Very excited about my former JMP now forthcoming at the @JEEA_News! For those still interested after so many years (or who haven& #39;t heard about it!!), here& #39;s a "little" thread. The paper is here: https://www.dropbox.com/s/9zpnjhtl0ssi7pr/EIGCFSDC_JEEA_final.pdf?dl=0">https://www.dropbox.com/s/9zpnjht...

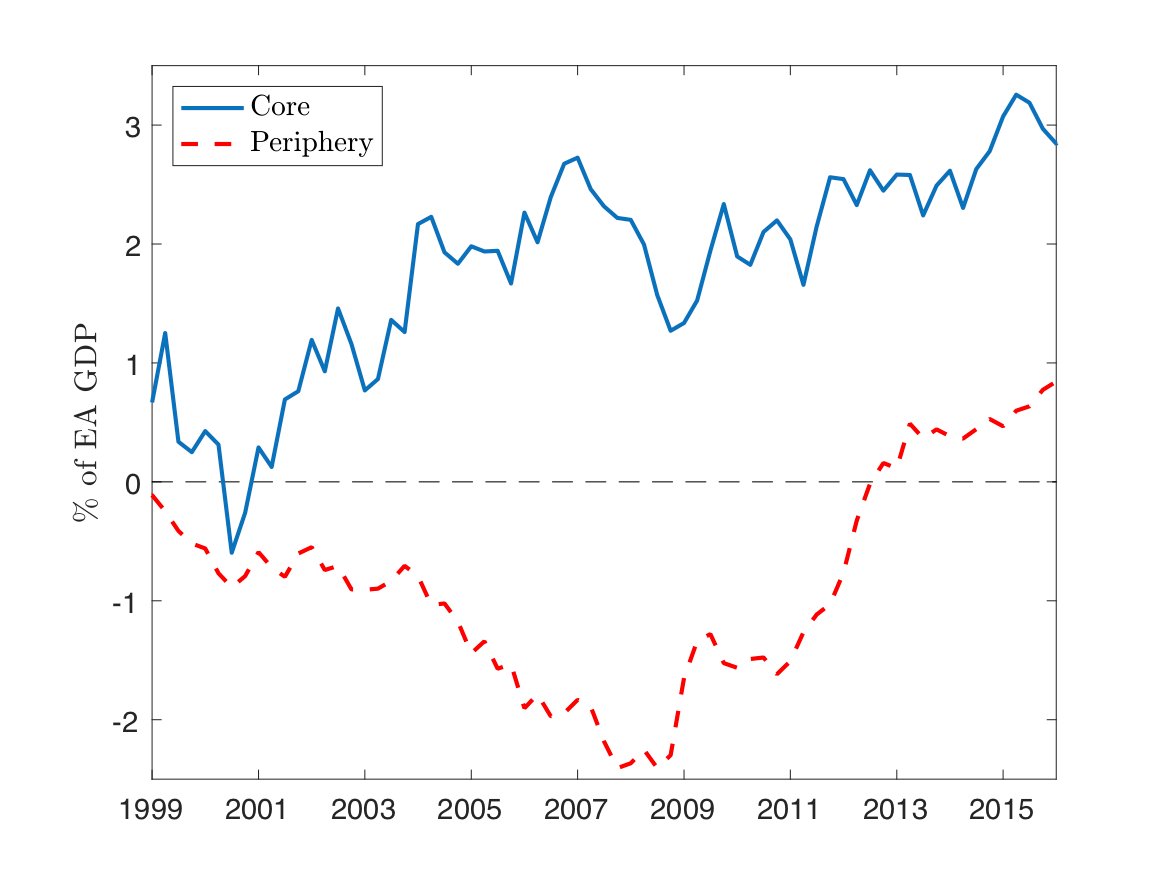

This is a paper on the euro area, about the capital flows that took place after its creation, and the debt crisis that followed. First, it is well known that the current account balances of countries in the "Core" and "Periphery" of the union diverged and became very large.

