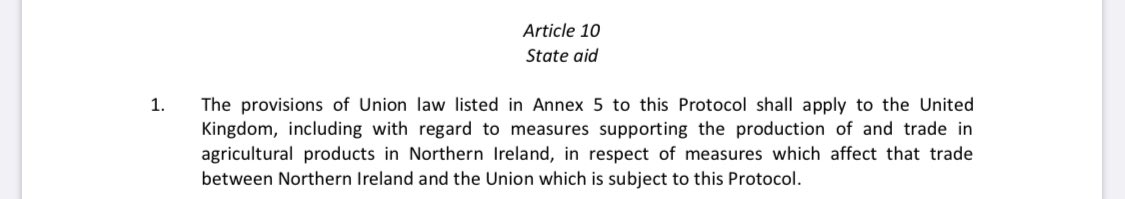

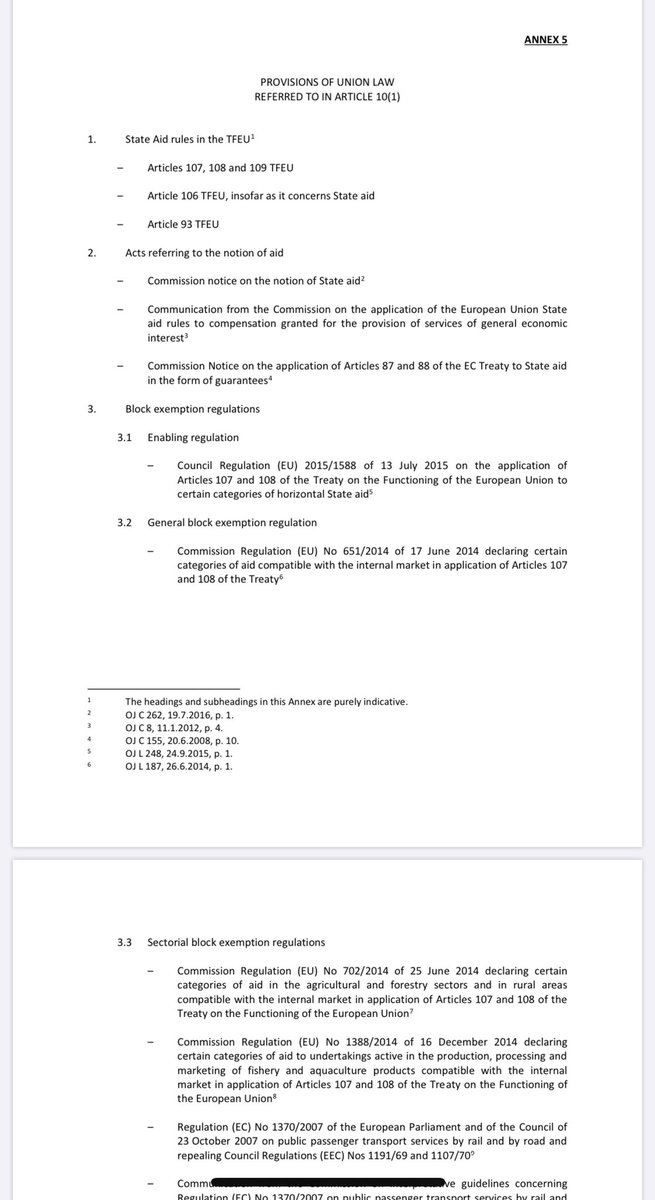

An under-reported aspect of the new NI protocol. Article 10 and Annex 5 apply the full panoply of EU State aid rules (the law; its application by the Commission and ECJ; enforceability in the UK courts) to *the United Kingdom* in perpetuity.

The only condition is that the measure at issue is one that affects trade in goods between NI and the EU27.

This is a low threshold. A UK-wide tax measure applying to NI as to the rest of the UK (reduced VAT for widgets; a corporation tax break for widget-makers) would be above that threshold and caught by EU State aid rules.

A grant to a widget-making business headquartered in Birmingham with any branch or sales activity in NI would also be likely to be caught.

“Caught” here means “quite likely to be invalid unless within the terms of an EU exemption or approved in advance by the Commission.”

Even if the Commission chooses not to act, these rules will remain enforceable in national courts. Whatever UK law may otherwise say: see clause 5 of the Withdrawal Agreement Bill.

So the UK has, under Johnson’s deal, “escaped” EU State aid rules only in the sense in which a prisoner who has got most of his body out of his cell window but still has his foot chained to the floor can be said to have “escaped”.

Read on Twitter

Read on Twitter