Long thread on $AAPL

Sometimes it& #39;s good to sit back and understand/appreciate the miracles around.

It& #39;s easy to complain that Apple has lost it& #39;s innovative touch, iPhone sales are falling, Services are just OK etc (Yeah, the Market is a forward looking machine and all that).

Sometimes it& #39;s good to sit back and understand/appreciate the miracles around.

It& #39;s easy to complain that Apple has lost it& #39;s innovative touch, iPhone sales are falling, Services are just OK etc (Yeah, the Market is a forward looking machine and all that).

Here are some things I still find amazing that $AAPL has managed to pull off in the last 10 yrs.

@DavidGFool @GavinSBaker @david_perell @IntrinsicInv @ToddWenning @Gautam__Baid @TMFInnovator @TMFJMo @awealthofcs @JohnHuber72 @BluegrassCap @dollarsanddata @TMFStoffel

@DavidGFool @GavinSBaker @david_perell @IntrinsicInv @ToddWenning @Gautam__Baid @TMFInnovator @TMFJMo @awealthofcs @JohnHuber72 @BluegrassCap @dollarsanddata @TMFStoffel

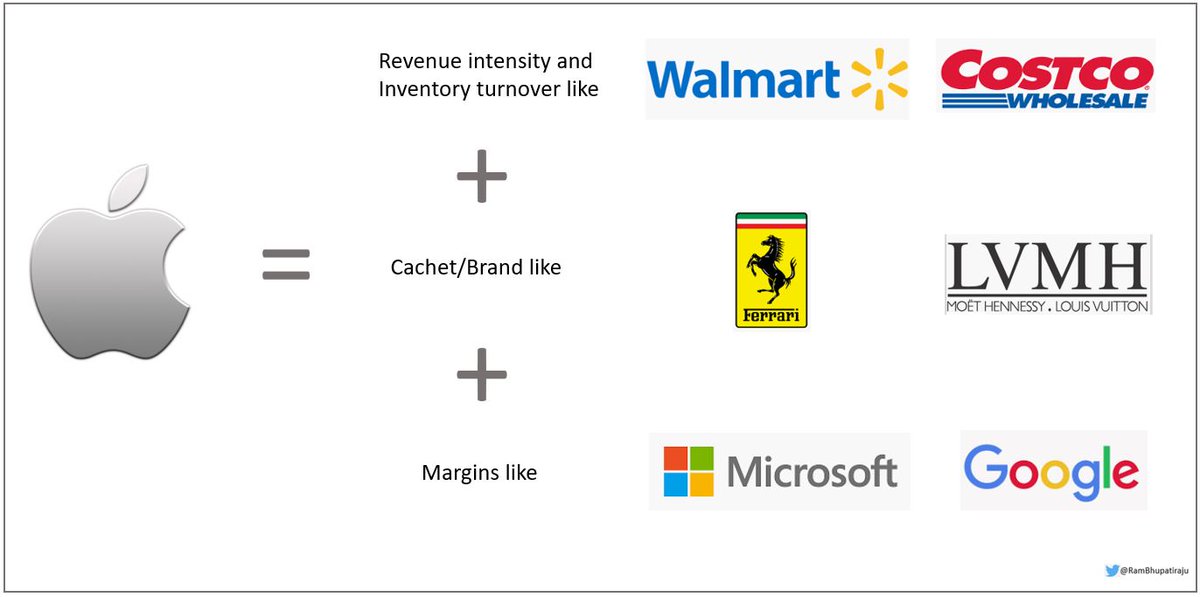

1)Retailers broadly fall into 2 categories

-High vol/Low Margin like Grocery/Dept stores

-Low vol/High Margin like Luxury/Jewelry stores.

With the iPhone and it& #39;s demand, Apple was able to smash these biz models together, and turn it into a high vol/high margin biz on steroids.

-High vol/Low Margin like Grocery/Dept stores

-Low vol/High Margin like Luxury/Jewelry stores.

With the iPhone and it& #39;s demand, Apple was able to smash these biz models together, and turn it into a high vol/high margin biz on steroids.

2)Selling hundreds of Millions of the iPhones, Apple still managed to make the owner of each one feel special about their Phone.