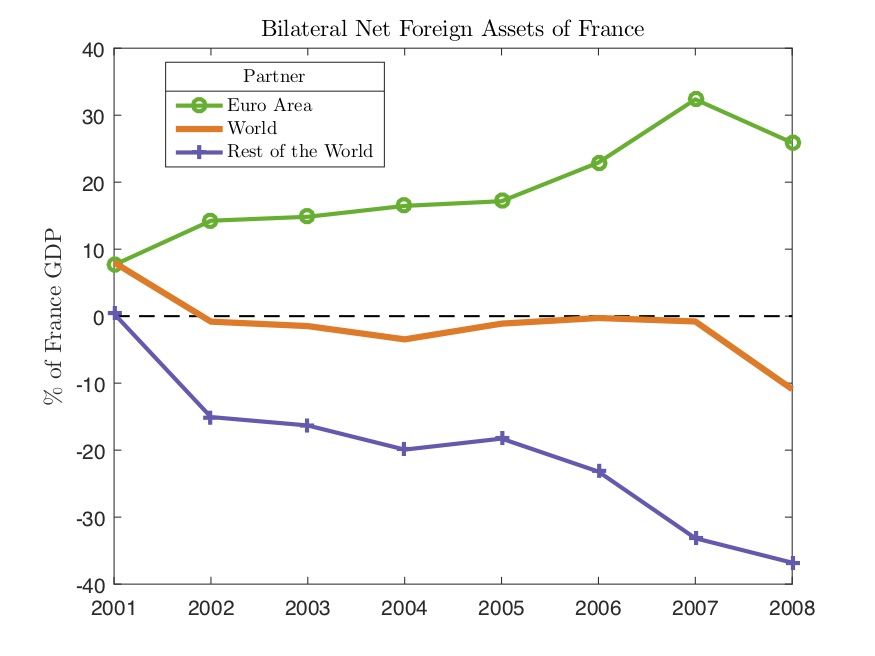

Second, gross capital flows were very interesting as well! Core countries (notably France) behaved a bit like banks, increasing assets against the rest of EA, and liabilities against non-EA countries. Great IMF WP documenting this by Waysand,Ross,DeGuzman: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1751408">https://papers.ssrn.com/sol3/pape...

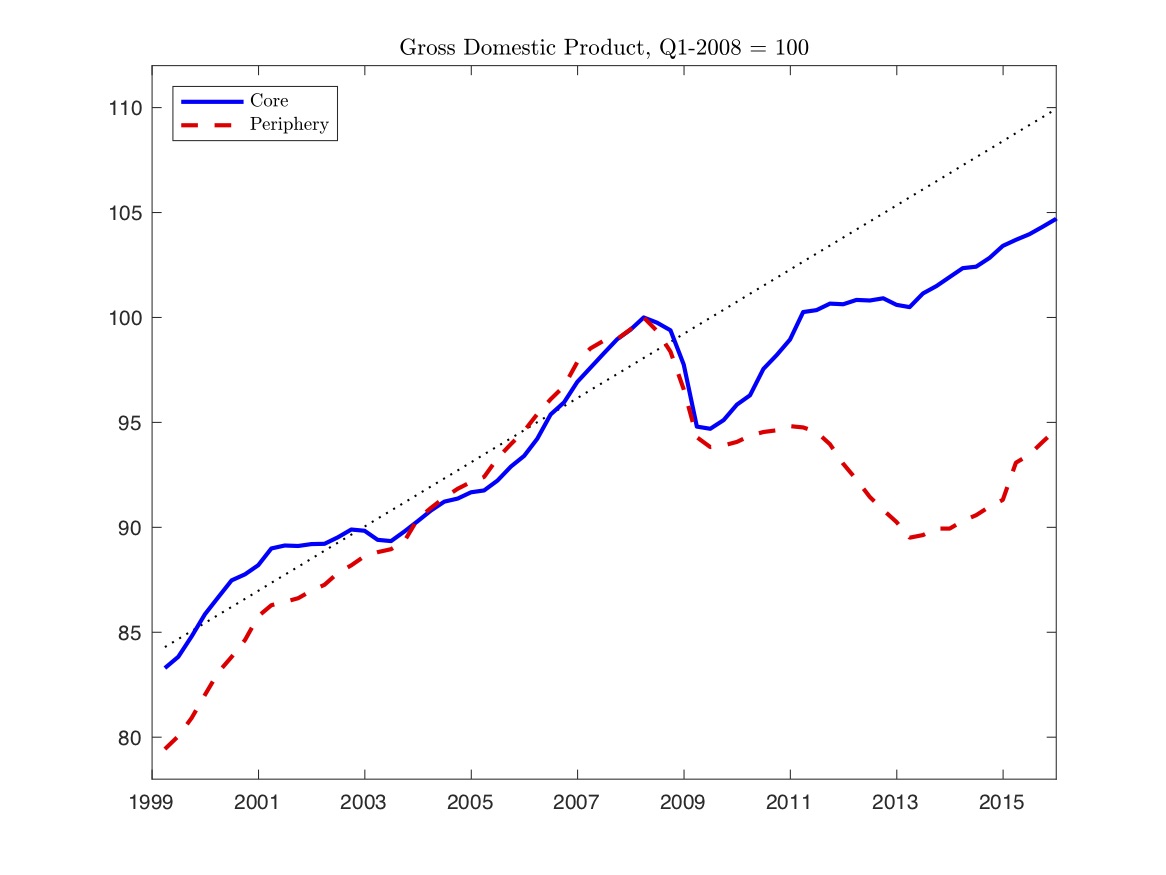

Third, the debt crisis came with a severe recession in the Periphery, and growth slowed down in the Core as well.

