Today @nwlc & partners @Groundwork @rooseveltinst @GCPIEconSec are unveiling our work to #TaxthePatriarchy, releasing 3 new reports on why tax is a gender & racial justice issue. https://www.theatlantic.com/ideas/archive/2019/11/tax-patriarchy/601864/">https://www.theatlantic.com/ideas/arc...

2/ If you care abt gender equality (that& #39;s you!), it’s time to talk taxes.

f you’re a tax wonk, it’s PAST time to reckon w/gender & racial bias in the tax code & who is (not) at the table.

Keep reading to learn how we

f you’re a tax wonk, it’s PAST time to reckon w/gender & racial bias in the tax code & who is (not) at the table.

Keep reading to learn how we

3/ The tax code’s first & best-known purpose is to collect revenue, which supports public investments in our shared priorities.

This function alone makes tax a gender justice issue as priorities like child care, paid leave, & more require lawmakers to invest resources.

This function alone makes tax a gender justice issue as priorities like child care, paid leave, & more require lawmakers to invest resources.

4/But its power goes further. The tax code is also a social and political document.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">it rewards and incentivizes behavior

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">it rewards and incentivizes behavior

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">It favors certain lifestyles & household structures

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">It favors certain lifestyles & household structures

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">The rules it sets can mitigate/exacerbate econ/political inequality

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">The rules it sets can mitigate/exacerbate econ/political inequality

In other words:

In other words:

5/The tax code reflects & enshrines a vision of society.

Accordingly, this set of reports argues we must harness the tax code’s full potential so that the society it reflects is one ROOTED in gender and racial equity.

https://nwlc.org/resources/gender-and-the-tax-code/

Let& #39;s">https://nwlc.org/resources... go deeper into each

Accordingly, this set of reports argues we must harness the tax code’s full potential so that the society it reflects is one ROOTED in gender and racial equity.

https://nwlc.org/resources/gender-and-the-tax-code/

Let& #39;s">https://nwlc.org/resources... go deeper into each

6/ Here’s the deal: our tax code was written by mostly straight, white, rich men. There wasn’t even a woman on the Sen Finance Committee until 1995!

Unsurprisingly, their biases are baked into our tax code, which means a LOT of tax laws don& #39;t work for women & esp women of color

Unsurprisingly, their biases are baked into our tax code, which means a LOT of tax laws don& #39;t work for women & esp women of color

7/ Paper #1 by @ajurowkleiman & @nwlc colleagues Amy Matsui & @estelleromaine examines tax provisions that reflect & enshrine racial/gender biases or outdated assumptions about families & workers - on everything from who is earning income, building wealth, and caregiving.

8/For example, tax code’s “joint filing” system, adopted in 1948, creates a "marriage bonus" for couples w/a main breadwinner (usually a man) & little/no earnings from other spouse. In 1940s, this was not controversial: it encouraged women to leave jobs 4 returning WWII soldiers

9/But today, 2/3 of families rely on mom& #39;s income.

Solution isn’t simply eliminating joint filing – that may also have inequitable implications. The report outlines the data & frameworks we need to evaluate how to bring our tax system into 21st century. https://www.americanprogress.org/issues/women/reports/2019/05/10/469739/breadwinning-mothers-continue-u-s-norm/">https://www.americanprogress.org/issues/wo...

Solution isn’t simply eliminating joint filing – that may also have inequitable implications. The report outlines the data & frameworks we need to evaluate how to bring our tax system into 21st century. https://www.americanprogress.org/issues/women/reports/2019/05/10/469739/breadwinning-mothers-continue-u-s-norm/">https://www.americanprogress.org/issues/wo...

Report #1 has a few other doozies.

For one thing, legal expenses to defend against bribery charges can be deducted as a “business expense.”

