Huami - $HMI, $700mn mcap.

I& #39;ll tell you about this now instead of ~Feb in my 2019 Annual Letter because I& #39;d be sad if it starts to run earlier than that...

Very clean & simple story here.

Instead of a loss-making FitBit, we have a quite profitable Chinese smartwatch maker.

I& #39;ll tell you about this now instead of ~Feb in my 2019 Annual Letter because I& #39;d be sad if it starts to run earlier than that...

Very clean & simple story here.

Instead of a loss-making FitBit, we have a quite profitable Chinese smartwatch maker.

Investors lost money with GoPro&FitBit.

-> Pain memory.

-> Fear of looking dumb.

Doesn& #39;t mean a Chinese company can& #39;t be profitable.

Huami just released strong 3Q results:

-> ~$30mn net income. -> ~$120mn 3Q annualized.

Cash balance grew the last two years, now to ~$240mn!

-> Pain memory.

-> Fear of looking dumb.

Doesn& #39;t mean a Chinese company can& #39;t be profitable.

Huami just released strong 3Q results:

-> ~$30mn net income. -> ~$120mn 3Q annualized.

Cash balance grew the last two years, now to ~$240mn!

So Enterprise Value here is ~$460mn.

PE of ~6 on mcap, but LQA ~4 on EV.

Revenue and net income is supposed to grow solidly over the next years, please check usual sources for earnings estimates to get a feeling about this... Think that will happen more likely than not.

PE of ~6 on mcap, but LQA ~4 on EV.

Revenue and net income is supposed to grow solidly over the next years, please check usual sources for earnings estimates to get a feeling about this... Think that will happen more likely than not.

Go read the last 2y of calls. It& #39;s just a very clean thing, clean execution, great achievements. The one thing that didn& #39;t move yet is the share price. That& #39;s okay. And understandable considering it& #39;s a seemingly low-marging smartwatch maker with lots of competition...

But I think very few people really thought about this and had a look themselves.

First of all, we& #39;re not paying that much here, - considering that Huami just outsold Huawei on double 11 and that assuming steady-state earnings for four years, there& #39;s no positive EV left.

First of all, we& #39;re not paying that much here, - considering that Huami just outsold Huawei on double 11 and that assuming steady-state earnings for four years, there& #39;s no positive EV left.

I know, this doesn& #39;t mean anything if this company would fall behind in being a low-cost producer (they& #39;re outsourcing) or being pretty good (they spend boatloads on R&D). Currently, they got good stuff, but no guarantees here.

Something must happen to increase staying power...

Something must happen to increase staying power...

Thesis: Huami will be a healthcare play.

My bet is that the Chinese simply would love to trade "data privacy" for $ healthcare kickbacks.

Also: The Chinese are very social.

Wearable healthtech equals contributing to the good of society bc of data sharing + AI analytics& nudges.

My bet is that the Chinese simply would love to trade "data privacy" for $ healthcare kickbacks.

Also: The Chinese are very social.

Wearable healthtech equals contributing to the good of society bc of data sharing + AI analytics& nudges.

This thesis might be a little steep for most of you, but y& #39;all should study Livongo. $LVGO

Currently there& #39;s some massive revolution happening in the Diabetes space and it& #39;s the very first inning. Data + AI + Healtcare flywheels are very real & it& #39;s mindblowing. It& #39;s the future.

Currently there& #39;s some massive revolution happening in the Diabetes space and it& #39;s the very first inning. Data + AI + Healtcare flywheels are very real & it& #39;s mindblowing. It& #39;s the future.

The future is that many will wear devices that link their health data to the cloud and they/we will benefit from that.

Almost inevitable, but will probably take longer to happen in Europe vs other places...

China probably and rationally will leapfrog this.

Almost inevitable, but will probably take longer to happen in Europe vs other places...

China probably and rationally will leapfrog this.

My intuition here is that Huami will soon make lots of deals with Chinese insurers. And that the Chinese will happily and quickly adopt wearable healthtech currently in the form of smartwatches.

Interests align (govt, tech, insurers, people, culture, saving $) into a flywheel.

Interests align (govt, tech, insurers, people, culture, saving $) into a flywheel.

My variant perception?

I simply wouldn& #39;t be surprised at all if the Chinese would love their smartwatches assuming they get kickbacks from their insurers.

That& #39;s just now becoming a reality. Those modern watches just now are starting to be useful here.

(So 5y out, even more so)

I simply wouldn& #39;t be surprised at all if the Chinese would love their smartwatches assuming they get kickbacks from their insurers.

That& #39;s just now becoming a reality. Those modern watches just now are starting to be useful here.

(So 5y out, even more so)

Huami should get additional high-margin revenues from insurers.

Let& #39;s not forget: Prevention is the real opportunity in health.

Making sure people go for more walks etc: probably worth >>$100bn.

It& #39;s hard to quantify. But we can do this now better than ever with smartwatches.

Let& #39;s not forget: Prevention is the real opportunity in health.

Making sure people go for more walks etc: probably worth >>$100bn.

It& #39;s hard to quantify. But we can do this now better than ever with smartwatches.

So, if I& #39;m correct that the circle is being closed so that prevention healthcare data can be put into a ROI equation for healtcare & insurers, Huami as a smart wearables company is in a solid position to capture the opportunity, especially assuming this is very valuable data.

I mean "valuable data" very differently than FitBit& #39;s data bc insurers don& #39;t/can& #39;t really use FitBit& #39;s data, right?

It& #39;s an assumption, but I imagine China to be different.

I believe China will exploit this opportunity and will incentivise good behaviour & wearing smartwatches.

It& #39;s an assumption, but I imagine China to be different.

I believe China will exploit this opportunity and will incentivise good behaviour & wearing smartwatches.

One question that in my opinion belongs on any investment checklist is: How can this be a future PE of 1?

Let& #39;s assume the hardware part stays at $120mn a year. Still needs $580mn @ $700mn mcap.

What must happen on the healthcare/insurer side so that Huami makes $580mn a year?

Let& #39;s assume the hardware part stays at $120mn a year. Still needs $580mn @ $700mn mcap.

What must happen on the healthcare/insurer side so that Huami makes $580mn a year?

Very abstract math & thinking backwards:

$580mn profit = $193.33mn people & $3 profit per year per person.

$3 profit = RMB 4.375 / $0.625 revenue per month ($7.5 per year) at 40% margins.

This via contracts with insurers.

$580mn profit = $193.33mn people & $3 profit per year per person.