Finally, my question: How did the creation of the monetary union contribute to these three facts?

Finally, my question: How did the creation of the monetary union contribute to these three facts?

My Story: Subsidies on assets traded within the EA have contributed to CA imbalances, expansion of gross positions, and to a more severe and widespread debt crisis.

Subsidies could be favourable regulation for holding govt debt, or bailout expectations by holders of govt debt.

Subsidies could be favourable regulation for holding govt debt, or bailout expectations by holders of govt debt.

I formalize this story in a theoretical model, and I use these insights to build a quantitative model of the euro area, as an union of heterogeneous countries with endogenous sovereign default risk, open to capital flows with the rest of the world.

Key model result 1: If savers benefit from a bailout promise, they happily lend to risky countries at low interest rates, not fearing their default because of the bailout. In turn, risky countries borrow a lot, because of the low interest rates (which we also saw in the EA!)

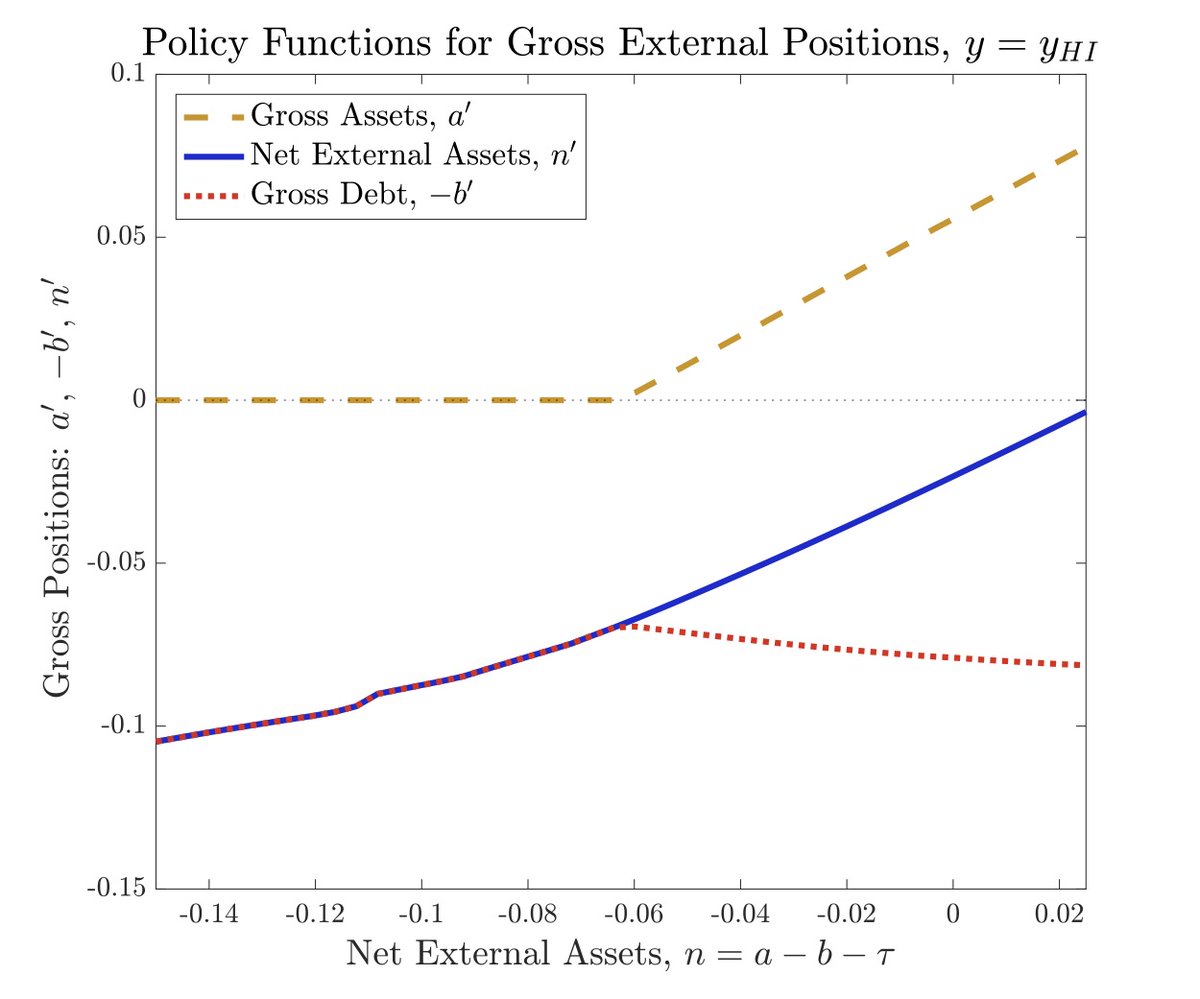

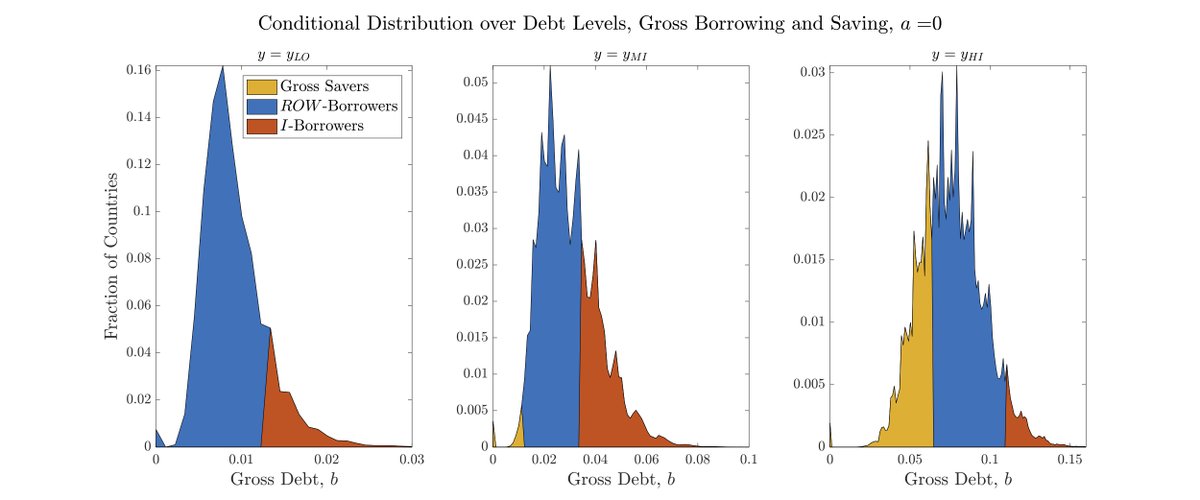

2: Lenders want to make the most of the subsidies, and they buy a lot of assets issued in the union. Hence, they borrow funds from the ROW to buy more risky assets, made safe by the bailout promise. This looks like the intermediation observed in the EA-Core countries.

3, what about the CA surplus of the Core? It rises, too! Households in the Core know that they will have to finance a bailout in the future,e.g. through higher taxes, and they save a bit more to insure against it. This surplus isn& #39;t mechanic, because the union is an open economy.