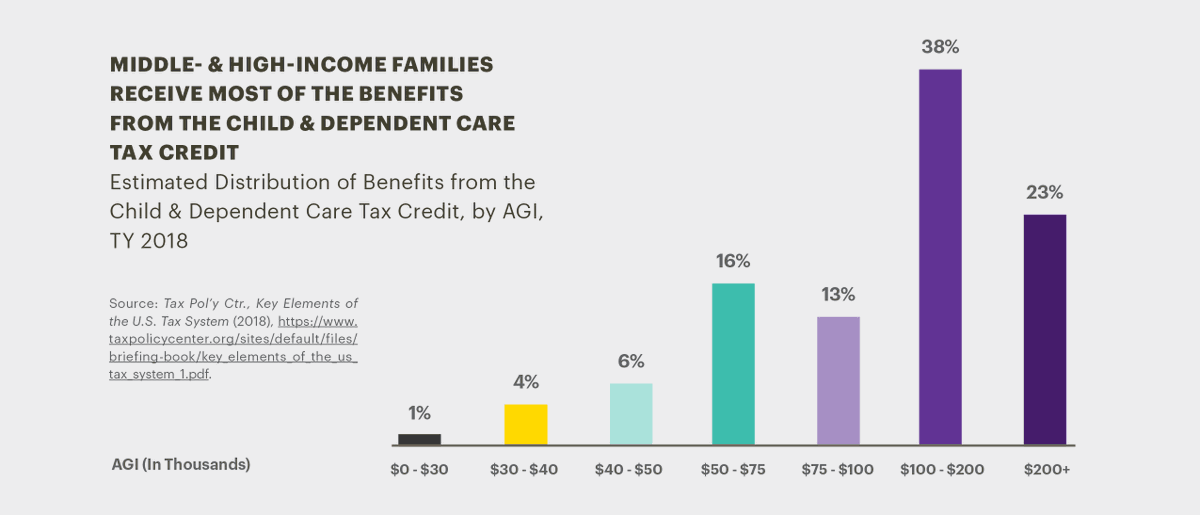

But the mom paid poverty wages who NEEDS child care to work? Her income doesn& #39;t qualify her for the nonrefundable child care tax credit.

For one thing, legal expenses to defend against bribery charges can be deducted as a “business expense.”

But the mom paid poverty wages who NEEDS child care to work? Her income doesn& #39;t qualify her for the nonrefundable child care tax credit.

11/ Ready to get really angry?

Awards for workplace injuries (likely to be men) are not taxed, but awards for workplace discrimination, including sexual harassment (likely women, ppl of color, & ppl w/disabilities) ARE taxed.

Awards for workplace injuries (likely to be men) are not taxed, but awards for workplace discrimination, including sexual harassment (likely women, ppl of color, & ppl w/disabilities) ARE taxed.

12/Hopefully this whets your appetite on Report #1 – you can read the whole thing here,

https://nwlc.org/resources/the-faulty-foundations-of-the-tax-code-gender-and-racial-bias-in-our-tax-laws/

&">https://nwlc.org/resources... when you’re good and mad, sign-up for @nwlc email at http://www.nwlc.org"> http://www.nwlc.org (top of the page on the right) so you can engage in our efforts to #TaxthePatriarchy

https://nwlc.org/resources/the-faulty-foundations-of-the-tax-code-gender-and-racial-bias-in-our-tax-laws/

&">https://nwlc.org/resources... when you’re good and mad, sign-up for @nwlc email at http://www.nwlc.org"> http://www.nwlc.org (top of the page on the right) so you can engage in our efforts to #TaxthePatriarchy

13/report #2 by @nwlc @rooseveltinst pulls back curtain on how tax breaks for the rich hurt women & ppl of color. Those breaks forego revenue that support equitable investments. Lesser known is how they actually enable behaviors that EXACERBATE inequality. https://nwlc.org/resources/reckoning-with-the-hidden-rules-of-gender-in-the-tax-code-how-low-taxes-on-corporations-and-the-wealthy-impact-womens-economic-opportunity-and-security/">https://nwlc.org/resources...

14/ . @katy_milani @stephsterlingdc @SarahHassmer & I explore how a series of trickle-down tax policies interact with historical/structural exclusions of women & people of color, and why a tax agenda should be part of gender justice agenda to rebalance these inequities.

15/ 1st, we discuss how “trickledown” tax cuts fail to deliver on promised econ growth for all.

