\begin{JMPthread}

Only half of recent student loan borrowers made any progress on their student loans after their first year of repayment.

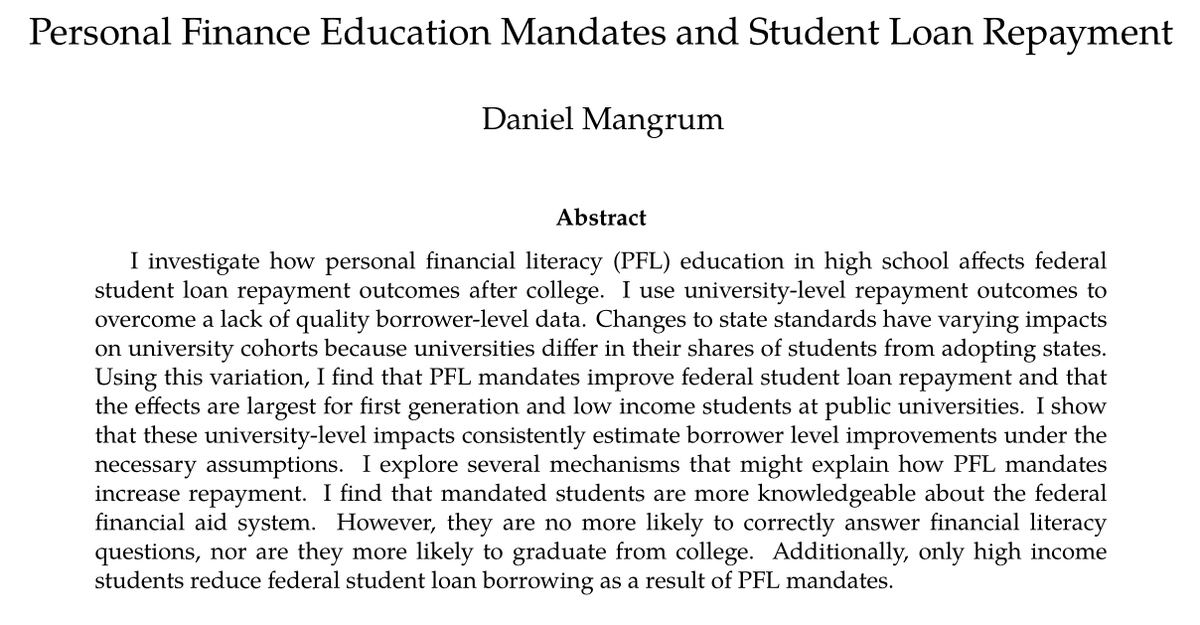

My JMP asks: can mandated personal finance coursework during high school improve student loan outcomes?

more https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> https://www.danielmangrum.com/research.html

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> https://www.danielmangrum.com/research.html

1/n">https://www.danielmangrum.com/research....

Only half of recent student loan borrowers made any progress on their student loans after their first year of repayment.

My JMP asks: can mandated personal finance coursework during high school improve student loan outcomes?

more

1/n">https://www.danielmangrum.com/research....

