We talk a lot about #SaaS, and I& #39;d like to present a framework I use to evaluate these types of companies.

It& #39;s important for SaaS to recoup upfront costs thru ongoing subscriptions.

I& #39;ll walk through my process, using Veeva Systems $VEEV as an example. https://docs.google.com/spreadsheets/d/1KvJaTEW7gMq66C5ltYYZ_x-ltbbmH9g4o1_0cUesUjQ">https://docs.google.com/spreadshe...

It& #39;s important for SaaS to recoup upfront costs thru ongoing subscriptions.

I& #39;ll walk through my process, using Veeva Systems $VEEV as an example. https://docs.google.com/spreadsheets/d/1KvJaTEW7gMq66C5ltYYZ_x-ltbbmH9g4o1_0cUesUjQ">https://docs.google.com/spreadshe...

Specifically, we& #39;re looking for Customer Lifetime Value (LTV) to exceed the Customer Acquisition Cost (CAC).

We want to see customers pay enough & stick around to justify the upfront sales & ongoing R&D.

If LTV > CAC, the company is generating profits for its shareholders.

We want to see customers pay enough & stick around to justify the upfront sales & ongoing R&D.

If LTV > CAC, the company is generating profits for its shareholders.

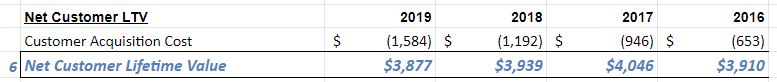

Veeva $VEEV spent $148m last year on Sales & Mktg to acquire 94 new customers.

So on average, its Customer Acquisition Cost (1) is $1.584 million.

[Note that this isn& #39;t perfect. Much of that sales spend went to current customers; but it& #39;s the best data we have available.]

So on average, its Customer Acquisition Cost (1) is $1.584 million.

[Note that this isn& #39;t perfect. Much of that sales spend went to current customers; but it& #39;s the best data we have available.]

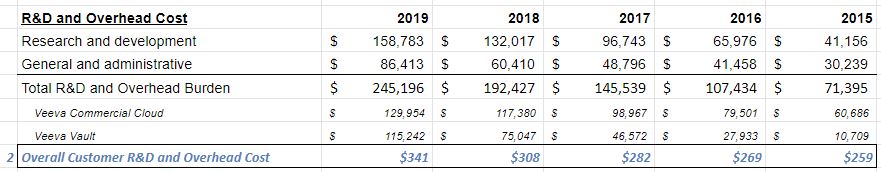

But those customers also require ongoing R&D and overhead to keep them happy.

Veeva $VEEV spent $158m on R&D and $86m last yr across its 719 clients

On average, that& #39;s an ongoing R&D and Overhead burden (2) of $341k per customer per year.

Veeva $VEEV spent $158m on R&D and $86m last yr across its 719 clients

On average, that& #39;s an ongoing R&D and Overhead burden (2) of $341k per customer per year.

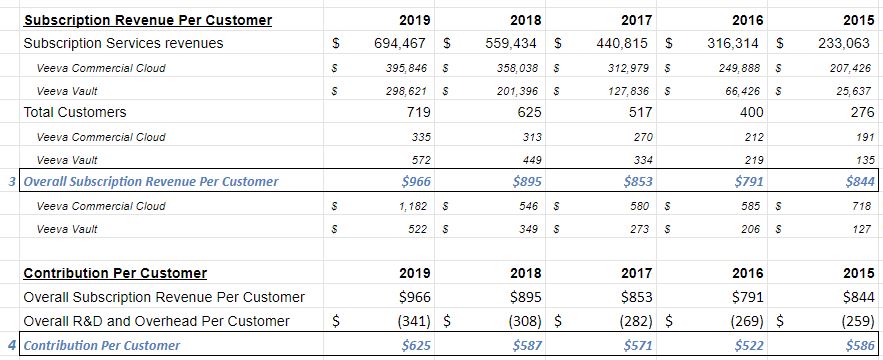

Veeva generated $694m in subscription revenue last yr, which is an avg per customer (3) of $966k.

Backing out R&D and Overhead, the "average" Contribution Per Customer (4) is $625k/yr.

Note: this doesn& #39;t include $VEEV& #39;s Professional Services revenue, which is also profitable.

Backing out R&D and Overhead, the "average" Contribution Per Customer (4) is $625k/yr.

Note: this doesn& #39;t include $VEEV& #39;s Professional Services revenue, which is also profitable.

We now make a few assumptions on customer churn rate & the discount rate to bring future subs to the present.

Using a Churn Rate of 4% & a Discount Rate of 10.5%, I derive a Customer LTV (5) of $5.46 million.

[There& #39;s sensitivity; if we double Churn to 8%, LTV becomes $4.2m]

Using a Churn Rate of 4% & a Discount Rate of 10.5%, I derive a Customer LTV (5) of $5.46 million.

[There& #39;s sensitivity; if we double Churn to 8%, LTV becomes $4.2m]

Now to the bottom line (almost done, I promise):

Subtracting that $1.58m acquisition cost from the $5.46m LTV gives a *Net Customer LTV* of $3.87m (6).

That& #39;s fantastic! Veeva& #39;s $VEEV avg customer is worth $3.8 million in present value, *even after* taking out all of the costs!