Example: companies w/high shares of women & people of color in their workforce, used huge windfall from #GOPTaxScam to reward shareholders instead of raising pay for their workers.

Example: companies w/high shares of women & people of color in their workforce, used huge windfall from #GOPTaxScam to reward shareholders instead of raising pay for their workers.

16/Starbucks’ workforce is 2/3 women & abt ½ ppl of color. Median pay: $12,754.

In 2018, post-tax law, Starbucks https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow">spending on stock buybacks by 240% to $7.2 BILLION to reward shareholders.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Upwards arrow" aria-label="Emoji: Upwards arrow">spending on stock buybacks by 240% to $7.2 BILLION to reward shareholders.

That could have paid for $24,729 pay bump for its 291,000 workers!

Cc @teamcoworker

In 2018, post-tax law, Starbucks

That could have paid for $24,729 pay bump for its 291,000 workers!

Cc @teamcoworker

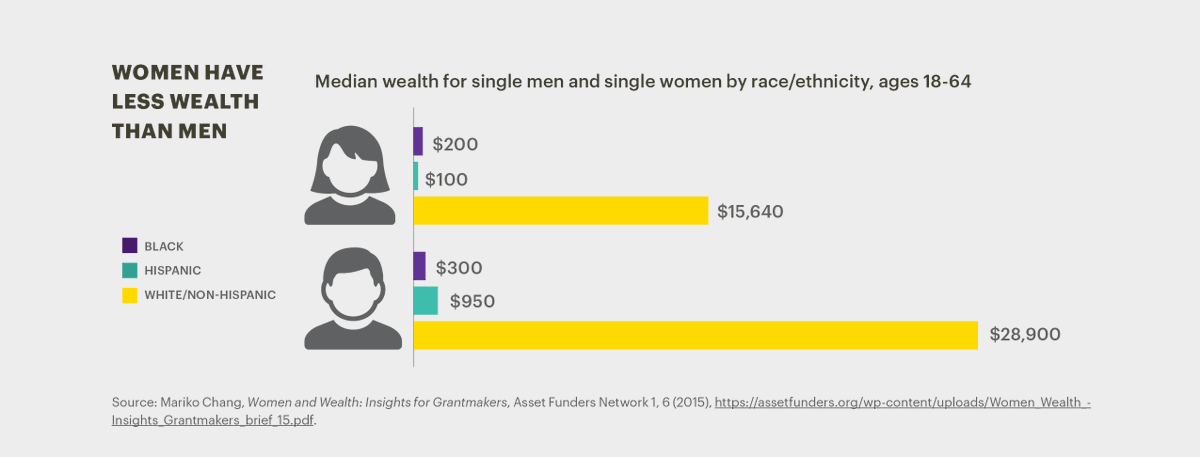

17/ @nwlc & @rooseveltinst paper also underscores role of taxes in gender &r racial wealth gaps.

Power & wealth beget power & wealth. White man have it. Black & Brown women have been systemically denied opportunities to build it.

Power & wealth beget power & wealth. White man have it. Black & Brown women have been systemically denied opportunities to build it.