$3 profit = RMB 4.375 / $0.625 revenue per month ($7.5 per year) at 40% margins.

This via contracts with insurers.

Truth be told, if it& #39;s RMB 2 per month and 100mn people, at 30% margins, that& #39;s still a ~$103mn profit opportunity.

This probably would get a healthcare-typical multiple and create lots of wealth, too.

Opportunity = Others haven& #39;t thought about this. I have no competition here.

This probably would get a healthcare-typical multiple and create lots of wealth, too.

Opportunity = Others haven& #39;t thought about this. I have no competition here.

Also: Assume that if there& #39;s really a circle between healtgcare insurance & smartwatches, - not sure if the Chinese will accept FitBit for that. The Chinese FDA will probably prefer a Chinese company. So, that actually decreases Huami& #39;s competition. Huami is nr 5/6 worldwide rn.

Thus, the competition might be smaller than expected. Let& #39;s assume 3 different other Chinese competitors. Let& #39;s assume Huami gets 250mn users with kickbacks. Would need $5.8 in revenue at 40% margins per year to get to $580mn profit.

RMB 3.38 revenue per month is reasonable...

RMB 3.38 revenue per month is reasonable...

I really would prefer if you wouldn& #39;t even quote me on those numbers. It& #39;s a feature. Being VERY rough greatly simplifies and protects. No need for a DCF when I& #39;m 10% right.

It shouldn& #39;t matter if it& #39;s a $50mn or a $700mn opportunity. What matters to me: I& #39;m paying PE of ~6 NOW.

It shouldn& #39;t matter if it& #39;s a $50mn or a $700mn opportunity. What matters to me: I& #39;m paying PE of ~6 NOW.

I& #39;m paying in my opinion very little for any potential positive outcome close to my very abstract thoughts here.

If Huami makes $100mn a year for 3y and nothing else happens and their positioning stays constant, that& #39;s 42% upside from $700mn to $1bn mcap. = >12.6% 3y CAGR...

If Huami makes $100mn a year for 3y and nothing else happens and their positioning stays constant, that& #39;s 42% upside from $700mn to $1bn mcap. = >12.6% 3y CAGR...

More interesting is viewing it this way:

Let& #39;s assume China& #39;s healthcare costs at 6% of GDP of $14tn, that is: $840bn.

Let& #39;s assume that a smartwatch-based health insurance incentive/nudging system can decrease this by 2% or $16.8bn.

How much capture am I assuming for Huami?

Let& #39;s assume China& #39;s healthcare costs at 6% of GDP of $14tn, that is: $840bn.

Let& #39;s assume that a smartwatch-based health insurance incentive/nudging system can decrease this by 2% or $16.8bn.

How much capture am I assuming for Huami?

If I& #39;d assume that Huami captures 1% of the 2% saved of the 6% of $14tn GDP, that& #39;s $168mn in revenue, or $67.2mn net income at 40% margins.

If that happens in 5y, at a PE of 20, Huami will be more than a triple.

Your job:

Find ideas with huge optionality and pay very little.

If that happens in 5y, at a PE of 20, Huami will be more than a triple.

Your job:

Find ideas with huge optionality and pay very little.

...One gets good growth+profit outlook for free.

One gets two years of successful execution for free. Now arguably less risky vs 2y ago.

Wonderful balance sheet.

Wang Huang is a 43 year old Founder CEO with ~36% ownership!

Xiaomi is an investor with ~14.8% ownership.

One gets two years of successful execution for free. Now arguably less risky vs 2y ago.

Wonderful balance sheet.

Wang Huang is a 43 year old Founder CEO with ~36% ownership!

Xiaomi is an investor with ~14.8% ownership.

For all those reasons, Huami is a 0.5% position in my portfolio.

I think I can see the future here.

Unfortunately, I just am not sure if it& #39;s really Huami capturing the data flywheel opportunity in the irreversible linking of China& #39;s healthcare system with smart wearables.

I think I can see the future here.

Unfortunately, I just am not sure if it& #39;s really Huami capturing the data flywheel opportunity in the irreversible linking of China& #39;s healthcare system with smart wearables.

I wrote about this 20.11.2019, disclosing I& #39;m long. Closing price that day: $10.41.

Company released this 06.12.2019: https://www.sec.gov/Archives/edgar/data/1720446/000119312519307646/d825912dex991.htm">https://www.sec.gov/Archives/... -

Can recommend to read this press release. Shows they& #39;re smart.

Price EOY 2019: ~$11.98.

Company released this 06.12.2019: https://www.sec.gov/Archives/edgar/data/1720446/000119312519307646/d825912dex991.htm">https://www.sec.gov/Archives/... -

Can recommend to read this press release. Shows they& #39;re smart.

Price EOY 2019: ~$11.98.

Google bought Fitbit for ~$2.1bn.

Facebook bought CTRL-Labs.

Huami? Nobody cares. Yet! Almost always the same. People usually buy things when everybody pitches the same ideas, it& #39;s blatantly obvious. That& #39;s simply how most humans function. Little risk of going alone.

Facebook bought CTRL-Labs.

Huami? Nobody cares. Yet! Almost always the same. People usually buy things when everybody pitches the same ideas, it& #39;s blatantly obvious. That& #39;s simply how most humans function. Little risk of going alone.

That& #39;s perfectly fine. But there& #39;s hardly a chance for outperformance if you only buy things because X, Y and Z already bought it. (not soliciting anything, just reflecting on psychology)

If you want the best, you have to lead, thus you have to read.

If you want the best, you have to lead, thus you have to read.

I mean, to those that read this (~500 people according to my Twitter stats) - what& #39;s your response? How do you act upon such information like the press release? How do you estimate chances of success? Why isn& #39;t this an appropriately sized part of your portfolio?

By the way, YouTube Originals has produced a series called The Age of AI. four episodes right now, three of them are available for all, 4th with YT Premium.

Imho it& #39;s gross neglect to not watch this.

It perfectly sets the tone for the 2020s.

Big theme is tech + AI + healthcare.

Imho it& #39;s gross neglect to not watch this.

It perfectly sets the tone for the 2020s.

Big theme is tech + AI + healthcare.

Also love this by Huami Founder Huang Wang:

"Mr. Huang believes smart watches are more than a simple duplication or replacement of smartphones; they are a much more powerful and revolutionary product, with wider healthcare functionalities that are not offered by smartphones."

