A brief outline of Mailpac& #39;s prospectus:

contributed by @guruintraining_.

FOR INFO PURPOSES ONLY.

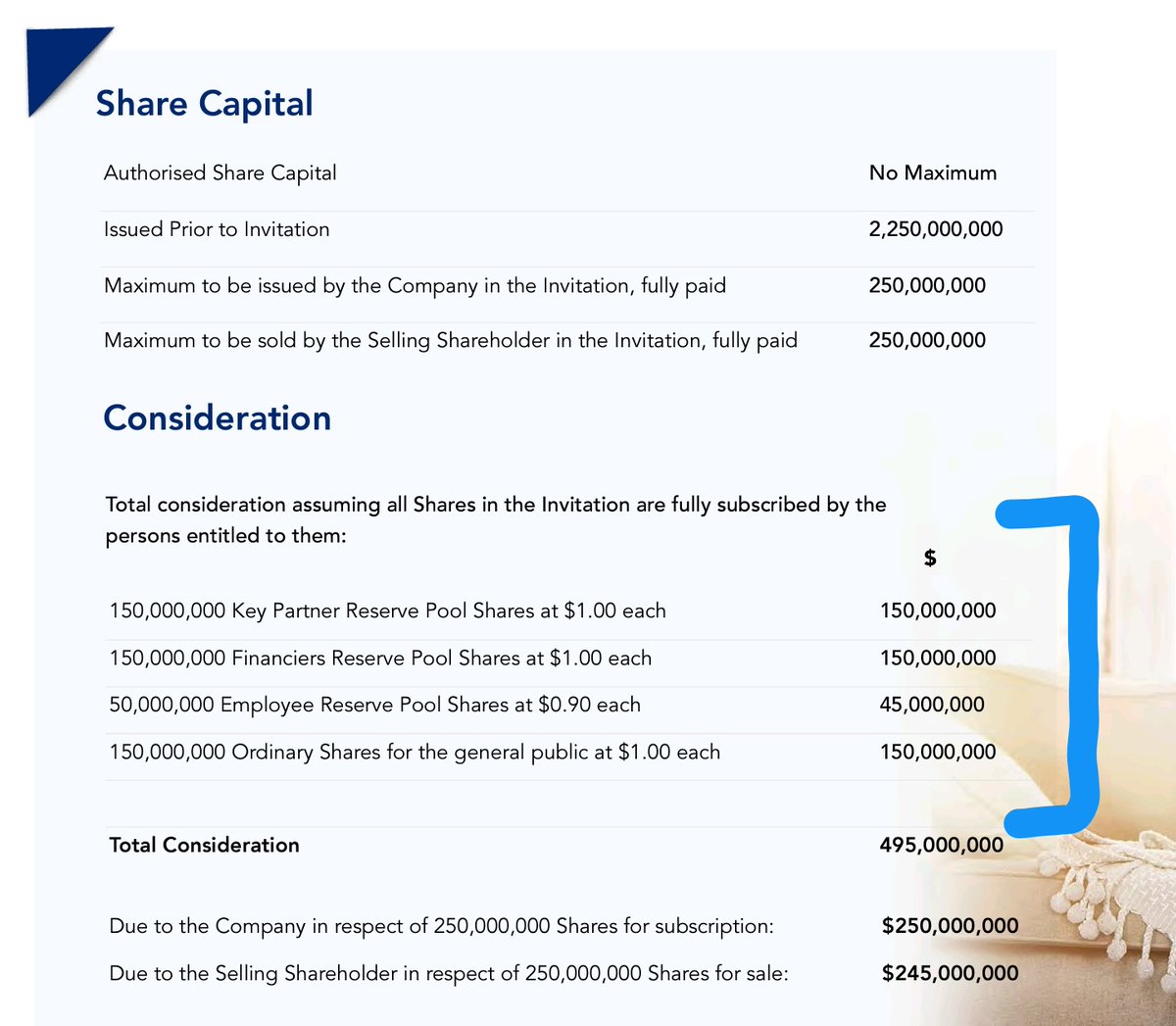

Mailpac Group Limited (MGL) intends to come to the market to raise $495M through issuing 500M shares to investors.