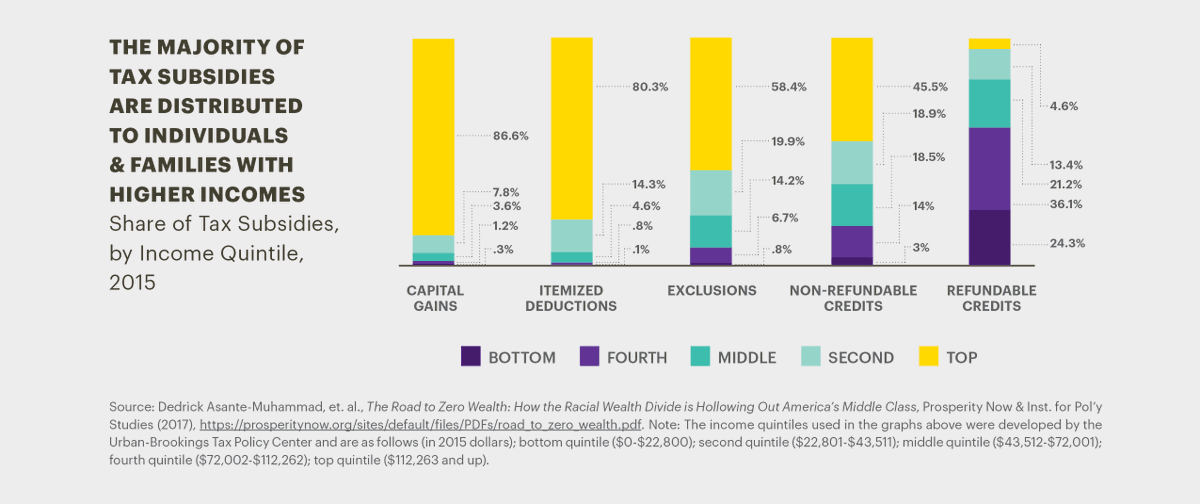

18/when our tax code rewards income from wealth over income from work; and when the vast majority of tax subsidies reward those with the highest incomes, those gaps grow.

19/ Our report explains how

1) tax treatment of inherited wealth/preference for income from wealth

2) low effective rates on the rich/breaks for “pass-through” income

3) tax law& #39;s treatment of debt

exacerbate pay, power &/or wealth disparities between CEOs & low-paid workers

1) tax treatment of inherited wealth/preference for income from wealth

2) low effective rates on the rich/breaks for “pass-through” income

3) tax law& #39;s treatment of debt

exacerbate pay, power &/or wealth disparities between CEOs & low-paid workers

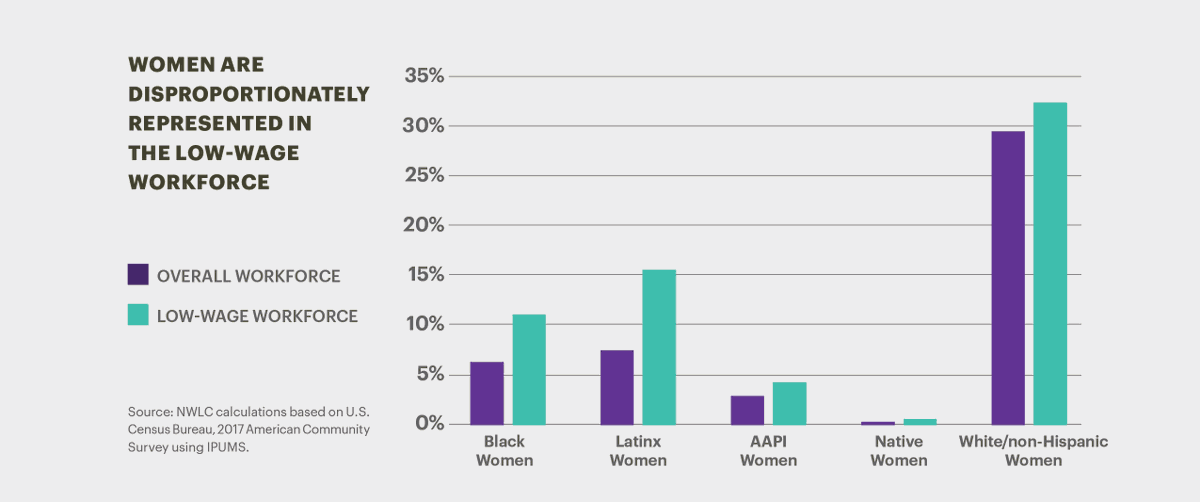

20/And who is in the low-wage workforce, seeing little to no income growth as CEO pay skyrockets? That’s right, it’s disproportionately women and especially women of color

21/All those jargony tax terms?

“pass-through income”

“carried interest”

“stepped up basis in capital gains”

Don’t worry, we got you covered! This paper explains what they are, why they matter, & how they enable behaviors that hurt women & esp WOC.

“pass-through income”

“carried interest”

“stepped up basis in capital gains”

Don’t worry, we got you covered! This paper explains what they are, why they matter, & how they enable behaviors that hurt women & esp WOC.

