Thread: I& #39;d like to weigh in with clarity about the wealth tax. First of all, please stop saying I "blast" people or things when I haven& #39;t, I was blasting anyone who would claim to lose money on being taxed at 2% on massive wealth. If you make a conservative 6% on your assets 1/

And you have a billion dollars, your wealth will expand by 60mm a year. If the government take 2% that leaves you with 40mm That& #39;s ON TOP of the billion you already have. Add compounding to this dynamic and tell me how it is possible this is any kind of a hardship. 2/

There are two kinds of inequality that are eroding our democracy: income and wealth inequality. Income inequality is the obscene gulf between what people make at the bottom of the pay school and what people make at the top. That is a driver of wealth inequality for sure. 3/

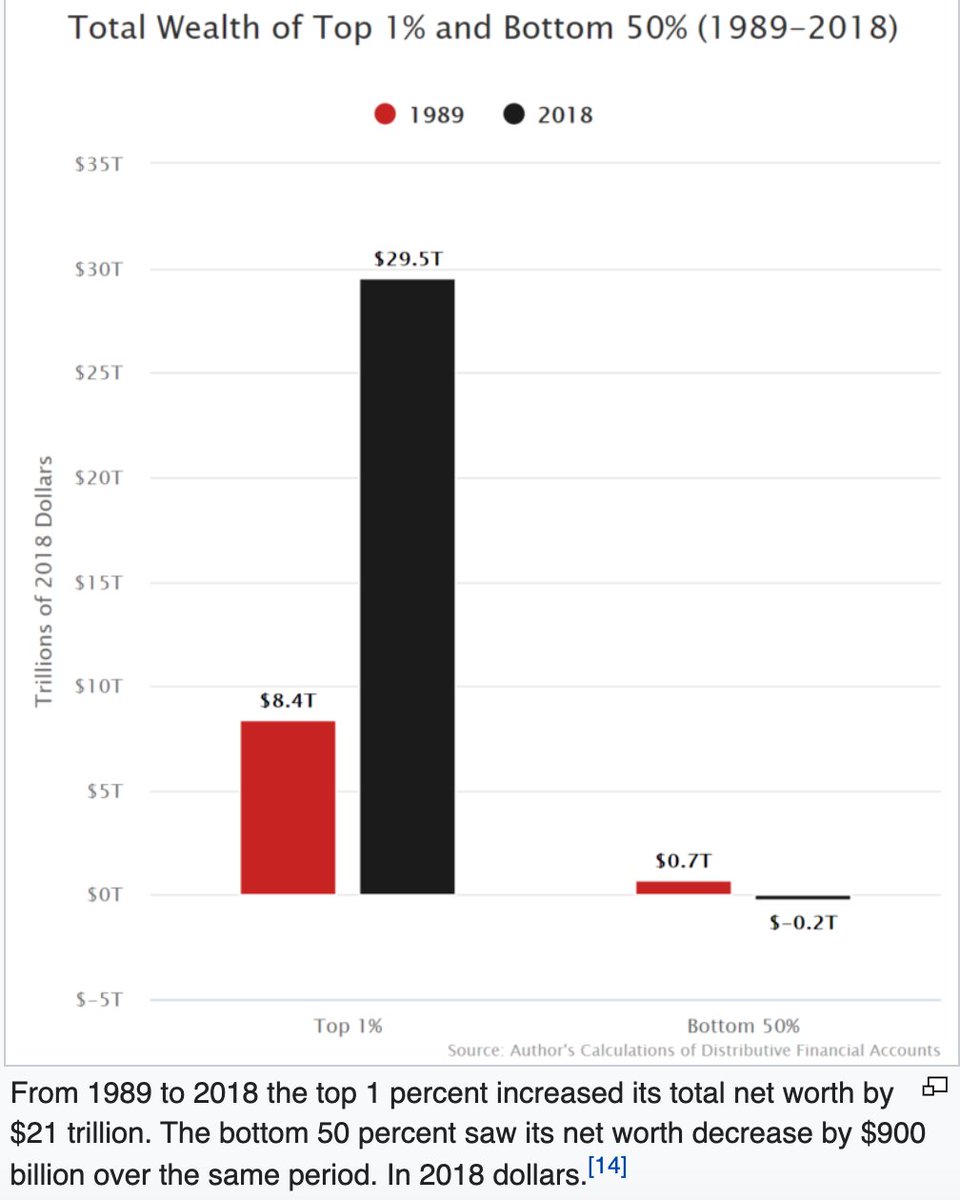

But once the wealth gets concentrated in the hands of a few, and every year it continues to get more concentrated because of our tax structure, the wealth gap widens even more dramatically. Perhaps this chart will drive the point home for you: 4/

On the left hand side you have what the 1% had in in 1989 as opp to 2018. Yes, their net worth rose--THE ONE PERCENT-- rose from 8.4 TRILLION to 29 T in just thirty years. That& #39;s 300%. The bottom 50% don& #39;t even make it into this screen shot. In 1989 they controlled 5/

0.7 trillion and now, in 2018, they are in negative numbers, at -.2 trillion. NEGATIVE NUMBERS. Does this strike anyone as fair? More importantly, does this strike anyone as a good idea? Socially stable? The basis for a sustainable future????? 6/

One of the reasons for this massive shift has been that we have chosen to tax work differently than ownership. People who amass fortunes do not take in paychecks. Or if they do those paychecks are a regular source of chuckling around the office, so meaningless they are 7/

They wealth amasses as a result of capital appreciation. In other words the things they own get more and more valuable over time. And yet, even though they make so much of their money by just owning it, they pay a far lower tax rate: the capital gains rate, which is 8/

Depending on your bracket and how long you have owned the asset, no higher than 20%. In the meantime, a working family, if they are filing jointly and make between $78,900 and $168,400 pays 22% on their income. A married couple filing jointly with 80k in income is not 8/

