The most charitable thing I can say about most blockchain advocates is that they seem to have access to excellent drugs. Let& #39;s look at this example of magical thinking:

This is basically astrology. "If I stretch and filter data enough and compare it with the positions of earth and sun, then those positions clearly prove my other weird stretch correct when the planets align again."

Consider the actual timeline, but starting with public launch. The web was properly launched in 1991. During 1991 and 1992, it was mainly academic. Still useful, mind you; very early things on the web included phone directories, access to software, and FAQs. But very niche.

But starting in 1993, things took off. You had news. Communities. the IMDB. Real-world things like a museum and a religious organization. Magazines, music, webcams, bookstores. https://en.wikipedia.org/wiki/List_of_websites_founded_before_1995">https://en.wikipedia.org/wiki/List...

And from there, the web was delivering real value every day to ordinary people. Getting access was hard, but once you had it, you weren& #39;t going to give it up. Even in its early incarnation, it made hard things easy.

Was their a *financial* bubble? Sure. But was there a user bubble? No. User growth continued unimpeded. Nobody quit using the internet because Webvan wasn& #39;t around anymore. https://ourworldindata.org/internet ">https://ourworldindata.org/internet&...

The web was the original up-and-to-the-right growth curve that launched a thousand unicorns. But it happened because the web unlocked a lot of existing potential. It made many different things better for many different people.

Of course, we still had a long way to go in 1999. The smartphone in particular unlocked another wave of innovation. Yet more things got better for yet more people.

Let& #39;s contrast this with Bitcoin. It was launched in 2009. It was certainly interesting. Technically novel. The original paper makes a case that there& #39;s a need for a true electronic cash. https://bitcoin.org/bitcoin.pdf ">https://bitcoin.org/bitcoin.p...

Who did Bitcoin make things better for? Almost nobody. By 2009, digital money options included debit cards, credit cards, and Paypal (launched a decade earlier). ATMs turned digital money into physical cash. And had for decades: https://www.theatlantic.com/technology/archive/2015/03/a-brief-history-of-the-atm/388547/">https://www.theatlantic.com/technolog...

Bitcoin *did* allow for a sort of global wire transfer in ways better than banks. But since it was its own currency, it added risk and complication. The software was hard to use, and if you did it wrong you could lose all your money irrevocably.

Despite that, plenty of people tried out Bitcoin. A number of merchants prominently added support. You& #39;d see Bitcoin stickers on some stores and pseudo-ATMs. But after a while, major merchants quietly dropped support.

Bitcoin& #39;s full failure as electronic cash was made manifest when even a Bitcoin conference stopped taking Bitcoin: https://slate.com/technology/2018/01/the-most-important-blockchain-conference-of-the-year-wont-take-bitcoin-for-last-minute-sales.html">https://slate.com/technolog...

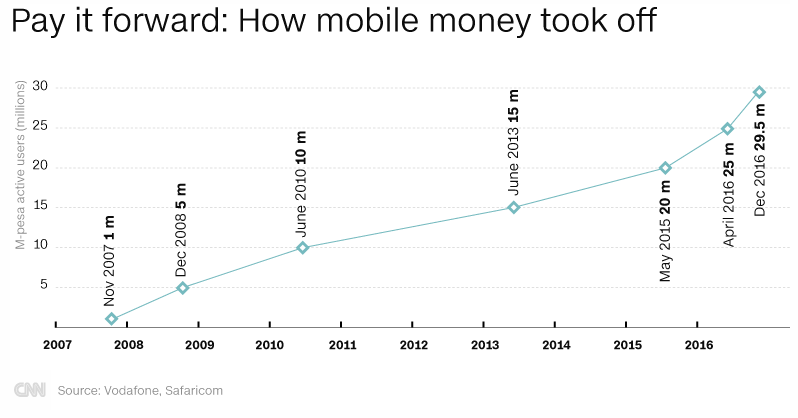

In comparison, let& #39;s look at mobile-money solution M-Pesa, launched in Kenya in 2007: https://en.wikipedia.org/wiki/M-Pesa ">https://en.wikipedia.org/wiki/M-Pe...

Ten years in, it was hugely successful. It has millions of users, billions of transactions per year. Like the web, it demonstrated early, broad utility and evolved to address more user needs. https://www.cnn.com/2017/02/21/africa/mpesa-10th-anniversary/index.html">https://www.cnn.com/2017/02/2...

So it& #39;s not like financial innovation was impossible. Bitcoin was just a bad solution that didn& #39;t get any better. A bad solution for ordinary people, I should say. But clearly it has been good for some people. Who?

The obvious one is scam artists. They have done incredibly well. They glossed up age-old investment cons with digital pixie dust and extracted truly absurd amounts of money. E.g.: https://www.bbc.com/news/stories-50435014">https://www.bbc.com/news/stor...

Or this one: https://www.vanityfair.com/news/2019/11/the-strange-tale-of-quadriga-gerald-cotten">https://www.vanityfair.com/news/2019...

Aside from the actual criminals, there were plenty of fools. E.g., early Bitcoin exchange Mt Gox (which was, I swear, short for Magic the Gathering Online Exchange, as the programmer went from trading game cards to trading currencies) was a fool circus: https://en.wikipedia.org/wiki/Mt._Gox ">https://en.wikipedia.org/wiki/Mt._...

Or, as I wrote about previously, the small-time fools building businesses serving yet smaller fools: https://twitter.com/williampietri/status/1071824627515584512">https://twitter.com/williampi...

All of this of course built on a pyramid of suckers, people who wanted something for almost nothing. People who were desperate for a miracle. People whose friend& #39;s brother was very persuasive that this was a great investment.

And we have to include small-time criminals. Bitcoin& #39;s not bad if you want to do some light money laundering, some casual evasion of financial controls. But don& #39;t fly too high, you criminal Icaruses: https://en.wikipedia.org/wiki/Ross_Ulbricht">https://en.wikipedia.org/wiki/Ross...

So the key difference between the World Wide Web and Bitcoin is that one of them was and is broadly useful, and the other is a pipe dream that quickly turned irredeemably seedy. No magical 10-to-15-year cycle will save it.

But wait, say you! What about BLOCKCHAIN! And I say, good job reader! You correctly noticed the other slight of hand in that paragraph I quoted. That when the going gets tough, the claims suddenly shift!

I& #39;m going to leave that trickery mostly aside today, as I have a long run to get to. But I will say that, cryptocurrencies aside, I& #39;ve never found a real-world use for blockchains that couldn& #39;t be done better with existing tech. Often, orders of magnitude better.

For more on that, I recommend reading @davidgerard& #39;s "Attack of the 50-Foot Blockchain": https://www.amazon.com/Attack-50-Foot-Blockchain-Contracts-ebook/dp/B073CPP581">https://www.amazon.com/Attack-50...

With that, a fond adieu. Pacific Ocean, here I come!

Read on Twitter

Read on Twitter