22/ Our 3rd paper w/ @GCPIEconSec including @indivard @kaligrant, Funke Adenronmu and Rachel Black looks at how we create a “Tax Code for the Rest of Us” https://nwlc.org/resources/a-tax-code-for-the-rest-of-us-a-framework-recommendations-for-advancing-gender-racial-equity-through-tax-credits/">https://nwlc.org/resources...

23/ We explain how low-income families –disproportionately headed by women & people of color –have limited access to tax subsidies that wealthy families receive AND little support from spending-side basic assistance programs in areas like housing, child care, higher ed & transit

24/ One example: We give billions in tax breaks for vacation & luxury homes through mortgage interest deduction. Yet lawmakers cry ‘deficit’ when it’s time to invest in rental assistance for struggling families. Who is gets hurt by this under-investment in rental asst?....

25/The exception is refundable tax credits like Earned Income Tax Credit (EITC) & Child Tax Credit (CTC). These credits disproportionately benefit women of color. They cut poverty & improve health, education & employment.

https://www.cbpp.org/research/federal-tax/women-of-color-especially-benefit-from-working-family-tax-credits

How">https://www.cbpp.org/research/... do we build on that success?

https://www.cbpp.org/research/federal-tax/women-of-color-especially-benefit-from-working-family-tax-credits

How">https://www.cbpp.org/research/... do we build on that success?

26/The @nwlc @GCPIEconSec report offers a practical framework for leveraging refundable tax credits for greater equity in the tax code, showing how they can help families on the tax side, while complementing spending side investments & proposals.

27/Here’s the rub: Nowhere does the tax code explicitly say that women shall be treated differently than men, or families of color treated differently than white families. But while the language may be neutral,the IMPACT disadvantages women & people of color in practice. In short

28/Here’s the good news: our tax code didn’t happen by accident. People in power made decisions. We can make different &better decisions. These reports aim to provide research to inform & inspire collective action to build the power to create a tax code that works for ALL of US

29/You can help lawmakers start making better decisions today!

Tell Congress to ensure that tax credits like the EITC and CTC that help low-income women and families are strengthened as part of year-end tax negotiations. https://act.nwlc.org/onlineactions/gnczdv9_nUKhuPEIoofxIw2?emci=0c0965e3-a604-ea11-828b-2818784d6d68&emdi=ea000000-0000-0000-0000-000000000001&ceid=&contactdata=">https://act.nwlc.org/onlineact...

Tell Congress to ensure that tax credits like the EITC and CTC that help low-income women and families are strengthened as part of year-end tax negotiations. https://act.nwlc.org/onlineactions/gnczdv9_nUKhuPEIoofxIw2?emci=0c0965e3-a604-ea11-828b-2818784d6d68&emdi=ea000000-0000-0000-0000-000000000001&ceid=&contactdata=">https://act.nwlc.org/onlineact...

30/If you believe in gender justice, join us to fight for tax justice.

If you fight for tax justice, join us to center gender and racial equity in our tax code.

It’s going to take all of us to take back our tax code. #TaxThePatriarchy!

If you fight for tax justice, join us to center gender and racial equity in our tax code.

It’s going to take all of us to take back our tax code. #TaxThePatriarchy!

Read on Twitter

Read on Twitter

it rewards and incentivizes behavior https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">It favors certain lifestyles & household structureshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">The rules it sets can mitigate/exacerbate econ/political inequalityIn other words:" title="4/But its power goes further. The tax code is also a social and political document.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">it rewards and incentivizes behavior https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">It favors certain lifestyles & household structureshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">The rules it sets can mitigate/exacerbate econ/political inequalityIn other words:" class="img-responsive" style="max-width:100%;"/>

it rewards and incentivizes behavior https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">It favors certain lifestyles & household structureshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">The rules it sets can mitigate/exacerbate econ/political inequalityIn other words:" title="4/But its power goes further. The tax code is also a social and political document.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">it rewards and incentivizes behavior https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">It favors certain lifestyles & household structureshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">The rules it sets can mitigate/exacerbate econ/political inequalityIn other words:" class="img-responsive" style="max-width:100%;"/>