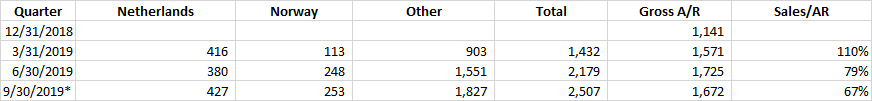

$TSLAQ Since Greenlight Capital has joined the party examining the A/Rec balance for $TSLA. Here is the gross accounts receivable compared to auto sales. Look at the gross jump from Q42018 to Q12019. 18.79% to 44.78%. It then "reverts" to only 33% of auto sales. 1/7

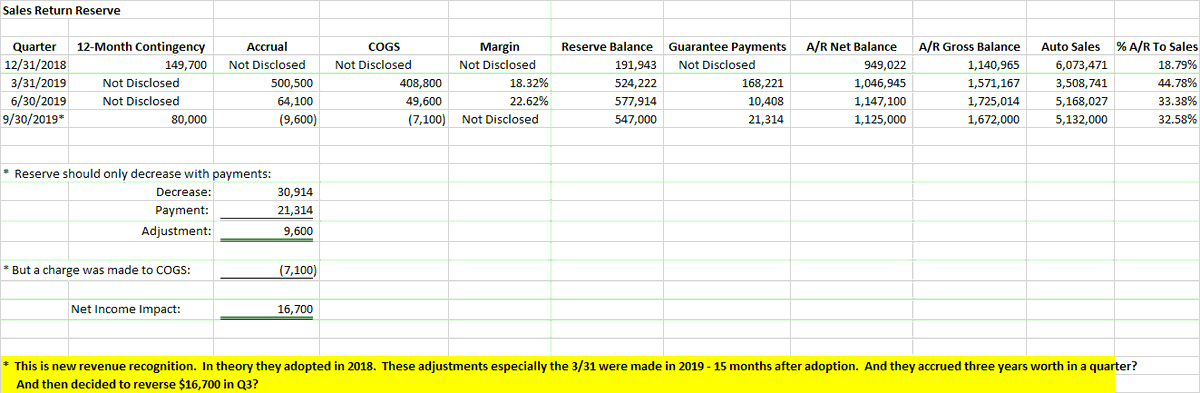

Q12019 the company made a $500m accrual to a sales return account. Sales with rights of return are allowed under new Rev Rec standards. You need a reserve for the returns. They adopted in the standard at Q12018. Notes said accrual was funding the guaranteed buyback program 2/7

The 12 month contingency column reports what was disclosed as the potential guarantee payments for the next 12 months. Q42108, they had a years worth of reserve. Q12019 did not disclose the contingency. Use Q42018 as an estimate - 3.50 years reserve at Q1 3/7

At Q3? Now there are 7 years of accruals. So magically they reversed $16.7m of accruals from the reserve to make the Q32019 profit miracle. 4/7

Conspiracy theories aside, the reserve for bad debts and returns function the same. It looks like someone when to the principles& #39; office at year end for the receivables. To not report a credit loss, it was that previous overseas program of providing a buyback guarantee 5/

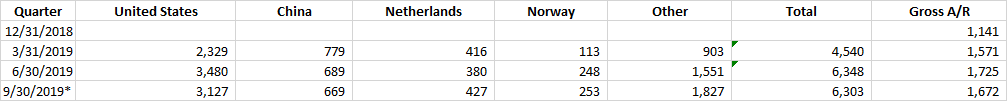

Now the part that @davidein questions. WTF is the deal with the a/rec? It& #39;s not leasing receivables. Or, solar panels. A/R was almost half of sales in Q12019. And is 1/3 of sales in Q2/Q3 2019. Einhorn noted that IR said the receivable was due to Europe late deliveries. 5/7

Here is geographic sales compared to the A/R. It includes all sales but it does raise a question. Look at other geography of sales. This should really be the rest of Europe plus Japan and Korea. 6/7

Read on Twitter

Read on Twitter