"Mr. Huang believes smart watches are more than a simple duplication or replacement of smartphones; they are a much more powerful and revolutionary product, with wider healthcare functionalities that are not offered by smartphones."

Statements like this highlight why I love Chinese entrepreneurs& #39; spirit. I love the energy, I love the ambitions. Who else is basically telling you that healthcare is 6x the size of smartphones and that they will try to tackle this market?

There& #39;s no failure in trying.

There& #39;s no failure in trying.

Because now it& #39;s more clear to me that this company is not a dumb hardware manufacturer but knows about its historic opportunity, and because I spent some time studying healthcare + AI since 20.11.19, I will increase my position above 0.5% in the next days.

Do your own work!

Do your own work!

I think from what& #39;s currently known, e.g. wonderful balance sheet, profitable, growing, arguably low valuation based on hardware alone - over time this could get rerated as a "medical device" play, get >45x PE etc.

Most investments don& #39;t even have a path to 10x. This does.

Most investments don& #39;t even have a path to 10x. This does.

By the way, you have to realize that those typically juicy medical device valuations could be EVEN BETTER with software / AI.

2020 thinking:

Software / AI as a medical device, just with even better distribution.

2020 thinking:

Software / AI as a medical device, just with even better distribution.

Huami / $HMI with another press release today:

https://finance.yahoo.com/news/huami-corporation-ceo-issues-open-103000117.html

Based">https://finance.yahoo.com/news/huam... on my 28 months of investing experience, if you have CEOs operating in China that communicate in letters, that& #39;s very good. Examples: $JD, $PDD, China Meidong ($1268.HK, no position, but see VIC post)

https://finance.yahoo.com/news/huami-corporation-ceo-issues-open-103000117.html

Based">https://finance.yahoo.com/news/huam... on my 28 months of investing experience, if you have CEOs operating in China that communicate in letters, that& #39;s very good. Examples: $JD, $PDD, China Meidong ($1268.HK, no position, but see VIC post)

...People don& #39;t read. From experience: even when you study philosophy in university, only the top 10% truly read.

Reading means studying texts as if it was the truest form of the bible.

So if you read press releases, I think that& #39;s already above average.

Reading means studying texts as if it was the truest form of the bible.

So if you read press releases, I think that& #39;s already above average.

Once you& #39;ve researched a company, it& #39;s obvious who hasn& #39;t done much work.

E.g. I cloned $FCAU based on other people& #39;s work. Learning not to lose = good start. :/

Now I see the momentum crowd owning $LVGO en masse. They haven& #39;t done the work. Long-term risky to rely on others...

E.g. I cloned $FCAU based on other people& #39;s work. Learning not to lose = good start. :/

Now I see the momentum crowd owning $LVGO en masse. They haven& #39;t done the work. Long-term risky to rely on others...

That& #39;s why I LOVE when I& #39;m working on my own and simply don& #39;t have any competition. At this point in time, writing about tickers is a double-edged sword. Not writing about something is very powerful as well, because you can gauge if a name is spreading. See $LVGO. I worked alone.

That& #39;s why $HMI is feeling quite comfortable so far. Judging by searching for the ticker, it just seems I& #39;m the only one discussing it from a fundamental perspective.

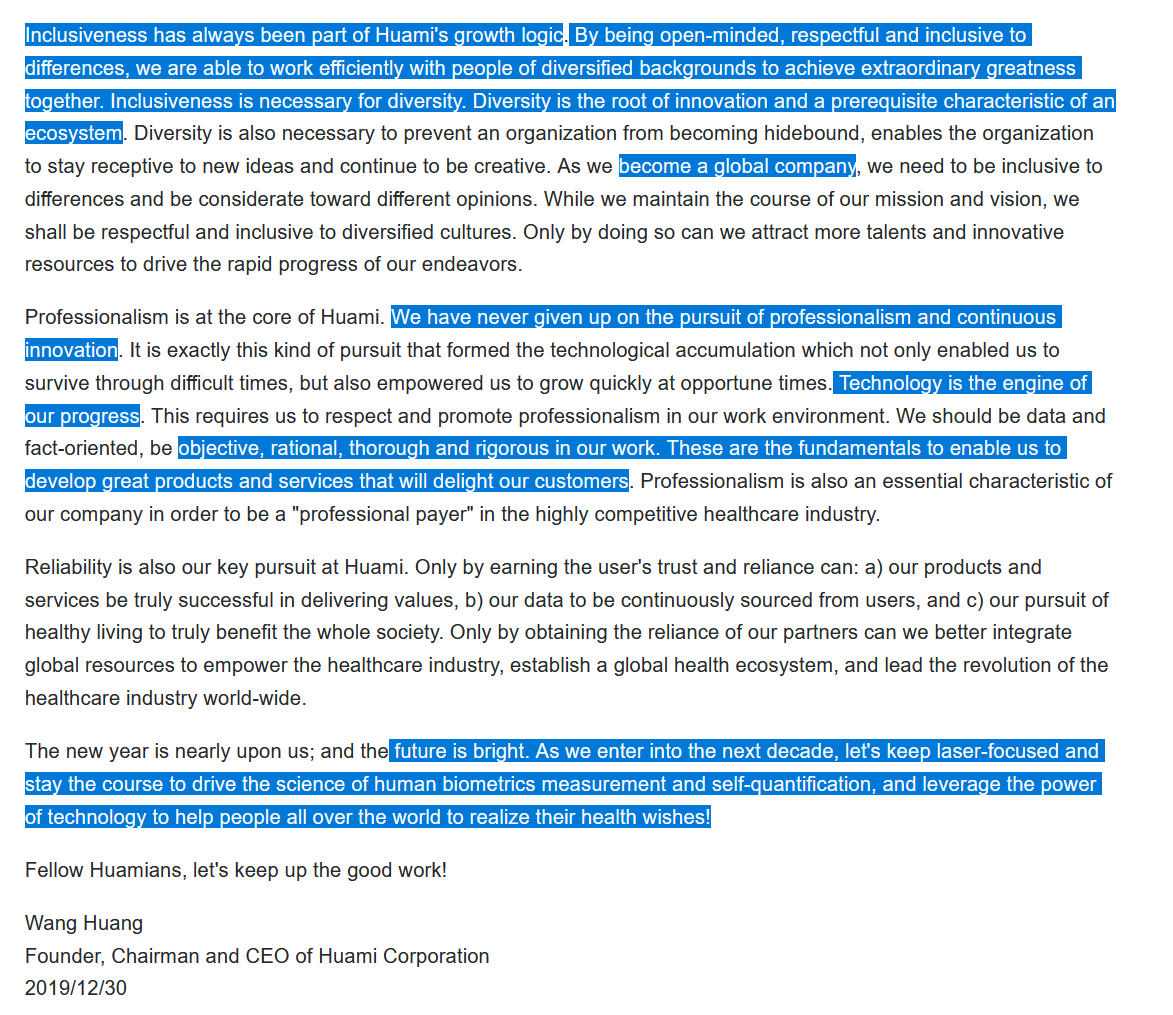

So, let& #39;s check out what Founder CEO Wang Huang wrote recently:

So, let& #39;s check out what Founder CEO Wang Huang wrote recently:

In my opinion, this is some A level writing.

