A temporary shortage in the FX market does not necessarily mean a FX shortage for the country/economy.

#BOJSpeaks #FinanceTwitterJa A THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

#BOJSpeaks #FinanceTwitterJa A THREAD

Part 2

After accounting for FDI financing of imports, the Balance of Payments shows that since FY2015/1, Jamaica has roughly been earning as much as we spend. There can be no national shortage unless that big picture changes.

After accounting for FDI financing of imports, the Balance of Payments shows that since FY2015/1, Jamaica has roughly been earning as much as we spend. There can be no national shortage unless that big picture changes.

Part 3

Demand may not always be met, but FX market inflows have increased, not declined. 2019 so far shows average daily inflows at just over US$33 million. This is above the US$31.5 and US$30.63 million daily averages for 2018 and 2017 and more than the current 5 year average.

Demand may not always be met, but FX market inflows have increased, not declined. 2019 so far shows average daily inflows at just over US$33 million. This is above the US$31.5 and US$30.63 million daily averages for 2018 and 2017 and more than the current 5 year average.

Part 4

The FX rate is merely the price of a commodity in a market, like the price of any other commodity.

Like any other commodity, this price moves in reaction to market conditions.

The FX rate is merely the price of a commodity in a market, like the price of any other commodity.

Like any other commodity, this price moves in reaction to market conditions.

Part 5

Viewing the FX rate as a barometer of economic health is misleading. This would mean Jamaica’s economy is only slightly behind Japan and far better than South Korea. Both have respective exchange rates in the region of 109 and 1,160 to one US dollar.

Viewing the FX rate as a barometer of economic health is misleading. This would mean Jamaica’s economy is only slightly behind Japan and far better than South Korea. Both have respective exchange rates in the region of 109 and 1,160 to one US dollar.

Part 6

The FX rate as an indicator of economic health would mean Jamaica was better off years ago with higher inflation and much higher debt, living off borrowed money. The fact is that even with the highest ever exchange rate, Jamaica’s economy has never been better.

The FX rate as an indicator of economic health would mean Jamaica was better off years ago with higher inflation and much higher debt, living off borrowed money. The fact is that even with the highest ever exchange rate, Jamaica’s economy has never been better.

Part 7

In a free market, the FX rate is an indicator of swings in demand and supply. The FX rate is supposed to act as an elastic band that reacts to short term market pressures.

In a free market, the FX rate is an indicator of swings in demand and supply. The FX rate is supposed to act as an elastic band that reacts to short term market pressures.

Part 8

Masking the ‘elastic band’ role of the FX rate with intervention is something Jamaica and many other countries already tried, to our detriment. It doesn’t work. Most inflation targeting countries adopted this policy after FX rate targeting led to currency crises.

Masking the ‘elastic band’ role of the FX rate with intervention is something Jamaica and many other countries already tried, to our detriment. It doesn’t work. Most inflation targeting countries adopted this policy after FX rate targeting led to currency crises.

Part 9

To those who need reminding, FX rate targeting leads to reserve depletion, borrowing and taking Jamaica back to debt and stagnation. This is obviously not in the best interest of the economy or the people of Jamaica, so it’s not the plan.

To those who need reminding, FX rate targeting leads to reserve depletion, borrowing and taking Jamaica back to debt and stagnation. This is obviously not in the best interest of the economy or the people of Jamaica, so it’s not the plan.

Part 10

In a free market economy where there is no national shortage, the FX rate is SUPPOSED to move up and down. This is normal, expected and routine, therefore movement in either direction should be no reason for undue excitement.

In a free market economy where there is no national shortage, the FX rate is SUPPOSED to move up and down. This is normal, expected and routine, therefore movement in either direction should be no reason for undue excitement.

Part 11

A stable exchange rate does not mean one that doesn’t move.

A stable exchange rate does not mean one that doesn’t move.

Part 12

No national shortage means that despite the temporary swings, the FX rate will not change that much over a longer horizon, such as a year, so a long term outlook on the market is prudent.

No national shortage means that despite the temporary swings, the FX rate will not change that much over a longer horizon, such as a year, so a long term outlook on the market is prudent.

Part 13

In annual terms, the FX rate closed 2017, the first year of 2-way market fluctuations, at 125, a 2.7% appreciation after closing 2016 at 128.44, which in turn was a 6.7% depreciation over 2015. The FX rate closed 2018 at 127.71, a mild depreciation of 2.1%.

In annual terms, the FX rate closed 2017, the first year of 2-way market fluctuations, at 125, a 2.7% appreciation after closing 2016 at 128.44, which in turn was a 6.7% depreciation over 2015. The FX rate closed 2018 at 127.71, a mild depreciation of 2.1%.

Part 14

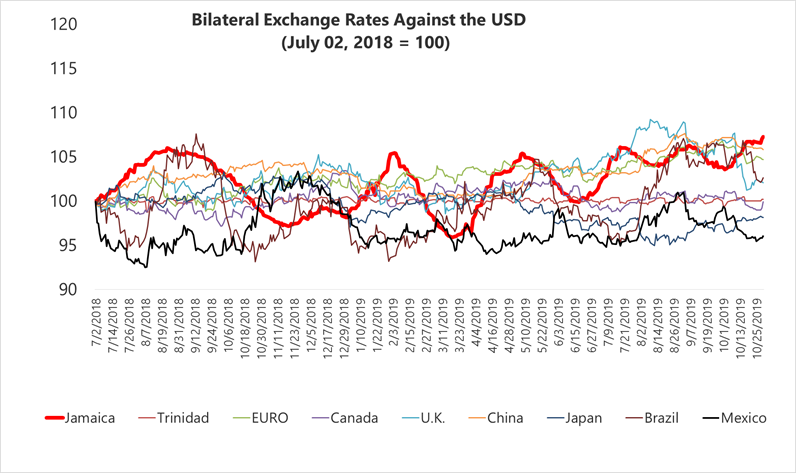

‘Volatility’ does not mean ‘depreciation’ and refers to movement in both directions. As the context of this graph indicates, more advanced economies with deeper markets experience more short-term volatility than we do.