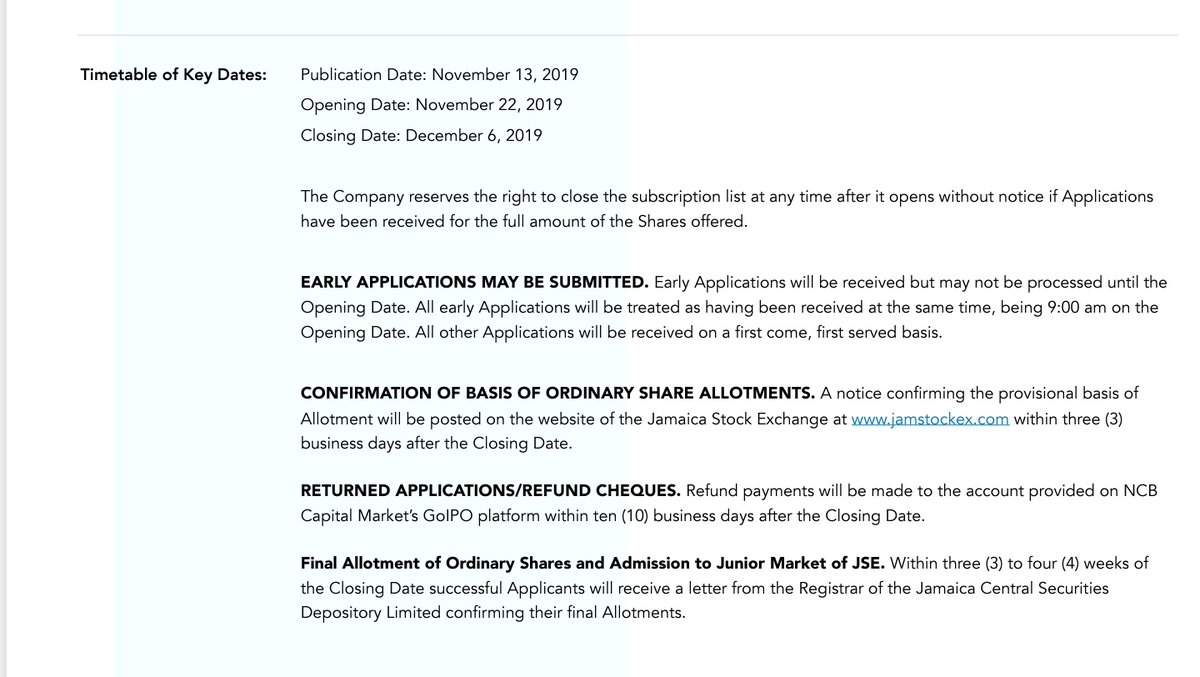

The offer opens on the 22nd at a share price of $1.00.

contributed by @guruintraining_.

FOR INFO PURPOSES ONLY.

Mailpac Group Limited (MGL) intends to come to the market to raise $495M through issuing 500M shares to investors.

The offer opens on the 22nd at a share price of $1.00.

Breakdown of share invitation can be seen below. Only 30% of the shares being sold will go to the general public. That& #39;s $150M to be split being thousands of potential investors who were anticipating this. If participation is high, allocations are likely to be low.

The offer opens on the 22nd of November. But as per usual, if you do decide to invest you& #39;ll need to apply prior because as stated the amount being raised is relatively low compared to possible interest.

Minimum units is 10,000.

Minimum units is 10,000.

What does Mailpac do?

- MGL& #39;s core business is shipping goods for customers from overseas, clearing them at customs and delivering through various means.

-Online shopping platform, Mailpac Marketplace

-Ocean Freight for large packages

-local online shopping, Mailpac Local

- MGL& #39;s core business is shipping goods for customers from overseas, clearing them at customs and delivering through various means.

-Online shopping platform, Mailpac Marketplace

-Ocean Freight for large packages

-local online shopping, Mailpac Local

The company is proposing a healthy dividend policy. 75% of net profits as long as MGL doesn& #39;t need the cash for reinvestment.

Important stat that was pointed out:

In 2010, when NCIC (predecessor of Norbrook Equity Partners) acquired Mailpac Services Limited, there were approx 6 providers that would clear goods at the NMIA on behalf of online shoppers. Today, there are approx 60.

