A thread of payment ecosystem

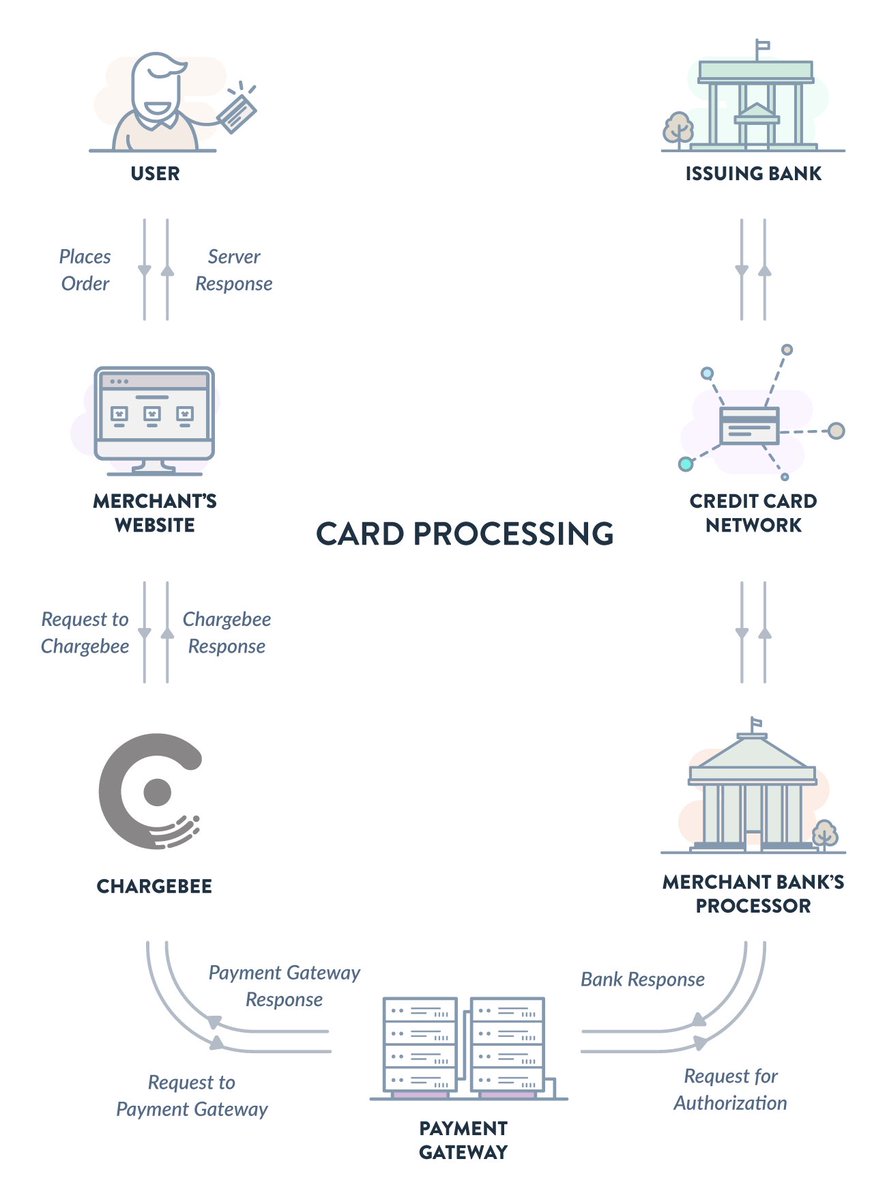

1. There are generally 5 players to a transaction: The card issuing bank, merchant acquirer/payment gateway, the merchant’s bank, payment card processor and the payment network provider (Visa & MasterCard)

2. An institution can play multiple roles

1. There are generally 5 players to a transaction: The card issuing bank, merchant acquirer/payment gateway, the merchant’s bank, payment card processor and the payment network provider (Visa & MasterCard)

2. An institution can play multiple roles

3. For credit card purchase, the average cost to process a payment is 2.75%. In most countries, the cost is bone by the merchant except in a few e.g Australia where the customer incurs the cost

4. ~1.75%-2.20% goes to the card issuing bank to compensate for taking the credit risk

4. ~1.75%-2.20% goes to the card issuing bank to compensate for taking the credit risk

5. Payment networks takes 0.19% & the balance is split between the merchant acquirer/gateway & payment processor

6. Research show that consumers spend 15%-18% more when swiping vs. using paper cash

7. And the cost & risk of handling cash is ~3x higher than accepting card payments

6. Research show that consumers spend 15%-18% more when swiping vs. using paper cash

7. And the cost & risk of handling cash is ~3x higher than accepting card payments

8. Therefore most businesses prefer card payments (unless of course they have ulterior motives)

9. In addition, Governments are also pushing towards a cashless society. It makes it easier to clamp down on money laundering / tax evasions

10. So you going to start seeing more of https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">

9. In addition, Governments are also pushing towards a cashless society. It makes it easier to clamp down on money laundering / tax evasions

10. So you going to start seeing more of

Read on Twitter

Read on Twitter

" title="8. Therefore most businesses prefer card payments (unless of course they have ulterior motives)9. In addition, Governments are also pushing towards a cashless society. It makes it easier to clamp down on money laundering / tax evasions10. So you going to start seeing more of https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">" class="img-responsive" style="max-width:100%;"/>

" title="8. Therefore most businesses prefer card payments (unless of course they have ulterior motives)9. In addition, Governments are also pushing towards a cashless society. It makes it easier to clamp down on money laundering / tax evasions10. So you going to start seeing more of https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">" class="img-responsive" style="max-width:100%;"/>