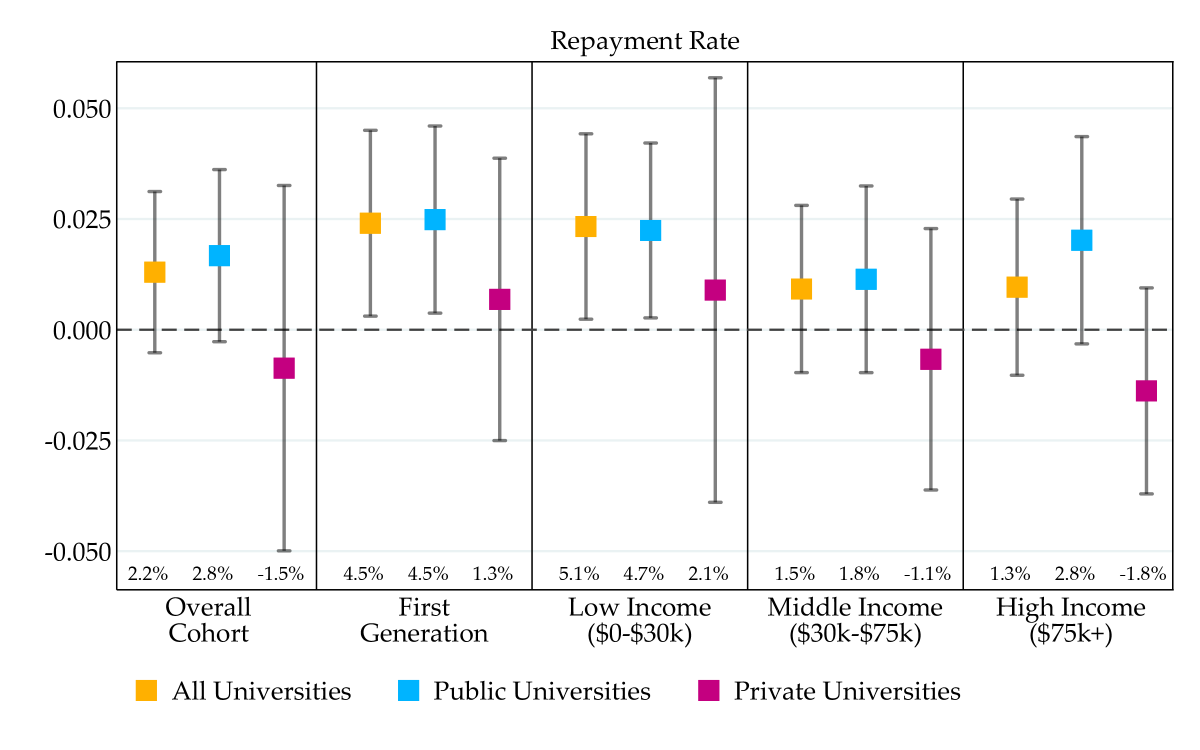

Spoiler: Personal finance education mandates make it more likely that first generation and low income students make progress on their loans a year after they enter repayment.

Results suggest improvements come from a better understanding of federal financial aid.

2/n

Results suggest improvements come from a better understanding of federal financial aid.

2/n

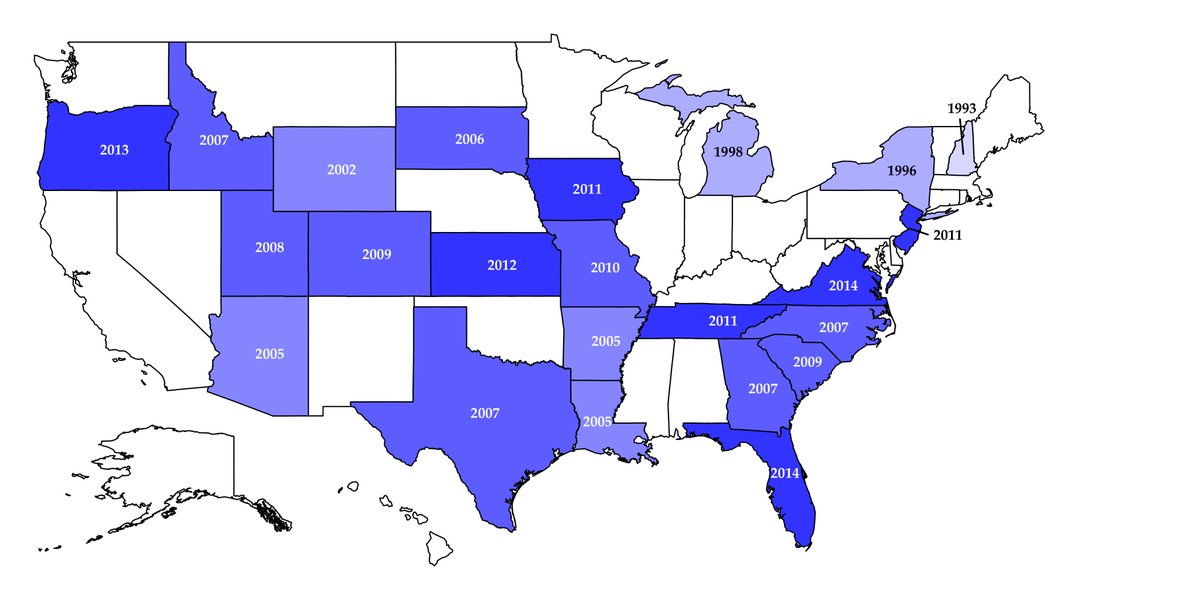

Since 1990, 23 states added standards requiring high school students to do personal financial literacy (PFL) coursework.

Kudos to the work by Carly Urban and coauthors (with support from @FINRA) for collecting data on PFL mandates

http://www.montana.edu/urban/research.html">https://www.montana.edu/urban/res...

3/n

Kudos to the work by Carly Urban and coauthors (with support from @FINRA) for collecting data on PFL mandates

http://www.montana.edu/urban/research.html">https://www.montana.edu/urban/res...