It& #39;s not easy to sell at the Rev scale of Walmart (OK, 50%), and still manage to have the cachet/Brand like a Ferrari or LVMH (OK, slightly lesser).

It& #39;s not easy to sell at the Rev scale of Walmart (OK, 50%), and still manage to have the cachet/Brand like a Ferrari or LVMH (OK, slightly lesser).

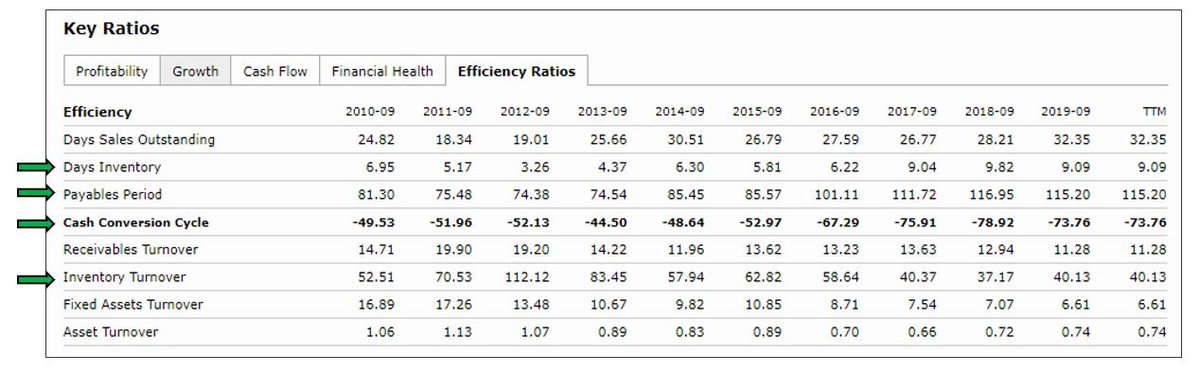

3)It& #39;s not easy to have a massive Global demand but setup your operations/logistics as lean as possible (yes, Tim Cook& #39;s magic) to

-meet the demand and sell your inventory within 9 days

-turn over the inventory about 40 times a year

-meet the demand and sell your inventory within 9 days

-turn over the inventory about 40 times a year

-Getting Suppliers to extend their Payables period to 115 days (yeah, they have to oblige their biggest Customer).

-Having a Cash Conversion Cycle of -75 days, yeah negative 75 days (like a 2 1/2 month interest free loan).

-Having a Cash Conversion Cycle of -75 days, yeah negative 75 days (like a 2 1/2 month interest free loan).

With their balance sheet strength, Apple doesn& #39;t need to do all this, but why not? if it wants to run as efficiently as possible and optimize Cash flow?

