0/ Thread: After constantly being asked what really changes between raising Seed & Series A, I just published my 9 reasons why Series A is not "just a big Seed round"  https://abs.twimg.com/emoji/v2/... draggable="false" alt="♠️" title="Spade suit" aria-label="Emoji: Spade suit"> https://medium.com/the-family-aaa/9-reasons-why-series-a-is-not-just-a-big-seed-round-e163f7a32bb0">https://medium.com/the-famil...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="♠️" title="Spade suit" aria-label="Emoji: Spade suit"> https://medium.com/the-family-aaa/9-reasons-why-series-a-is-not-just-a-big-seed-round-e163f7a32bb0">https://medium.com/the-famil...

1/ Series A is about the future… & the past

While previously your role was to promote your founding team & sell a vision for the future, now your pitch will be about the past, too: how well did you spend the $ you raised before? How good have you been at hiring? etc.

While previously your role was to promote your founding team & sell a vision for the future, now your pitch will be about the past, too: how well did you spend the $ you raised before? How good have you been at hiring? etc.

2/ Now you have a team to think about

While your Seed round probably involved you, your co-founders and 1 or 2 employees, you may now have between 8 & 50 team members. Good time management will be crucial, & it& #39;s never too early to start thinking about how to handle the process

While your Seed round probably involved you, your co-founders and 1 or 2 employees, you may now have between 8 & 50 team members. Good time management will be crucial, & it& #39;s never too early to start thinking about how to handle the process

3/ Series A Due Diligence is real

While the analysis & paperwork you go through at Seed is usually simple, closing a Series A can take many months from the day you start thinking about it. VCs will need serious (i.e. data-heavy) reasons to justify their investment to their LPs

While the analysis & paperwork you go through at Seed is usually simple, closing a Series A can take many months from the day you start thinking about it. VCs will need serious (i.e. data-heavy) reasons to justify their investment to their LPs

4/ You& #39;ll see many things for the first time

Most founders have never done an A round before, & are not familiar with the terms used or the materials required by VCs. Even if un-natural, you& #39;ll have to get your head around things like building a data room & negotiating liq pref

Most founders have never done an A round before, & are not familiar with the terms used or the materials required by VCs. Even if un-natural, you& #39;ll have to get your head around things like building a data room & negotiating liq pref

5/ It& #39;s hard to know when you& #39;re really ready for Series A

Knowing when to start raising is hard, as Series A sits in between being a Seed startup raising on promise & being a Series B co raising with solid metrics. How you tell your story can be more crucial than your metrics

Knowing when to start raising is hard, as Series A sits in between being a Seed startup raising on promise & being a Series B co raising with solid metrics. How you tell your story can be more crucial than your metrics

6/ At Series A, time is a serious matter

• You don& #39;t want to start raising too early - hard to get anyone interested

• You want to increase spending to show you& #39;re capable of investing in growth

• You don& #39;t want to "gamble" too much & raise too close to end of runway

You:

• You don& #39;t want to start raising too early - hard to get anyone interested

• You want to increase spending to show you& #39;re capable of investing in growth

• You don& #39;t want to "gamble" too much & raise too close to end of runway

You:

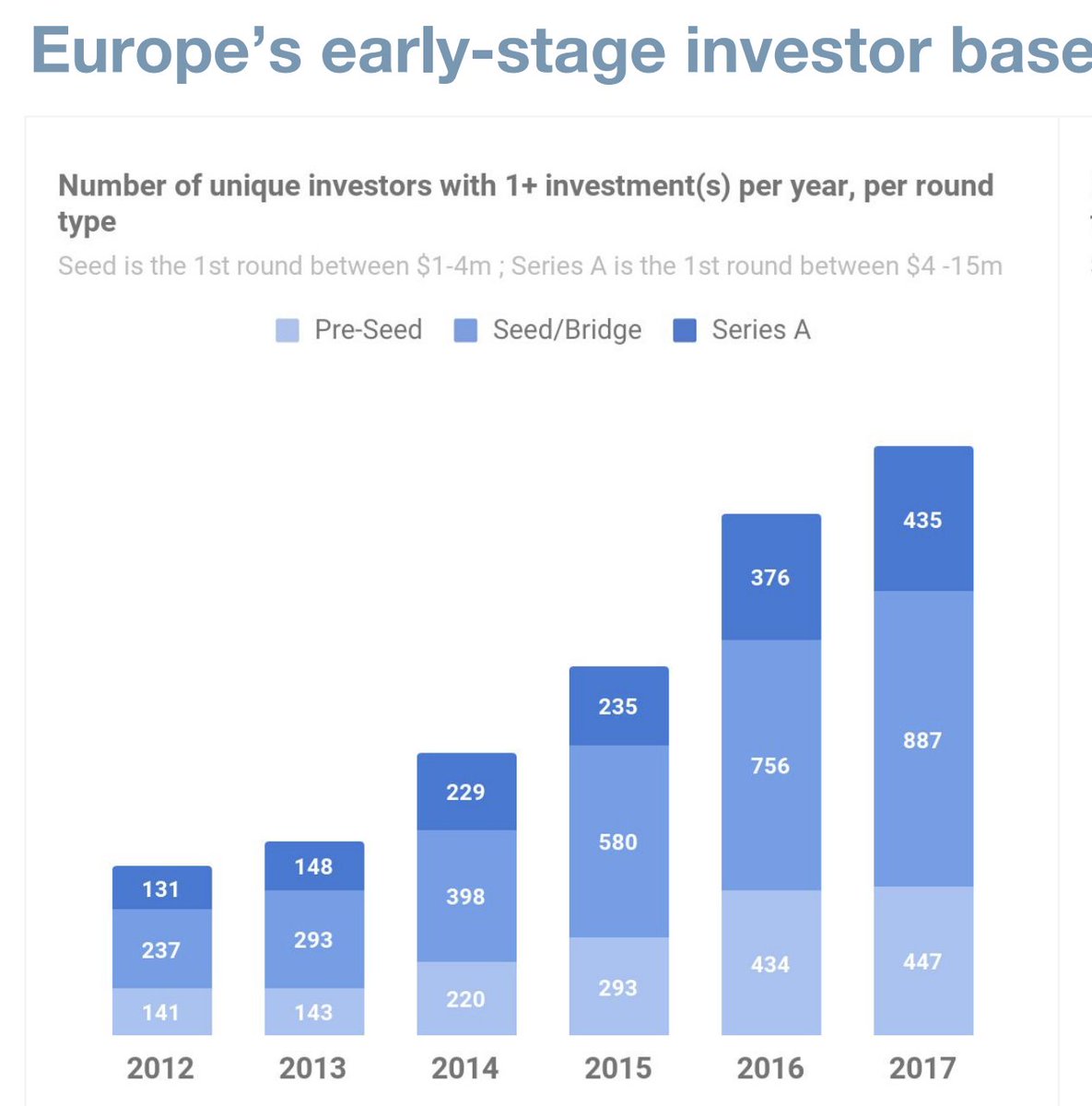

7/ Series A is a numbers game, and a tougher one than Seed

Like with your Seed round, at Series A you still need to speak to a large number of VCs. But you& #39;re starting with a much smaller pool of them. Finding 30+ VCs who may be interested in your sector & stage can be tricky

Like with your Seed round, at Series A you still need to speak to a large number of VCs. But you& #39;re starting with a much smaller pool of them. Finding 30+ VCs who may be interested in your sector & stage can be tricky

8/ Your VC at Series A is more crucial than at Seed

You need to choose your VC wisely, because Series A investors are very likely to take a board seat & work with you for the long term. Given the DD they did on you, they& #39;ll be considered by later investors as your reference VC

You need to choose your VC wisely, because Series A investors are very likely to take a board seat & work with you for the long term. Given the DD they did on you, they& #39;ll be considered by later investors as your reference VC

9/ You need to convince teams, not individuals

Differently from Seed, it& #39;s uncommon for a single person at a fund to make the call for a Series A all by themselves. If someone else in their team is against the deal, it won& #39;t happen. You& #39;ll have to juggle VC internal politics

Differently from Seed, it& #39;s uncommon for a single person at a fund to make the call for a Series A all by themselves. If someone else in their team is against the deal, it won& #39;t happen. You& #39;ll have to juggle VC internal politics

10/ In case you& #39;ve gone past your monthly reading limit on Medium, here& #39;s a link anyone can use :) https://medium.com/p/9-reasons-why-series-a-is-not-just-a-big-seed-round-e163f7a32bb0?source=email-3f37cd63a560--writer.postDistributed&sk=d854eea889a21810cf5030ae67fdb6b5">https://medium.com/p/9-reaso...

Read on Twitter

Read on Twitter