3/n

What do these courses teach? Often general financial literacy topics: savings, budgeting, debt, investing, interest, inflation, and risk.

Examples from some state standards https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

4/n

Examples from some state standards

4/n

But states increasingly include topics and instructions about federal financial aid and career research into PFL standards.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

5/n

5/n

You typically take these classes while applying to college which helps students make better decisions about financial aid. Urban et al find that this works: PFL courses make students more likely to apply for and receive federal aid.

http://www.montana.edu/urban/FinEdStudentLoansRR2_Dec_2018.pdf">https://www.montana.edu/urban/Fin...

6/n

http://www.montana.edu/urban/FinEdStudentLoansRR2_Dec_2018.pdf">https://www.montana.edu/urban/Fin...

6/n

But what about after college? Are students who start with better aid packages/higher financial literacy/more information about federal aid better at managing loans?

Yes!

7/n

Yes!

7/n

I find that first generation and low income students at public universities who had to do PFL coursework are better at repaying student loans (around 5% more likely to have made progress on their loans one year after entering repayment).

8/n

8/n

Lets talk data!

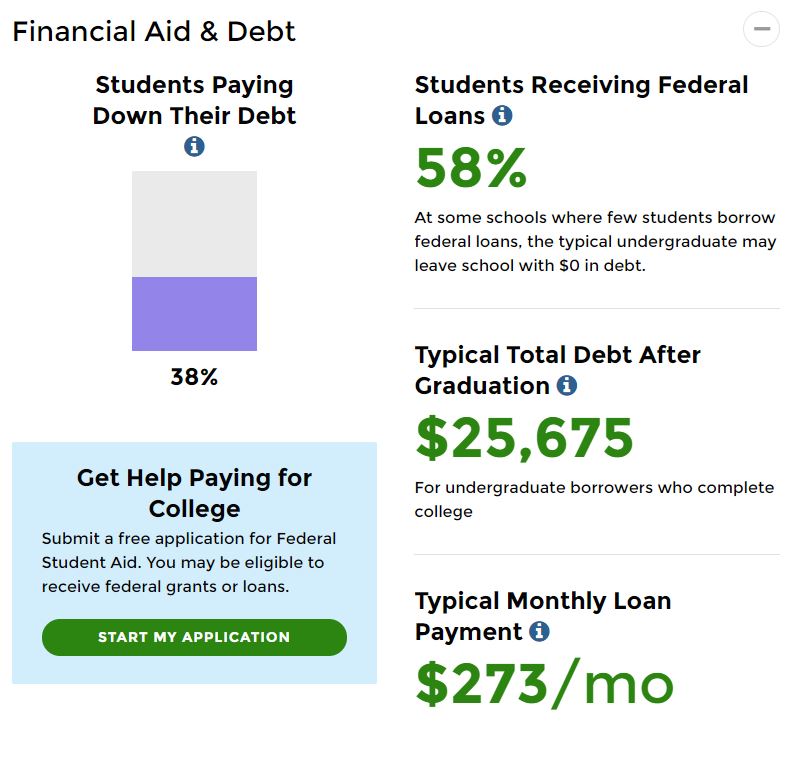

One of the biggest issues with research on student loan repayment is the lack of quality borrower-level data. I get around this by using university-level data from the College Scorecard.

9/n

One of the biggest issues with research on student loan repayment is the lack of quality borrower-level data. I get around this by using university-level data from the College Scorecard.

9/n

Universities have students from many states, so university-level outcomes are affected by other states& #39; PFL adoption to the extent that their students actually come from adopting states.

I use data from IPEDS to track student migration from HS to college.

10/n

I use data from IPEDS to track student migration from HS to college.

10/n

I combine data on the previous state of residence for university cohorts with PFL mandate status to calculate my main measure of exposure: the percentage of each entering cohort that was bound by a PFL mandate.

11/n

11/n

When TN adopted a mandate binding for c/o 2011, UT-Knoxville was almost entirely affected while Vanderbilt was much less affected (but more exposed to earlier state adoptions).

Meanwhile, CBU and TSU each fall between these two extremes in their exposure to TN& #39;s mandate.

12/n

Meanwhile, CBU and TSU each fall between these two extremes in their exposure to TN& #39;s mandate.

12/n

But mandated students also go to college in non-adopting states.