Nothing further to add.

And keep in mind that Huami didn& #39;t get much respect in the two years it& #39;s been public. It& #39;s very affordable even if you treat it as a commodity hardware manufacturer.

Nothing further to add.

And keep in mind that Huami didn& #39;t get much respect in the two years it& #39;s been public. It& #39;s very affordable even if you treat it as a commodity hardware manufacturer.

Investing is simple. I don& #39;t model Huami at all. I just use common-sense. Chinese ADRs trade in strong correlation just how much their trust batteries are loaded. E.g. the market doesn& #39;t trust $YY very much. But Huami, by communicating well, has loaded MY trust battery.

This is because I& #39;m not able to come up with a smarter way to think about what I would do if I were in their position. I would literally try to do the same thing that Huami is doing. I fully support that vision of the future. I& #39;m absolutely aligned with their great ambitions.

That& #39;s why I will be able to hold this, too.

Huami looks like a company version of myself that& #39;s much more capable and experienced, etc.

I admire this open letter.

I& #39;m only the simple investor, abstractly reading this and owning shares.

They& #39;re doing what I only dream of.

Huami looks like a company version of myself that& #39;s much more capable and experienced, etc.

I admire this open letter.

I& #39;m only the simple investor, abstractly reading this and owning shares.

They& #39;re doing what I only dream of.

Of course I& #39;m trying to be the very best investor I could possibly be. But I have soft spots. I do take short-cuts.

This is one of them:

How many CEOs do you know that quote Alan Kay?

(pls tell me about them!)

This is one of them:

How many CEOs do you know that quote Alan Kay?

(pls tell me about them!)

If you are a Chinese "small cap" CEO and you quote me Alan Kay, a true genius even among geniuses, that& #39;s simply very unusal.

And I know unusual.

Now what a normal retail person might do is put in 20% of their money into this. Might work.

I& #39;m ultra-conservative. I go with 1%.

And I know unusual.

Now what a normal retail person might do is put in 20% of their money into this. Might work.

I& #39;m ultra-conservative. I go with 1%.

1% because I love to learn about so many other things, too.

No way I will be in the top 1% in regard to knowledge here, too.

So far, this style has worked for me. I know when I know solidly above average... I mean I& #39;m 100% an armchair investor without boots on the ground, so far.

No way I will be in the top 1% in regard to knowledge here, too.

So far, this style has worked for me. I know when I know solidly above average... I mean I& #39;m 100% an armchair investor without boots on the ground, so far.

I& #39;m doing China-US arbitrage since two years now. I am long $LVGO and $HMI and my above avg knowledge about each name gives me a bigger advantage: I truly know I& #39;m surfing something bigger.

Because I know I& #39;m surfing, now I "only" have to focus on catching the right waves.

Because I know I& #39;m surfing, now I "only" have to focus on catching the right waves.

...Do your own due diligence. I don& #39;t solicitate anything.

You& #39;re radically and absolutely responsible for anything in your life.

I& #39;m writing this for the connaisseurs that have fun with investing as an audacious intellectual activity.

It& #39;s fun, regardless of the outcome.

You& #39;re radically and absolutely responsible for anything in your life.

I& #39;m writing this for the connaisseurs that have fun with investing as an audacious intellectual activity.

It& #39;s fun, regardless of the outcome.

Just like smartphones have "eaten" the discman, recorder, camera, notepad etc, smartwatches& #39; pulse sensors did the same to blood pressure meters thanks to machine learning.

This is medtech for all.

Everyone aware that this also tackles arteriosclerosis & hypertension?

This is medtech for all.

Everyone aware that this also tackles arteriosclerosis & hypertension?

1. Not the dumb devices of the past. Distinct unique qualities that your smartphone doesn& #39;t have.

2. Think about the eldery. Thanks to ML you know in advance how a graph looks like that e.g. means incoming clogging of artery. Those watches are cheap & valuable. -> Mass adoption.

2. Think about the eldery. Thanks to ML you know in advance how a graph looks like that e.g. means incoming clogging of artery. Those watches are cheap & valuable. -> Mass adoption.

Imagine lots of people would wear devices that could measure temperature, blood pressure, pulse, blood flow, movement etc.

Would enable early detection of viral symptoms, especially in clusters.

Dystopian? Maybe.

Personally I& #39;m happy to feed AIs with my data for health reasons.

Would enable early detection of viral symptoms, especially in clusters.

Dystopian? Maybe.

Personally I& #39;m happy to feed AIs with my data for health reasons.

GAAP earnings last 2Qs is $0.9 per ADS.

R&D 3Q19 was $17.4mn, now $20.1mn in 4Q19.

Think owning a company for ~$832mn mcap (~64mn ADS * $13 share price yesterday) that spends ~$80mn/y on R&D that just made ~$60mn net income last two Q whilst having $259mn net cash on BS is fine.

R&D 3Q19 was $17.4mn, now $20.1mn in 4Q19.

Think owning a company for ~$832mn mcap (~64mn ADS * $13 share price yesterday) that spends ~$80mn/y on R&D that just made ~$60mn net income last two Q whilst having $259mn net cash on BS is fine.

Wondering about the future. If most people wore smart watches, I bet we could simply have live maps where e.g. sudden fever clusters would be visible.

Stopping virus spread is easiest when it& #39;s detected early.

Smart watches are the only device that can do this detection.

Stopping virus spread is easiest when it& #39;s detected early.

Smart watches are the only device that can do this detection.

During coronavirus, we re-learn that we& #39;re all connected anyway, always have been.

Thus, global connected healthcare AI platforms are simply the answer to an old existing problem.

Technically, we can do this now.

Smart watches are eletronic herd immunity.

Thus, global connected healthcare AI platforms are simply the answer to an old existing problem.