My thoughts at d end.

In 2010, when NCIC (predecessor of Norbrook Equity Partners) acquired Mailpac Services Limited, there were approx 6 providers that would clear goods at the NMIA on behalf of online shoppers. Today, there are approx 60.

My thoughts at d end.

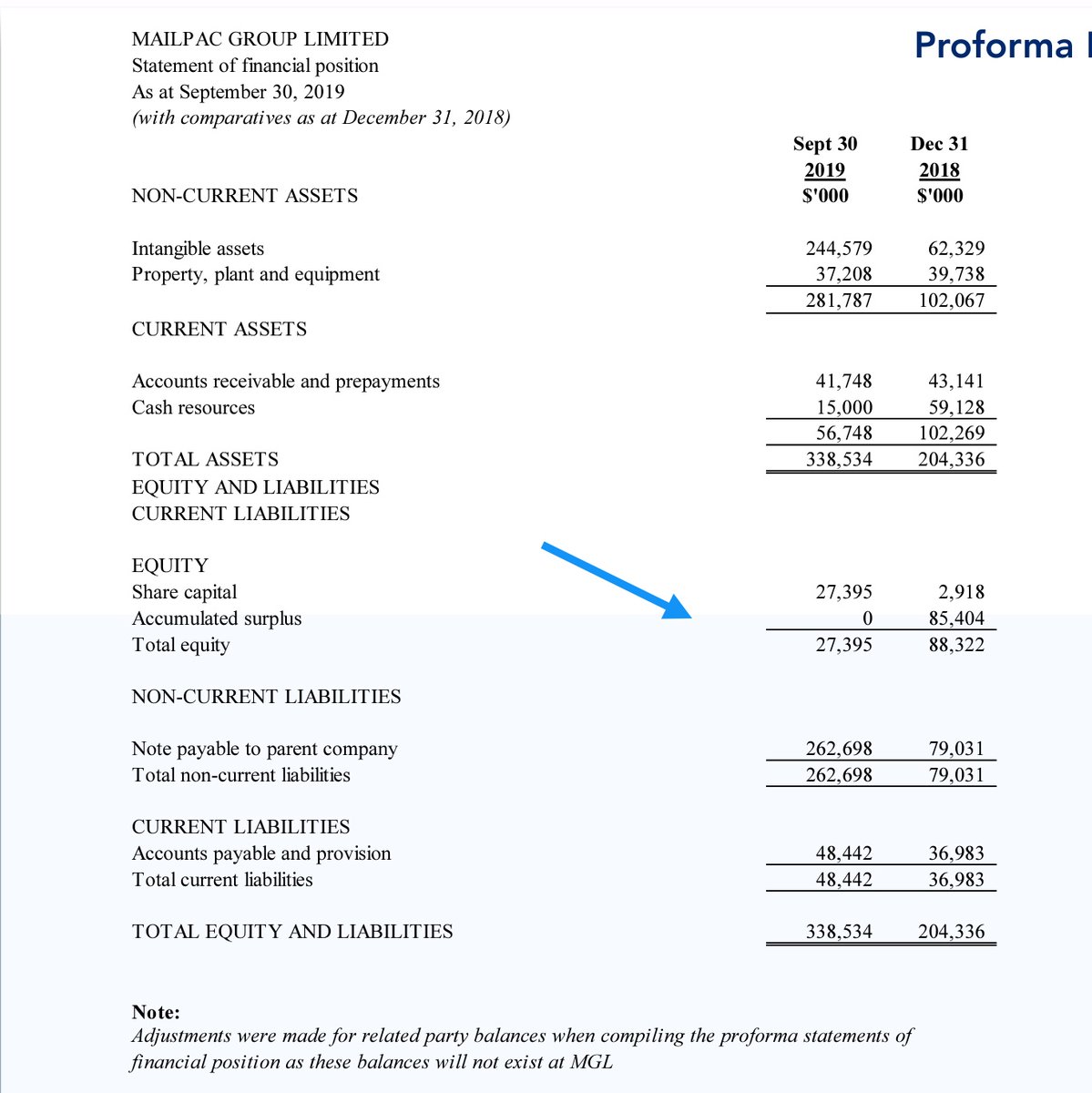

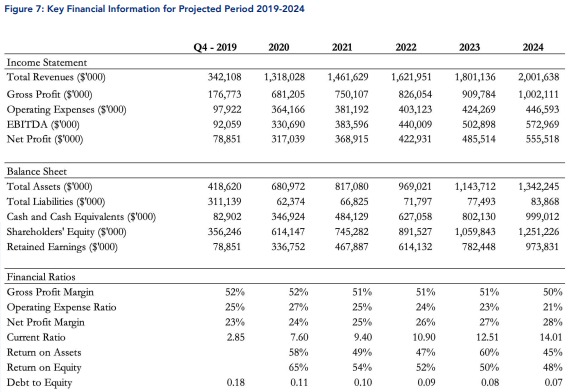

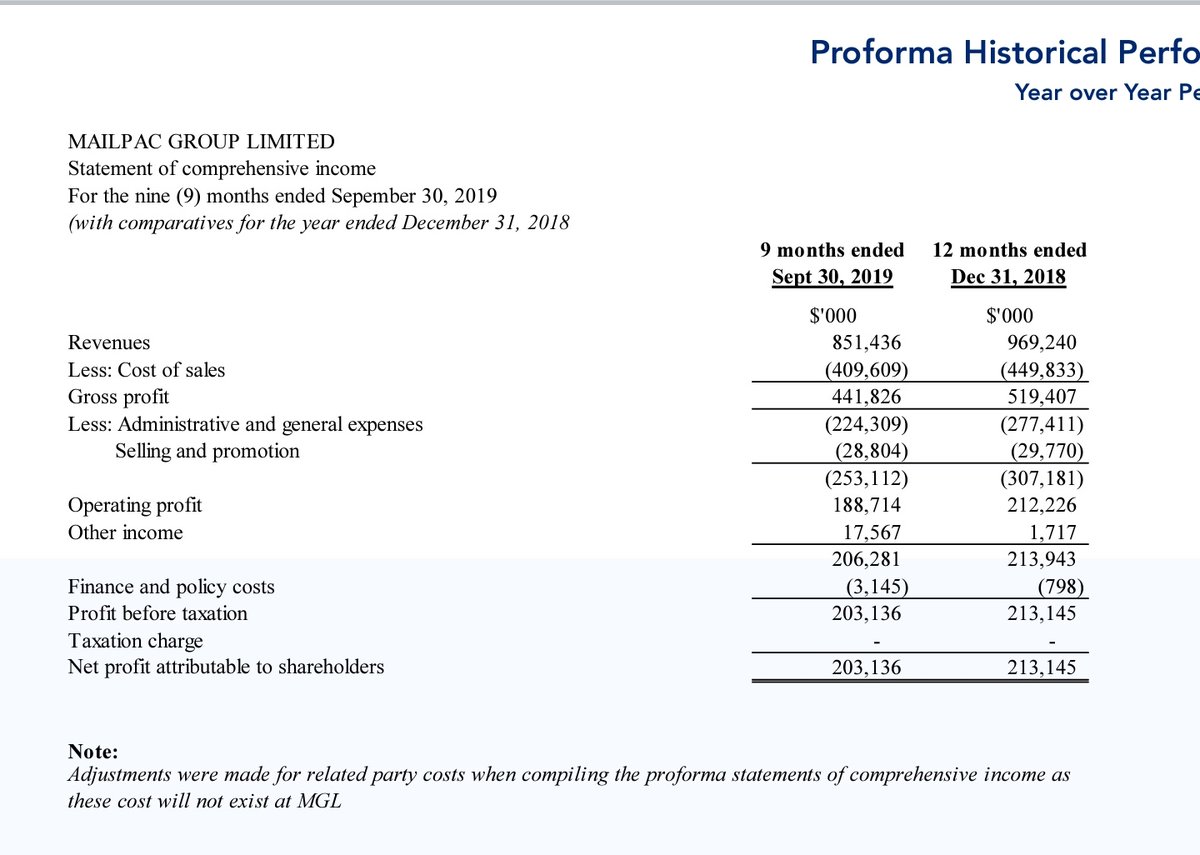

Financial statements are a consolidation of MGLs 2 subsidiary companies.