When Georgia adopted a mandate, Alabama universities were partially affected even though Alabama never adopted a mandate. Universities in both states are also slightly affected by TN and FL& #39;s mandates

13/n

When Georgia adopted a mandate, Alabama universities were partially affected even though Alabama never adopted a mandate. Universities in both states are also slightly affected by TN and FL& #39;s mandates

13/n

I leverage this variation in the percentage of college cohorts who were bound by PFL mandates to identify the causal effect of PFL mandates on federal student loan repayment. This variation is driven by state adoption of mandates combined with student migration to colleges.

14/n

14/n

I find that student loan repayment rates improve when the student body becomes increasingly bound by state mandates. I show in the paper that these effects are driven by borrower-level improvements in repayment and are not due to changes in student body composition.

15/n

15/n

How big is the impact?

Back-of-the-envelope calculations suggest that universal PFL mandates for the HS graduating classes of 2001-2008 would have improved student loan outcomes for an additional 9,000 students per year!

16/n

Back-of-the-envelope calculations suggest that universal PFL mandates for the HS graduating classes of 2001-2008 would have improved student loan outcomes for an additional 9,000 students per year!

16/n

So... what is causing the improvement?

Financial literacy? https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen">

Degree completion? https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen">

Changes to college going? https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="❌" title="Kreuzzeichen" aria-label="Emoji: Kreuzzeichen">

Smaller student loan balances? Only for high income students

Better understanding of the federal loan system? https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">

17/n

Financial literacy?

Degree completion?

Changes to college going?

Smaller student loan balances? Only for high income students

Better understanding of the federal loan system?

17/n

I find that students bound by PFL mandates are more likely to correctly answer questions pertaining to federal student loans.

This mechanism is consistent with studies that find simplifying the FAFSA and federal student loan process can improve financial aid outcomes.

18/n

This mechanism is consistent with studies that find simplifying the FAFSA and federal student loan process can improve financial aid outcomes.

18/n

What are the policy implications?

Even though I find no improvements in financial literacy, this doesn& #39;t mean PF mandates are ineffective. Carly Urban, @melody_harvey, and others find improvements in credit health and financial behaviors for mandated students.

19/n

Even though I find no improvements in financial literacy, this doesn& #39;t mean PF mandates are ineffective. Carly Urban, @melody_harvey, and others find improvements in credit health and financial behaviors for mandated students.

19/n

But if we want to improve student loan repayment, it is likely better to simplify the federal financial aid process.

Rather than teaching students to navigate the system, design the system for the students!

20/n

Rather than teaching students to navigate the system, design the system for the students!

20/n

If you like identification assumptions and robustness checks, I highly recommend checking out the paper. I have an event study specification, some randomization inference, and even a shift-share specification you won& #39;t want to miss. Plus, more details on mechanisms!

21/n

21/n

This paper wouldn& #39;t have been possible without the encouragement and fantastic advice from my adviser, @andreamoro. I am also eternally grateful for valuable input from Kitt Carpenter, @andrewdustan, Lesley Turner, Carly Urban, @agoodmanbacon, Tam Bui, and many others.

22/n

22/n

I am also grateful for the feedback I received at the University of Memphis (Go Tigers Go!), Western Illinois University, @equitablegrowth, and at the MVEA, AEFP, and SEA conferences. Double thanks to @equitablegrowth for generous support #EGgrantee

23/n

23/n

I am currently on the economics job market. If you& #39;re interested in my research, you can check out some of my other work at http://danielmangrum.com/research.html

I& #39;m">https://danielmangrum.com/research.... broadly interested in policy relevant topics in applied micro, largely in labor, education, urban, and health economics.

24/n

I& #39;m">https://danielmangrum.com/research.... broadly interested in policy relevant topics in applied micro, largely in labor, education, urban, and health economics.

24/n

Feel free to @ me or email me at daniel.mangrum@vanderbilt.edu if you have questions or comments about this paper or any of my other work.

\end{JMPThread}

\end{JMPThread}

Read on Twitter

Read on Twitter https://www.danielmangrum.com/research...." title="\begin{JMPthread}Only half of recent student loan borrowers made any progress on their student loans after their first year of repayment.My JMP asks: can mandated personal finance coursework during high school improve student loan outcomes?more https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> https://www.danielmangrum.com/research...." class="img-responsive" style="max-width:100%;"/>

https://www.danielmangrum.com/research...." title="\begin{JMPthread}Only half of recent student loan borrowers made any progress on their student loans after their first year of repayment.My JMP asks: can mandated personal finance coursework during high school improve student loan outcomes?more https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Rückhand Zeigefinger nach rechts" aria-label="Emoji: Rückhand Zeigefinger nach rechts"> https://www.danielmangrum.com/research...." class="img-responsive" style="max-width:100%;"/>