‘Volatility’ does not mean ‘depreciation’ and refers to movement in both directions. As the context of this graph indicates, more advanced economies with deeper markets experience more short-term volatility than we do.

Part 15

The cold hard fact is that Jamaica’s future depends on being an export-led economy. This means that during transition, the economy will not be friendly to those whose business models and consumption patterns depend purely or largely on imports.

The cold hard fact is that Jamaica’s future depends on being an export-led economy. This means that during transition, the economy will not be friendly to those whose business models and consumption patterns depend purely or largely on imports.

Part 16

An export-led economy means we are earning our way to what we want and where we want to be, and this depends on the private sector, not government.

An export-led economy means we are earning our way to what we want and where we want to be, and this depends on the private sector, not government.

Part 17

An export-led economy means that money in the market is money we have earned, so on any day you think the FX market is short, ask why we are not earning more. That’s where the money is supposed to come from.

An export-led economy means that money in the market is money we have earned, so on any day you think the FX market is short, ask why we are not earning more. That’s where the money is supposed to come from.

Part 18

BOJ doesn’t target an FX rate, so our concern is supply, not price. If you can’t find any money in the market, we have a problem. If there is money for sellers and buyers to do business but you just don’t like the price, that’s for you and your dealer to negotiate.

BOJ doesn’t target an FX rate, so our concern is supply, not price. If you can’t find any money in the market, we have a problem. If there is money for sellers and buyers to do business but you just don’t like the price, that’s for you and your dealer to negotiate.

Part 19

BOJ will intervene to quell disorderly market conditions. That’s it. FX is not a subsidized commodity.

BOJ will intervene to quell disorderly market conditions. That’s it. FX is not a subsidized commodity.

Part 20

A two-way FX rate is not a Jamaican invention. Every other free market economy has it and handles it, therefore so can we.

A two-way FX rate is not a Jamaican invention. Every other free market economy has it and handles it, therefore so can we.

Part 21

Can we do a better job in making the FX market more efficient? Yes, we can. Central bank-led initiatives, like a trading platform, are coming.

Can we do a better job in making the FX market more efficient? Yes, we can. Central bank-led initiatives, like a trading platform, are coming.

Part 22

Recent rumours of an entity trying to source US$240 million were grossly exaggerated, as the entity in question already had most of the money and did not need to source much from the market. This transaction therefore did not move the market. Speculation about it did.

Recent rumours of an entity trying to source US$240 million were grossly exaggerated, as the entity in question already had most of the money and did not need to source much from the market. This transaction therefore did not move the market. Speculation about it did.

Part 23

US$ holdings can earn no more than 2% at current rates. At current rates, a JSE index fund for J$ holdings would be earning more than 30%.

US$ holdings can earn no more than 2% at current rates. At current rates, a JSE index fund for J$ holdings would be earning more than 30%.

Part 24

We urge the business and financial sectors to play the leadership role that is rightfully theirs in creating viable solutions to better manage the FX needs of both buyers and sellers.

We urge the business and financial sectors to play the leadership role that is rightfully theirs in creating viable solutions to better manage the FX needs of both buyers and sellers.

Part 25

The big solution to 2-way market inconvenience is not speculation, but forward contracts. It’s what other countries do. Sound forward contracts are good for the FX market, good for inflation, good for the business person and good for the consumer. Everybody wins.

The big solution to 2-way market inconvenience is not speculation, but forward contracts. It’s what other countries do. Sound forward contracts are good for the FX market, good for inflation, good for the business person and good for the consumer. Everybody wins.

Part 26

The financial sector needs to create and market forward instruments that are both viable for them and attractive to business-people.

The financial sector needs to create and market forward instruments that are both viable for them and attractive to business-people.

Part 27

Viable forward contracts for dealers means they don’t lose money and at least make a bit. More importantly, attractive forward contracts for businesspersons mean assurance of supply and the ability to hold prices for longer periods regardless of FX rate swings.

Viable forward contracts for dealers means they don’t lose money and at least make a bit. More importantly, attractive forward contracts for businesspersons mean assurance of supply and the ability to hold prices for longer periods regardless of FX rate swings.

Part 28

In addition to Christmas season demand, large transactions outside the norm of day-to-day business have been happening in the FX market. Although they may create temporary growing pains, note that these transactions are also very good signs of an improving economy.

In addition to Christmas season demand, large transactions outside the norm of day-to-day business have been happening in the FX market. Although they may create temporary growing pains, note that these transactions are also very good signs of an improving economy.

Part 29

Entities paying off US$ debts and converting debt to J$ is a positive thing. Jamaican companies confident and healthy enough to expand is a positive thing. Both may cause short-term FX market pressure, but both are good for the economy in the long term.

Entities paying off US$ debts and converting debt to J$ is a positive thing. Jamaican companies confident and healthy enough to expand is a positive thing. Both may cause short-term FX market pressure, but both are good for the economy in the long term.

Read on Twitter

Read on Twitter " title="A temporary shortage in the FX market does not necessarily mean a FX shortage for the country/economy. #BOJSpeaks #FinanceTwitterJa A THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

" title="A temporary shortage in the FX market does not necessarily mean a FX shortage for the country/economy. #BOJSpeaks #FinanceTwitterJa A THREAD https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>