Technically, we can do this now.

Smart watches are eletronic herd immunity.

This time, masks have been the symbol of "I care about the virus".

Inherent to the realm of the symbol is some part of failure.

Smart watches to me look like an improvement to masks.

You show you care by being part of the general healthcare AI platforms, and it is effective.

Inherent to the realm of the symbol is some part of failure.

Smart watches to me look like an improvement to masks.

You show you care by being part of the general healthcare AI platforms, and it is effective.

Wouldn& #39;t rule it out that everyone in China wears such a "health watch" mid-term because it& #39;s the link between collective and individual health.

Might also mark a cultural shift: China as a leader in healthcare platforms that need cloud sync between individual and collective.

Might also mark a cultural shift: China as a leader in healthcare platforms that need cloud sync between individual and collective.

Just take the word "watch".

We use this word, but its meaning "watching" was disconnected to the underlying device, the clock.

Ironically, this old word "watch" will be 100% "in sync" again with contemporary time & world.

Smart health watches are literally "watching" over you.

We use this word, but its meaning "watching" was disconnected to the underlying device, the clock.

Ironically, this old word "watch" will be 100% "in sync" again with contemporary time & world.

Smart health watches are literally "watching" over you.

One could take "watch" so literal, it& #39;d look silly in a Cyberpunk novel...

But this "watch", a health connection smart _watch_ device linking individual and collective (for positive spiral in health problem detection via AI) seems to be the most logical future, esp for China.

But this "watch", a health connection smart _watch_ device linking individual and collective (for positive spiral in health problem detection via AI) seems to be the most logical future, esp for China.

Also, what will be the cost of the Coronavirus disruption? It& #39;s trillions already, wouldn& #39;t be shocked if it& #39;s one order higher. But who knows? I have zero competence in estimating this anyway.

(Might be negatively biased by my recent abysmal portfolio returns, to be honest...)

(Might be negatively biased by my recent abysmal portfolio returns, to be honest...)

Let& #39;s assume smart watches will become a cultural must-have, a social attribute of caring for the collective.

Even 100mn devices a year at $40 per device = $4bn hardware revenue opportunity alone.

Sure, I& #39;m early. But love to buy optionality cheaply, $HMI fits very well...

Even 100mn devices a year at $40 per device = $4bn hardware revenue opportunity alone.

Sure, I& #39;m early. But love to buy optionality cheaply, $HMI fits very well...

What I would love to see is that Huami as a company is conscious about its opportunity and markets accordingly. Should be a strong sales pitch for them.

Thesis risk is that Huami never gets into non-hardware revenues. Nicely profitable hardware now, but commoditization risk...

Thesis risk is that Huami never gets into non-hardware revenues. Nicely profitable hardware now, but commoditization risk...