4: In a two-good version of the model, the subsidies can make a default crisis worse for the defaulting countries themselves. This is because when they default, they hurt their neighbors, who are their trade partners and the destination of their exports.

This trade story may be important in the EA, where trade links are strong, and it is an economic-union version of the famous "secondary burden" of a transfer, first theorized by Keynes in 1929.

Thanks for resisting thus far! Still shorter than the paper. I& #39;ll spare you the full results of the big model. What I like most: intermediation endogenously arises in countries with high income & assets, while countries that issue a lot of debt borrow from their union neighbors.

I owe thanks loads of people. Three great referees and the editor at @JEEA_News, Claudio Michelacci, who helped me a great deal in improving the paper. Of all the people I thank in the paper, I& #39;ll single out @BenignoGianluca and Wouter Den Haan, who have been great supervisiors.

Most importantly, lots of  https://abs.twimg.com/emoji/v2/... draggable="false" alt="♥️" title="Heart suit" aria-label="Emoji: Heart suit"> to my big family!Especially to my super-wife @Federomei1, who held out when things were tough,without whom this would NOT have been possible. And to little Gaia, who was in the making while this was being written, and nudged me gently to click submit!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="♥️" title="Heart suit" aria-label="Emoji: Heart suit"> to my big family!Especially to my super-wife @Federomei1, who held out when things were tough,without whom this would NOT have been possible. And to little Gaia, who was in the making while this was being written, and nudged me gently to click submit!

Read on Twitter

Read on Twitter