Delighted to welcome @MKorevaar93 to QUCEH to present his work on investor demand and house prices

Despite widespread central banker concerns about investors reaching for yield in housing markets, very little research on the extent to which it actually happens. @MKorevaar93

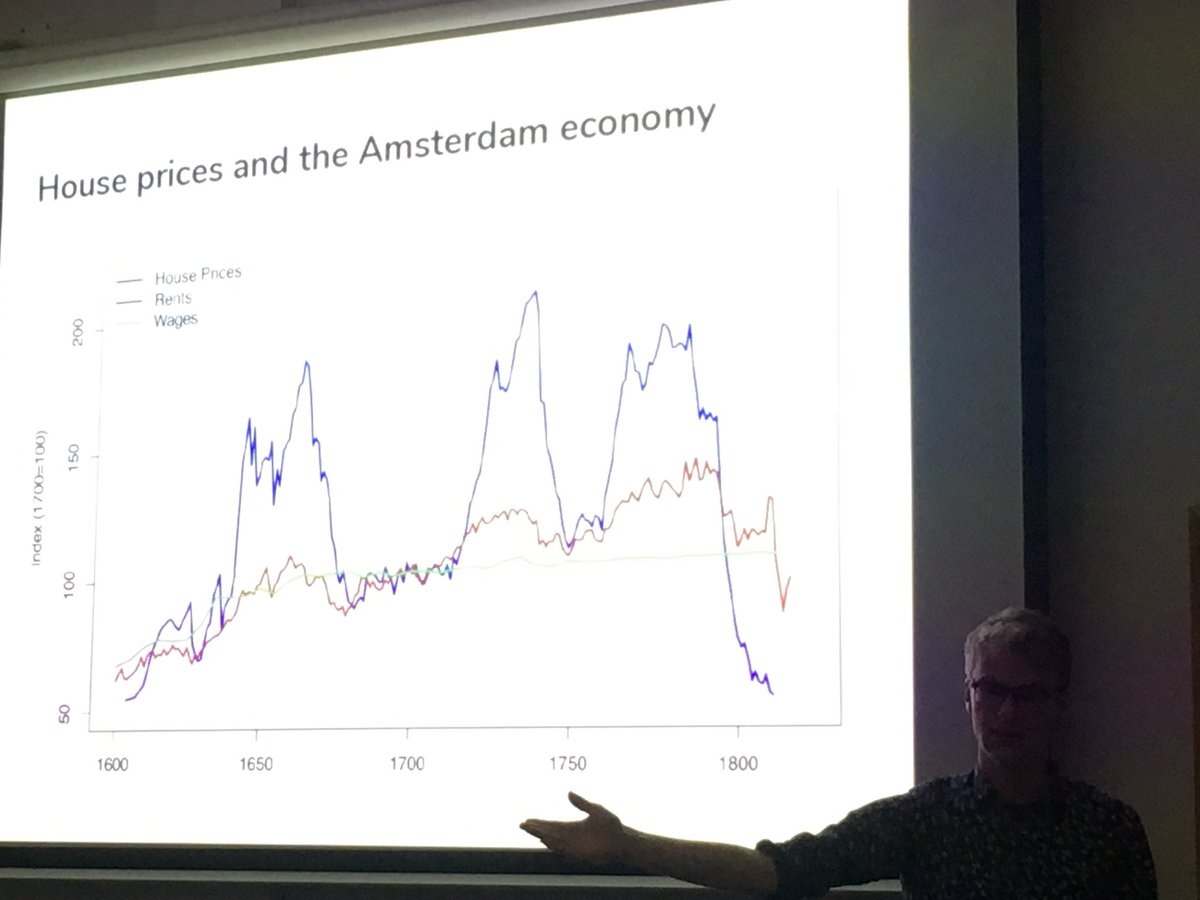

@MKorevaar93 looks at historical Amsterdam, where there was negligible mortgage and some interest rate changes were exogenous, so he can isolate the effect of reaching for yield.

Finds that low bond yields caused a reach for yield in housing in that era, amplifying boom-and-bust cycles. @MKorevaar93 also argues that this increased wealth inequality, but also fostered financial development.

@MKorevaar93 argues that this was driven by (mostly very rich) investors shifting funds into housing when bond yields were low

Read on Twitter

Read on Twitter