Nice article by @AliKhizar. To add to the dialogue, I& #39;d like to share a few thoughts: https://twitter.com/AliKhizar/status/1198466300126912512">https://twitter.com/AliKhizar...

Pakistan moved into a current account surplus after years of a deficit. There seems to be a debate on whether that’s a good or a bad thing. Are CAD “bad”? As with everything in economics, the answer is ‘it depends’. #PakThink 1/n

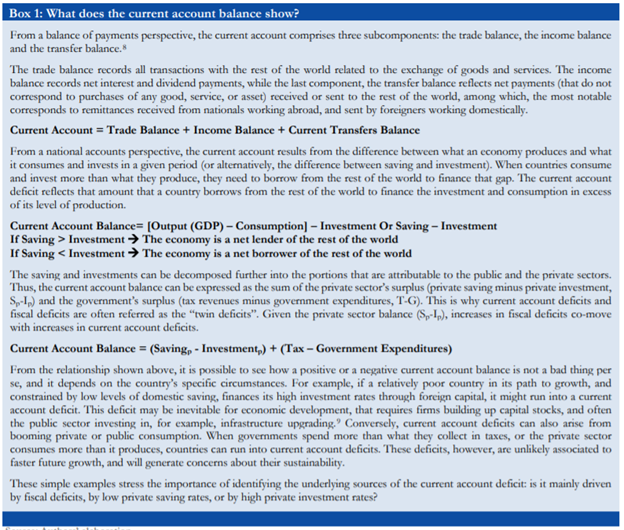

To understand why, let’s look at what is it that the CA balance shows. I wrote this a few years ago and can help clarify – Essentially composition of the CA balance and financing matter. #PakThink 2/n

The CA balance results from the difference between what Pakistan produces and what it consumes and invests in a period – the difference between saving and investment. From that, the ‘it depends’ answer becomes clear. Consider these cases. #PakThink 3/n

1: Economy grows, w/ high investment (I), > than domestic saving (S). To keep growing, it’ll need to finance I w/ foreign S. Hence, it’ll run a CAD & the financial acct of BoP will show it’s borrowing. If markets believe growth will follow, they& #39;ll keep lending. #PakThink 4/n

2: Economy grows, led by consumption (C), little investment (I). C is high, S is low - not enough to finance I. Hence, it’ll run a CAD. Financial acct will show it’s borrowing. If markets don& #39;t believe future growth will follow, may become uneasy about financing it. #PakThink 5/n

From a sustainability point of view, (1) and (2) are different. CAD in 1 may not be a problem, rather a symptom of health. CAD in 2 may be a symptom of problems. #PakThink 6/n

3: The economy shows weak investment and weak consumption, making imports collapse. CA is in surplus. The CB is either accumulating reserves, or reducing liabilities w/ the rest of the world. #PakThink 7/n

Should we celebrate Case 3 or not? Again, it depends. Nothing to celebrate about weak C or I, but the CA surplus in 3 may be welcome if previous CAD had created increased financial vulnerabilities and there were challenges to finance the CAD ahead. #PakThink 8/n

Also: the way you finance the CAD matters. External crisis risk increases when CADs/GDP increase (making net foreign liabilities increase), but if you finance a big chunk of the CAD with FDI, you’re less vulnerable. Check here https://www.imf.org/external/pubs/ft/wp/2013/wp13113.pdf">https://www.imf.org/external/... #PakThink 9/n

Many healthy countries run stable CAD for prolonged periods, many healthy countries run stable CA surpluses. It’s composition of the CAD and how you finance it that matters. #PakThink 10/10

Read on Twitter

Read on Twitter