Just released our new report (from @ChuckCBPP , Kathleen Bryant & me) - our contribution to the debate on how to better tax the wealthy. Thread: https://www.cbpp.org/research/federal-tax/substantial-income-of-wealthy-households-escapes-annual-taxation-or-enjoys">https://www.cbpp.org/research/...

There’s consensus that income & wealth inequality are large & growing (which hurts households of color the most, b/c they’re overrepresented at the low end of the income/wealth distribution).

Tax policy has contributed to these disparities, but can also push back against them.

Tax policy has contributed to these disparities, but can also push back against them.

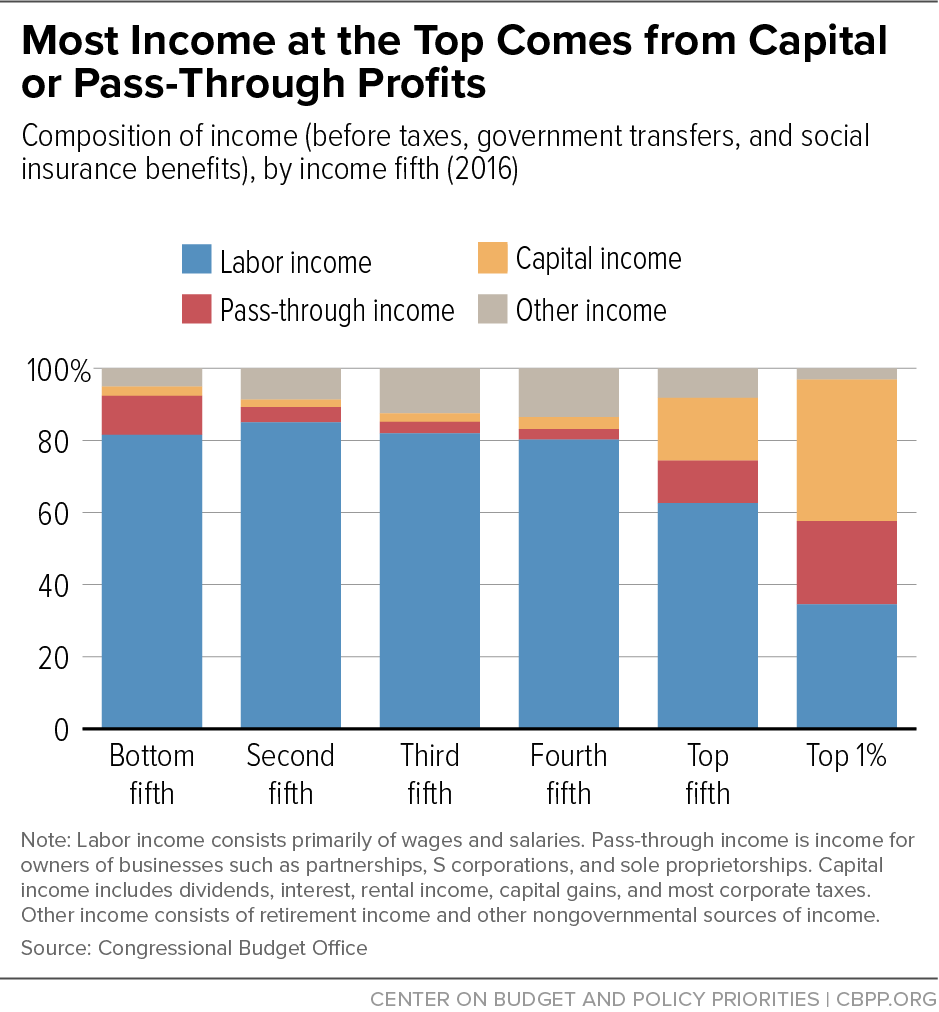

Right now, the way we tax the wealthy is flawed. That’s partly b/c high-end income is taxed differently than most Americans’ income, which is mainly labor income (wages & salaries).

Most high-end income is from capital & pass-through profits, which often get special tax breaks.

Most high-end income is from capital & pass-through profits, which often get special tax breaks.

But that only tells part of the story. The graph above omits unrealized capital gains, which often don’t face income tax for years, if ever, & are highly concentrated in the top 1%.

Our paper outlines ways to tax high incomes & large fortunes more effectively, by taxing more types of income & improving taxation of income already taxed.

All would help counter inequality & raise significant progressive revenue when our nation sorely needs it.

#TaxFairness

All would help counter inequality & raise significant progressive revenue when our nation sorely needs it.

#TaxFairness

Read on Twitter

Read on Twitter