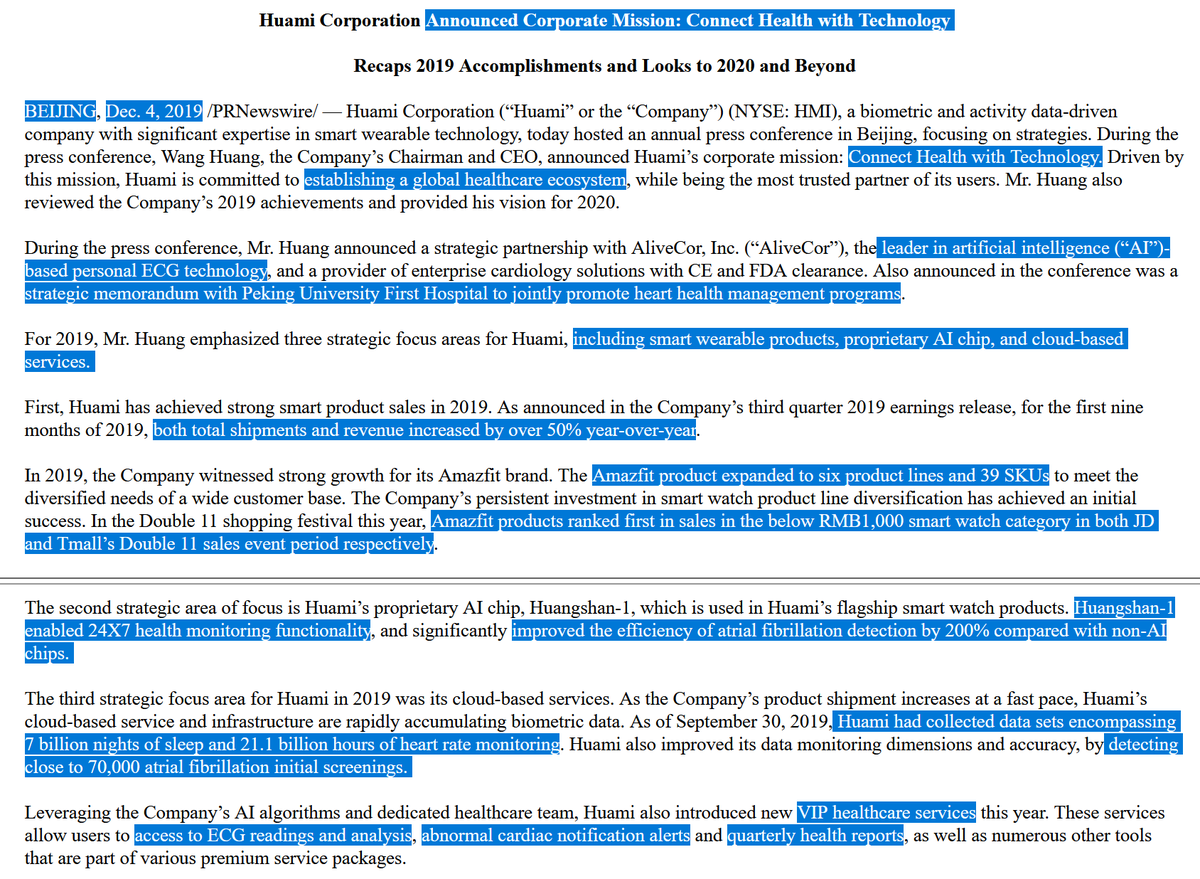

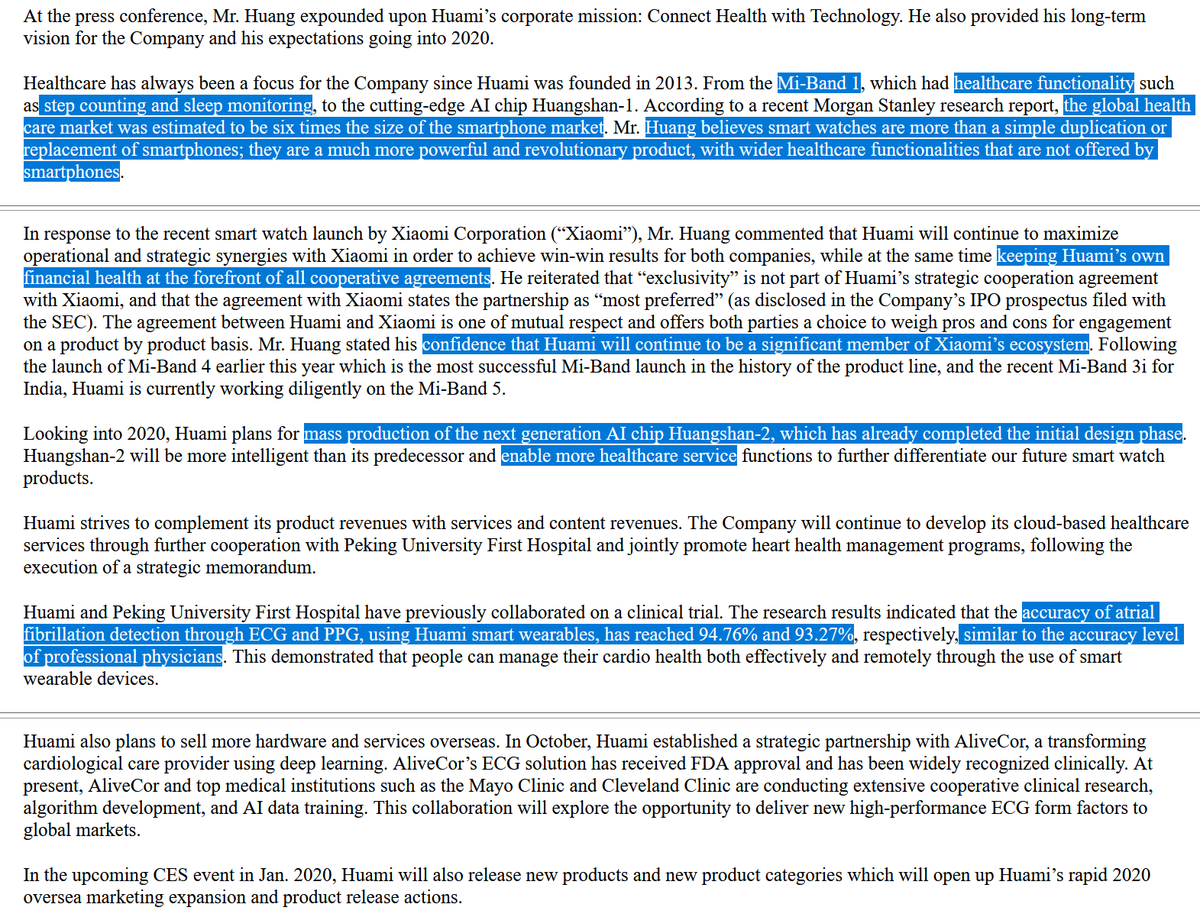

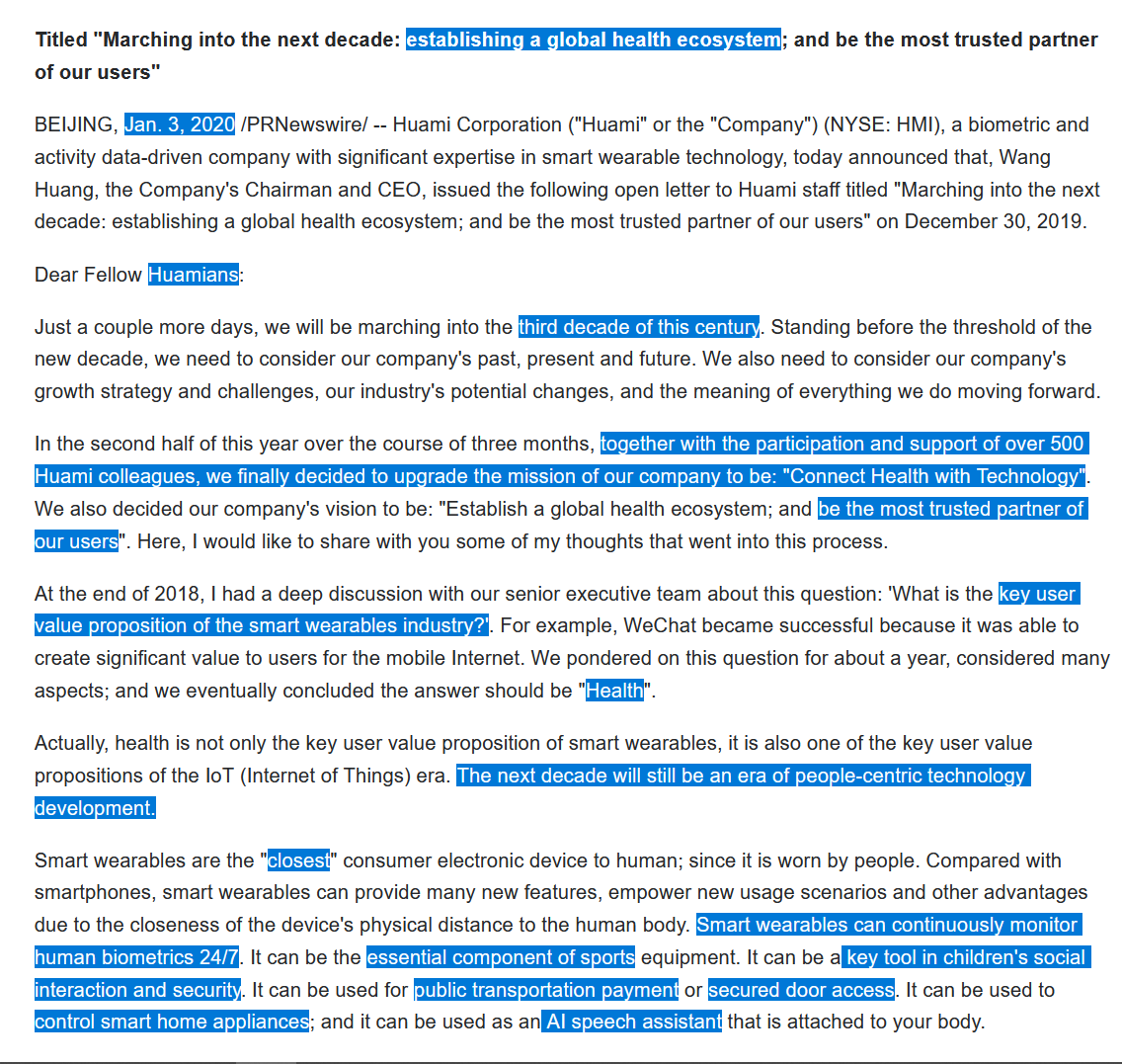

favorite parts & sentences of 4Q $HMI coms:

"we are working on such a product [with a body temperature sensor] right now, yes."