See explanation of the group here.

See explanation of the group here.

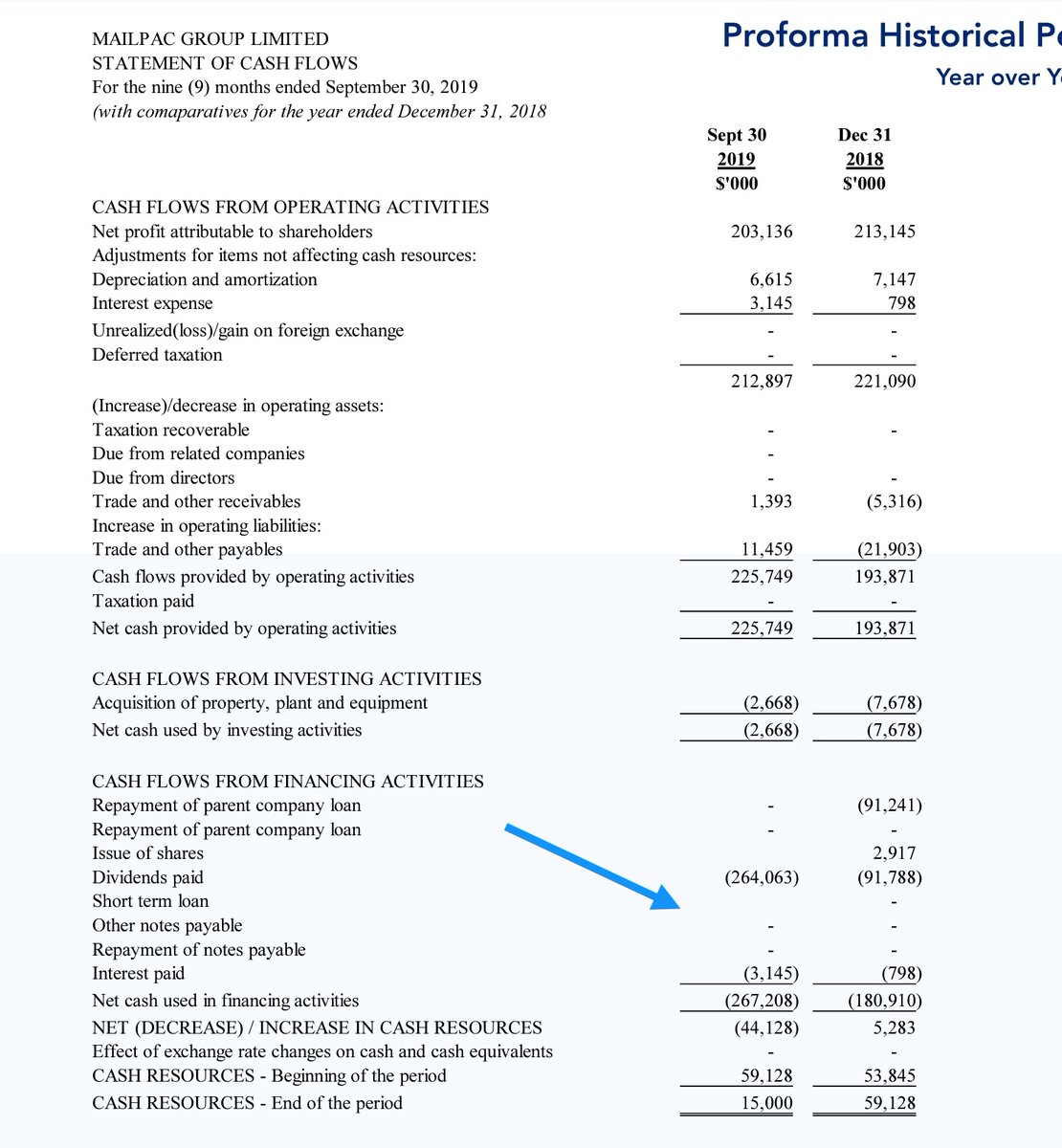

It would’ve helped to also provide 9M 2018 results for comparison purposes but I’ll go out on a limb and say Oct to December which includes black Friday, cyber Monday and Christmas shopping may be one of their better quarters and 2019 income should outperform.

