As audio categories continue to blend — podcasts, books, education, wellness, religion — Spotify is upstream (data-wise) of a lot of compelling consumer subscription expansion opportunities it can capture via M&A, new product, & platform to close audio’s engagement/revenue gap. https://twitter.com/BluegrassCap/status/1197956094716461057">https://twitter.com/Bluegrass...

These additional subscription paths mean, in part, that as their streaming business caps out market size-wise, Spotify is well positioned to grow revenue off of its existing customer base and become the first “negative churn” consumer subscription company. https://twitter.com/brettbivens/status/1166392861480357890">https://twitter.com/brettbive...

This alone — that Spotify has paths to same customer revenue growth — is notable but not unique. Any co. that has captured meaningful demand should.

Remember this https://abs.twimg.com/emoji/v2/... draggable="false" alt="📸" title="Camera with flash" aria-label="Emoji: Camera with flash"> from Peloton’s S-1?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📸" title="Camera with flash" aria-label="Emoji: Camera with flash"> from Peloton’s S-1?

But “all revenue is not created equal” & that’s where Spotify has a singular opportunity.

Remember this

But “all revenue is not created equal” & that’s where Spotify has a singular opportunity.

Peloton and many other consumer subscription companies have low business model leverage — meaning that new revenue paths will almost always come at the expense of gross margin.

Apparel, in-person studio classes, etc. are costlier to provide than a digital subscription.

Apparel, in-person studio classes, etc. are costlier to provide than a digital subscription.

Spotify has extremely high business model leverage.

