So....probably a good opportunity to bring up a few interesting numbers from AEMO& #39;s latest Quarterly Dynamics report for Q3 2019, on battery storage performance. Some charts below https://twitter.com/dmichie66/status/1198681905744318464">https://twitter.com/dmichie66...

Currently, lithium ion batteries are surprisingly good at providing rapid-response grid services that can inject or consume power quickly, so the frequency of the grid can recover from surprising things (like power lines falling over).

They& #39;re not so good at long-term storage.

They& #39;re not so good at long-term storage.

Here& #39;s the thing: it& #39;s the short term rapid response stuff (& #39;security& #39; requirements) that the grid needs right now, rather than the long term stuff (& #39;reliability& #39;, which will be a bigger thing in the near future).

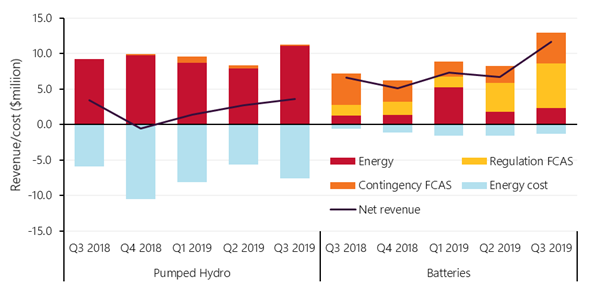

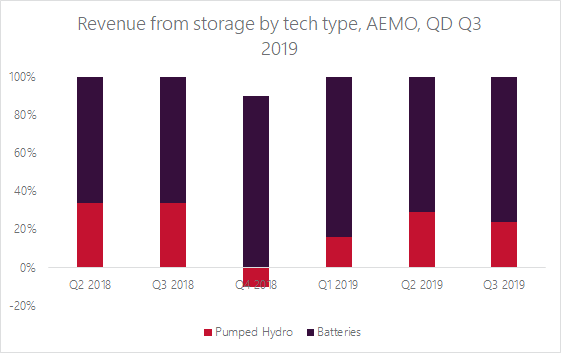

The latest @AEMO_Media Quarterly Dynamics report estimates revenue from hydro power soaking up power and emitting it over long stretches, versus the new, tiny battery systems doing fast-injection stuff to help grid management.

And the small batteries are earning more $$:

And the small batteries are earning more $$:

The installed capacity of pumped hydro is relatively huge - but it& #39;s earning far less.

This is because the energy market is rewarding the services that batteries provide, rather than the service large-scale pumped hydro provides:

This is because the energy market is rewarding the services that batteries provide, rather than the service large-scale pumped hydro provides:

Storage is a spanner in a box of tools you can implement to ease the integration of renewable energy into a modern grid. You don& #39;t need a 1:1 installed capacity for renewables:batteries. They punch *way* above their weight, as you can see above.

& #39;the output is so tiny!& #39; is an effort to distract from their intended function, and to imply a failure in a task they were never really meant to perform.

Also see: Alan Jones https://www.theguardian.com/commentisfree/2017/jul/12/commentators-who-dont-understand-the-grid-should-butt-out-of-the-battery-debate">https://www.theguardian.com/commentis...

Also see: Alan Jones https://www.theguardian.com/commentisfree/2017/jul/12/commentators-who-dont-understand-the-grid-should-butt-out-of-the-battery-debate">https://www.theguardian.com/commentis...

Read on Twitter

Read on Twitter