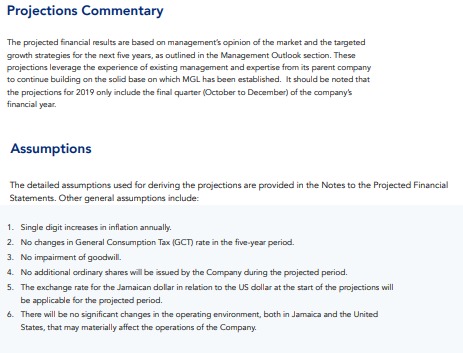

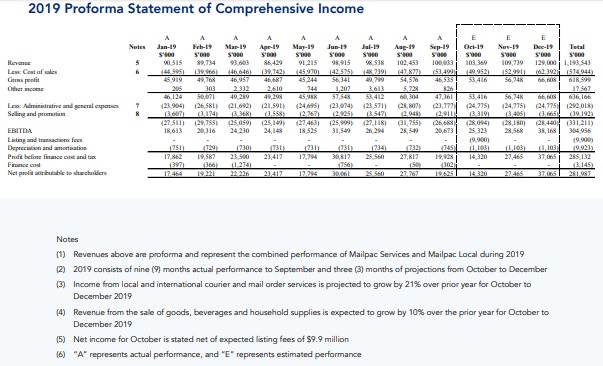

Annualized adjusted Total Sales for full 2019 is $1.09B and annualized Total Net Profits before taxes is $256M.

Mailpac& #39;s projected Total 2019 Sales- $1.19B

Mailpac& #39;s projected Total 2019 profits- $282M

Est. EPS: $0.10/$0.11

Listing P/E: 9-10X based on method https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face"> CHEAP?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face"> CHEAP?

Mailpac& #39;s projected Total 2019 Sales- $1.19B

Mailpac& #39;s projected Total 2019 profits- $282M

Est. EPS: $0.10/$0.11

Listing P/E: 9-10X based on method

If business clears debt then equity position should strengthen and open up room to re-leverage or recapitalize in short order for either organic or inorganic growth.

Note that no accumulated surplus is in business and a 264M dividend was paid out since year.

Note that no accumulated surplus is in business and a 264M dividend was paid out since year.

Key: Business generates solid operational cashflows.

May be a bit concerned about the very low equity position even after the raise. But business prospect is good.

May be a bit concerned about the very low equity position even after the raise. But business prospect is good.