Subtracting that $1.58m acquisition cost from the $5.46m LTV gives a *Net Customer LTV* of $3.87m (6).

That& #39;s fantastic! Veeva& #39;s $VEEV avg customer is worth $3.8 million in present value, *even after* taking out all of the costs!

Alternate versions:

- If we use *Sub Gross Profit* rather than Sub Rev, Net Customer LTV is $2.4m

- If we also include Prof Svcs & use the Combined Gross Profit, Net CLTV is $2.9m

- If we only use Sub Gross Profit & apply 15% Churn (most conservative!), Net CLTV is still $900k

- If we use *Sub Gross Profit* rather than Sub Rev, Net Customer LTV is $2.4m

- If we also include Prof Svcs & use the Combined Gross Profit, Net CLTV is $2.9m

- If we only use Sub Gross Profit & apply 15% Churn (most conservative!), Net CLTV is still $900k

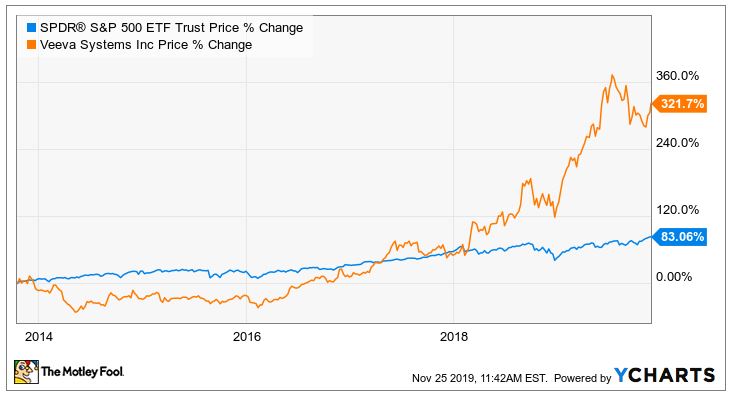

The moral of the story is unit economics really matters for #SaaS.

Not all growth is profitable & not all SaaS comps will be around in 10 yrs.

But look for quality. Compelling products create switching costs, which lead to high retention rates & yrs of recurring subscriptions.

Not all growth is profitable & not all SaaS comps will be around in 10 yrs.

But look for quality. Compelling products create switching costs, which lead to high retention rates & yrs of recurring subscriptions.

There are tons of additional resources, such as @RamBhupatiraju& #39;s link to SaaS 2.0 metrics & @TMFStoffel& #39;s great piece about how to invest in SaaS.

I& #39;ve included both below. And my DMs are open, if you have specific questions.

https://twitter.com/RamBhupatiraju/status/1197518012028456960

https://twitter.com/RamBhupat... href=" https://twitter.com/TMFStoffel/status/1032824279359021057">https://twitter.com/TMFStoffe...

I& #39;ve included both below. And my DMs are open, if you have specific questions.

https://twitter.com/RamBhupatiraju/status/1197518012028456960

Read on Twitter

Read on Twitter

![Veeva $VEEV spent $148m last year on Sales & Mktg to acquire 94 new customers. So on average, its Customer Acquisition Cost (1) is $1.584 million.[Note that this isn& #39;t perfect. Much of that sales spend went to current customers; but it& #39;s the best data we have available.] Veeva $VEEV spent $148m last year on Sales & Mktg to acquire 94 new customers. So on average, its Customer Acquisition Cost (1) is $1.584 million.[Note that this isn& #39;t perfect. Much of that sales spend went to current customers; but it& #39;s the best data we have available.]](https://pbs.twimg.com/media/EKOy6X_XkAAqvus.jpg)

![We now make a few assumptions on customer churn rate & the discount rate to bring future subs to the present.Using a Churn Rate of 4% & a Discount Rate of 10.5%, I derive a Customer LTV (5) of $5.46 million.[There& #39;s sensitivity; if we double Churn to 8%, LTV becomes $4.2m] We now make a few assumptions on customer churn rate & the discount rate to bring future subs to the present.Using a Churn Rate of 4% & a Discount Rate of 10.5%, I derive a Customer LTV (5) of $5.46 million.[There& #39;s sensitivity; if we double Churn to 8%, LTV becomes $4.2m]](https://pbs.twimg.com/media/EKO0IHmXYAAJupd.jpg)

https://twitter.com/TMFStoffe..." title="There are tons of additional resources, such as @RamBhupatiraju& #39;s link to SaaS 2.0 metrics & @TMFStoffel& #39;s great piece about how to invest in SaaS. I& #39;ve included both below. And my DMs are open, if you have specific questions. https://twitter.com/RamBhupat... href=" https://twitter.com/TMFStoffel/status/1032824279359021057">https://twitter.com/TMFStoffe..." class="img-responsive" style="max-width:100%;"/>

https://twitter.com/TMFStoffe..." title="There are tons of additional resources, such as @RamBhupatiraju& #39;s link to SaaS 2.0 metrics & @TMFStoffel& #39;s great piece about how to invest in SaaS. I& #39;ve included both below. And my DMs are open, if you have specific questions. https://twitter.com/RamBhupat... href=" https://twitter.com/TMFStoffel/status/1032824279359021057">https://twitter.com/TMFStoffe..." class="img-responsive" style="max-width:100%;"/>