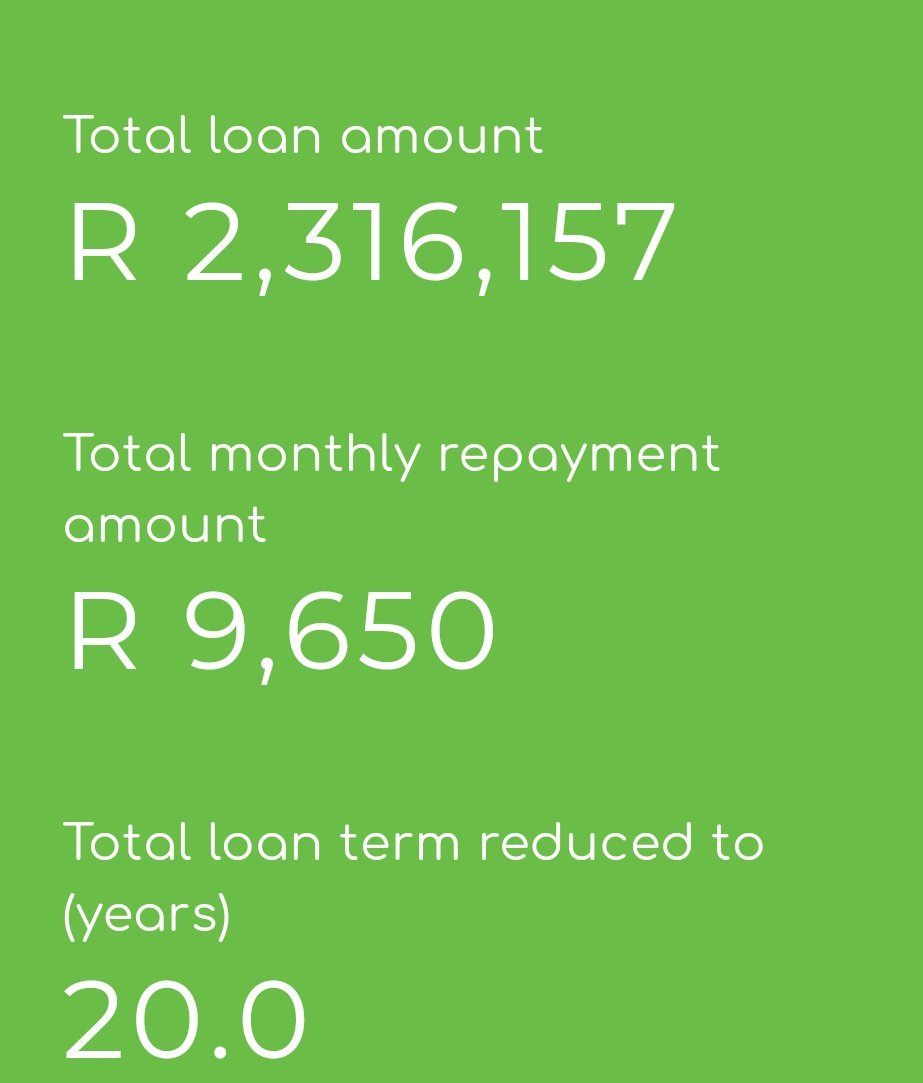

Paying an extra R250/month on a R1m home loan will reduce the period by 1.5yrs https://twitter.com/jgillllll/status/1192882685317931008">https://twitter.com/jgillllll...

You can negotiate a better interest rate with the bank, most people accept the first number.

Bonds are priced using standard models, ask your home loan specialist for the list of "credit pricing inputs" they are using.

You might be much lower risk & eligible for lower pricing!

Bonds are priced using standard models, ask your home loan specialist for the list of "credit pricing inputs" they are using.

You might be much lower risk & eligible for lower pricing!

A R1m bond ends up with you paying comfortably over R2m over its 20yr life.

The goal is to be in a position of strong financial control:

- Negotiate hard with the bank (& home seller)

- Reduce the tenor by paying a little extra each month

- Pay a bigger deposit if you can

The goal is to be in a position of strong financial control:

- Negotiate hard with the bank (& home seller)

- Reduce the tenor by paying a little extra each month

- Pay a bigger deposit if you can

Know your credit rating. Something as simple as a delayed credit card payment could be hurting your rating.

Factor in "hidden" costs of home ownership (levies, rates and taxes). Because you qualify for a large bond, doesn& #39;t mean you can actually afford it.

Factor in "hidden" costs of home ownership (levies, rates and taxes). Because you qualify for a large bond, doesn& #39;t mean you can actually afford it.

Read on Twitter

Read on Twitter