Please RT

THREAD

When Volkswagen became the world’s most valuable company – for a few days

How derivatives can cause market failure

Back in October 2008, Porsche announced that it had increased it’s ownership of shares in Volkswagen to 43%. There had been market rumours

THREAD

When Volkswagen became the world’s most valuable company – for a few days

How derivatives can cause market failure

Back in October 2008, Porsche announced that it had increased it’s ownership of shares in Volkswagen to 43%. There had been market rumours

rumours that Porsche was positioning itself to take over VW.

In addition, Porsche announced that it had purchased options that could add a further 31% ownership. This created a bit of a scandal, because, it was claimed, Porsche should have declared their intention to control VW

In addition, Porsche announced that it had purchased options that could add a further 31% ownership. This created a bit of a scandal, because, it was claimed, Porsche should have declared their intention to control VW

well before these announcements.

However, as the claim was that these shares were to be settled via cash settlement (that is, Porsche would be paid for the difference between the higher market price of the actual shares, compared to the lower strike price of the options

However, as the claim was that these shares were to be settled via cash settlement (that is, Porsche would be paid for the difference between the higher market price of the actual shares, compared to the lower strike price of the options

), rather than physical delivery of the shares, then Porsche were not subject to the shareholding disclosure rules.

It also highlights some of the massive pitfalls and risks when dealing with derivatives. In this case, as Porsche was steadily acquiring shares, the share price in

It also highlights some of the massive pitfalls and risks when dealing with derivatives. In this case, as Porsche was steadily acquiring shares, the share price in

in VW was rising.

Hedge funds saw this price, and considered it inflated. So they decided to short sell the stock. They borrowed the stock, and sold it at the “inflated” market price, expecting the price to later fall. At that stage, the hedge funds

Hedge funds saw this price, and considered it inflated. So they decided to short sell the stock. They borrowed the stock, and sold it at the “inflated” market price, expecting the price to later fall. At that stage, the hedge funds

could then purchase the stock at the lower price, and then deliver them back to the parties that had lent the stock to the hedge funds in the first place, netting themselves (the hedge funds) huge profits.

Instead, what happened was that, upon Porsches’ announcements, the price

Instead, what happened was that, upon Porsches’ announcements, the price

price of VW shares skyrocketed.

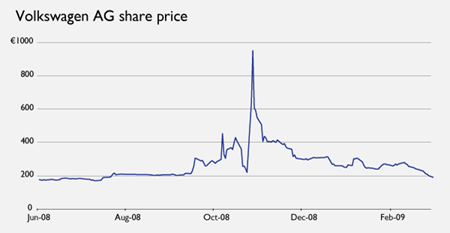

The price rose from 200 EUR to around 1,000 EUR. They were trading at 63 times the expected 2009 earnings. Quite impressive.

This was driven by the fact that short sellers had “sold” 12.8% of VW stock

The price rose from 200 EUR to around 1,000 EUR. They were trading at 63 times the expected 2009 earnings. Quite impressive.

This was driven by the fact that short sellers had “sold” 12.8% of VW stock

, and, in addition to the total of 74% that Porsche already owned or controlled, the state of Lower Saxony was also the owner of a 20% stake in VW. This meant that there remained only a free float of 6%.

So these short sellers had, in theory, to purchase 12.8% of stock

So these short sellers had, in theory, to purchase 12.8% of stock

from an amount of only 6% that was available on the market. Demand far outstripped supply.

Prices, of course, increased.

If the lenders of that 12.8% of stock all claimed their stock back at the same time, the hedge funds would be forced to try to buy that stock from the free

Prices, of course, increased.

If the lenders of that 12.8% of stock all claimed their stock back at the same time, the hedge funds would be forced to try to buy that stock from the free

free float of 6%. This is a great example of a squeeze – the price would continue to rise until the short sellers literally went broke.

Of course, this is similar to a run on a bank – when depositors simultaneously demand their cash, and the bank simply does not maintain enough

Of course, this is similar to a run on a bank – when depositors simultaneously demand their cash, and the bank simply does not maintain enough

cash reserves to meet demand.

The fact that these short sellers were hedge funds means, naturally, that we do not feel that sorry for them. If there is one sector of finance that has less sympathy than bankers, it is probably hedge funds.

The fact that these short sellers were hedge funds means, naturally, that we do not feel that sorry for them. If there is one sector of finance that has less sympathy than bankers, it is probably hedge funds.

This is a great illustration of market failure. In theory, financial instruments are valued based on their ability to deliver profits/revenue in the future. These profits (whether it is growth in future price, or delivery of dividends / coupons) are discounted to a present value

, and this should be the expected current value of that security.

Commodities, on the other hand, have a price that is driven by demand and supply. They are scarce, and have value in consumption and utilisation.

Securities should NOT have a price driven by demand and supply.

Commodities, on the other hand, have a price that is driven by demand and supply. They are scarce, and have value in consumption and utilisation.

Securities should NOT have a price driven by demand and supply.

However, this is exactly what occurs in a short squeeze of this type – the share price rises precisely because the demand for shares outstrips the maximum possible supply.

Incidentally, the share price of 1,000 EUR led to VW being the world’s most valuable company (for a short period of time).

Read on Twitter

Read on Twitter