1/ Bubble Investing aka Quality Investing - Some charts

What has been the trend of some key stocks on Price to Earnings or Price to Book for Financial companies.

Things not only have to be considered in context of relativity amongst peers, general mkt but even its own history

What has been the trend of some key stocks on Price to Earnings or Price to Book for Financial companies.

Things not only have to be considered in context of relativity amongst peers, general mkt but even its own history

2/

Avenue Supermarts

Starting with the bad boy on the street - Dmart

Whoever doesn& #39;t have it says it will implode soon.

Price has gone up but look at the chart below.

Avenue Supermarts

Starting with the bad boy on the street - Dmart

Whoever doesn& #39;t have it says it will implode soon.

Price has gone up but look at the chart below.

3/

HDFC AMC - The Stallion

It seems that everyday it gives 2%-4% returns.

At IPO everyone was laughing that it& #39;s corrected & insiders are selling. Then the momentum took off. But what goes up must come down. So they say.

Has had a fairly flat PE most of its listed history.

HDFC AMC - The Stallion

It seems that everyday it gives 2%-4% returns.

At IPO everyone was laughing that it& #39;s corrected & insiders are selling. Then the momentum took off. But what goes up must come down. So they say.

Has had a fairly flat PE most of its listed history.

4/

The Wall - HDFC Bank

Impenetrable so far. Valuation wise on book value it& #39;s fairly been at a median level for a decade. I have shared this chart on a yearly basis before.

When the market is down all fund managers take shelter behind The Wall aka Dravid!

The Wall - HDFC Bank

Impenetrable so far. Valuation wise on book value it& #39;s fairly been at a median level for a decade. I have shared this chart on a yearly basis before.

When the market is down all fund managers take shelter behind The Wall aka Dravid!

6/

Credit for all - Bajaj Finance

Another stock which gets a lot of hate. Highly overvalued and always rising in valuations.

But it delivers on numbers I think always. Does consistency deserve a better valuation?

Credit for all - Bajaj Finance

Another stock which gets a lot of hate. Highly overvalued and always rising in valuations.

But it delivers on numbers I think always. Does consistency deserve a better valuation?

7/

Another one from the stable - HDFC Life

Except 2 people I don& #39;t know anyone who truly understands Life Insurance Business and knows how to value them.

Another one from the stable - HDFC Life

Except 2 people I don& #39;t know anyone who truly understands Life Insurance Business and knows how to value them.

8/

The compounder - Asian Paints

Receives a lot of hate too. Marcellus swears by them. Others have said multiple times that how they will collapse & written their epitaph on valuation terms.

Overpriced? Certainly.

Do you want to buy reliability? It keeps The Wall good lookin

The compounder - Asian Paints

Receives a lot of hate too. Marcellus swears by them. Others have said multiple times that how they will collapse & written their epitaph on valuation terms.

Overpriced? Certainly.

Do you want to buy reliability? It keeps The Wall good lookin

9/

Berger Paints

Has had a better CAGR than Asian Paints. Gets a PE re rating.

Does it deserve so much? I don& #39;t know. But have played momentum momentum with it.

Berger Paints

Has had a better CAGR than Asian Paints. Gets a PE re rating.

Does it deserve so much? I don& #39;t know. But have played momentum momentum with it.

11/

Nation Builder - L&T

Poor chap has been stable and underperformed but still gets thrown into the quality bubble.

Nation Builder - L&T

Poor chap has been stable and underperformed but still gets thrown into the quality bubble.

12/

Soaps & Shampoos - HUL

Another one who gets all the hate. Everyone loves to work for them (P&G too) but no one wants to give money to buy their stock.

Soaps & Shampoos - HUL

Another one who gets all the hate. Everyone loves to work for them (P&G too) but no one wants to give money to buy their stock.

