I would stumble upon category after category it has a presence in, either through its own brands or the made-for-Amazon ones.

When I started looking into Amazon’s private labels in India, little did I realise I would stumble upon category after category it has a presence in, either through its own brands or the made-for-Amazon ones.

Pet supplies, janitorial products, diapers and strollers, just some of the niche categories Amazon is in, just 4 years after starting its private label business here. (flicking @peegeekay & #39;s GIF since I don’t how to do that or copy it)

This is not a situation that is unique to India of course. The WSJ recently reported that Amazon changed its search algorithm to boost its own products. https://on.wsj.com/2DqGyGV ">https://on.wsj.com/2DqGyGV&q...

Amazon dominates every category it enters, thanks to its powerful and far-reaching data on customer buying patterns. It’s a high-volume, high-margin proposition, so obviously the company wants to grow it, regulatory hassles aside.

Which brings us to Amazon’s latest play, the global accelerator program introduced in India last year. It’s a seller program where third-party brands tie up with Amazon exclusively and pay 7% of their gross sales each month as a fee, all in exchange for precious data.

This is in addition to the commission and advertising fees Amazon gets as a marketplace. The catch is that Amazon can buy the brand outright at any time for $10,000 and a seller breaching the exclusivity clause pays Rs 6.5 crore as damages, according to a copy of the contract.

So how does Amazon do it all? read it on @TheKenWeb here: https://the-ken.com/story/amazon-private-labels/

Special">https://the-ken.com/story/ama... thanks to the awesome @prajektor for going through a wild amount of raw data for the charts.

Special">https://the-ken.com/story/ama... thanks to the awesome @prajektor for going through a wild amount of raw data for the charts.

Read on Twitter

Read on Twitter