"currently building an infectious disease prediction system"

"cloud based healthcare services"

Consequence: Huami hasn& #39;t sold off at all lately.

"we are working on such a product [with a body temperature sensor] right now, yes."

"currently building an infectious disease prediction system"

"cloud based healthcare services"

Consequence: Huami hasn& #39;t sold off at all lately.

"Bracelets" I imagined this before Corona even happened: https://mobile.twitter.com/BillAckman/status/1246871980160229376

Corona">https://mobile.twitter.com/BillAckma... is the special case that helps the general case of "health watches". Future got pulled forward. Hope Huami team knows about their historic opportunity to fight future viruses where they spawn.

Corona">https://mobile.twitter.com/BillAckma... is the special case that helps the general case of "health watches". Future got pulled forward. Hope Huami team knows about their historic opportunity to fight future viruses where they spawn.

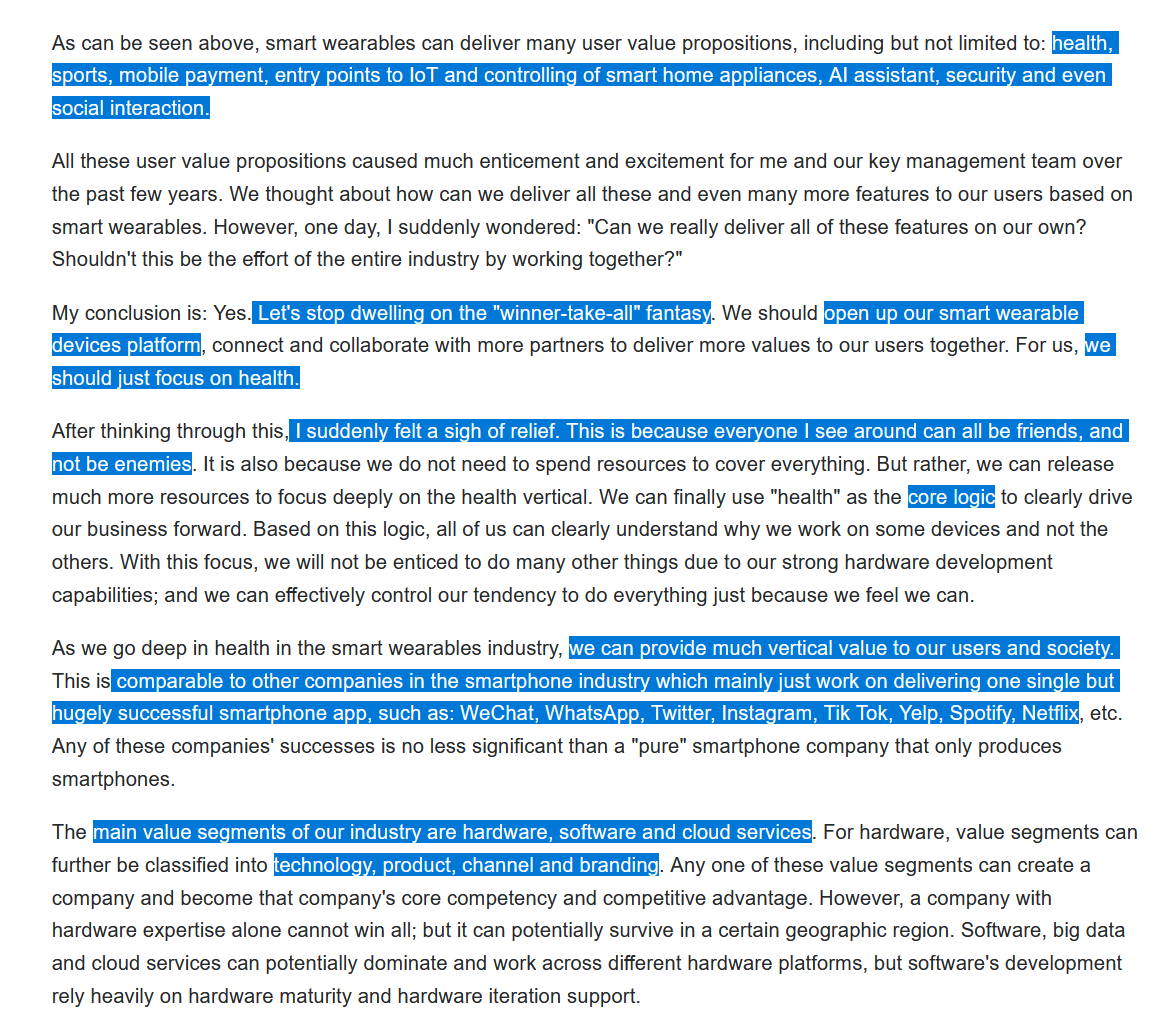

https://en.amazfit.com/about.html

"[]">https://en.amazfit.com/about.htm... recorded a cumulative 81.2[tn] steps, a [] sleep record of 7[bn] nights, [] heart rate records of 21.1[bn h], and 14,890,000 ECG electrocardiogram[s], thereby detecting nearly 70[k] cases of suspected or preliminarily screened out atrial fibrillation."

"[]">https://en.amazfit.com/about.htm... recorded a cumulative 81.2[tn] steps, a [] sleep record of 7[bn] nights, [] heart rate records of 21.1[bn h], and 14,890,000 ECG electrocardiogram[s], thereby detecting nearly 70[k] cases of suspected or preliminarily screened out atrial fibrillation."

If this company was seen as a medical device company that can help with >>10k yearly cases of atrial fibrillation alone, $HMI is probably worth more than a single digit earnings multiple.