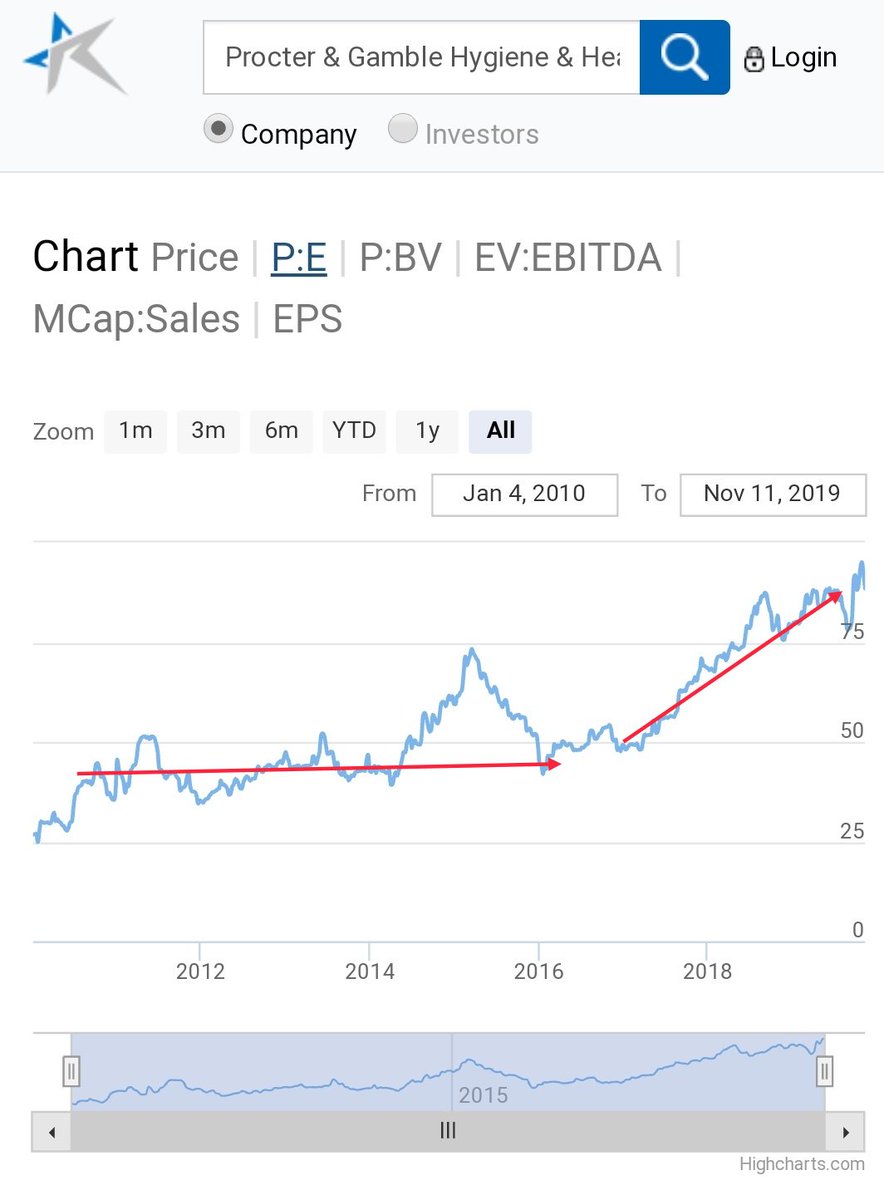

13/

P&G - Poor Growth

If you say they have the best ROIC you will immediately be told pathetic growth.

Why invest? Why discuss it even. Let it go into oblivion.

Imho one of the best places to work by the way.

P&G - Poor Growth

If you say they have the best ROIC you will immediately be told pathetic growth.

Why invest? Why discuss it even. Let it go into oblivion.

Imho one of the best places to work by the way.

14/

Atoot Jor - Pidilite the Elephant

We all remember the ads since the 90s and say oh if we had invested then. I said the too 8-9 years ago. But put in some money.

I still like the ads and offocurse the company.

You never know how the future will unfold though.

Atoot Jor - Pidilite the Elephant

We all remember the ads since the 90s and say oh if we had invested then. I said the too 8-9 years ago. But put in some money.

I still like the ads and offocurse the company.

You never know how the future will unfold though.

15/

TT - Top Talent - Top Tata Company - TCS

Valuation is stagnant. What else does it do?

If you list TCS& #39;s Free Cash Flow as a separate company on NSE it will be amongst the top 100 in market capitalisation.

Cool statistic isn& #39;t it!

TT - Top Talent - Top Tata Company - TCS

Valuation is stagnant. What else does it do?

If you list TCS& #39;s Free Cash Flow as a separate company on NSE it will be amongst the top 100 in market capitalisation.

Cool statistic isn& #39;t it!