Dogging it, or leaning back and letting the government take care of them. Quite the opposite. And once they have paid off their mortgage, their kids expenses, healthcare, transportation, heating, etc etc, they don& #39;t have a lot of money left over to invest 9/

Go see a movie or enjoy themselves from time to time. I& #39;m told that those owners who enjoy that capital gains rate provide jobs and stimulate the economy, but how good at that can they possibly be if they wealth of the working people they are supposedly providing those jobs 10/

Have gotten less wealthy not more so. If that dynamic worked, wouldn& #39;t we have seen improvement in the wealthy held more broadly by working americans, rather than the cataclysmic plummet into negative numbers with which we are currently faced? 11/

40% of Americans can& #39;t cover a $400 emergency. Yes, I& #39;ve seen that figure debunked, but the argument that this is inaccurate consists of 1) it& #39;s only 39% and 2) they could do it, but they& #39;d have to borrow to do it. Methinks those debunking that number have not 12/

Thread: I& #39;d like to weigh in with clarity about the wealth tax.(headline writers: please stop saying I "blast" people when I haven& #39;t) I do get impatient with anyone who would claim to lose money on being taxed at 2% on huge wealth. If you make a conservative 6% on your assets 1/

And you have a billion dollars, your wealth will expand by 60mm a year. If the government takes 2% that leaves you with 40mm That& #39;s ON TOP of the billion you already have. Add compounding to this dynamic and tell me how it is possible this is any kind of a hardship. 2/

There are two kinds of inequality that are eroding our democracy: income and wealth inequality. Income inequality is the obscene gulf between what people make at the bottom of the pay structure and what people make at the top. That is a driver of wealth inequality for sure. 3/

But once the wealth gets concentrated in the hands of a few, it continues to get more concentrated because of our tax structure, and so the wealth gap keeps widening dramatically. Perhaps this chart will drive the point home for you: 4/

On the left hand side you have what the 1% had in in 1989 as opp to 2018. Yes, their net worth rose--THE ONE PERCENT-- rose from 8.4 TRILLION to 29 T in just thirty years. That& #39;s 300%. The bottom 50% don& #39;t even make it into this screen shot. In 1989 they controlled 5/