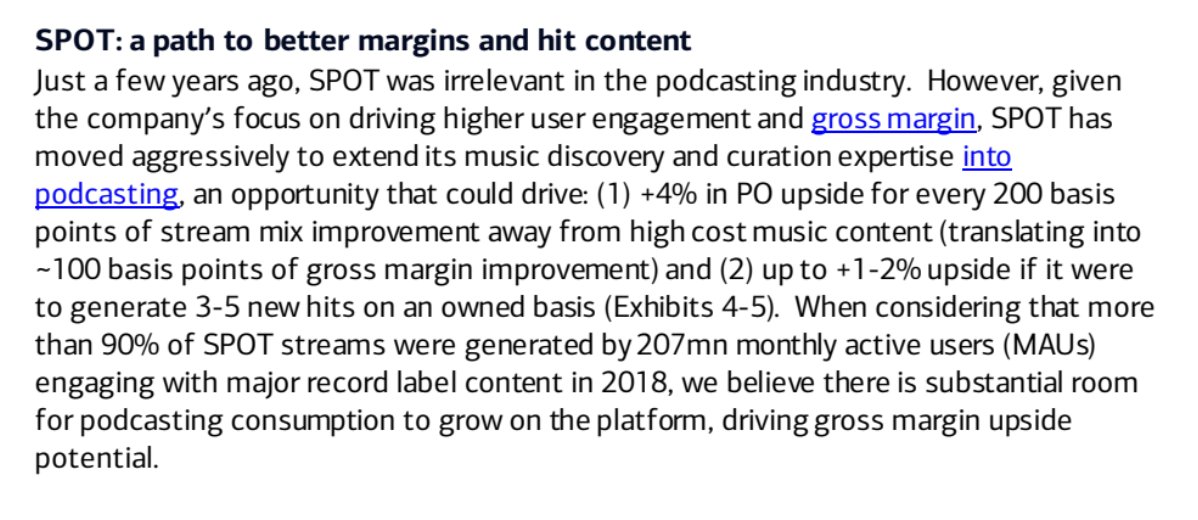

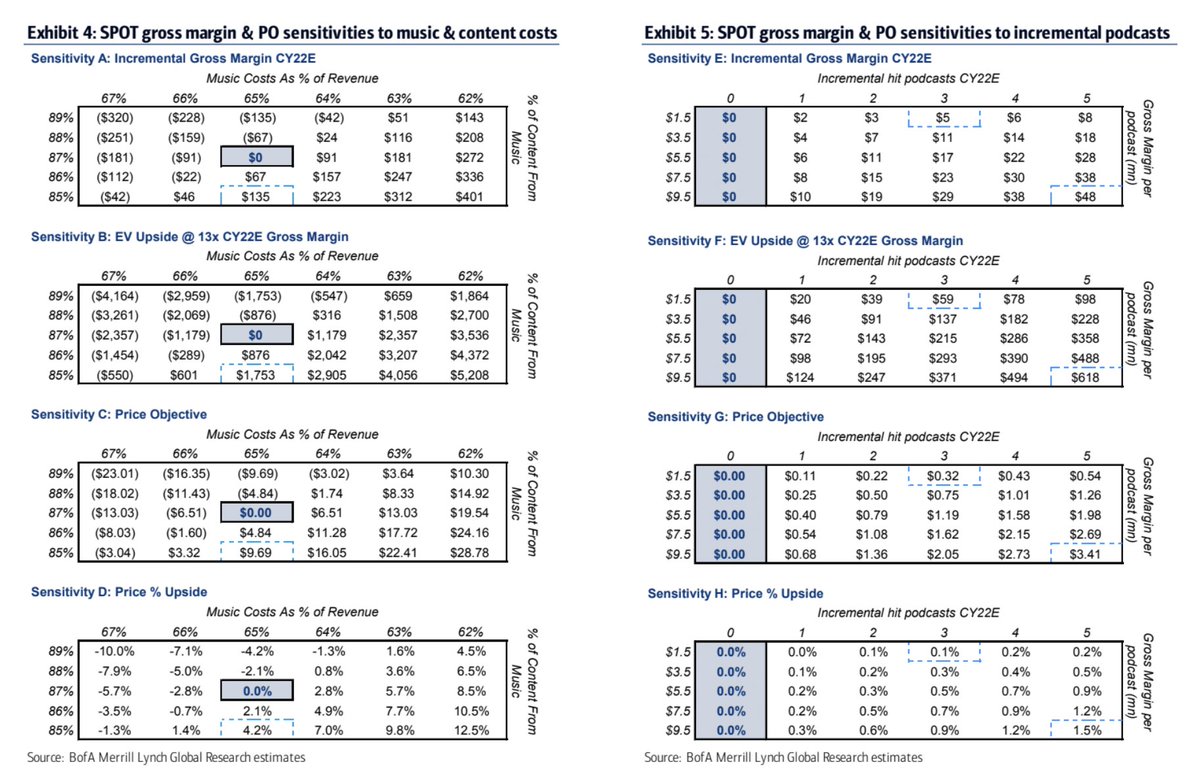

While streaming economics — i.e. paying for content on a marginal cost basis — are not ideal for the company, their execution of that model has positioned them with consumers to ladder up to more profitable lines of business.

While streaming economics — i.e. paying for content on a marginal cost basis — are not ideal for the company, their execution of that model has positioned them with consumers to ladder up to more profitable lines of business.

This in turn creates a gross margin flywheel for Spotify.

Podcasts were the 1st step. A Calm-like acquisition, creating direct “upsell” revenue on low CAC via a massive install base could be next.

Higher GM means more https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag">to invest down the P&L, keeping the flywheel spinning.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💰" title="Money bag" aria-label="Emoji: Money bag">to invest down the P&L, keeping the flywheel spinning.

Podcasts were the 1st step. A Calm-like acquisition, creating direct “upsell” revenue on low CAC via a massive install base could be next.

Higher GM means more

From there, more M&A...but more interestingly given Spotify’s product leadership in the market, we will see more internal products blending audio genres leveraging their “upstream” positioning and advantaged knowledge of emergent trends on their platform.

Read on Twitter

Read on Twitter from Peloton’s S-1?But “all revenue is not created equal” & that’s where Spotify has a singular opportunity." title="This alone — that Spotify has paths to same customer revenue growth — is notable but not unique. Any co. that has captured meaningful demand should.Remember this https://abs.twimg.com/emoji/v2/... draggable="false" alt="📸" title="Camera with flash" aria-label="Emoji: Camera with flash"> from Peloton’s S-1?But “all revenue is not created equal” & that’s where Spotify has a singular opportunity." class="img-responsive" style="max-width:100%;"/>

from Peloton’s S-1?But “all revenue is not created equal” & that’s where Spotify has a singular opportunity." title="This alone — that Spotify has paths to same customer revenue growth — is notable but not unique. Any co. that has captured meaningful demand should.Remember this https://abs.twimg.com/emoji/v2/... draggable="false" alt="📸" title="Camera with flash" aria-label="Emoji: Camera with flash"> from Peloton’s S-1?But “all revenue is not created equal” & that’s where Spotify has a singular opportunity." class="img-responsive" style="max-width:100%;"/>