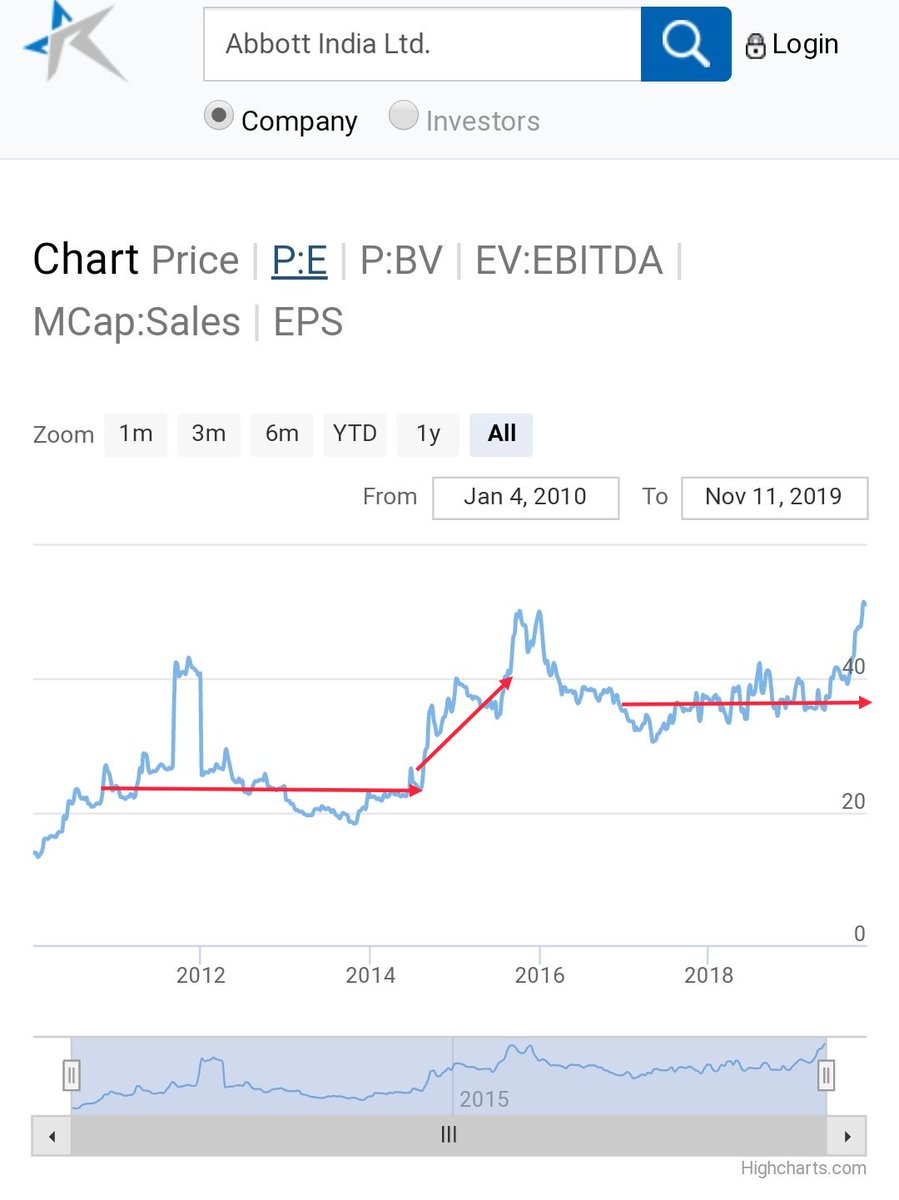

16/

The new kid on the block - Abbott

The block is the quality bubble one not anything else.

It has a top class product profile. Infact everything about the company looks too polished and good.

The new kid on the block - Abbott

The block is the quality bubble one not anything else.

It has a top class product profile. Infact everything about the company looks too polished and good.

18/

Escape Parachute - Marico

Have heard it being called a value buy these days. Why? Because it hasn& #39;t given stock returns.

Bhaav ke khiladi - they say.

Escape Parachute - Marico

Have heard it being called a value buy these days. Why? Because it hasn& #39;t given stock returns.

Bhaav ke khiladi - they say.

19/

Tape this company onto the Quality portfolio - 3M

Median valuation levels have been flat. But it& #39;s still in a bubble.

Who is their competition?

Tape this company onto the Quality portfolio - 3M

Median valuation levels have been flat. But it& #39;s still in a bubble.

Who is their competition?

20/

Nobody can wait 2 minutes these days - Nestle

Overvalued historically speaking?

How many have competed against Maggi? Even lead which withstands Chernobyl level radiations gave way to Maggi.

I don& #39;t remember when I first ate Maggi.

Nobody can wait 2 minutes these days - Nestle

Overvalued historically speaking?

How many have competed against Maggi? Even lead which withstands Chernobyl level radiations gave way to Maggi.

I don& #39;t remember when I first ate Maggi.

21/

Tired typing on phone at night. Will add more later.

The charts are from ratestar. I haven& #39;t verified.

Disc: Just for entertainment (& not educational) purposes.

Tired typing on phone at night. Will add more later.

The charts are from ratestar. I haven& #39;t verified.

Disc: Just for entertainment (& not educational) purposes.

Read on Twitter

Read on Twitter