(Not that I care about short-term price upside, just updating my thesis: It& #39;s on track)

(Not that I care about short-term price upside, just updating my thesis: It& #39;s on track)

Also listened to a podcast with @balajis on @farnamstreet recently.

China& #39;s future Great Viruswall will probably look like how I imagined it earlier: lots of smart devices that monitor your health status.

Continue to believe that my $HMI investment was prescient & anti-fragile.

China& #39;s future Great Viruswall will probably look like how I imagined it earlier: lots of smart devices that monitor your health status.

Continue to believe that my $HMI investment was prescient & anti-fragile.

The world has formed around my $HMI investment.

Future got pulled forward by many years. Probably just a matter of some years now until essentially every Chinese person will use Huami or equivalents. Huami is very, very well positioned for this opportunity to say the least.

Future got pulled forward by many years. Probably just a matter of some years now until essentially every Chinese person will use Huami or equivalents. Huami is very, very well positioned for this opportunity to say the least.

Newer devices will come with temperature measurement. Combined with AI, Huami can detect virus spread & resurgence.

Viewed from the perspective of the system as a whole, Huami may be the lowest cost solution WHILST having a big impact in their capability to detect viruses early.

Viewed from the perspective of the system as a whole, Huami may be the lowest cost solution WHILST having a big impact in their capability to detect viruses early.

Huami has many shots on goal for recurring revenue. See my rough math earlier in this thread. But Corona is the specific reason to gain a foothold & expand medical use cases from there.

Probability of _mandatory_ Huami adoption? No matter the input, it& #39;s probably not priced in.

Probability of _mandatory_ Huami adoption? No matter the input, it& #39;s probably not priced in.

Of course, it& #39;s not only about Corona. Detecting tens of thousands of cases of atrial fibrillation is huge in itself. I have little doubt that there will be many, many other useful medical cases thanks to AI + better sensors.

Corona was/is the catalyst for future mass adoption.

Corona was/is the catalyst for future mass adoption.

I think the market continues to wrongly view $HMI as some toy electronic manufacturer instead of a med tech company that& #39;s potentially going to save >>10k lives from various illnesses, with decades of iteration in front of them with patriotic & semi-mandatory adoption near term.

I& #39;ve told you to study $LVGO here on 20.11.2019. Hope y& #39;all DYODD & bought the Corona+lockup expiry dip (long from <$22). Another example why I& #39;m calm about investing during Corona. Of course, I didn& #39;t anticipate specifics, but companies like these were/are inevitables generally.

Inevitable companies are those that, during times of crisis, get pulled forward.

This is because they feel inevitable in the first place. It& #39;s just that before a crisis, there are some factors why the mainstream is hesitant.

E.g. $HMI: "Why should everyone wear it? Privacy!!!"

This is because they feel inevitable in the first place. It& #39;s just that before a crisis, there are some factors why the mainstream is hesitant.

E.g. $HMI: "Why should everyone wear it? Privacy!!!"

In the past I would have had to argue why adoption would happen. Now I just don& #39;t have to argue anymore. If $HMI can detect viruses "early" by measuring temperature & e.g. AI mapping of abnormal distribution of fevers, there just won& #39;t be a discussion.

Reality argues. Inevitably.

Reality argues. Inevitably.

Thus, if you believe a company is inevitable, then you should be able to come up with reasons why they could get pulled forward in time.

Thinking about inevitable companies enables you to think about potential sources of crisis, too.

Thinking about inevitable companies enables you to think about potential sources of crisis, too.

Read on Twitter

Read on Twitter

![favorite parts & sentences of 4Q $HMI coms: "we are working on such a product [with a body temperature sensor] right now, yes.""currently building an infectious disease prediction system""cloud based healthcare services"Consequence: Huami hasn& #39;t sold off at all lately. favorite parts & sentences of 4Q $HMI coms: "we are working on such a product [with a body temperature sensor] right now, yes.""currently building an infectious disease prediction system""cloud based healthcare services"Consequence: Huami hasn& #39;t sold off at all lately.](https://pbs.twimg.com/media/ETCAGotWkAAASL9.png)

![favorite parts & sentences of 4Q $HMI coms: "we are working on such a product [with a body temperature sensor] right now, yes.""currently building an infectious disease prediction system""cloud based healthcare services"Consequence: Huami hasn& #39;t sold off at all lately. favorite parts & sentences of 4Q $HMI coms: "we are working on such a product [with a body temperature sensor] right now, yes.""currently building an infectious disease prediction system""cloud based healthcare services"Consequence: Huami hasn& #39;t sold off at all lately.](https://pbs.twimg.com/media/ETCAYn_XYAMFwiy.png)

![favorite parts & sentences of 4Q $HMI coms: "we are working on such a product [with a body temperature sensor] right now, yes.""currently building an infectious disease prediction system""cloud based healthcare services"Consequence: Huami hasn& #39;t sold off at all lately. favorite parts & sentences of 4Q $HMI coms: "we are working on such a product [with a body temperature sensor] right now, yes.""currently building an infectious disease prediction system""cloud based healthcare services"Consequence: Huami hasn& #39;t sold off at all lately.](https://pbs.twimg.com/media/ETCAaxhWkAAEO6D.png)

![favorite parts & sentences of 4Q $HMI coms: "we are working on such a product [with a body temperature sensor] right now, yes.""currently building an infectious disease prediction system""cloud based healthcare services"Consequence: Huami hasn& #39;t sold off at all lately. favorite parts & sentences of 4Q $HMI coms: "we are working on such a product [with a body temperature sensor] right now, yes.""currently building an infectious disease prediction system""cloud based healthcare services"Consequence: Huami hasn& #39;t sold off at all lately.](https://pbs.twimg.com/media/ETCAbs_XQAAE7Vc.png)

![https://en.amazfit.com/about.htm... recorded a cumulative 81.2[tn] steps, a [] sleep record of 7[bn] nights, [] heart rate records of 21.1[bn h], and 14,890,000 ECG electrocardiogram[s], thereby detecting nearly 70[k] cases of suspected or preliminarily screened out atrial fibrillation." https://en.amazfit.com/about.htm... recorded a cumulative 81.2[tn] steps, a [] sleep record of 7[bn] nights, [] heart rate records of 21.1[bn h], and 14,890,000 ECG electrocardiogram[s], thereby detecting nearly 70[k] cases of suspected or preliminarily screened out atrial fibrillation."](https://pbs.twimg.com/media/EVcGhejXgAAyZ3y.png)