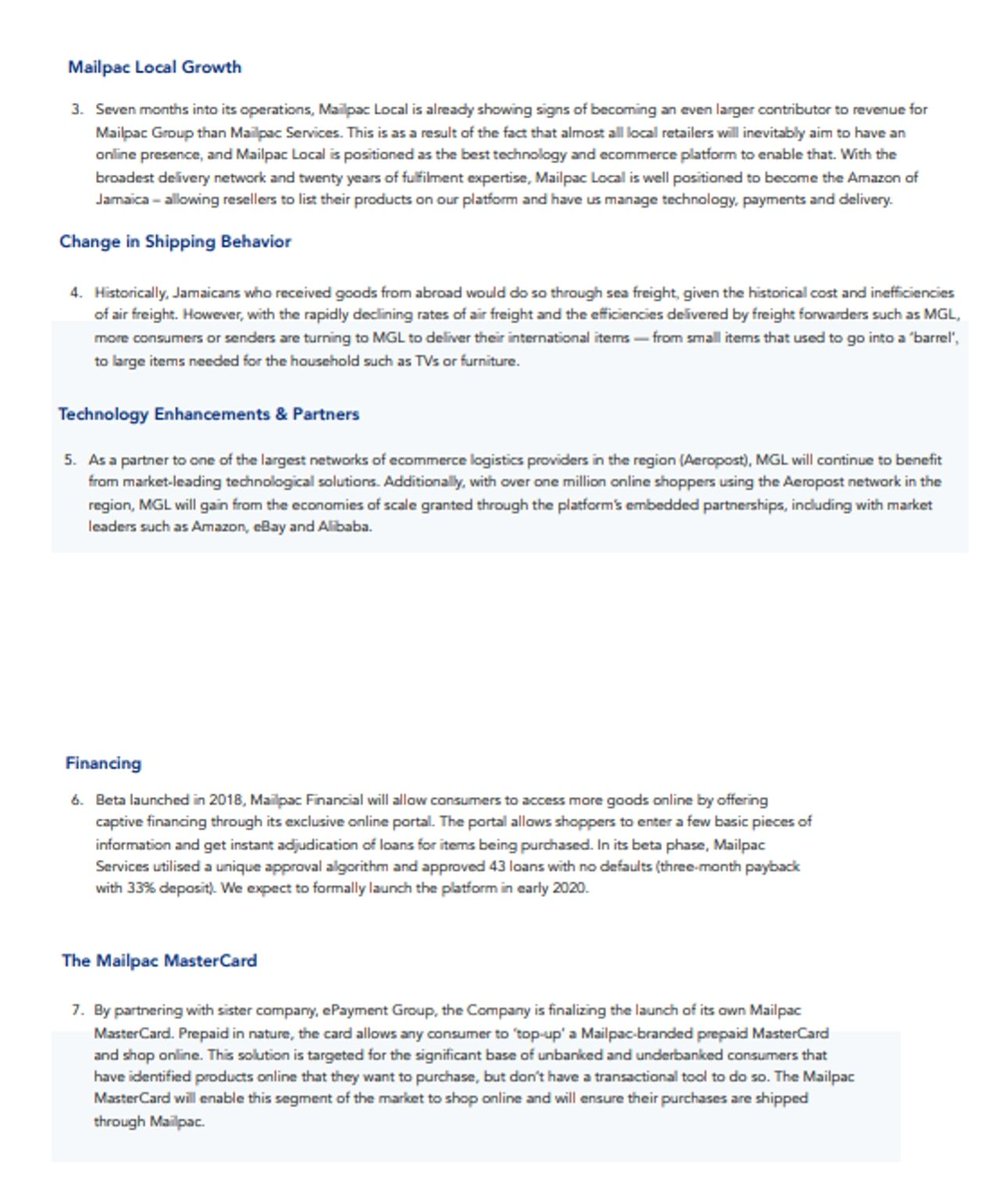

Excerpts from Management Outlook:

I would actually agree with them here. I’ve shared similar sentiments. I understand that private businesses do as they want but the cash from the payment of that large dividend could’ve been used to achieve these goals a bit faster, imo.

I would actually agree with them here. I’ve shared similar sentiments. I understand that private businesses do as they want but the cash from the payment of that large dividend could’ve been used to achieve these goals a bit faster, imo.

The continued reiteration of them being tech based and providing egs of such and how they aim to add to that advantage is a positive for me. This industry will soon be dependent on the man that can provide the best possible service to the most people at the lowest cost.

Imo,Competition is high in this sector in Jamaica. Mailpac beating its competitors to a successful listing will no doubt prove an advantage to them as they’ll benefit from increased brand participation from investors and other parties.

I strongly believe that an advantage for these kind of companies will be getting the product from offshore to JA to doorstep as soon as possible. That means that a robust delivery network will be key. Delivery trucks are ok for now but Mailpac and/or competitors will need

..

..

packages coming to both ends of the island at distribution centres, need outpost at distrib center of the island (geographical center of island may not be distrib center), and have partnerships with large brick and martyr chains to enhance distrib (Megamart, Fontana, etc).

Read on Twitter

Read on Twitter

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face"> CHEAP?" title="Annualized adjusted Total Sales for full 2019 is $1.09B and annualized Total Net Profits before taxes is $256M.Mailpac& #39;s projected Total 2019 Sales- $1.19BMailpac& #39;s projected Total 2019 profits- $282MEst. EPS: $0.10/$0.11Listing P/E: 9-10X based on method https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face"> CHEAP?" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face"> CHEAP?" title="Annualized adjusted Total Sales for full 2019 is $1.09B and annualized Total Net Profits before taxes is $256M.Mailpac& #39;s projected Total 2019 Sales- $1.19BMailpac& #39;s projected Total 2019 profits- $282MEst. EPS: $0.10/$0.11Listing P/E: 9-10X based on method https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face"> CHEAP?" class="img-responsive" style="max-width:100%;"/>