0.7 trillion and now, in 2018, they are in negative numbers, at -.2 trillion. NEGATIVE NUMBERS. Does this strike anyone as fair? More importantly, does this strike anyone as a good idea? Socially stable? The basis for a sustainable future????? 6/

One of the reasons for this massive shift has been that we have chosen to tax work differently than ownership. People who amass fortunes do not take in paychecks. Or if they do those paychecks are a regular source of chuckling around the office, so meaningless are they 7/

Their wealth amasses as a result of capital appreciation. In other words the things they own get more and more valuable over time. And yet, even though they make so much of their money by just owning it, they pay a far lower tax rate: the capital gains rate, which is, 8/

Depending on your bracket and how long you have owned the asset, no higher than 20%. In the meantime, a working family, if they are filing jointly and make between $78,900 and $168,400 pays 22% on their income. A married couple filing jointly with 80k in income is not 8/

Dogging it, or leaning back and letting the government take care of them. Quite the opposite. And once they have paid off their mortgage, their kids expenses, healthcare, transportation, heating, etc etc, they don& #39;t have a lot of money left over to invest 9/

Go see a movie or enjoy themselves from time to time. I& #39;m told that those owners who enjoy that capital gains rate provide jobs and stimulate the economy, but how good at that can they possibly be if the wealth of the working people they are supposedly providing those jobs to10/

Have gotten more and more anemic over the years when they were making it hand over fist. If that dynamic worked, wouldn& #39;t we have seen improvement in the wealth held more broadly by working americans, rather than this cataclysmic plummet into negative numbers? 11/

40% of Americans can& #39;t cover a $400 emergency. Yes, I& #39;ve seen that figure debunked, but the argument of the debunkers consists of 1) it& #39;s only 39% and 2) they could do it, but they& #39;d have to borrow to do it. Methinks those debunkers have never 12/

Had to carry a credit card balance at those usurious rates. Methinks they don& #39;t fully comprehend the headfirst dive into quicksand it is to borrow from friends, or to get your water bill paid by a pay day lending company. 13/

This taxing of ownership over work is a deep structural values problem that rises directly from our days as a slave-holding economy? What? you say? That has nothing to do with this. But you& #39;d be wrong. The only reason the founding fathers objected to taxes on ownership 14/

Was because if they didn& #39;t forbid it the south would never have joined the union. They were afraid northerners would try to effectively abolish slavery by taxing it into oblivion, since most of their wealth was in the form of TRAFFICKED HUMAN BEINGS. Is that a legacy we want 15

to continue to lean on? I don& #39;t think so. And unless we tax wealth, any adjustments in the income tax code will have zero effect on the existing chasm, since income is such a small reason why the wealth gap has formed in the first place. 16/

Yes, other countries have tried it and failed. Other other countries have tried it and succeeded, so we get the benefit of their knowledge. But no, you say, rich people will flee the country! They might, though I& #39;d like to know where they& #39;d go, this isn& #39;t Monaco, we& #39;ve got 17/

Way more places to go for fun than they do. And if they make their money here then we ensure they pay their taxes here. It& #39;s a question of how we write the law. But no, you say, they will just cheat! Yes, they will cheat. Good lord of course they will cheat. But 18/

But there& #39;s a little something called enforcement. We don& #39;t do much of it right now, in fact the IRS has been gutted. But that& #39;s like saying murder should be legal because you can& #39;t stop people from murdering each other. That is silly and you know it. 19/

The only real barrier to the wealth tax is its constitutionality. That& #39;s a pretty big barrier, for sure. I& #39;ll let the lawyers fight that out. But in terms of whether or not we should think about changing that part of the constitution, given its roots in the ownership 20/

Of human beings,I& #39;d be all for an amendment if that& #39;s what& #39;s needed.And I& #39;d be all for a tax code that reflected the values we claim as a nation: that work is a good thing, that ownership is nice if it& #39;s deployed in a way that supports a thriving economy, and that when a small21/

Of people own enough to completely reinvigorate all the aspects of the supposed American Dream that have decayed into near uselessness over the last 50 years, then Bernie, Elizabeth, I say go for it. Bring on the wealth tax. I will happily pay.

Read on Twitter

Read on Twitter