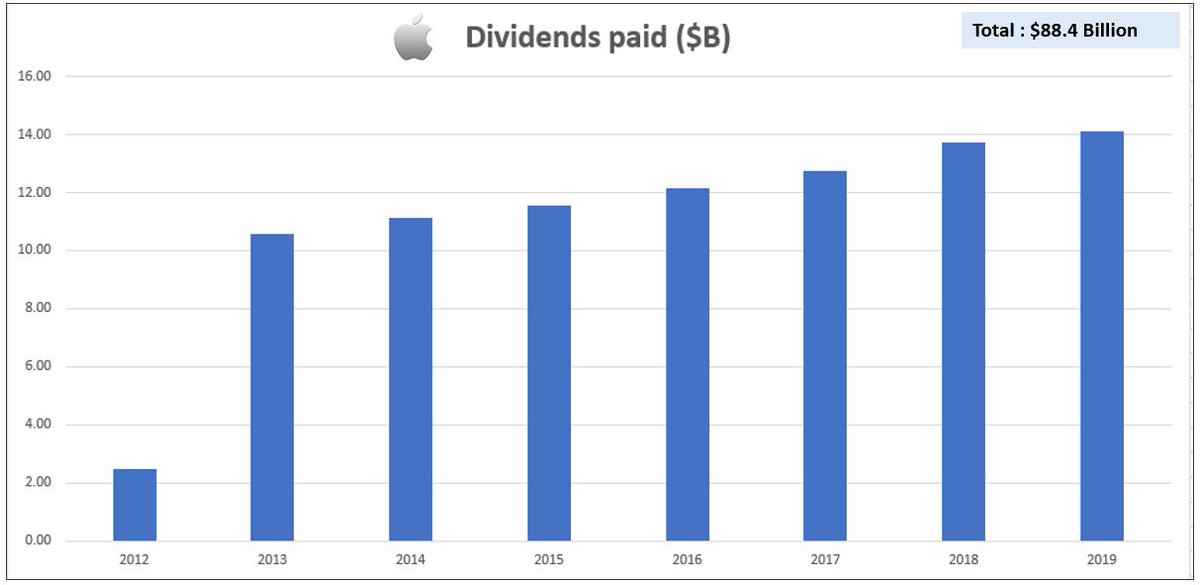

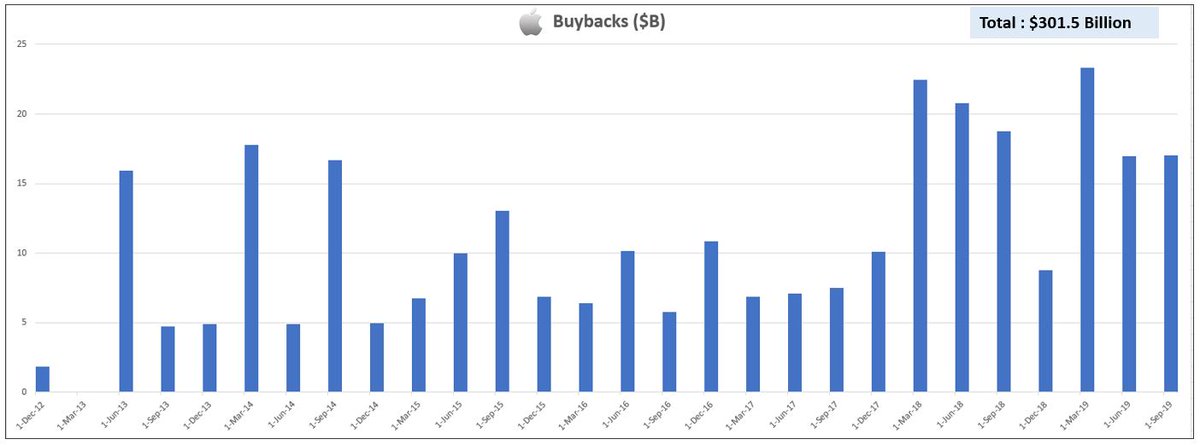

4)Massive Buybacks and Dividends paid since 2012

When your Business is throwing off $50-$60B cash in a year, it can& #39;t possibly be all absorbed by internal needs (R&D, working capital..) or smart acquisitions.

When your Business is throwing off $50-$60B cash in a year, it can& #39;t possibly be all absorbed by internal needs (R&D, working capital..) or smart acquisitions.

An undisciplined Mgmt can easily drain most of that money with Empire building (or buying $NFLX, $TSLA if they follow the advice of Monday morning quarterbacks).

What they have instead so sensibly done is

-Pay a very conservative dividend, but increasing it every year since 2012. Cumulatively paid ~$89B so far.

-Pay a very conservative dividend, but increasing it every year since 2012. Cumulatively paid ~$89B so far.

-Buy back ton of their stock consistently, even more so whenever the Market beat down their stock due to iPhone slowdown fears. Bought back ~$300B so far.

Some might call this Financial Eng (to boost EPS), but its more like sensible Capital allocation given their position.

Some might call this Financial Eng (to boost EPS), but its more like sensible Capital allocation given their position.

Disclaimer : I& #39;m neither an Apple aficionado or a Professional Analyst. All the above is based on my research and observations as an Individual Shareholder (for most part of the last 10 yrs). So... not liable for any minor errors in above figures.

Different people might have different opinions on above stuff and Apple in general. I appreciate that. The difference in opinions (and flexibility of changing your mind) is what makes the Market great and what creates opportunity to invest in general.

Thank you for reading. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏🏼" title="Person with folded hands (medium light skin tone)" aria-label="Emoji: Person with folded hands (medium light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏🏼" title="Person with folded hands (medium light skin tone)" aria-label="Emoji: Person with folded hands (medium light skin tone)">

Thank you for reading.

Read on Twitter

Read on Twitter